“Cryptocurrency is such a powerful concept that it can almost overturn governments.” – Said Creator of Litecoin Charlie Lee

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 23, 2021

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(WHY WARREN BUFFET HATES GOLD),

(GLD), (GDX), (ABX), (GOLD)

Mad Hedge Technology Letter

September 22, 2021

Fiat Lux

Featured Trade:

(SHOP UNTIL YOU DROP)

(SHOP), (ZM), (TDOC), (TIKTOK)

E-commerce is now happening absolutely everywhere except the pipes in your house, and Shopify’s (SHOP) plan is to ensure that merchants using Shopify can sell pretty much everywhere.

That’s just how it is these days.

The internet town squares of modern day are social media and that corresponds to everywhere as people take social media to the streets in droves.

And so, it's important that wherever consumers could be potentially looking to purchase that Shopify merchants continue to show up there.

And from a merchant perspective, that it all neatly feeds back into a centralized back office where they can run their business.

So whether it's Google Search or it's on Instagram or it's on all the other channel integrations Spotify has, that is essential.

Now, again, over time, you are going to see more of these surfaces show up where commerce is happening, and Shopify is also integrating there to make sure that merchants can access those customers.

It’s SHOP’s job to stay one step ahead and that’s what they are exactly doing.

And of course, as more of those services come to life, that increases the complexity of commerce and running a business, a modern-day business, and that also increased the value Shopify provides to their customers.

Shopify and its platform do internet selling at a world-class level.

And yes, there are sometimes where it's faster, better, and more effective for them to partner with another technology company. They’ve developed a solid reputation for being a company that builds incredible software and particularly are renowned for having trustful partners.

But there are other times where SPOT needs to build it themselves because it's just mission-critical, and I have full confidence in them that they can actually deliver the best product on the planet.

This story and numbers are backed up by the latest short-term performance showing that SHOP is turning into an e-commerce juggernaut.

The latest earnings showed that year-over-year GMV growth in the rest of the world actually outpaced North America in Q2 2021.

We are seeing more international merchants that are joining and are succeeding on Shopify.

And fortunately, SHOP is stepping up its growth marketing, sales, and support efforts in places like Brazil and all over the world.

It isn't necessarily any particular focus on Brazil per se, but there are merchants around the world who are looking for a retail operating system and Shopify certainly is the priority.

Revenue in the second quarter was up 57% year over year to $1.1 billion, marking the first time Shopify exceeded $1 billion in a single quarter.

This was driven by strong performance from subscription solutions and merchant solutions segments.

The combined strength in revenue, improved margin profile, and lower overall opex spend as a percent of revenue contributed to strong adjusted operating earnings in Q2 compared to the same period last year.

Adjusted operating income was $236.8 million in the second quarter compared with adjusted operating income of $113.7 million in the second quarter of 2020, as revenue growth outpaced growth in spend.

Echoing the bit I said about social media being the townhall of ecommerce — this is something management takes personally, which is why they announced a partnership with TikTok to launch new in-app shopping features.

The deal will allow a select group of Shopify merchants to add a shopping tab to TikTok profiles and link directly to their online stores for checkout.

The understanding of buying things is now transforming shopping into an experience that's rooted in discovery, connection, and entertainment, creating unparalleled opportunities for brands to capture consumers' attention.

TikTok is uniquely placed at the center of content and commerce, and these new solutions make it even easier for businesses of all sizes to create engaging content that drives consumers directly to the digital point of purchase.

Social commerce is a rapidly booming market.

Sales on social media apps will surge 34.8% to more than $36 billion in 2021, according to eMarketer.

Partnering with the wildly popular short form video platform TikTok is a brilliant move for Shopify — one that’s likely to pay off quite quickly.

Back to the stock market — the stock today sits at $1,450 and has gone through a time correction shifting sideways for the past 3 months.

These levels still mean that SHOP is trading at PE levels around 75, but they are a growth stock so who cares about PE levels!

The past quarter’s sensational performance translated into expanding revenue by 57%.

No doubt that beating the comparable data from a covid year is turning out to be arduous with almost the effect of turning 2021 into a consolidation year.

That has certainly been the case for Zoom Video (ZM) and Teledoc (TDOC).

Management indicated that revenue won’t be growing at the same pace as last year, but readers shouldn’t stress because this lack of pace doesn’t suggest anything is wrong with the business model.

As long as Shopify sustains a growth rate of over 40% for the next few years which is easily attainable for a company accruing only $3 billion of revenue per year, the stock will go up.

That will surely happen, and I am guessing they can maintain a 50% growth rate.

Once the lower growth rates are digested, I envision this stock turning the corner and will rise to $1,800 by the middle of 2022.

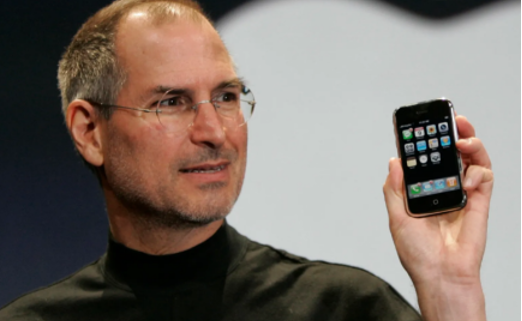

“Creativity is just connecting things. When you ask creative people how they did something, they feel a little guilty because they didn’t really do it, they just saw something.” — Said Co-Founder of Apple Steve Jobs

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 22, 2021

Fiat Lux

Featured Trade:

(THE GOVERNMENT’S WAR ON MONEY)

(TESTIMONIAL)

Mad Hedge Biotech & Healthcare Letter

September 21, 2021

Fiat Lux

FEATURED TRADE:

(GO GLOBAL WITH THIS VALUE PICK)

(AMRN), (HKMPF), (RDY)

Since it bottomed out in March last year, the stock market has been relatively unstoppable.

It took the widely tracked S&P 500 roughly 17 months to practically double its value, exhibiting what could only be described as the strongest rebound from a bear-market bottom throughout history.

But it looks like things are only starting to heat up. Even with the market already hitting new all-time highs, there remain some serious values up for grabs.

One of them is a small-cap company operating in the biotechnology and healthcare sector: Amarin (AMRN).

This biotech’s claim to fame is Vascepa, which can lower the risk of major adverse cardiovascular occurrences by 25% among patients undergoing statin therapy.

Basically, Amarin discovered that controlling cholesterol with statins is not enough to prevent heart disease.

Therefore, it formulated Vascepa to do something more effective: to reduce triglycerides, which is a kind of fat found in your blood.

What makes Vascepa an amazing drug is that it offers us a new understanding of the No. 1 killer among humans.

Based on a Harvard study, Vascepa’s ability to lessen triglycerides has succeeded in reducing strokes, heart attacks, and even deaths.

Right now, Amarin stock is incredibly cheap. There are two possible reasons behind this.

One reason is the COVID-19 pandemic, which triggered lockdowns that consequently hampered sales growth.

Typically, doctors need to be informed of new scientific and medical breakthroughs in their fields. That’s obviously difficult to do amidst lockdowns.

Despite that challenge, Amarin actually still managed to boost its revenue in 2020 by 43%. Considering that the lockdowns have started to ease this year, I anticipate increasing the rate in 2021.

The second reason for the stock’s low price is Amarin’s involvement in legal battles over its patents in the past year.

This problem has opened doors for the likes of Hikma Pharmaceuticals USA Inc. (HKMPF) and Dr. Reddy’s Laboratories (RDY) to offer generic versions of Amarin’s Vascepa in the US market.

As expected, this cast a cloud over the biotech’s growth story and pushed its share price down.

Although Amarin is caught in a tug-of-war between believers and naysayers, I still expect sales of Vascepa to spike in the future.

Regardless of the generic competition in the US, Amarin has retained 89% of the market share in this segment.

Moreover, Amarin’s patents outside the US remain intact. In fact, the European Commission has allowed the company to market the drug in the region.

Amarin’s patent on Vascepa has been extremely well protected in Europe for roughly two decades.

In fact, the company will be launching this blockbuster drug as Vazkepa in Germany and the UK this year—a strong contender as one of the company’s main revenue streams, with 80 million people diagnosed with cardiovascular disease in these regions.

For context, Vazkepa is expected to be sold for $250 in Europe compared to the lower $88 price point in the US, resulting from generic erosion.

Probably stemming from this issue, Amarin has modified its business model to focus more on global expansion.

One area of expansion is in Asia, specifically in China.

What we know so far is that Amarin and its Chinese partner are expected to receive regulatory approval by the end of 2021. When this happens, Vazkepa can then be marketed in mainland China and Hong Kong through commercial partners.

Apart from Europe and Asia, Amarin has also been expanding in other regions, including Canada, the UAE, and Lebanon.

Considering that the market for cardiovascular drugs is projected to reach roughly $92.4 billion this year, it’s not farfetched to say that Vascepa holds a multi-billion-dollar market opportunity.

In short, Amarin holds an approved drug proven to save lives, a massive market opportunity, and a solid competitive moat.

With a market capitalization of a little over $2 billion and priced at roughly $5 per share, Amarin is projected to reach at least $19 in the following months.

That’s a 280% upside awaiting patient investors.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.