When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech & Healthcare Letter

March 23, 2021

Fiat Lux

FEATURED TRADE:

(THIS ISN’T THE TIME TO HIT THE PANIC BUTTON)

(AZN), (PFE), (BNTX), (ALXN), (MRK), (RHHBY)

Everybody will have heard about the issue in Europe these days, with more countries suspending dosing of the COVID-19 vaccine from AstraZeneca (AZN) and Oxford.

However, I think gaining clarity over the situation is important.

I haven’t been the greatest advocate of the AstraZeneca vaccine because its initial rollout was, to put it mildly, botched.

At the time, it was difficult to determine just how efficacious the vaccine, AZD1222, really was, and the latest figure I heard is that it’s 60% effective.

While the European Medicines Agency declared AZD1222 as safe, many member states of the EU seem to disagree, pointing out the reports of blood clotting issues after dosing.

I can see several apparent levels of this concern, but the most pressing, clearly, is medical.

The main problem that the experts are figuring out isn’t about the fairly common blood clots, which actually occurred at background levels and can generally be observed among elderly folks.

Their focus is the extremely rare autoimmune disorder that’s triggered when the body starts aggressively destroying the platelets needed for clotting.

That particular condition is hard to treat and can even be fatal.

Although they haven’t zeroed in on the specifics of the problem just yet, the experts agree that the blood clot issue is caused by some sort of overreaction in the immune system.

The stimulus for this reaction is still under review, but there’s a growing consensus that it could be genetic predisposition in a rare group of people.

This could be the same case as the doctor in Florida who died because of his immune system’s overreaction, which was triggered by the vaccine from Pfizer (PFE) and BioNTech (BNTX).

That’s not conclusive though, since it’s the only case cited in the United States.

The experts also pointed out that the condition is extremely rare, which was why it was not observed even in the Phase 3 trial of AZD1222.

While this is clearly a medical issue, there’s also an image issue for AstraZeneca to think about. How does this negative news on AZD1222 affect the stock?

Here’s a key point to keep in mind when analyzing AstraZeneca’s potential: The company is not selling AZD1222 for a profit while we’re going through the pandemic.

That means that suspending the dosing of AZD1222 won’t hurt AstraZeneca’s profit for 2021.

However, that doesn’t mean that AZD1222 has absolutely no effect on the company’s standing.

If anything, AZD1222 is an earnings opportunity for AstraZeneca in the future because the company’s expected to raise prices and generate a profit after the pandemic.

To underscore this goal, AstraZeneca has actually been ramping up capacity to manufacture at least 3 billion doses every year.

Considering this target, AstraZeneca is clearly signaling that it has the infrastructure to become a dominant player—if not the ultimate market leader—in the coronavirus vaccine sector.

If the issues with AZD1222 are resolved, then AstraZeneca holds a product that could rake in billions in revenue in the years to come.

Notably, AstraZeneca’s shares haven’t budged much regardless of the vaccine news released.

Since April 30, which was the day that the company announced its plans to join the COVID-19 vaccine race, AstraZeneca stock has fallen by roughly 6%.

In the past 11 months, which was filled with ups and downs for AZD1222, and up until the European countries suspended dosing in March 2021, the shares barely changed.

On the whole, AstraZeneca isn’t exactly known for massive one-year gains.

Rather, investors enjoy long-term wins, as seen in the company’s impressive 75% climb in over the past five years.

So far, AstraZeneca has 38 candidates in its pipeline queued for Phase 1 trials, 54 are slated for Phase 2, and 41 are lined up to go through Phase 3.

To fight off stagnation, AstraZeneca acquired biotechnology company Alexion Pharmaceuticals (ALXN) for a whopping $39 billion last December.

This deal offers a major expansion in AstraZeneca’s portfolio because Alexion brings with it its famed rare disease drug Soliris, which generates approximately $1 billion in revenue every quarter.

For 2020 alone, Alexion was estimated to add up to $5.95 billion in sales.

By 2025, AstraZeneca projects that Alexion will be on track to consistently contribute double-digit growth in its annual revenue.

It’s reasonable to say that AstraZeneca is one of the frontrunners in the COVID-19 race.

However, the past weeks have seen the company’s woes multiply due to questions on AZD1222’s side effects.

It’s worth reminding ourselves though why huge biopharmaceutical companies like AstraZeneca, Pfizer, Merck (MRK), and Roche (RHHBY) are not sensitive to these vaccine updates: They do not rely on their vaccine revenue alone for growth.

AstraZeneca markets an extensive array of products, which include eight blockbuster drugs.

In 2020, the company’s sales climbed by 10% to reach over $25 billion year-over-year.

Therefore, the reports on AstraZeneca’s AZD1222 isn’t a cause for alarm. The company’s overall portfolio is well-positioned to drive profit higher in the next several years.

More importantly, if AstraZeneca’s track record serves as any indication, then long-term shareholders should remain optimistic about the company’s growth trajectory.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 23, 2021

Fiat Lux

Featured Trade:

(NOW THE FAT LADY IS REALLY SINGING FOR THE BOND MARKET),

(JPM), (BAC), (C), (FCX), (TLT), (UBER)

Global Market Comments

March 22, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or ENTERING TERRA INCOGNITA),

(TLT), (TSLA), (JPM), (VIX), (QQQ), (IWM), (BAC), (C), (SPY)

During the Middle Ages, when explorers sought new lands and their rich treasures, large sections of their navigational charts were marked with the term “terra incognita.”

That meant what lays beyond was unknown and that they should enter only at their own risk. Often there was a picture of a dragon or a sea monster to mark the spot.

There was also often a warning that you might even sail off of the edge of the earth.

Financial markets have entered a “terra incognita” of their own recently.

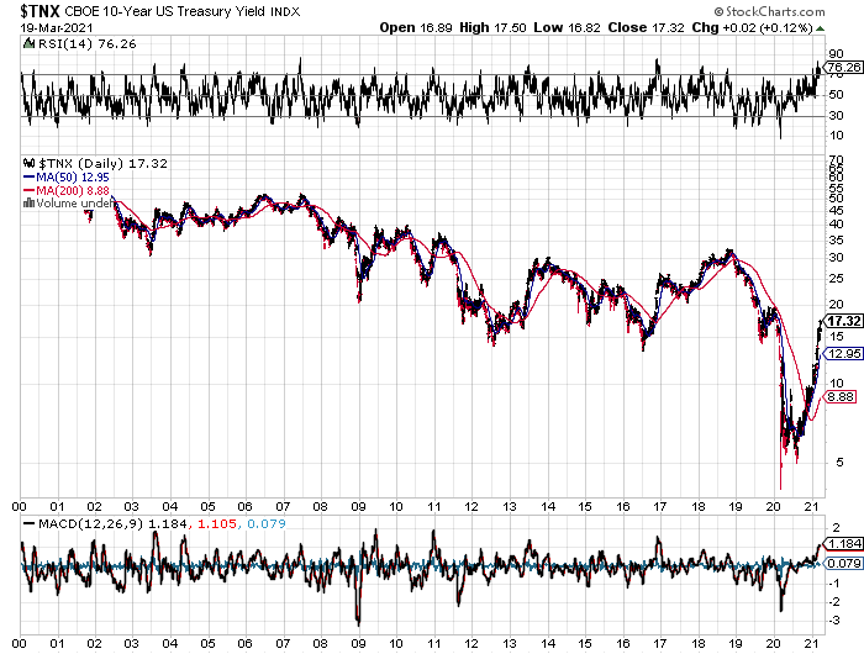

Here is the big unknown: How high can ten-year US Treasury bond yields soar when the Federal Reserve is promising to keep overnight interest pegged at 25 basis points until 2024 in the face of essentially unlimited monetary and fiscal stimulus?

So far, the answer is: more.

That is a really big question because we’ve never really been here before.

In fact, some Cassandras from the right are even predicting such a policy will cause us to sail off of the edge of the earth. The modern-day equivalent of running into dragons is inviting runaway inflation.

I can tell you from my own vast, almost immeasurable navigational experience (I am licensed by the US government) that “terra incognita” does not invite inordinate risk-taking or betting of ranches by traders or investors. Instead, they tend to sit on their hands, work on their golf swing, or update their Facebook pages.

That is what the Volatility Index (VIX) last week is essentially screaming at us by touching the $19 handle for the first time in a year.

Almost everyone I know has made more money in the markets than at any time in their lives. That is what a near doubling of the stock market in a year gets you.

And the new wealth was not attained because their intelligence and market insight have suddenly doubled, although a strong case for such can be made for readers of Mad Hedge Fund Trader.

So I used the Friday, March 19 option expiration to go into a rare 100% cash position. I really have gotten away with too much lately.

Then feeling guilty, I slapped on a single long in Tesla (TSLA), that old reliable money-maker. It’s worked for me since it was $3.50 a share. After all, a gigantic green energy infrastructure bill is about to pass in Congress. What better to own than the world’s largest EV car maker.

And what a tear it has been.

After bringing in a ballistic 66.64% profit in 2020, I reeled in another 40.38% gain in the first 2 ½ months of 2021. I did this via 40 trades which generated 38 wins and only two losses. That’s a success rate of an incredible 95%. I have to pinch myself when I read these numbers.

I am concerned because numbers any higher than this will look fake. It’s a rule of thumb in the investment business that when managers claim a 100% success rate, they are either high-frequency traders back by super-fast mainframe computers or running a scam.

So, I have been advising clients to pare back their biggest positions that became massively overweight purely through capital appreciation. Financials come to mind. JP Morgan (JPM) up 81% in three months? Sounds like a Ponzi Scheme.

So let me give you some upside targets in the bond market. We doubled bottomed in 2012 and 2016 at a 1.37% yield in the ten-year Treasury bond yield. We have already surpassed that level like a hot knife through butter.

At the depths of the 2008-2009 Great Recession, rates bottomed at 2.0% yield, which now seems within easy reach. The lowest yield we saw after the 2003 Dotcom Crash was a 3.0%.

When the upside targets in interest rates in this cycle are the lows of the previous economic cycles, that augurs pretty well for the future of stock prices. That is the guaranteed outcome of the tidal wave of cash now sweeping the global financial system.

The permabears are warning that the “Roaring Twenties” have already happened. I argued that they are only just getting started and that the indexes have another 4X of upside in them over the rest of the decade. When the last “Roaring Twenties” occurred, you didn’t sell in 1921.

It also reminds me of the huge “rip your face off” rally we saw from March 2009 to 2010. A lot of market gurus said then that was the peak. They were wrong. Today, they are driving for Uber and Lyft.

So when a talking head warns you that higher interest rates will cause the stock market to crash, just turn off the boob tube and go back to practicing your golf swing.

The Mad Hedge Summit Videos are Up, from the March 9,10, and 11 confab. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. The product discounts offered last week are still valid. Start, stop, and pause the videos at your leisure. Best of all, access to the videos is FREE. Access them all by clicking here at www.madhedge.com, click on CURRENT SUMMIT REPLAYS in the upper right-hand corner, and then choose the speaker of your choice.

Ten Year Bond Yields (TLT) soar to a 1.75%, setting financials on fire and demolishing tech (QQQ). We are rapidly approaching a 2.00% yield, which could trigger a huge round of profit-taking on bond shorts, a domestic stock selloff, and a tech rally. The next great rotation may be just ahead of us.

Oil (USO) dives 8% on fears of an imminent Saudi production increase and a worsening Covid-19 outlook in Europe. Are we next with all these early reopening’s? Gone 100% cash at the close with the March quadruple witching option expiration.

A Tax Hike is next on the menu. Corporate tax rates are returning from 21% to 28% for the small proportion of companies that actually PAY tax. Raising taxes on earnings of more than $400,000. Pass through entities to get a haircut. Increasing estate taxes. You better die soon if you want your kids to stay rich. Increase in capital gains taxes over $1 million. I want my SALT deduction back! The grand negotiation begins on who needs bridges, rail lines, and subway extensions. Hint: for some reason, there have been no new federal projects started in California for the past four years and all the existing ones were cut back.

Value Stocks (IWM) are beating growth ones, reversing a decade-long trend. The Russell Value Index is up 11% this year, while growth is unchanged. It’s a total flip from last year when growth was tech-led. This could continue for years, or until the tech becomes the new value stocks. Big winners include Boeing (BA), JP Morgan (JPM), and Morgan Stanley (MS), all Mad Hedge moneymakers.

Bitcoin tops 61,000. Nothing else to say but that because there are no fundamentals. It’s up 80% in 2021 and 540% YOY. But it is becoming a good risk-taking indicator thought, and right now it is shouting a loud and clear “Risk On.”

It’s going to be All About Stock Picking for the Rest of 2021, says Morgan Stanley strategist Mike Wilson. Dragging on the index from here on will be the prospects of rising rates, tax hikes, and inflation. Mike especially dislikes small caps (IWM) which have already had a terrific run, with a 19% YTD gain. Stock picking? Boy, did you come to the right place!

Fed to hold off on rates hikes through 2023, said Governor Jay Powell after the open Market Committee Meeting. Bonds rallied a full half-point on the news and then crashed again, taking yields to a new 1.70% high. It sees inflation reaching a positively stratospheric 2.0% sometime this year, after which it will die, so nothing to do here. This is what a 100% dovish FOMC gets you. Let the games begin!

New Housing Starts Collapse, from an expected +2.5% to -10.3%, as high lumber, land, labor, and interest rates take their toll. This will only drive new home prices high at a faster rate and the little remaining supply dries up. Millennials need some place to live.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

It’s amazing how well patience can help your performance. My Mad Hedge Global Trading Dispatch profit reached a super-hot 16.89% during the first half of March on the heels of a spectacular 13.28% profit in February.

It was a tough week in the market, so I held fire and ran my seven remaining profitable positions into the March 19 options expiration. I took advantage of a meltdown in Tesla (TSLA) shares to put on my only new position of the week with a very deep-in-the-money long. That leaves me with 90% cash and a barrel full of dry powder.

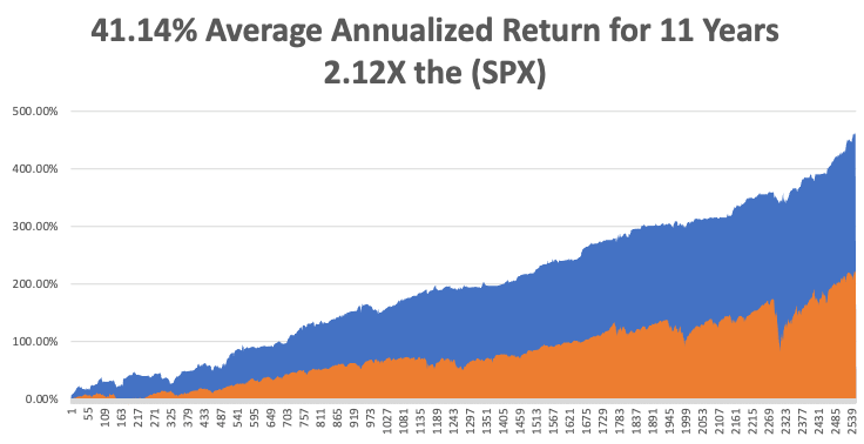

This is my fifth double-digit month in a row. My 2021 year-to-date performance soared to 40.38%. The Dow Average is up a miniscule 7.7% so far in 2021.

That brings my 11-year total return to 462.93%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.14%.

My trailing one-year return exploded to 121.60%, the highest in the 13-year history of the Mad Hedge Fund Trader. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 29.8 million and deaths topping 542,000, which you can find here. Thankfully, death rates have slowed dramatically, but Obituaries are still the largest sector in the newspaper.

The coming week will be a boring one on the data front.

On Monday, March 22, at 9:00 AM, Existing Home Sales for February are released.

On Tuesday, March 23, at 9:00 AM, New Home Sales are published.

On Wednesday, March 24 at 8:30 AM, we learn US Durable Goods for February are printed.

On Thursday, March 25 at 8:30 AM, Weekly Jobless Claims are out. We also get the final read of US Q4 GDP.

On Friday, March 26 at 8:30 AM, US Personal Income & Spending for February are released. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I have been doing a lot of high altitude winter mountain climbing lately, and with the warm spring weather, the risk of avalanches is ever present. It takes me back to the American Bicentennial Everest Expedition, which I joined in 1976.

It was led by my old friend, instructor, and climbing mentor Jim Whitaker, who pulled an ice ax out of my nose on Mt. Rainer in 1967 (you can still see the scar). Jim was the first American to summit the world’s highest mountain. I tried to break a high-speed fall and an ice ax kicked back and hit me square in the face. If I hadn’t been wearing goggles I would have been blinded.

I made it up to 22,000 feet on Everest, to Base Camp II without oxygen because there were only a limited number of canisters reserved for those planning to summit. At that altitude, you take two steps, and then break to catch your breath.

There is a surreal thing about that trip that I remember. One day, a block of ice the size of a skyscraper shifted on the Khumbu Ice Fall and out of the bottom popped a body. It was a man who went missing on the 1962 American expedition. Everyone recognized him as he hadn’t aged a day in 15 years, since he was frozen solid.

I boiled my drinking water, but at that altitude, water can’t get hot enough to purify it. So I walked 100 miles back to Katmandu with amoebic dysentery. By the time I got there, I’d lost 50 pounds, taking my weight to 120 pounds.

Jim was an Eagle Scout, the first full-time employee of Recreational Equipment Inc. (REI), and last climbed Everest when he was 61. Today, he is 92 and lives in Seattle, WA.

Jim reaffirms my belief that daily mountain climbing is a great life extension strategy, if not an aphrodisiac.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

March 22, 2021

Fiat Lux

Featured Trade:

(WHAT’S THE DEAL WITH SPOTIFY?)

(SPOT)

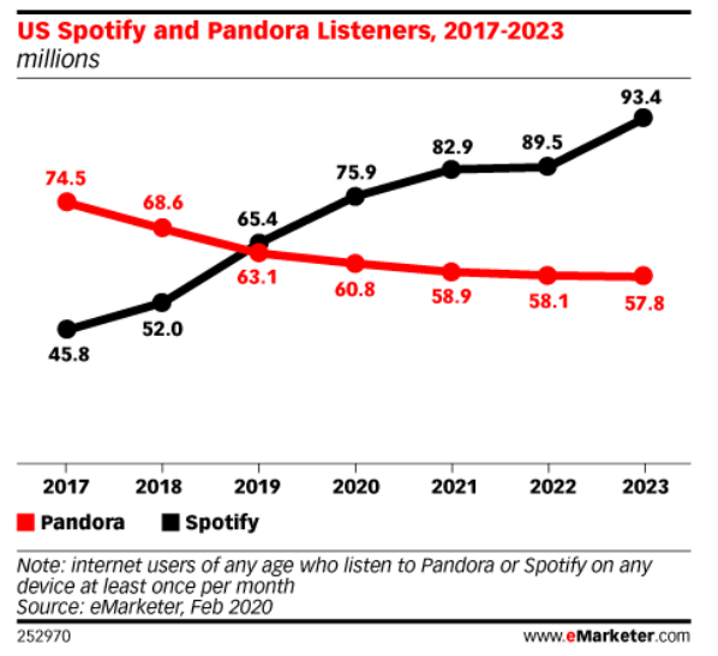

Many would believe that ad-based music streaming and the free streaming of it would represent a massive windfall in this new work-from-home economy.

And that is exactly what happened when Spotify’s (SPOT) stock rose from $121 on March 1st, 2020 and elevated to $365 just in February 2021.

The close to tripling of SPOT's shares came on the heels of a new annual year-end report by America’s Recording Industry Association showing that overall recorded music revenue increased by roughly 9.2% in 2020 to $12.2 billion.

This overperformance in music streaming was a relatively significant increase compared to 2019’s reported $8.9 billion, but the big takeaway was that two tech companies have seized the bulk of the revenue.

Both Spotify and Apple Music were the two most dominating streaming platforms, raising approximately $7 billion amongst the two, while subscriptions rose from 60.4 million to 75.5 million.

Even more unthinkable, the figures show 83% of the music industry’s revenue came as a result of streaming.

Why did 2020 work out so well for SPOT?

More time at home resulted in more people getting hooked on streaming and turning to SPOTs platform, but it also created disruption in listening habits, consumption hours and the release of new music and podcasts.

The new dynamics of music streaming is cause for belief that subscribers have been pulled forward from the back half of 2020, which could translate into underperformance for subscriber growth in the year ahead.

Long term, the trend lines are healthy as streaming from a shift from linear to on-demand has clearly accelerated and will continue to remain as a massive multi-billion user opportunity.

SPOTs stock has consolidated from highs of $365 and now trade around $270 after investors got scared hearing management’s lukewarm optimism for 2021.

The hesitation culminated when management admitted that the “full-year 2021 plan will have a higher variance than prior years.”

Uncertainty is always killer in tech and SPOTs response is to shift to more aggressive revenue growth where they know pricing power will enable SPOT to increase ARPU.

SPOT is flirting with price increases across a number of markets even if in the world’s largest music market, the company’s $10-a-month subscription cost has remained fixed for years even as Spotify added millions of podcasts and songs to the platform.

Spotify announced at the investor day that it would double the number of countries where its services are available and roll out dozens of new podcast shows from the likes of Barack Obama and Ava DuVernay.

The ultimate problem that SPOT still confronts is if music streaming can be a profitable business and I believe launching SPOT in 85 new territories across Africa, Asia, and Latin America, such as Ghana, Sri Lanka and Pakistan, will deteriorate SPOTs average revenue per user (ARPU).

ARPU has been declining steadily as the company offered promotional discounts and expanded into countries such as India, where it charges subscribers a lower price. ARPU dropped 8% in the fourth quarter from a year ago, to only €4.26.

At a broader level, the overall number of total ears is saving them but the reckoning with profitability problem could turn out to be 2021 which is inherently terrible for the underlying stock.

In the last year alone, SPOT tripled the number of podcasts on their platform, moving from about 700,000 in Q4 2019 to 2.2 million podcasts today.

Investments in originals and exclusives are creating more and more reasons for listeners to choose Spotify, and exclusive programming is already proving to be an essential part of differentiation.

But how long will they be able to burn through cash before they can scale a profit?

Even if we are in the early days of seeing the long-term evolvement of how we can monetize audio on the Internet, tech will have all business models, and that's the future for all media companies that first will have ad-supported subscription and a la carte sort of in the same space of all media companies in the future, and you should definitely expect Spotify to follow that strategy in that pattern.

Even with that tidal wave of secular positivity, Spotify’s management is modeling ARPU to be “roughly flattish” for 2021 and that’s a red flag.

The crop has already been harvested for 2020 because last year was the year that investors gave tech and all corporates a free pass to write off performance with investors only focusing on low rates, liquidity, and the overarching secular trends.

As 2021 plays out, the tech market is grappling with an undermining bond scare along with tough quarterly comparisons to last year.

It won’t be surprising to see tech growth consolidating and absorbing the higher rates and optimistic re-opening expectations.

After this dip, I expect SPOT to reaccelerate its growth contingent on increasing the ARPU that is beginning to become a sensitive spot for the company’s metrics.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.