“When you give everyone a voice and give people power, the system usually ends up in a really good place. So, what we view our role as, is giving people that power.” – Said Co-Founder and CEO of Facebook Mark Zuckerberg

Global Market Comments

March 30, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(SHOPPING FOR FIRE INSURANCE IN A HURRICANE),

(VIX), (VXX), (XIV),

(THE ABCs OF THE VIX),

(VIX), (VXX), (SVXY)

Mad Hedge Biotech and Healthcare Letter

March 29, 2022

Fiat Lux

Featured Trade:

(A DURABLE AND ENDURING STOCK IN THESE TROUBLING TIMES)

(AMGN), (JNJ), (AZN), (ABBV)

The latest market sell-off has motivated me to take a closer look at blue-chip businesses with solid track records of bringing value to shareholders regardless of the economic conditions.

After all, an insistence on putting money only in the highest quality stocks is key to long-term success in investing.

And when investing in the biotechnology and healthcare industry, it’s vital to choose stocks with robust drug portfolios and promising pipelines of candidates. This ensures continuous solid growth in the near and long run.

Amgen (AMGN) fits that description.

Over the years, Amgen has risen as one of, if not the most prominent biotechnology company. This company is one of the largest and possibly longest-running biotechnology businesses in the world.

It is a leader in various sectors, including oncology, blood disorders, cardiology, inflammation, and immunology. It has also expanded in other segments, with “King of Biologics” as the latest moniker for this biotech titan.

Amgen has been consistently profitable throughout its history, sustaining industry-leading margins that boost both its top and bottom-line growth.

Founded in 1980, it has steadily made a name for itself following the approval of its first drug —anemia treatment Epogen — in 1989.

Since then, this biotechnology stalwart has evolved into a significant player in the industry with a market capitalization of roughly $130 billion and an enterprise value of approximately $156 billion.

This translates to the company demonstrating a solid balance sheet on top of a robust repurchase program and an impressive track record of increasing its dividends.

Amid the sluggish economic climate in 2021, Amgen pulled $26 billion in total revenue to record a 6% climb year-over-year in adjusted EPS.

This improvement in its performance was fueled by its remarkable portfolio of branded drugs and biosimilars.

Naturally, the next question is whether the company can sustain this growth.

For 2022, Amgen announced a guided total revenue within the range of $25.4 billion and $26.5 billion.

In 2023, the company anticipates an accelerating growth primarily due to the US launch of the all-around immunology injection Amgevita, the expansion of psoriasis and psoriatic arthritis Otezla’s label, and additional momentum from future blockbusters severe asthma treatment Tezspire and non-small cell lung cancer oral therapy Lumakras.

Looking at the track record, the company estimates potential mid-single-digit growth in revenues from these products and over double-digit increase in EPS.

Moreover, the company has an impressive pipeline of roughly 40 innovative candidates. The programs include 10 cutting-edge molecules advancing through mid- and late-stage trials.

Among these are biosimilars for blockbuster products such as Johnson & Johnson’s (JNJ) Crohn’s disease treatment Stelara, and AstraZeneca’s (AZN) blood disorder drug Soliris.

If these get the green light, then each biosimilar could siphon hundreds of millions of dollars in yearly revenue from these competitors.

In particular, Amgen’s work on a biosimilar for AbbVie’s (ABBV) severe rheumatoid arthritis treatment Humira could generate substantial sales for the company.

Its burgeoning biosimilars programs and other pipeline candidates contribute to predictions that Amgen could record at least 7% in annual earnings growth over the next five years.

More importantly, Amgen offers a market-beating 3.3% dividend yield, making it an attractive investment with incredible growth potential.

As the market continues to make sense of the effects of inflation, the continuing conflict between Ukraine and Russia, and the constant threat of rate hikes, it has become essential to come up with a list of top quality companies that can offer steady growth and a healthy dividend.

Thus far, Amgen has been excellent at delivering on both counts.

It’s a great biotechnology company with a very solid history and, judging from its pipeline candidates, an even more solid future.

Mad Hedge Bitcoin Letter

March 29, 2022

Fiat Lux

Featured Trade:

(ANOTHER WIN FOR BITCOIN)

(RUSSIA), (BTC)

Bitcoin is getting its time in the sun as chairman of the Russian State Duma Committee on Energy, Pavel Zavalny revealed that payment for oil in Bitcoin (BTC) would be greenlighted.

What a dropped bombshell this is for the digital gold.

It’s hard to wrap my mind around that statement because it was just a few years ago when Bitcoin was the global pariah and not the world’s gas station Russia.

Now Russia has become the global pariah and to maneuver around a tricky political landscape, they have decided to just move the goalposts completely.

This is important for the dollar and the euro which are competitors to Bitcoin.

Those were the currencies that Europeans and other foreigners were used to settle their oil purchases with the Russians in the past.

Not anymore.

US President Joe Biden freezing Russian reserves has had the reverse effect of the Saudis looking to do business in oil without the US dollar and Russia tapping digital gold as their new form of payment or the alternative option of demanding payment of oil in Russian Rubles.

Hindsight is 20/20 and effectively scaring away foreigners from using the US dollar is a giant and transformational victory for cryptocurrency itself.

Historians might look back at this moment in history as the day the dollar hit the high watermark because I highly doubt that China or Russia will ever go back to settling even half a barrel of oil in US dollars.

Throwing fuel on the fire are countries like Hungary whose leader Viktor Orban has refused to stop buying Russian energy doubling down against the West saying that the Hungarian people aren’t footing the bill for this conflict.

The net net of this all is that Russia has received a narrow form of a free pass in markets like that because of the certainty involved in sending equities soaring.

Bitcoin has benefited from the risk-on sentiment with Bitcoin back up to $48,000.

Diversifying into Bitcoin and other currencies will lessen the dependence on dollars and euros issued by “unfriendly states” like the U.S. and the EU—and in the process skirt the sanctions they placed on it.

So then one must deduce that the severity of the sanctions has been reduced and we have clearly seen that flow through the market with the Russian Ruble reversing by 40% to almost pre-conflict levels.

One of the knocks on Bitcoin is the lack of institutional capital that can trigger a war chest of capital.

Bitcoin is now on the receiving end of a dream development with the biggest energy-producing nation ready to conduct business in its currency.

If this isn’t legitimizing Bitcoin, then someone please help me to understand what is?

Simply switching to Bitcoin or Ether would not exempt actors obligated to observe existing EU sanctions, but what if nations convert fiat to Bitcoin only to never convert it back to fiat and just hold a Bitcoin balance continuously.

That wouldn’t rub up against sanctions.

The takeaway from this debacle is that there are so many holes in the western “alliance” that Russian and China are just picking and choosing how they want to pick it apart like dissecting a toad with tweezers.

What this does amount to is a giant tsunami of potential flows into the cryptocurrency system and this puts $100,000 Bitcoin fairly in play again after the interest rate rise killed bullish sentiment earlier this year.

Russia has already partitioned off countries into “friendly” and “unfriendly” which the latter will be required to pay in Bitcoin or rubles.

One must question, is the intelligence about Russia losing really that accurate or was this their plan all along?

Let’s look at the tailwinds behind Russia at the moment.

Europeans like Germans and Hungarians continue to fund the Russian military machine through energy purchases.

Russia is able to skirt financial and energy sanctions using crypto.

The exorbitant current price of oil means significantly higher revenue for Russia in 2022 resulting in a healthier fiscal position.

The Russian government has been able to nationalize factories and infrastructure left by foreign companies.

The Russian Ruble staging a breathtaking turnaround of 40% are all signs that it's business as usual for the Kremlin.

Either way, this paves the way for energy deals with the global gas station to be settled in Bitcoin which is a monumental victory for crypto diehards and could trigger another leg higher for Bitcoin.

“One machine can do the work of fifty ordinary men. No machine can do the work of one extraordinary man.” – Said American Writer Elbert Hubbard

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 29, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(A BUY-WRITE PRIMER),

(AAPL)

There is always a way to make money in the stock market. Get the direction right and the rest is a piece of cake.

But what if the market is going nowhere, trapped in a range, with falling volatility? Yes, there is even a low risk, high return way to make money in this kind of market, a lot like the one we have now.

2022 may be a more subdued affair than recent years, with the Dow gaining a modest 10%. The average annualized return for the last ten years is 13.9%, including dividends.

And that’s the way markets work. It’s like watching a bouncing ball, with each successive bounce shorter than the previous one. Thank Leonardo Fibonacci for this discovery (click here for details.)

Which means a change in trading strategy is on order. The free lunch is over. It’s finally time to start working for your money.

When you’re trading off a decade low, it's pedal to the metal, full firewall forward, full speed ahead, damn the torpedoes. Your positions are so aggressive and leveraged that you can’t sleep at night.

Some 16 months into the bull market, not so much. It’s time to adjust your trades for a new type of market that continues to appreciate, but at a slower rate and not as much.

Enter the Buy-Write.

A buy-write is a combination of positions where you buy a stock and also sell short options on the same stock against the shares at a higher price, usually on a one-to-one basis.

“Writing” is another term for selling short in the options world because you are in effect entering into a binding contract. When you sell short an option, you are paid the premium the buyer pays and the cash sits in your brokerage account accruing interest.

If the stock rallies, remains the same price, or rises just short of the strike price you sold short, you get to keep the entire premium.

Most buy-writes take place in front month options and the strike prices are 5% or 10% above the current share price. I’ll give you an example.

Let’s say you own 100 shares of Apple (AAPL) at $140. You can sell short one August 2021 $150 call for $1.47. You will receive the premium of $147.00 ($1.47 X 100 shares per option). Remember, one option contract is exercisable into 100 shares.

As long as Apple shares close under $150 at the August 20 option expiration, you get to keep the entire premium. If Apple closes over $150, you automatically become short 100 Apple shares. Then you simply instruct your broker to cover your short in the shares with the 100 Apple shares you already have in your account.

Buy-writes accomplish several things. They reduce your risk, pare back the volatility of your portfolio, and bring in extra income. Do these right and it will enhance the overall performance of your portfolio.

Knowing when to strap these babies on is key. If the market is going straight up, you don’t want to touch buy-writes with a ten-foot pole as your stock will be called away and you will miss substantial upside.

It’s preferable to skip dividend-paying months, usually March, June, September, and December to avoid your short option getting called away mid-month by a hedge fund trying to get the dividend on the cheap.

You don’t want to engage in buy-writes in bear markets. Whatever you take in with option premium, it will be more than offset by losses on your long stock position. You’re better off just dumping the stock instead.

Now comes the fun part. As usual, the are many ways to skin a cat.

Let’s say that you are a cautious sort. Instead of selling short the $150 strike, you can sell the $155 strike for less money. That would bring in $79 per option. But your risk of a call-away drops too.

You can also go much further out in your expiration date to bring in more money. If you go out to the January 18, 2022 expiration, you will take in a hefty $6.67 in option premium, or $667 per option. However, the likelihood of Apple rising above $150 and triggering a call-away by then is far greater.

Let’s say you are a particularly aggressive trader. You can double your buy-write income by doubling your option short sales at the ratio of 2:1. However, if Apple closes above $150 by expiration day, you will be naked short 100 shares of Apple.

It is likely you won’t have enough cash in your account to meet the margin call for selling short 100 shares of Apple so you will have to buy the shares in the market immediately. It's something better left to professionals.

How about if you are a hedge fund trader, have a 24-hour trading desk, a good in-house research department, and serious risk control? Then you can entertain “at-the-money buy writes.”

In the case of Apple, you could buy shares and sell short the August 20 $140 calls against them for $4.45 and potentially take in $4.45 for each 100 Apple shares you own. Then you make a decent profit if Apple remains unchanged or goes up less than $4.45.

That amounts to a $3.18% return in 34 trading days and annualizes out at 26%. In bull markets, hedge funds execute these all day long, but they have the infrastructure to manage the position. It’s better than a poke in the eye with a sharp stick.

There are other ways to set up buy-writes.

Instead of buying stock, you can establish your long position with another call option. These are called “vertical bull call debit spreads” and are a regular feature of the Mad Hedge Trade Alert Service. “The “vertical” refers to strike prices lined up above each other. The “debit” means you have to pay cash for the position instead of getting paid for it.

How about if you are a cheapskate and want to get into a position for free? Buy one call option and sell short two call options against it for no cost. The downside is that you go naked short if the strike rises above the short strike price, again triggering a margin call.

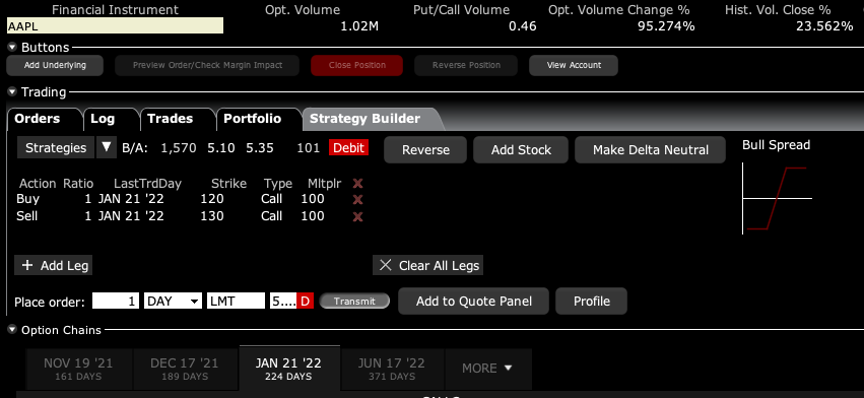

Here is my favorite, which I regularly execute in my own personal trading account. Buy long-term LEAPS (Long Term Equity Anticipation Securities) spreads like I recommended some time ago with the (AAPL) January 21 $120-$130 vertical bull call spread for $5.20.

On expiration day, it closed at $7.21, up 38.65%.

This is a bet that one of the world’s fastest-growing companies will see its share unchanged or higher in seven months. In Q1, Apple’s earnings grew by an astonishing 35% to $23.6 billion. Sounds like a total no-brainer, right?

If I run this position all the way to expiration, the total return would be ($10.00 - $5.20 = $4.80), or ($4.80/$5.20 = 92.31%) by the January 21, 2022 options expiration. This particular expiration benefits from the year-end window dressing surge, and the New Year asset allocation into equities.

Whenever we have a big up month in the market, I sell short front-month options against it. In this case, that is the August 20 $150 calls. This takes advantages of the accelerated time decay you get in the final month of the life of an option, while the time decay on your long-dated long position is minimal.

Keep in mind that the deltas on LEAPS are very low, usually around 10% because they are so long-dated. That means your front month short should only be 10% of the number of shares owned through your LEAPS in order to set delta neutral. Otherwise, you might get hit with a margin call you can’t meet.

After doing this for 53 years, it is my experience that this is the best risk/reward options position available in the market.

To make more than 92.31% in seven months, you have to take insane amounts of risk, or engage in another profession, like becoming a rock star, drug dealer, or Bitcoin miner.

I’m sure you’d rather stick to options trading, so good luck with LEAPS.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.