When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

June 6, 2022

Fiat Lux

Featured Trade:

(A KEY CLUE TO THE FUTURE OF META)

(FB), (COMPQ)

Chief Operating Officer (COO) of Facebook (FB) Sheryl Sandberg quitting from her post caught many off guard.

It seemed like she was in it to the end, until she wasn’t.

Most thought she wouldn’t stop until the company she worked for completely destroyed democracy, or ruined other countries’ free elections, or until she had more money than most sovereign countries.

Apparently, that wasn’t the finish line!

Did she get tired of all the mass killings that Facebook streamed live to its multi-billion-person audience?

Probably not.

My read into this is that Facebook is heading directly for a cataclysmic revenue iceberg and Sandberg is definitely not on board with the new direction of the company, i.e. the Metaverse.

The Metaverse has already lost 10s of billions of dollars and will continue to do so for the next couple of years for a very untested and unproven technology.

She clearly gives the Metaverse a big thumbs down and we might look back on this to a vital signal or even a missed sign.

Sandberg would most likely stay on board if there was another billion it in for her.

Remember, it was Sandberg who brought the concept of a digital ad model from Google to Facebook which catapulted Facebook into a wildly successful cash cow for its shareholders.

After that, I am not sure what else she did, but most executives never get that far in the first place.

Another takeaway from her resignation is that her digital ad model which essentially stole personal data from the user to sell to digital advertisers is on a downward and irreversible trajectory.

The underlying data supports this notion as Facebook, minus Instagram, bleeds users.

So instead of being in Menlo Park to take the blame for the downfall, might as well rebrand herself as the most powerful female Venture Capitalist in technology and move on to reignite her corporate feminism.

Even though she did pocket well over a billion dollars from her 14-years in mostly vested stock selling, she will be more known for selling out the Facebook user.

Rather than sacrifice a smidgeon of profitability to protect users, she decided to build a colossal army to construct a communications and government affairs squad to deny and deflect criticism of Facebook.

Those teams have been supremely effective at stymieing any momentum to go after Facebook itself.

That’s why the company is never in trouble and executives aren’t in jail.

They run a playbook of delaying tactics that stretch each story beyond the attention span of journalists and policymakers and even paying others to write bad press.

Sandberg was the engineer of that strategy and of the teams that implemented it. This was a deliberate choice. So was the Facebook decision to hire a consultancy to do opposition research about George Soros after the billionaire criticized Facebook in a speech at the World Economic Forum in early 2018.

She is a master of the dark arts and her quitting at Facebook does help cleanse the stench of the tech industry that has built a rotten reputation recently.

The biggest corporate sellout of Silicon Valley quitting epitomizes the deep trenches tech and Facebook find themselves in right now.

The fall from grace in 2022 has forced many hedge funds to liquidate.

Negative wealth effects are something no industry wants to be a part of.

However, it appears there is light at the end of the tunnel.

The 30% correction in the Nasdaq index has been followed by a 6% bear market rally.

The good news is that it's highly likely the Nasdaq index will not experience another 30% correction in the second half of 2022.

However, a recession not yet being priced into Nasdaq shares and a bad earnings setup put a spanner into the works, which is why the bear market rally is legitimately capped to the upside.

This means that it's the year of the short-term trader while long-term ETF holders won’t and haven’t found much success this year.

Sell the big rallies and buy the big dips, then take profits.

At least now is the time we are starting to discover dip buyers after they took the first 6 months off in 2022.

“I know tech better than anyone.” – Said then-current President of the United States Donald J. Trump on his Twitter Account in 2018

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

June 6, 2022

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT IS ON FOR JUNE 14-16)

(MARKET OUTLOOK FOR THE WEEK AHEAD, or PUTIN’S DEAD END),

(VIX), (HYG), (JNK), (PTON), (W), (MSTR), (RDFN), (BYND), (F), (TSLA), (NVDA)

The current consensus for market strategists is that volatility will remain high.

Please pinch me because I think I died and went to heaven. For every time the Volatility Index (VIX) tops $30, I make another 10%-15% for my followers.

The bulk of market players are now obsessing whether we are entering a recession or not, as if their investment faith depended on it.

Recession, resmession.

As long as I can keep making a 65.40% trailing one-year return, while the Dow Average is off -4.2% during the same time period, I could care less what the economy is actually going to do.

After an impressive 380-point, 10% rally in the S&P 500, it now looks like the stock market is failing once again. Best case, we revisit this year’s low at 3,800. Worst case, we break to new lows at 3,600. The very worst case, we break below 3,500 and wish you had never heard of the stock market.

If you are a trader, there is a fantastic opportunity here to buy low, sell high, and retire early. If you are disciplined, you still have a ton of cash left over from the end of 2021 (I was 100% cash) and will be cherry-picking on the big down days.

It's really very simple. The longer you have been doing this, the easier it gets and the more money you will make. After 52 years of practice, I can do this in my sleep.

As the bear market worsens, we are seeing old asset classes return from the dead like the revived dinosaurs of Jurassic Park. Call convertible bonds are the velociraptors of the bunch.

Take the main junk bond ETF like the iShares iBoxx High Yield Corporate Bond Fund (HYG) and the SPDR Barclays High Yield Bond Fund (JNK), which have seen yields double from 3% to over 6% in only six months.

If you are willing to take on more risk, individual busted convertible bonds yield infinitely more. You know all the names. Peloton (PTON) converts are paying a 10.4% yield to maturity, Wayfair (W) 11.0%, MicroStrategy (MSTR) 13.1%, Redfin (RDFN) 14.5%, and Beyond Meat (BYND) 19.5%. Buy ten of these and even if one goes under, you still earn a decent double-digit return.

Having run a convertible bond trading desk for ten years, I can tell you that the risk/reward balance for many individuals with this investment class is just right.

As my summer military duty approaches, information about the Ukraine War is pouring into me. I will share with you what I can, what has been declassified for the war is still a major factor in your investment outcomes. I have been able to use my “top secret” status for 50 years,= to your benefit.

The amazing thing is that in this modern age, information goes from “top secret” to declassified in only a day. It is a new strategy used by the current administration that is working incredibly well. Information is more valuable shared than locked up.

I have been getting a lot of questions from readers as to why Vladimir Putin committed such a disastrous error by invading Ukraine as he is considered a smart guy. My initial response was that he surrounded himself with “yes” men who only told him what he wanted to hear, leading to terrible outcomes, which I have seen happen many times.

The costs of the war for Putin have so far been enormous; 50,000 casualties, 1,000 tanks, 1,300 armored vehicles, banishment from the western economy, the loss of $1 trillion in foreign held assets, and the decline of the national GDP from $1.5 trillion to $1 trillion.

The costs are about to substantially rise. The US is now sending over its most advanced artillery systems, the MRLS, or Multiple Rocket Launch System, which can hit any target within 300 miles with an accuracy of one meter. All you have to do is dial in the latitude and longitude of the target and it never misses. This one weapon will certainly bring the war to a stalemate and consign it to page three of the newspapers.

But after doing a ton more research, my view has evolved. Putin has in fact launched a Resource War against the entire rest of the world. The result has been to boost the price of practically everything Russia produces, including oil ($123 billion), refined petroleum products ($63 billion), iron & steel ($28 billion), coal ($17 billion), fertilizer ($13 billion), wood ($12 billion), wheat ($9 billion), aluminium ($8 billion), platinum, palladium, uranium.

There is also the inflation angle. While the US benefits from many of these high prices as well, they have raised the US inflation rate from 5% to 8.3%. That damages the election prospects of Biden and the Democrats. High inflation improves the election of prospects of a former president who Putin seems to vastly prefer for whatever reason.

After covering Russia for 50 years, flying their front-line fighters, springing a wife out of jail in Moscow, I can tell you that everything there is a chess game, and they play a very long game.

Nonfarm Payroll Report comes in at 390,000, better than expected. Leisure & Hospitality led the gains with 84,000, and Professional & Business Services by 75,000. Manufacturing fell to only 18,000, largely because of a shortage of workers. The Headline Unemployment Rate remained the same at 3.6%. Average hourly earnings rose by an inflationary 5.2% YOY. The U6 “discouraged worker” rate rose back to 7.1%.

Weekly Jobless Claims jump 19,000 to 200,000, a two-month high, according to the Department of Labor. Compensation for American workers has hit a 30-year high. New York showed the largest increase followed by Illinois.

OPEC+ raises oil output to meet surging energy demand caused by the Ukraine War. Up 648,000 barrels a month for July and August. They could easily do a lot more. The cartel is aiming for the pre-pandemic 10 million barrels a day. No dent in prices at the pump yet.

Hedge Funds were slaughtered in May, with the flagship Tiger Global Fund down a massive 14%. Gee, Mad Hedge Fund Trader was UP 11% in May and am up 44% on the year. Maybe there’s something in the water here at Lake Tahoe. Or, maybe it’s the “Mad” that is giving me my edge?

S&P Case Shiller National Home Price Index tops 20.6%, a new all-time high. Tampa (34.8%), Miami (32.4%), and Phoenix (32.0%) lead the gains. Incredible as it may seem, price rises are accelerating. But expect that to cool off once current prices start feeding into the index.

Home Listings soar, with homes for sale up 9% YOY as homeowners fear missing getting out at the top. New listings have doubled in a year, according to Redfin. Outrageous over-market bids have definitely ended in California. So far, no hint of price drops….yet.

A Ford (F) Electric Pickup can power your house for ten days, but only if you live in a tiny house. Ford is the first company to introduce bidirectional charging that lets your home run off the vehicle’s 1,300-pound lithium-ion battery. All you need is a $3,895 hardware upgrade from Sunrun. The range is 320 miles, not as much as the latest Tesla Model X (TSLA). Good luck getting one. Ford isn’t taking any new orders until it fills the 200,000 it already has. Expect Tesla to copy the move.

The Fed may overshoot on raising interest rates if Fed governor Christopher Waller has his way. That’s because going too tight may be necessary to break the back of inflation. That’s what happened in 1980, when Fed Funds hit 17%, and ten-year bond yields hit 15.84%. My first home mortgage interest rate for a coop in Manhattan back then was 17%.

China Covid Cases fade, prompting a big Bitcoin rally. This could be the impetus for a sudden global economic recovery that will deliver a big US stock market rally. Good thing I loaded the boat with tech stocks two weeks ago.

The Fed Minutes were not so horrible, downplaying the risk of a full 1% rate rise, triggering a 1,000-point rally in the Dow. With five up days in a row this is starting to look like THE bottom. Is this the light at the end of the tunnel?

NVIDIA (NVDA) rips, surprising to the upside on almost every front, sending the stock up $30, or 18.75%. Mad Hedge followers bought (NVDA) last week. This is one of the best run companies in the world. I expect the shares to rise from the current $178.51 to $1,000 in five years. Buy (NVDA) on dips.

Q1 GDP dives 1.5%, in its final read. It’s the worst quarter since the pandemic began during Q2 2022. Weekly Jobless Claims dropped 8,000 to 210,000.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyperaccelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my June month-to-date performance recovered to +2.49%.

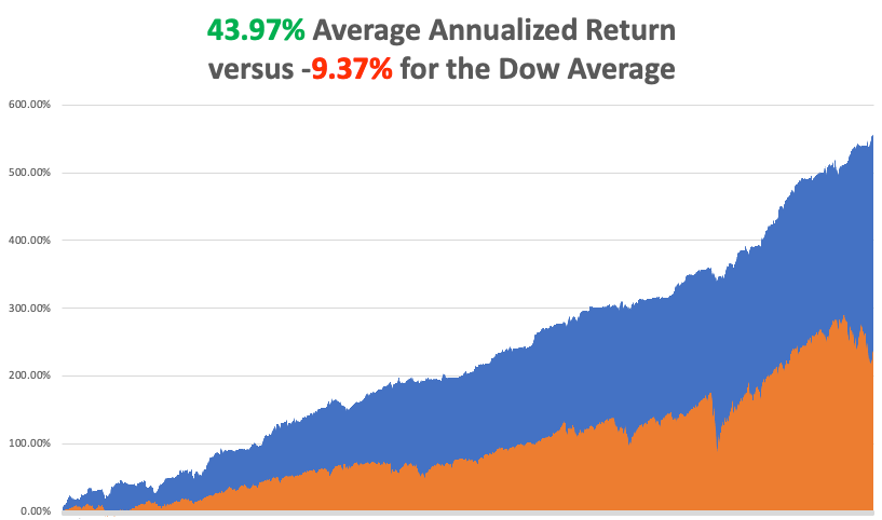

My 2022 year-to-date performance exploded to 44.36%, a new all-time high. The Dow Average is down -9.37% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky high 65.40%.

That brings my 14-year total return to 556.92%, some 2.37 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.97%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 84.7 million, up 300,000 in a week and deaths topping 1,000,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, June 6 is the 78th anniversary of the D-Day invasion of Normandy. All of the veterans I knew have long since passed. I’ll miss the memorial this year.

On Tuesday, June 7 at 8:30 AM, the US Balance of Trade for April is released.

On Wednesday, June 8 at 10:30 AM, US Crude Inventories are published.

On Thursday, June 9 at 8:30 AM, Weekly Jobless Claims are out.

On Friday, June 10 at 8:30 AM, the blockbuster US Core Inflation Rate is announced. More importantly, the new dinosaur movie, Jurassic World: Dominion, is released. At 2:00 the Baker Hughes Oil Rig Count are out.

As for me, this is not my first Russian invasion.

Early in the morning of August 20, 1968, I was dead asleep at my budget hotel off of Prague’s Wenceslas Square when I was suddenly awoken by a burst of machine gun fire. I looked out the window and found the square filled with T-54 Russian tanks, trucks, and troops.

The Soviet Union was not happy with the liberal, pro-western leaning of the Alexander Dubcek government so they invaded Czechoslovakia with 500,000 troops and overthrew the government.

I ran downstairs and joined a protest demonstration that was rapidly forming in front of Radio Prague trying to prevent the Russians from seizing the national broadcast radio station. At one point, I was interviewed by a reporter from the BBC carrying this hulking great tape recorder over his shoulder, as I was the only one who spoke English.

It seemed wise to hightail it out of the country, post haste, as it was just a matter of time before I would be arrested. The US ambassador to Czechoslovakia, Shirley Temple Black (yes, THE Shirley Temple), organized a train to get all of the Americans out of the country.

I heard about it too late and missed the train.

All borders with the west were closed and domestic trains shut down, so the only way to get out of the country was to hitch hike to Hungary where the border was still open.

This proved amazingly easy as I placed a small American flag on my backpack. I was in Bratislava just across the Danube from Austria in no time. I figured worst case, I could always swim it, as I had earned both, the Boy Scout Swimming, and Lifesaving merit badges.

Then I was picked up by a guy driving a 1949 Plymouth who loved Americans because he had a brother living in New York City. He insisted on taking me out to dinner. As we dined, he introduced me to an old Czech custom, drinking an entire bottle of vodka before an important event, like crossing an international border.

Being 16 years old, I was not used to this amount of high-octane 40 proof rocket fuel and I was shortly drunk out of my mind. After that, my memory is somewhat hazy.

My driver, also wildly drunk, raced up to the border and screeched to a halt. I staggered through Czech passport control which duly stamped my passport. I then lurched another 50 yards to Hungary, which amazingly let me in. Apparently, there is no restriction on entering the country drunk out of your mind. Such is Eastern Europe.

I walked another 100 yards into Hungary and started to feel woozy. So, I stumbled into a wheat field and passed out.

Sometime in the middle of the night, I felt someone kicking me. Two Hungarian border guards had discovered me. They demanded my documents. I said I had no idea what they were talking about. Finally, after their third demand, they loaded their machine guns, pointed them at my forehead, and demanded my documents for the third time.

I said, “Oh, you want my documents!”

I produced my passport, When they got to the page that showed my age they both started laughing.

They picked me and my backpack up and dragged me back to the road. While crossing some railroad tracks, they dropped me, and my knee hit a rail. But since I was numb, I didn’t feel a thing.

When we got to the road, I saw an endless stream of Russian army trucks pouring into Czechoslovakia. They flagged down one of them. I was grabbed by two Russian soldiers and hauled into the truck with my pack thrown on top of me. The truck made a U-turn and drove back into Hungary.

I contemplated my surroundings. There were 16 Russian Army soldiers in full battle dress holding AK-47s between their legs and two German Shepherds all looking at me quizzically. Then I suddenly felt the urge to throw up. As I assessed that this was a life and death situation, I made every effort to restrain myself.

We drove five miles into the country and then stopped at a small church. They carried me out of the truck and dumped me and my pack behind the building. Then they drove off.

The next morning, I woke up with the worst headache of my life. My knee bled throughout the night and hurt like hell. I still have the scar. Even so, in my enfeebled condition, I realized that I had just had one close call.

I hitch-hiked on to Budapest, then to Romania, where I heard that the beaches were filled with beautiful women. My Italian let me get by passably in the local language.

It all turned out to be true.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

One More Off to College

If You Don’t Like the Price, Don’t Use it

"If we live in a period of uncertainty long enough, it becomes the norm," said Drew Matus, an economist at UBS.

Mad Hedge Technology Letter

June 3, 2022

Fiat Lux

Featured Trade:

TECH RECESSION IS COMING)

(GOOGL), (MSFT), (AAPL), (TSLA)

The Nasdaq index isn’t pricing in a recession, but it absolutely should, as economic data streaming in shows cracks beneath the surface.

The Federal government finally went on record to admit the historically epic blunder they committed by categorizing inflation as “transitory,” with Treasury Secretary Janet Yellen acknowledging that she was “wrong.”

It's about time.

The colossal mismanagement of monetary policy by the Federal Reserve has had an extraordinary whiplash on tech shares and many have gotten burnt.

What we are experiencing now is high volatility that used to never exist in the stock market as an overleveraged system flooded by cheap money is now deleveraging.

Strong tech names like Google (GOOGL) and Microsoft (MSFT) have experienced 3% up or down days on just normal trading days with growth stocks like Tesla (TSLA) up or down 10% in just a day.

Retail traders are in over their head if they go at this alone and this is why the Mad Hedge Technology Letter is guiding you to safety.

Taking profits on the spikes and valleys is what we do best.

After months of strong consumer spending and supply-chain improvements, some of the country’s most outspoken corporate leaders have started to freak out.

Tech growth bellwether Tesla (TSLA) and their CEO Elon Musk just announced a 10% staff layoff, and that move could be the canary in the coal mine for the tech economy.

Musk clearly feels something isn’t right, and we could be approaching an economic cliff.

If that wasn’t the canary, then Microsoft's downgraded revenue expectations for next quarter’s earnings has to be as the strongest tech companies downgrade forecasts.

The probability of a recession has lurched higher, to around 50%, and this is all while the government preaches about how great the American consumer is doing.

Like many things about the US Federal government, don’t take what they say at face value because usually, the inverse is true.

The sense of doom has been especially evident in the banking sector, where Dimon told investors this week that they should be preparing for an economic “hurricane.”

State side is getting a little crusty, so then the international picture is a little rosier, right?

Wrong.

Apple is shifting its iPad production to Vietnam from China after China’s dystopian zero covid policy has effectively shut down the supply chain there.

The iPhone maker already produces some of its AirPods in Vietnam. The shift to move some iPad production to Vietnam may help it boost iPad revenue.

Ironically enough, as bad as the United States is doing now, the situation abroad is a lot worse.

Europe has completely capitulated to the military conflict and the German Producer Pricing Index has accelerated to 30%.

To make matters even worse, the European Central Bank still is maintaining a 0% net interest rate policy meaning there are Central Bank’s out there doing a lot worse job than the United States Federal Reserve.

Quite hard to believe this level of policy failure.

In short, this inflation problem hasn’t been solved at all and although it could come down a tick year-over-year, it still does nothing material to change the picture.

Even worse, a tech CEO has to be a complete fool to invest in growing capacity right now unless they have $10 billion of extra cash laying around which few companies have unless you’re Facebook, Google, Apple, Microsoft, or Tesla.

At the smaller and ground level, small tech and their balance sheets have been getting slaughtered and so has the American consumer.

Just because the American consumer goes from eating premium beef to chicken, doesn’t mean the consumer is strong.

Sooner or later, they will run out of things to substitute down from.

Same goes for smartphones, software programs, semiconductor chips, and cloud enterprise contracts.

We are in a substitute down phase and that doesn’t shout economic bullishness to me.

Maybe the American consumer can substitute driving a gas-powered car for riding a leg-powered bicycle, I wouldn’t put it past the current government to recommend this to the country.

In Europe, people have already been fed with the drive slower and dress warmer B.S. to cover up government mistakes.

Next, Europeans will need to endure the “eat less” policy come this summer and fall.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.