When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 16, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or RAIDING THE PIGGY BANK),

(SPY), ($INDU), (JPM), (CAT), (UNP), (UPS), (SLV), (TLT), (TSLA)

I remember the last time that the market went up 10% in ten days.

In the fall of 1982, I was in the office of Carl Van Horn, the chief investment officer of JP Morgan Bank. I was interviewing him about the long-term prospects for the stock market with the Dow Average at 600 and gurus like Joe Granville predicting Dow 300 by yearend.

The odd thing about the interview was that he kept ducking out of the room for a minute at a time and then coming back in. I finally asked him what he was doing. He answered, “Oh, I had to go out and buy $100 million worth of stock.”

And that was back when $100 million actually bought you something!

Over the last two weeks, the Dow Average has tacked on a historic $4,000 points. For a few fleeting second, it actually touched 30,000. Cassandras everywhere are tearing their hair out.

The monster rally began a few days before the election and has continued unabated. In my view, this is the second leg of a 20-fold move that started in 2009 when the Dow was at 6,000 and will continue all the way up to 120,000 by 2029.

No wonder investors are so bullish! It seems that recently, quite a few have come over to my way of thinking.

And how could they not be so bovine-inclined?

The most contentious election in history over. The pandemic is about to end. In a year we’ll, all have our Covid-19 vaccinations, at least those who want them. I’m planning on getting all six.

The greatest burst of economic growth in history is about to be unleased. Consumption wasn’t destroyed, just deferred into 2021 and 2022, unless you’re in the cruise, airline, or restaurant business. The exponential profit growth unleashed by the pandemic isn’t even close to being discounted.

This hasn’t been just any old rally. Stocks left for dead years ago, the old-line industrials and cyclicals have sprung back to life. Union Pacific (UNP) has exploded. JP Morgan Chase (JNP) has gone off to the races. Caterpillar (CAT) is in orbit.

The great thing about these moves is that it is very early days. They could run for years. But where will the money come from to pay for these? How about raising the big tech piggy bank, which has been leading markets for years and is now wildly overvalued.

However, $4,000 points is a lot. So, we may get some back and fill and a sideways “time” correction before we attempt higher highs by yearend. The only thing that could upset this scenario is if Covid-19 cases explode, which they are now doing.

Where will the market care? Who knows, but like stock prices, US Corona cases have doubled in ten days to 160,000.

Covid-19 is cured! News that Pfizer (PFE) has discovered a Covid-19 vaccine that is 90% effective has sent stocks soaring to new all-time highs! The Dow futures were up $1,800 at the highs pre-market. The Great Depression is over. Recovery stocks like banks, cruise ships, restaurants, energy, and railroads are exploding to the upside, with stay-at-home stocks such as couriers, precious metals, and streaming companies in free fall. Some 500,000 health care workers have priority in getting the two-shot regime. The US Army will begin national distribution almost immediately, but you may not get it until the summer.

Market volatility crashed, with the Volatility Index (VIX) down from $41 last week to $18. Happy times are here again, at least says the market, this minute. I told you to go short last week!

Walt Disney is the best recovery play in the market. With theme parks, hotels, and cruise ships, it had the most exposure of any blue-chip company to the pandemic. It is also best positioned for any recovery. The stock was up 26% at the highs this morning. Only its rock-solid balance sheet gets this company alive. My 2021 target is $200 a share. Back to waiting in lines for hours, packing shoulder to shoulder on rides, and paying $20 for hamburgers.

The end of the depression may be in sight, but the US still faces a massive loan default wave that could erode confidence in the economy. A full economic recovery in a year will be too late for millions of businesses, especially small ones. The Fed says the risks are “severe,” and Disneyland is still laying off workers. Just when you think we are risk-free; we are not.

A big recovery in dividend stocks is coming after sitting in the doghouse for years while big tech hogged the limelight. Phillip Morris (PM) at a 6.7% yield? AbbVie (ABBV) at 5.5%? Williams Co (WMB) at 8.3%? They certainly will draw some buyers in this near-zero interest rate world. High yields REITs are also in for some joy now that a vaccine is on the horizon.

Home Prices are soaring at the fastest rate in seven years. Ultra-low interest rates and a structural shortage create the perfect storm for higher prices. Houses are now seen as “safe” since they didn’t crash 40% like the stock market did in the spring. Mortgage brokers are so overloaded it takes three months to get a refi done. This could continue for another decade.

China’s “Single’s Day” breaks all records, bringing in an eye-popping $116 billion in sales for Alibaba (BABA). US customers were the biggest buyers, eclipsing our “Black Friday” by a huge margin. I told you (BABA) was a “BUY”.

Biden could lock down the economy for 4-6 weeks if new cases keep growing at their current rate. That would knock the pandemic on the nose for good, but is it worth the price? That is an idea making the rounds in the incoming Biden administration. Cases could be peaking at 250,000 a day right around the inauguration. I may not go this year.

Stocks may Go up for years. That’s is what the Volatility Index (VIX) is telling us down here at $22. If we break below $20 and stay there, then the long-term Bull market becomes a sure thing. Stocks are now discounting the end of the pandemic.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

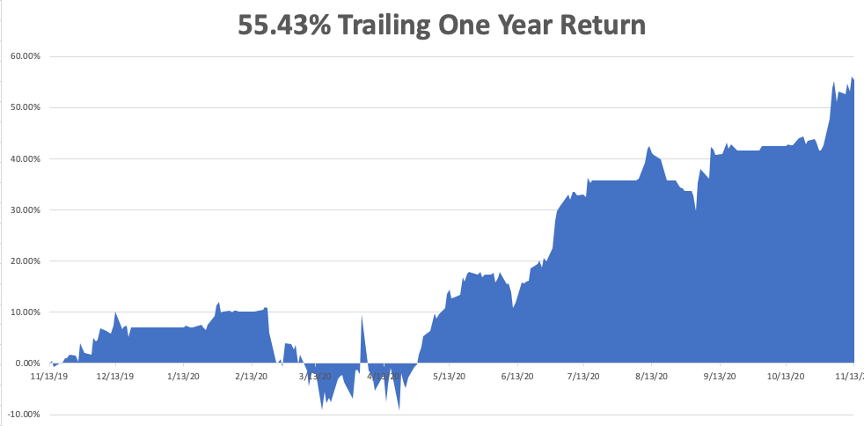

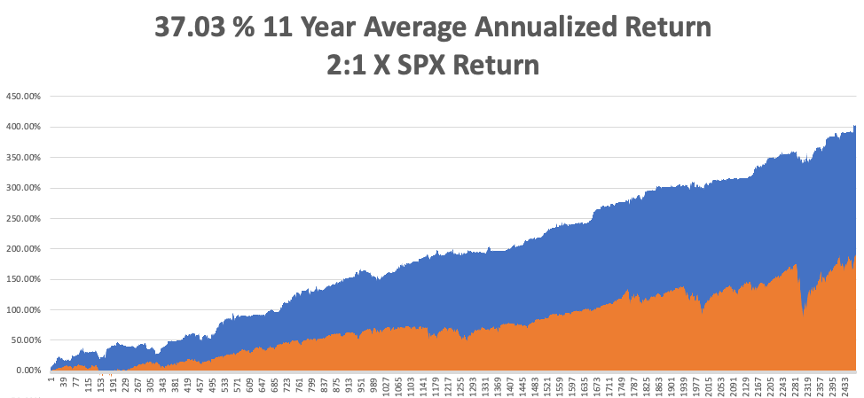

My Global Trading Dispatch exploded to another new all-time high last week. November is up 12.31%, taking my 2020 year-to-date up to a new high of 48.34%. That brings my eleven-year total return to 404.25% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a new high of 37.03%.

It was a week of profit-taking on the fully invested portfolio I piled on just before the election. My one new long was in the silver ETF (SLV) and my one new short was in (TLT), both of which turned immediately profitable. I used the one dip of the week to cover a short in the (SPY) close to cost.

It worked in spades.

The coming week will be a sleeper compared to the previous one. We also need to keep an eye on the number of US Coronavirus cases and deaths, now over 10 million and 240,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, November 16 at 9:30 AM EST, the Empire State Manufacturing Index is out.

On Tuesday, November 17 at 9:30 AM, US Retail Sales are published.

On Wednesday, November 18 at 9:30 AM, US Housing Starts for October are released.

On Thursday, November 19 at 8:30 AM, the Weekly Jobless Claims are announced. At 11:00 AM, the big Existing Home Sales for October are announced.

On Friday, November 13, at 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I’ll be cleaning off the grime from the last Boy Scout trip of the year up to the giant redwoods of north Mendocino County. I haven’t been up there in 13 years and boy has it changed. The vineyards have ground enormous and entire new exurbs have been constructed. There are only a few apple farms left, where I picked up some nice cider, pie, and bags of fresh apples.

There are still a few bits of the old California left.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

I would like to make a suggestion on a stock where a bottom appears to be setting up.

The stock is Gilead Sciences, Inc. (GILD)

GILD reported on October 28th, with an earnings beat.

My suggestion is going to be a debit spread. And I am I going to suggest you trade the December 11th expiration.

This gives the stock about three weeks to make a move.

GILD is trading around $60.85 as I write this.

Here is how you open the position:

Buy to Open December 11th - $60.00 Call for $2.20

Sell to Open December 11th - $65.00 Call for $.45

The net debit will be $1.75 per spread.

Based on the tracking portfolio, I suggest you limit the trade to a 6 lot or 1% of the portfolio.

The maximum gain on a five lot would be about $1,950 or 1585%.

Mad Hedge Technology Letter

November 13, 2020

Fiat Lux

Featured Trade:

(HOW TO STOP THE E-CRIMINALS)

(CRWD), (AVGO)

Cybersecurity is not a discretionary purchase for corporates.

This must-have product soothes the minds of every cybersecurity executive in the world.

I’ll explain how this point of strength is capitalized on by major growth security tech company CrowdStrike (CRWD).

Let me put my stamp on this indispensable service keeping cloud services afloat.

I can say with conviction that this is the beginning of a multi-year trend being driven by the industry consolidation that took place last year along with the seismic shift to cloud technologies.

Fortune 500 companies are increasingly choosing CrowdStrike as their security cloud platform.

CrowdStrike customers have never been larger and have never bought more modules and the same type of optimism appears in the stickiness of the number of new customers that surpass annual recurring revenue (ARR) of over $1 million.

Cybersecurity is mission-critical to both the public and private sectors.

Endpoint or workload security is also essential to protecting a remote workforce and as many of you know, the global remote workforce has never been bigger because of the pandemic.

While the damage to the macroeconomy from the coronavirus is gyrating at an accelerated pace, it is forcing companies to conduct business differently and rapidly shift to a remote workforce.

With CrowdStrikes’ cloud-native platform, this lightweight agent is easily deployed at scale and its frictionless go-to-market engine, CrowdStrike is uniquely positioned to meet any type of cybersecurity requirement.

The financial performance of the company is as healthy as ever as the company added a record $99 million in net new ARR and year-over-year, they increased the number of net new subscription customers by 116%, achieving 90% subscription revenue growth and 89% total revenue growth.

There were three outsized achievements this year: CrowdStrike delivered exceptional growth at scale, significantly improved margins, and achieved positive free cash flow for the fiscal year.

The seismic shift to cloud-native technologies and cloud workloads including containers has created an environment with massive greenfield opportunities.

Many competitors are dragged down by the complexities of integrating acquired technologies, rationalizing their workforce, or retooling their on-prem offerings.

Another positive tailwind is when Broadcom (AVGO) began integrating Symantec, there was a nice increase in inquiries among both customers and partners because they simply didn’t like Broadcom’s new products and vacated them to move towards CrowdStrike’s offerings.

This dynamic will contribute to an expansion in CrowdStrike’s pipeline, an acceleration in the overall customer adoption and increased engagement with partners.

Several partners in the United States and abroad have launched Symantec replacement campaigns as well but I believe CrowdStrike offers some of the most robust products.

One company submitted a list of several thousand of their customers that will be migrating away from Symantec in the next year and there was very little overlap between these prospects and CrowdStrike’s existing customer base.

The customer base has more than doubled and now protects the safety of 5,431 customers.

870 net new customers in Q4 joined CrowdStrike, which is up 136% year-over-year.

Chief Information Officers (CIOs) and Chief Information Security Officers (CISOs) are looking for a strategic partner to help them bridge this skills gap and simplify their operations, while at the same time, reducing cost.

They are also looking for ways to leverage enhanced automation in their security operations to increase efficacy and free up resources.

These organizations are increasingly rotating capital to CrowdStrike’s Falcon platform to protect an array of workloads, stop breaches, and restore system performance.

All new customers increased average number of modules in every quarter this past fiscal year.

The percentage of all subscription customers with four or more modules once again increased and those that adopted five or more cloud modules grew to one-third of their customer base.

As customers adopt more modules that span a wide array of workloads, it strengthens the customer relationship and increases CrowdStrike’s strategic position with the customer.

Companies who pay for other security alternatives keep running into the same roadblock of patchwork vendors who are largely ineffective and bureaucratic.

The burden is then directly placed on their resource-constrained IT security team eroding performance and souring team morale.

Another big problem is that a large percentage of the corporate platforms are not on the latest build of Windows, they could not update to newer versions exposing them to malware and security malfunctions.

This result is a cumbersome, manual remediation process and often requires the security team to reach out to users directly dragging out any possible IT solution.

CrowdStrike simply has this covered and can replace all three endpoint security solutions with the Falcon platform and offer seven modules providing firms with comprehensive protection and visibility in their environment and freeing up internal resources.

Existing legacy vendor failing is a common problem, and they fall victim to malicious activity shutting down production at major international facilities.

The ability to deploy the solution quickly can save the customer millions in manufacturing line productivity losses.

Beyond the immediate value provided by remediating a breach, there is significant value realized by streamlining a security stack. With the Falcon platform, firms can eliminate more than ten legacy tools and considerably improve their visibility and security posture.

CrowdStrike is collecting customers across diverse industries, geographies, and size because of proven efficacy and stopping breaches, and its cloud-native platform and lightweight single agent that is easily deployed at scale.

The predictive power of AI-driven threat graph that gets smarter the more data it consumes means the products get better with age.

The coronavirus has done nothing to dent the insatiable trend of companies searching for better security solutions.

While the coronavirus is having an impact on the global economy, it will not stop cyber adversaries. Cybersecurity provides business resiliency and meets compliance requirements.

In times of crisis, adversaries will try to exploit the situation, prey on the public's fear, and escalate new attacks.

I know it's difficult to fathom, but we've already seen nation-state adversaries from rogue regimes and e-criminals launch phishing campaigns using coronavirus marketing as clickbait entrance mechanism.

The world of global business is certainly not naïve in 2020 and tech investors shouldn’t be too.

CrowdStrike is still a small company but its growth trajectory is a sight to behold and every dip should be bought on the back of their solid business model.

“There are two kinds of companies, those that work to try to charge more and those that work to charge less. We will be the second.” – Said CEO and Founder of Amazon Jeff Bezos

Global Market Comments

November 13, 2020

Fiat Lux

Featured Trade:

(NOVEMBER 11 BIWEEKLY STRATEGY WEBINAR Q&A),

(AMZN), (TSLA), (FB), (AAPL), (ROKU), (UUP), (ITB), (TLT), (TBT), (FXI), (SPY), (BIDU), (TCTZF), ($NATGAS), (DIS) (AMD), (IP), (BIIB), (VRTX)

Below please find subscribers’ Q&A for the November 11 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: I bought Amazon (AMZN) on the dip and am concerned.

A: What I would say for all tech questions is take profits for the short term but keep them for the long term. All we’re seeing is a natural rotation out of big tech into domestic recovery stocks, which is long overdue; Where do you raid the piggy bank to get the money to buy domestic recovery stocks? Tech! But tech always comes back so if you can take the pain then keep them. Otherwise, if you’re a trader, then you probably should be looking at other new sectors like the one we’ve been calling.

Q: How does Tesla (TSLA) compete with Chinese electric vehicles? They copy, then improve, that’s their mojo.

A: Not actually; 12 years ago, I toured China visiting all of their electric car factories. They were pumping out tens of thousands of electric cars before Tesla ever produced even one of them. The problem is that the quality and safety standards are terrible, and they have a nasty habit of catching on fire. They have never been able to produce a car to compete in the US market and I expect that to remain true in the foreseeable future. What is more likely is Tesla will build more cars in China and invite the Chinese to participate as partners.

Q: Is there more downside in tech?

A: Probably, but not much. Apple (AAPL) down 40% from the high after a new iPhone generation launch is always a good rule of thumb. So far, it dropped 25% from the September high.

Q: Will we get another lockdown in the US?

A: Probably not; the states are handling it on a state-by-state basis. I don’t think we’ll ever go back to the total lockdown we had in March/April. It will be much more selective than it was, and the economy will be still able to function to some extent. Plus, it will be over in 3-6 months. The market is trading on recovery, not on the prospect of a further lockdown economy. Use the lockdown risk down days to buy.

Q: Do you see Facebook (FB) going down next year because of anti-trust issues?

A: No, antitrust will go absolutely nowhere; at the very worst they’ll put a disclosure on page 25 of their website, get fined a million dollars and then walk away. That's how these things always work. I was at Facebook quarters yesterday and antirust was the furthest thing from their minds.

Q: What happens to stocks if the vaccines don’t work?

A: We all die and stock go to new lows.

Q: Are you positive on Roku (ROKU)?

A: Yes, but it's overbought and having a correction just like all of the rest of tech.

Q: Would you sell homebuilders based on the chance of interest rates rising under a new administration?

A: Probably yes. Homebuilders (ITB) practically doubled this year. We’ve been recommending them for the entire year, and they have had a fantastic run, but there are better fish to fry right now buying these domestic stocks where you have much more upside potential. It a great place to raid the piggy bank.

Q: Are you saying the dollar (UUP) is going lower against all of the currencies?

A: Yes. The multiyear prospects for the greenback are grim. Sell every rally.

Q: Should we be buying the ProShares Ultra Short 20-year plus US Treasury Fund (TBT) now?

A: No, $14-$15 was the buy. Here you just want to run your long unless we get another $5-$7-point rally in the (TLT), then you want to go into the (TBT); but right now is a terrible entry point for any short bond plays.

Q: If we get a big increase in COVID-19, could the Treasury Bond ETF (TLT) make it back to $161?

A: That is entirely possible because then the fear will become a return to lockdown, and that could cause interest rates to crash and bonds to rally sharply.

Q: Is Advanced Micro Devices (AMD) a buy now or wait for pullback?

A: Wait for a pullback on all of tech, it looks like it has more to go. A lot of these domestic stocks haven’t been touched for years. That's where the money is going in now, and the only way to raid the piggy bank is to sell your tech stocks.

Q: Are the S&P 500 (SPY) put spreads you have risky?

A: Yes, but we don’t get $4,000 points in the Dow Average very often, basically once every 100 years, so I'm hanging on trying to get a better exit point. With any luck, the market will move sideways, and time decay will take our position to max profit next week. The rational thing to do here is at least to come out of one position for a small loss on the next big dip, and then run the other one into expiration and recover that loss.

Q: Can Chevron hit $100?

A: Maybe, as the entire sector is so oversold. But oil will still be the wrong industry to be in going into a Biden administration. Remember, the US had one million leatherworkers back when the population was only 100 million, or about 2% of the workforce. There are no more ten 10,000 leatherworkers today. You don’t want to be investing in the next leather industry.

Q: Any chance that Tesla will be added to the S&P 500 this December?

A: Probably not because all of the Tesla profits are coming from Zero Emission Vehicle (ZEV) credits they receive from other car companies. That’s considered accounting-based income, which Standard and Poor’s does not permit in their profit calculations. You have to have three quarters of consecutive operating profits to qualify for inclusion in the S&P 500, and these green credits don’t meet that qualification.

Q: Is Alibaba (BABA) a good buy now?

A: Probably yes, because the disaster over the Ant Financial listing is a short-term problem. I think eventually, they will list Ant Financial somewhere, they’ll get that money and then it’s off to the races again for (BABA). I predict that US China relations (FXI) are about to improve and that will be good for all Chinese assets.

Q: Is it too late to get into Copper (FCX) or wait for a pullback?

A: Wait for a pullback, that’s why I said stand aside on commodities. They really have had incredible runs already.

Q: Do you think once all the votes are recounted, Trump will be elected? And what will the market do?

A: Recounts never, or very rarely, produce changes in vote counts of more than 500 votes, so that is definitely a short-dated option. If Trump were elected, the Dow would drop about 4,000 points, probably in a day. We would give up the entire Biden rally that’s occurred over the last 6 days and a lot of you would end up jumping out of windows because your stocks have just been slaughtered.

Q: Is Chinese tech a buy?

A: Yes, and that’s one of the reasons I recommended Alibaba. We also like Baidu (BIDU), Tencent Holding (TCTZF), and several of the other Chinese majors. We think there's about to be an improvement in trade relations with China for some strange reason...

Q: Do you record this?

A: Yes, we post it on the website in about 2 hours later to allow for the format conversion. You just have to log in and go to your account section. If you can’t find it, just send an email to our customer support.

Q: Is International Paper (IP) a buy?

A: Yes, it is one of the domestic commodity plays that should do better.

Q: What about Natural Gas ($NATGAS)?

A: We’re not touching that right now because we’re trying to avoid the entire energy sector as the current tax system guarantees never-ending gluts of supply in the face of falling demand. That makes it very difficult to trade against unless you have inside information, on which 90% of all the trading in energy is indeed based.

Q: Best domestic stock play now?

A: Walt Disney Corp. (DIS). Buy Disney on the dip if we get one for some reason. Disney was a perfect storm on the downside, with theme parks, hotels, and cruise lines. It will become a perfect storm on the upside as well. It is also one of the best run companies in the world but hell to work for. Disney characters are not allowed to throw up on duty. They have to do it inside their character suits.

Q: Do you think the Vertex Pharmaceutical (VRTX) pipeline justifies a buy now?

A: Yes, we love the entire biotech sector; and the same is true for Biogen (BIIB).

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.