Global Market Comments

November 30, 2020

Fiat Lux

FEATURED TRADE:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SANTA COMES EARLY),

(SPY), (TLT), (TSLA), (JPM), (CAT), (BABA)

Global Market Comments

November 30, 2020

Fiat Lux

FEATURED TRADE:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SANTA COMES EARLY),

(SPY), (TLT), (TSLA), (JPM), (CAT), (BABA)

Everyone has been expecting a Santa Claus rally this year, but it looks like the jolly old man arrived early.

The holiday-shortened month was the best for stocks in 37 years. If you owned Tesla, like we did, it was even better. Elon Musk’s miracle creation shot up an incredible 60% this month.

At $600 a share, the company’s market capitalization expanded by an eye-popping $363 billion to $580 billion, the fastest wealth creation in history. The gain alone would rank it as the 55th largest company in the S&P 500. Similarly, Elon himself earned $100 billion this year, or $17 million an hour, the speediest wealth accumulation since capitalism begin.

These are numbers for the ages.

It’s all proof that if you live long enough, you see everything. OK, all of you who thought the Dow would soar by 12,000 points, or 67% in eight months, please raise your hands. Yes, I didn’t think I’d see many.

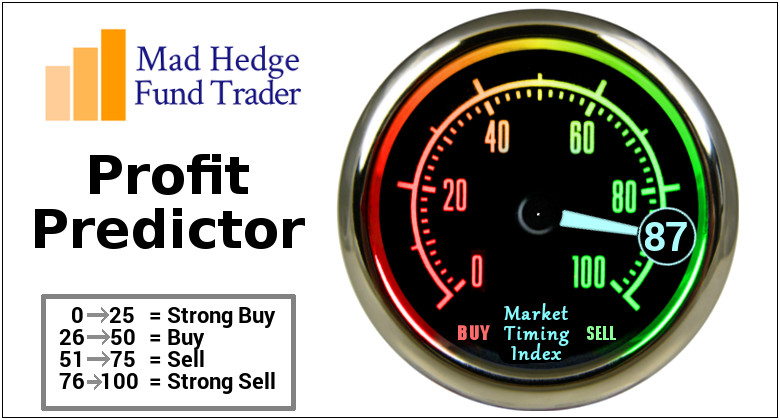

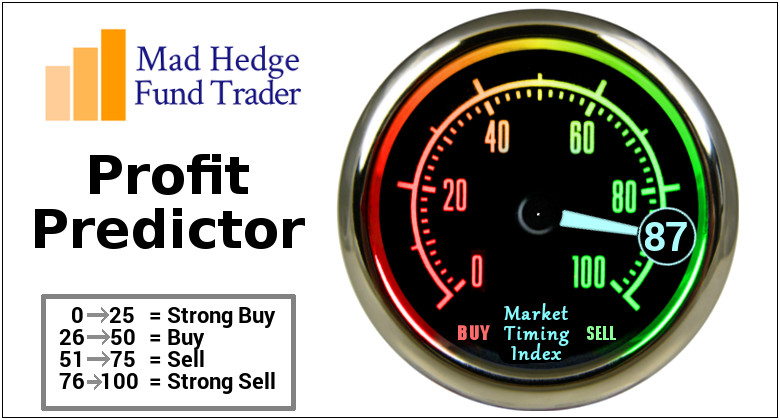

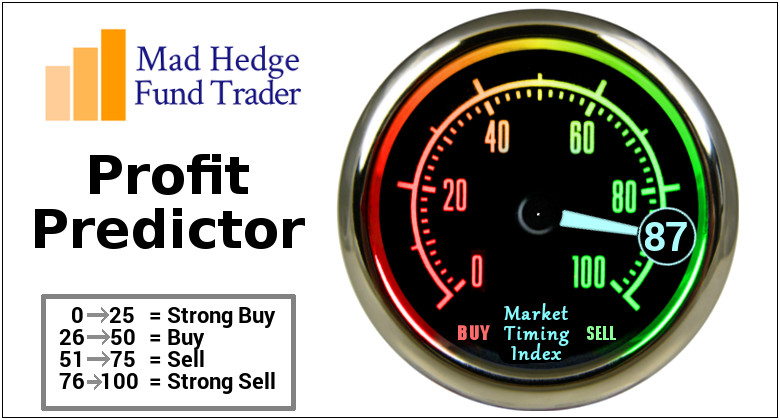

Which all raises some concerns for me. But then I’m always concerned. That’s why I’m still alive. That’s why I still have two nickels to rub together. My Mad Hedge Market Timing Index shouting “EXTREME SELL” urges further caution.

Rising at this meteoric pace, the market is pulling forward a big chunk of gains from 2021. Make hay while the sun shines because we may suffer long periods of boredom next year, when the Volatility Index (VIX) drops down to $10 and stays there.

It all reminds me of the Plaza Accord in 1987, when Japan agreed to a doubling of the yen against the US dollar in exchange for continued access to the US car market.

We all knew this would eventually demolish the Japanese stock market, but not for a while. I remember at the time, an old Japanese folk expression became popular. “The fool may be dancing, but the greater fool is watching.” The Nikkei Average doubled in three years before it crashed. Portfolio managers who only watched were left to pull rickshaws for a living. (This was before Uber).

This is why I have been urging followers to realize their biggest profits, as in Tesla, so they have dry powder with which to buy the next inevitable dip. And you don’t want to be left pulling a rickshaw.

The US Treasury delivered a hit for stocks, as outgoing Secretary Mnuchin cancels all remaining stimulus programs, sucking $459 billion out of the economy. It has so far prompted a $740-point dive in the Dow Average and a $7 rally in the TLT. It’s the ultimate scorched earth strategy that will prolong the recession. Use this move to buy more stocks (SPY) and sell short more bonds (TLT).

Janet Yellen was appointed the new Treasury Secretary in the incoming Biden administration. My old Berkeley economic professor wins again. She is probably the most qualified secretary ever appointed and as academic and former Fed governor. It looks like I may serve as an informal consultant on financial and monetary affairs like I did last time. I drove by her house last week and the vans were already loading up. The markets love her, with the Dow up 500 points and hitting 30,000. Janet is the Queen of Ease and the Master of QE, running a hyper-accommodative policy for five years.

Money is pouring into Asia. First into the pandemic, China was first out. With the most draconian lockdown yet seen, the Middle Kingdom was able to cap total deaths at 4,000. The US is now losing that number of people every two days….with one fourth the population. As a result, China now has the world’s strongest economy, growing at a 6.6% annual rate. The incoming Biden administration will lead to a major improvement in trade relations, bringing us back to a return of globalization. All of this is hugely positive for China.

Tesla tops $580 billion in market cap with a ballistic 37% move since its S&P 500 listing was announced two weeks ago. Look like Elon is due for another $20 billion bonus. Mad Hedge went into this with an aggressive 40% long weighting, making it the best trade of 2020, if not the decade. Tesla is my next trillion-dollar company.

Bitcoin crashed, down nearly $4,000 in 24 hours, or almost 20%. As is always the case with an asset with no fundamentals, nobody knows why as the cryptocurrency tests $16,000, down from $20,000. Fears of increased US regulation may be a factor.

New Home Sales exploded, up 41% YOY to 999,000, and gaining 1.5% in October. It’s the hottest since 2006. Homes sold but still under construction are up 60% YOY. Inventories plunged to 3.5 months and prices are rising due to shortages of labor and materials. This is where inflation begins.

Weekly Jobless Claims leaped to 778,000. The Coronavirus is felling people in the labor force in large numbers. Workers are losing jobs, benefits, and health care just as the pandemic goes exponential.

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

This has been the best week, month, and year in the 13-year history of the Mad Hedge Fund Trader, and the week was only three and a half days long!

My Global Trading Dispatch catapulted to another new all-time high. November is up 22.06%, taking my 2020 year-to-date up to a new high of 58.09%.

That brings my eleven-year total return to 414.00% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 37.63%. My trailing one-year return exploded to 64.91%. I’m running out of superlatives, so there!

I managed to catch the 50%, two-week Tesla melt-up with a rare quadruple long position, which is always nice for performance.

The coming week will be all about jobs. We also need to keep an eye on the number of US Coronavirus cases at 13 million and deaths 270,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, November 30 at 11:00 AM EST, Pending Home Sales for October are released.

On Tuesday, December 1 at 11:00 AM, The ISM Manufacturing Index for November is out.

On Wednesday, December 2 at 9:15 AM, the ADP Private Employment Report is printed.

On Thursday, December 3 at 9:30 AM, the Weekly Jobless Claims are published.

On Friday, December 4 at 8:30 AM, the Nonfarm Payroll Report for November is called. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, it’s Christmas tree season for the Boy Scouts again, so I just spent the morning unloading 700 conifers from a semi-truck that just arrived from Corvallis, Oregon. The scouts sell them to raise money for camping trips for the upcoming year. Some of the trees were 12 feet high and two men had to struggle to get them in place.

Last week, I took the scouts to Hendy State Park in northern Mendocino county. We were the only ones camping among the 2,000 year old giant redwoods, but all the RV sites were full. I realized then that tens of thousands are riding out the pandemic and the Great Depression in the California State Park system, rotating locations every two weeks to keep from being kicked out. These are our modern-day “Hooverville’s.”

It’s a sign of the times.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

November 30, 2020

Fiat Lux

Featured Trade:

(THE GREEN LIGHT FOR E-COMMERCE)

(AMZN), (W), (OSTK), (WMT), (TGT), (MELI), (EBAY), (CRM), (ADBE)

Data from Adobe Analytics is in and it suggests that e-commerce is delivering on its expected domination over retail.

I can’t ignore the helping hand of the pandemic which has deemed pedestrian shopping malls too dangerous to set foot in and for analog businesses that survive, it is essentially coming down to whether a digital footprint has been developed or not.

There is only so much a PPP loan can do to paper over the cracks of a non-digital business.

At some point, CEOs will need to wake up and understand that survival means a migration to digital.

Forecasts show that Black Friday online sales will register between $8.9 billion and $10.6 billion, which represents growth of up to 42% year over year.

The data firm expects Black Friday and Cyber Monday to become the two largest online sales days in history as consumers shift more spending toward e-commerce amid the public health crisis.

By last Friday morning, Salesforce projected online sales in the U.S. for Black Friday to spike 15% to $11.9 billion.

The truth is that many shoppers got their shopping done even before Thursday and Friday with digital sales in the U.S. spiking 72% year over year on Tuesday and were up 48% on Wednesday.

E-commerce companies front-ran the actual holidays to eke out more profit in the anticipation of competitors offering earlier sales.

According to Adobe, Thanksgiving sales hit a record $5.1 billion, up 21.5% over 2019 and this aggressive growth rate can be considered the new normal.

Smartphones continued to account for an increasing segment of online sales, with this year’s $3.6 billion up 25.3%, while alternative deliveries — a sign of the e-commerce space maturing — also continued to grow, with in-store and curbside pickup up 52% on 2019.

Shopify said that over 70% of its sales are being made using smartphones.

What are the hot gift items?

Electronics, tech, toys, and sports goods being the most popular categories — at the right price will help retailers continue to experience elevated sales volume.

Adobe said a survey of consumers found that 41% said they would start shopping earlier this year than previous years due to much earlier discounts.

This season is headed for record-breaking levels as consumers power online sales for both holiday gifts and necessities.

Not all big-box retailers were open over the holidays and getting that extra surge from the likes of daily needs such as paper towels, cleaning products, and garbage bags has boosted the top-line growth as well.

We have seen the perfect storm of elements fuse together to help the bottom line records of the likes we have never observed.

Comps will be difficult to beat next year if the vaccine solution starts coming online by next winter and considering that the worst economic damage is behind us.

Next year, the U.S. consumer will have more to spend setting up a tough but possible beat to next year’s numbers along with the high likelihood that tech stocks will experience another leg up.

There will be a lot happening in between, such as a new U.S. administration that is primed for a different economic polic; but it’s impossible not to love the narrative of certain e-commerce companies such as Shopify (SHOP), MercadoLibre (MELI), Target (TGT), Walmart (WMT), Etsy (ETSY), Wayfair (W), eBay (EBAY), Overstock.com (OSTK), Amazon (AMZN) and the companies that measure their data like Salesforce (CRM) and Adobe (ADBE).

If we ever could anoint when a year became the year of technology, then this would be it in 2020.

The base case for next year is that the borders and states will still grapple with the virus and the knock-on effects to society, economy, and politics as the capacity to produce the virus won’t meet demand for at least a year.

Tech stocks are primed to outperform non-tech next year and even though multiples are high, the momentum suggests that this group of stocks will be the gift that keeps giving as the Fed has offered generous liquidity conditions to tech investors.

“Life's too short to hang out with people who aren't resourceful.” – Said Jeff Bezos

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

I am going to suggest you close the PRA position.

This is because of two reasons. The first is that from a technical standpoint, it is overbought short term.

And the second reason is that the options are pretty thin, unlike the BOX position.

Sell PRA at the market, which is $17.01.

The position was put on at $16.45, so this results in a gain of

$.56 per share.

If you traded the suggested 400 shares, the overall gain is $224.

You should have also had a gain of $1 per share if you sold the calls on this position.

Including the call premium collected and the gain, the overall return is 13.7% or $624.

Global Market Comments

November 27, 2020

Fiat Lux

FEATURED TRADE:

(NOVEMBER 25 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (CRM), (CRSP), (CVS), (SQ), (CRSP), (LUV), (GLD). (SLV), (SPY), (TMO), (UUP), (TAN), (FXA), (FXE), (FXY), (FXB), (CYB)

BOX traded as high as $18.48 today and is now around $18.

I am still bullish on the stock, but it is trading right at a key technical level.

And as such, I would like to take this as an opportunity to collect some call premium.

As a result, I am going to suggest a trade on BOX.

Sell to Open (1) December $19 Call for every 100 shares you buy.

You should be able to sell them for 80 cents each.

Based on a sale at 80 cents, it will mean that you will have collected $1.20 per share in call premium.

And if the calls are assigned next month, the profit will be another 8%.

This alert applies to you only if you own shares in BOX.

Below please find subscribers’ Q&A for the November 25 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis.

Q: Is gold (GLD) still a hold?

A: Long term yes; short term no. Short term, cash is being drained out of gold in order to buy Bitcoin, just like silver. And once Bitcoin peaks, which could be today or tomorrow when it hits 20,000, then you could get a round of profit-taking and a nice little pop in gold. So, it's basically moving totally counter-cyclically to Bitcoin and the other cryptocurrencies right now.

(Note: since this webinar, Bitcoin has crashed by $3,000)

Q: A competitor of yours claims that asymptomatic transmission of COVID does not occur.

A: I would bet money that person does not have a medical degree. Asymptomatic transmission occurs in almost all diseases, so why COVID would be an exception is beyond me. I suggest that somebody is trying to sell newsletters at your expense with zero knowledge about the topic. Ask him to kiss a Covid victim. This is common in my industry where 99% of the people are crooks. This is also an example of the vast amounts of information that have been spread during an election year.

Q: Will you take a vaccine when it’s out or will you let others try it first?

A: Actually, by the time the public gets the vaccine, more than a million people will have already tried it, so I think it will be fairly safe. I am probably already the most vaccinated person on the planet; I've had flu shots every year for 40 years, so I will happily try it out. At my age, I have little to lose. And I would like to travel again, and that’s going to be a requirement for international travel. I am worried there could be long term side effects that we’ve seen with other drugs in the past, like all future children being born without arms and legs, which is what happened in the 1950s with Thalidomide.

Q: If the Senate flips to the Democrats, how do you see it affecting the market?

A: It doesn’t really affect the market overall; what it will do is affect sector reallocation. Solar, alternative energy and ESG companies do a lot better in A Democratic Senate, and energy oil companies do a lot worse. All you do is short the losers and buy the winners; it really makes no difference who wins. Most of the big conflicts over issues these days are social ones that don’t affect the market.

Q: Where do you see Tesla (TSLA) by the end of the year?

A: Well, this morning, it’s at an all-time high of $565. It looks like it wants to take a run at $600, and then we will be up 50% from where the news was announced that it was joining the S&P 500. That seems to me like a heck of a move on no real fundamental news. During this news, the market completely ignores a Model X recall and a Model Y pan from Consumer Reports. I would be inclined to take profits there or at least roll the strikes up on my options positions.

Q: What’s a good stock to play a commodity recovery?

A: You can’t do any better than Freeport-McMoRan (FCX), which I’ve been following for almost 50 years since I covered it for the Australian Financial Review newspapers.

Q: Will Salesforce (CRM) hold?

A: Yes, it’s just a matter of time before we break out to substantial new highs, and this is a stock that could double next year.

Q: What brokers do you suggest?

A: I would pick tastytrade. Click here for their site.

Q: Is CVS (CVS) a good buy?

A: I would say yes; a billion Covid-19 vaccine doses will need to be distributed next year. You can't do that without all the drug companies participating big time.

Q: Does Trump have a chance to win in his lawsuits?

A: It’s more likely that I will be elected the next Miss America; so, I wouldn’t place any bets on that. Some 30 consecutive Republican judges ruling against him does not augur well for his future.

Q: Would you buy any LEAPS here (Long Term Equity Participation Securities)?

A: Only in special one-off situations in the domestic stocks that haven’t moved in ten years. There are a lot of those out there now that I have been recommending. Those are all fertile territory for LEAPs, especially going out 2 years where you get the maximum bang for the buck and a 1,000% return. Don’t touch LEAPs in technology stocks here, and don’t touch Tesla in LEAPs.

Q: What’s your outlook on Southwest Air (LUV)?

A: I like it; it’s one of the healthiest domestic airlines most likely to come back.

Q: Are you going to update your long-term portfolio?

A: Yes, but I only update it twice a year and my next turn is on January 22. If you bought the last update on July 22, you made a fortune getting into Freeport McMoRan at $12 (it’s now $23), CRISPER Therapeutics at $80 (CRSP) (it’s now $110), and Square (SQ) at $110 (the current is $212). You can find it by logging into www.madhedgefundtrader.com, going to My Account, clicking on Global Trading Dispatch, on the drop-down menu, click on the Long-Term Portfolio tab and then clicking on the red tab for the Long-Term Portfolio. That lets you download an excel spreadsheet.

Q: Do you have any LEAPS to suggest now?

A: I only put out portfolios of LEAPS at giant market bottoms like we had in March. Then I put out lists and lists of LEAPS. At all-time highs, it’s not good LEAPS territory, except for specific names. So, if you want to get involved in that on a regular basis, I suggest you sign up for our Mad Hedge Concierge Service. There they are making millions of dollars a week right now.

Q: Where does the US dollar (UUP) go from here?

A: Straight down; the outlook for the buck couldn't be worse. I would be selling short the US dollar like crazy right now except that there are much better trades in US equities.

Q: Just to be clear, there’s no voter fraud?

A: There’s probably never been an election in US history without voter fraud on all sides; it’s just a question of who’s better at it. In the 1948 Texas Democratic Party runoff, back when the party owned Texas, Lyndon Johnson won by 87 votes out of 988,295 cast. It was later found that in five Hispanic-dominated counties that bordered Mexico, everyone had voted 100% for Johnson ….in alphabetical order. Johnson then took the seat with a 66% margin and went on to dominate the US Senate. I remember in the 1960 election, all the military absentee votes were sent flying around in circles over the Atlantic so Kennedy would win; that’s a story that’s been out there for a long time.

Q: You said stay away from other EVs except for Tesla?

A: A few have gone crazy this week, but that doesn’t mean they can actually make a car. So, you might get lucky on a quick trade on some of these, but long term, I don’t think any of the other non-Tesla EV companies are going to make it except for General Motors, which is plowing $27 billion into the sector. Even if (GM) may be able to put out a lot of cars, but they won’t be able to make very much money at it because they’re nowhere near the neighborhood of Tesla with the software where all the money is made.

Q: As the dollar gets weaker, will you expand your international stock picks?

A: Yes, we put out the first one in a long time, Ali Baba (BABA), on Monday, and we’ll be adding to that a bunch. I think the dollar could be weak for 5 or 10 years, a lot like it was in the 1970s.

Q: What’s your outlook for silver (SLV)?

A: Same as for gold (GLD). Quiet for the short term, double for the long term.

Q: Favorite names in biotech?

A: For that, you really need to subscribe to the biotech letter; we’re giving you two names a week there and all of them have done great. But another one might be Thermo Fisher (TMO), which seems to double every time I recommend it. It’s a great takeover target too.

Q: Is there any possibility of a 30% dip in the market (SPY) in 2021?

A: No, I don’t see more than a 10% dip in 2021. The tailwinds now are gale-force, generational, and will run for a decade.

Q: How do you sell the US dollar rally?

A: You buy all the ETFs that we cover in our foreign exchange sections. Those are the Australian dollar (FXA), the Euro (FXE), the Japanese Yen (FXY), the British pound (FXB), and the Chinese Yuan (CYB). Those are five ETFs that will do well on a weak dollar for the next several years.

Q: What about the Invesco Solar ETF TAN?

A: We have been recommending (TAN) for many years and it has done spectacularly well. I still love it long term, but it’s had one heck of a run; it’s up 300% from the March low. I think the entire country is about to have a solar explosion because the costs are now quite simply less than for oil. It’s an economic question. We are going to an all-Electric America.

Q: What do you think about LEAPS on gold?

A: It’s not really LEAPs territory yet, but on a two-year view, you’d have to do well on gold LEAPs.

Q: Is the Invesco DB US Dollar Index Bullish Fund (UUP) good to buy?

A: You should be looking to short the UUP. It’s a long dollar basket which we think will do terribly.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.