While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 26, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MIXED MESSAGES)

(SPY), (TLT), (UUP), (FCX)

It was definitely a week of mixed messages in the stock market.

Is Covid-19 going to disappear by itself shortly, or is it the worst thing since the black plague?

Are we going to get a $2 trillion stimulus package out of Washington, or not?

Are stocks too expensive, or still cheap?

We are being told the answers to these questions loud and clear, we just can’t hear them.

For this election looks to set all records on turnout. Every city in the country is seeing lines of voters snaking around the block waiting 2-8 hours. But which way are they voting? Are there hoards of hidden Biden voters coming out of the woodwork, or Trump ones? We won’t know the result for eight more days.

In the meantime, the markets bide their time.

Which raises one last question: how low can stocks fall over the next seven trading days?

In the meantime, some asset classes aren’t willing to sit on their hands any longer. Interest rates have started to rise, hitting a four-month high. This has knocked 15 points off of bond (TLT) prices. Yet, contrary to expectations, the US dollar is hugging a multiyear low (UUP), while commodity prices (FCX) soar.

All of this spell a record economic recovery in 2021. All that remains is for stock prices to play catch-up.

The word is that there is over $1 trillion sitting on the stock market ready to dive in the day after the election, possibly tacking on at least 10% to the major indexes by yearend. There could be one hell of a post-election celebration, no matter who wins.

Baby Boomers are unloading stocks to Gen Xers mostly, but Millennials as well. Of course, they have all the money, with a 53% ownership of all stocks, compared to 27% for Gen Xer’s and a mere 3% for Millennials. The Greatest Generation, born before 1946, have been shrinking their share ownership since 1990 and own only 17% of the total now. A coming jump in capital gains taxes will accelerate the process.

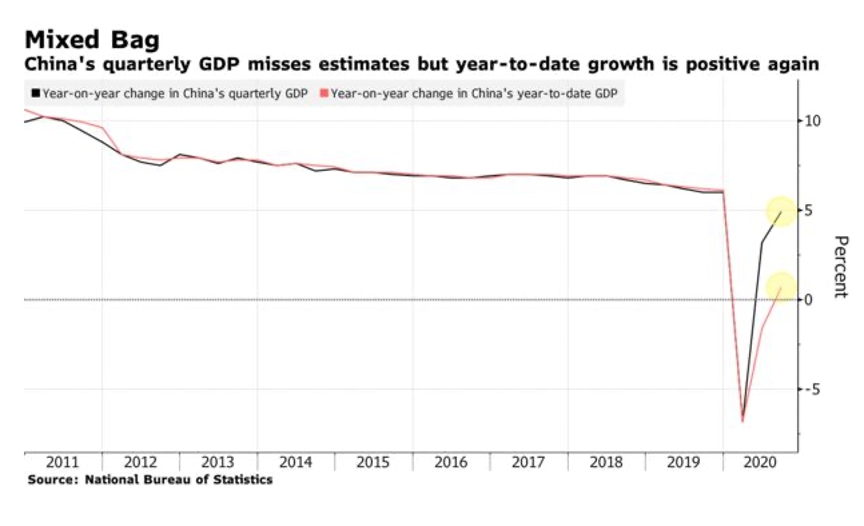

China’s Economy soared by 4.9%, in Q3 YOY with the pandemic in the rear-view mirror. First into the Coronavirus brings first out. Retail sales are through the roof and industrial production and business investment is accelerating.

Goldman Sachs says a Blue Wave will increase spending and boost the stock market. Total one-party control of the government eliminates the haggling that we are currently seeing in Washington and will deliver more Covid-19 aid faster. It should more than offset the ill effects of tax increases.

Beware of the coming Tax Loss Selling. A Biden win could unleash a torrent of selling as investors rush to beat an increase in the capital gains tax. That’s when you buy.

US Housing Permits blow the roof off at 1.553 million, up a staggering 22% YOY and a 13-year high. I wondered why I was suddenly getting a lot of flat tires on the freeway. They’re caused by nails and screws falling off the back up pickup trucks on the way to jobs. The long-term structural housing shortage continues. 30-year money at 2.75% makes a big difference.

Tesla generates a record profit for the fifth consecutive quarter in a row. The company is relying on its China factory to hit its 2020 target of 500,000 million units. Again, $397 million in regulatory credits drive earnings, payments from other carmakers who are lagging on electric car production. Gross margins rose 250 basis points to 23.5%. S&P 500 listing here we come! Next target $2,500!

Weekly Jobless Claims dropped to 787,000, better, but still horrible. California is finally reporting again.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Global Trading Dispatch hit a new all-time high last week by staying 100% in cash. I was just as grateful for having no positions on the up 600-point days as I was on the down 600-point days. Safe to say that I will be an increasingly more aggressive buyer on ever smaller dips and a seller on bigger rallies. October has now reached to a welcome 1.89% profit.

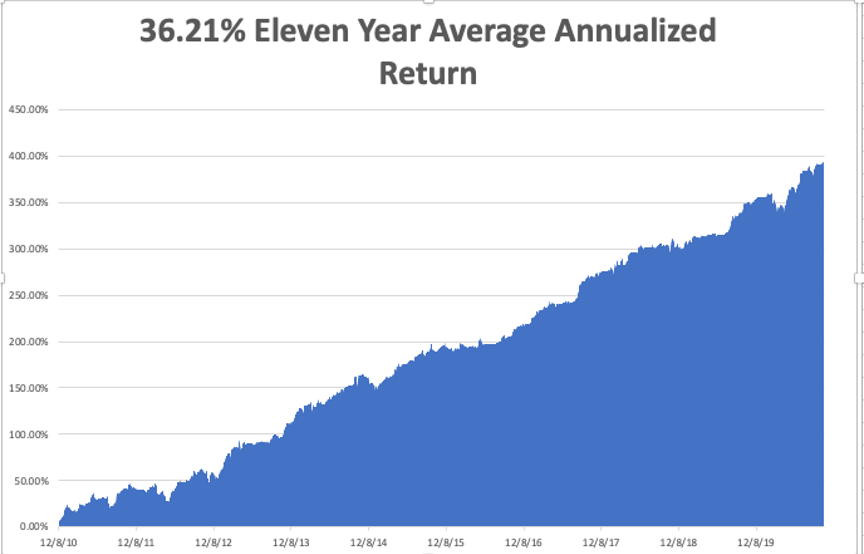

That keeps our 2020 year-to-date performance at a blistering +36.29%, versus a LOSS of -0.57% for the Dow Average. That takes my eleven year average annualized performance back to +36.21%. My 11 year total return stood at new all-time high at +392.30%. My trailing one year return appreciated to +42.86%.

The coming week will be a dull one on the data front. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, now at 225,239, which you can find here.

On Monday, October 26 at 10:00 AM EST, New Home Sales are published. Ely Lilly (LLY) and Merck (MRK) report earnings.

On Tuesday, October 27 at 9:00 AM EST, the S&P Case Shiller Home Price Index for August is released. Microsoft (MSFT) and Pfizer (PFE) report earnings.

On Wednesday, October 28, at 2:00 PM EST, the EIA Cushing Crude Oil Stocks are out. Boeing (BA) and Visa (V) report earnings.

On Thursday, October 29 at 8:30 AM EST, the Weekly Jobless Claims are announced. At the same time, we get the first read on Q3 GDP. Alphabet (GOOGL) and Amazon (AMZN) report earnings.

On Friday, October 30, at 8:30 AM, Personal Income for September is printed. Exxon (XOM) reports earnings. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I’ll be charging up every electronic device I have as the San Francisco Bay Area is expected to suffer a complete power blackout for the next three days. PG&E is shutting off the juice because winds are expected to reach 70 miles per hour and it hasn’t raised in six months.

I won’t be affected because I am totally off the grid with my own solar and battery network. You can easily find me because mine will be the only house in the mountains with the lights on.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

October 23, 2020

Fiat Lux

Featured Trade:

(PLAYING THE DIGITAL KLEPTOMANIA BOOM)

(SAIL)

I’ve got another one for you.

Yes, one of those early-stage tech growth companies that you should sock away in your tech portfolio only to peek at how much you are making every now and then.

This one is in the cybersecurity industry where business is booming.

Who would have thought that a pandemic crushing the global economy would stoke a mad rush into digital kleptomania?

Well, that is exactly where we find ourselves in late 2020 and that is why I undoubtedly need to recommend SailPoint Technologies Holdings, Inc. (SAIL) to my subscriber base.

Why should they be bought?

SailPoint Technologies Holdings, Inc. designs, develops, and markets identity governance software solutions.

Identity has become a critical part of the technology foundation businesses need to secure today's modern workforce.

A tech company that understands how to stoke the rate of adoption into higher SaaS platform numbers has my ear already and when you crossbreed this with customer interest and comfort in deploying their identity program in the cloud, then we are onto something.

Specifically, all signs flash green when increased adoption among larger enterprises this quarter has resulted in total revenue of approximately $92 million, representing 47% growth year-on-year.

Let’s list all the winner events that have made this company relevant recently.

For example, a large manufacturing company turned to SailPoint as part of their digital transformation efforts, shifting the majority of their business to the cloud, including their identity governance solution.

They chose SailPoint SaaS identity platform to help them govern their 65,000 users in an efficient, streamlined method while removing the nuisance of managing software updates and upgrades.

It’s clear to everyone that Sailpoint’s financial results in the quarter reflect broad-based accelerating adoption of the SailPoint platform and highlight the increasing criticality of the identity platform to today's distributed digital enterprise.

SailPoint stands out as the modern SaaS-native identity platform that can evolve with business, helping companies to sharpen decision-making and to support the workforce with greater velocity and efficiency.

Insatiable SaaS growth among Sailpoint’s existing customer base is a hallmark of Sailpoint as firms start to introduce a growing number of some of the newest SaaS services such as identity analytics and cloud governance.

Many companies are eager to extend and automate key areas of their identity program, giving Sailpoint another leg of growth within their SaaS business.

Another example is a large U.S. government agency that recently extended its identity program with SailPoint to ensure strong governance over the increasing number of cloud applications and infrastructure they manage across the business.

They selected SailPoint's cloud governance SaaS services to better protect and govern access over their various cloud resources, including their Azure cloud environment.

This is a critical next step for them in their journey with Sailpoint as much of their work relies on these cloud resources and needs to be properly governed and secured.

Deals were consummated at breakneck speed as of late, including many where Sailpoint replaced one of the large legacy vendors.

Closing this unbelievable volume of deals in the current precarious environment validates the criticality of Sailpoint’s products.

One of the world's largest multinational conglomerates that serve both commercial and government markets shifted to next-generation identity governance with Sailpoint. Sailpoint replaced a legacy identity vendor that could no longer meet their need for a much more dynamic, agile, and comprehensive approach to governing their 165,000 users worldwide.

These results were driven by strong bookings throughout the quarter and revenue upside in the next quarter is primarily in licensing, which for Sailpoint, comes primarily from sales of IdentityIQ.

Sailpoint IdentityIQ integrates provisioning and compliance features into a single solution. This product is able to address all the needs related to Identity and Access management such as access certifications, policy enforcement, account provisioning, and user life-cycle management.

A multitude of several large IdentityIQ deals was made in the quarter, and some of those were Sailpoint’s largest deals ever.

Most of the license outperformance was driven by term licenses that are effective subscriptions, just like Sailpoint’s SaaS and maintenance contracts.

Sailpoint also outperformed on SaaS bookings, driven primarily by SaaS first focus with IdentityNow and by sales of Sailpoint’s AI offerings to both IdentityNow and IdentityIQ customers.

Both sales to new logo customers and sales to existing customers helped subscription revenue increase by 36% year-over-year to $45.9 million or 50% of total revenue in the quarter.

Renewal rates remain strong across both maintenance and SaaS, and in a year where the pandemic has weakened sales, total gross margins for the quarter were 83% compared with 78% in Q2 of 2019.

The increase in gross margin was largely driven by the increased mix of license revenue in the quarter, although gross margins for other revenue lines continue to move in the right direction.

The cybersecurity company now expects total revenue to be between $341 million and $345 million with approximately $190 million driven by the subscription line, which represents 32% year-on-year subscription revenue growth.

An impressive feat in a year with outsized downward pressure on the macro environment.

To summarize, SailPoint Technologies Holdings, Inc. (SAIL) is a small player in the field with annual revenue south of half a billion dollars but growing revenue in the mid-30% range in a bad year and closer to 50% in good years.

The pathway to $1 billion annual revenue couldn’t be clearer for this company and is a buy on any dip.

“It is only when they go wrong that machines remind you how powerful they are.” – Said Australian Writer Clive James

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 23, 2020

Fiat Lux

Featured Trade:

(11 SURPRISES THAT WOULD DESTROY THIS MARKET),

(SPY), (USO), (AMZN), (MCD), (WMT), (TGT)

Note to readers: Sorry for the short letter today but PG&E is about to turn off my electric power to reduce the risk of a wildfire during these high, hot winds from the east so I’m sending you just a few quick thoughts.

The Teflon market is back.

Bad news is good news. Good news is good news.

What could be better than that?

However, there are a few issues out there lurking on the horizon that could pee on everyone’s parade.

Risks of an asymmetric outcome right now are huge. Let me call out the roster for you.

1) The China Trade War Escalates – Every day economic advisor Larry Kudlow tells us that the trade talks are progressing nicely, and every day the administration pulls the rug out from under him with new sanctions. The last chance to avoid the next recession is upon us. A trade deal is the rational thing to do. Oops! There's that “rational” word again.

2) Economic Data Gets Worse - After a great data run into the fall, they are suddenly rolling over. All of the forward-looking data is now 100% terrible.

3) The Fed Raises Interest Rates- This has been the world’s greatest guessing game for the past three years. Jay Powell has just promised NOT to raise interest rates for three years, so an increase would be completely out of the blue and have an outsize impact. The Fed lives in perpetual fear of the American economy going into the next recession with interest rates near zero! That would leave them powerless to do anything to engineer a revival.

3) Another Geopolitical Crisis - You could always get a surprise on the international front. But the lesson of this bull market is that traders and investors could care less about North Korea, ISIS, Al Qaida, Afghanistan, Iraq, Syria, Russia, the Ukraine, or the Chinese expansion in the South China Sea.

Every one of these black swans has been a buying opportunity of the first order, and they will continue to be so. At the end of the day, terrorists don’t impact American corporate earnings, nor do they own stocks.

4) A Recovery in Oil – The next drone attack against Saudi Arabia could send oil really flying. If it recovers too fast and rockets back to the $100 level, it could start to eat into stock prices, especially big energy-consuming ones, like transportation and industrials.

5) The End of US QE - The Fed’s $4.5 billion quantitative easing, relaunched in March, could end as soon as it gets the sense that the economy is recovering too fast. That would take the punch bowl away from the party. Anyone who said QE didn’t work obviously doesn’t own stocks.

6) A New War – If the US gets dragged into a major new ground war, in Iran, North Korea, Syria, Iraq, or elsewhere, you can kiss this bull market goodbye. Budget deficits would explode, the dollar would collapse, and there would be a massive exodus out of all risk assets, especially stocks.

7) US Corporate Earnings Collapse – They already have for the sectors of the economy where you can’t socially distance, like movie theaters, restaurants, and airlines. A much higher third wave of Covid-19 would do the trick nicely, bringing a new round of lockdowns. Do you think stocks (SPY) will notice?

8) Another Emerging Market (EEM) Crash - If the greenback resumes its long-term rise, another emerging market debt crisis is in the cards. Venezuela and Argentina are just the opening scenes.

When their local currencies collapse, it has the effect of doubling the principal balance of their loans and doubling the monthly payments, immediately.

This is the problem that is currently taking apart the Brazilian economy right now. It happened in 1998, and it looks like we are seeing a replay.

9) A Trump Victory – Since the stock market has spent the last six months discounting a Biden win, the opposite result would be a total out of the blue shock. Count on a 10% dive in the (SPY) immediately, and 20% eventually. Polls can be wrong. Who knew?

10) Inflation Returns – Steep tariff increases on everything Chinese is rapidly feeding into rising US consumer prices. What do you think the Amazon (AMZN) wage hike to $15 means? If McDonald’s (MCD), Walmart (WMT), and Target (TGT) join them, we’re there. This is a stock market preeminently NOT prepared for a return of inflation.

I know you already have trouble sleeping at night. The above should make your insomnia problem much worse.

Try a 10-mile hike with a heavy pack every night in the mountains. It works for me.

Down the Ambien, and full speed ahead!

A Threat to Your Portfolio?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.