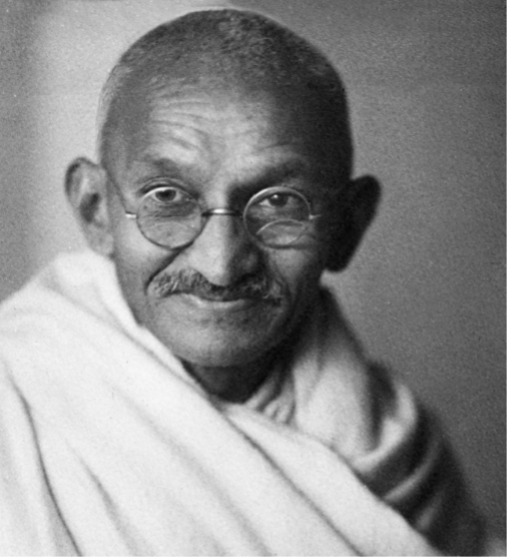

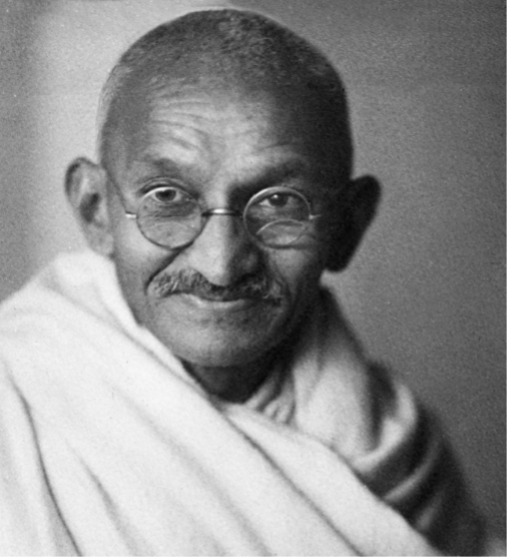

“Live as if you were to die tomorrow.” – Said Indian revolutionary Mahatma Gandhi

“Live as if you were to die tomorrow.” – Said Indian revolutionary Mahatma Gandhi

(THE MARKETS AHEAD AND A COUPLE OF STOCKS FOR YOUR CHRISTMAS STOCKING)

November 27, 2023

Hello everyone,

Welcome to the last week of November. In the Northern hemisphere, you are heading into winter and in the southern hemisphere, we are heading into a hot summer. Bushfires have already been experienced in four states, including New South Wales, Western Australia, Queensland, and Victoria. And on top of the cost-of-living crisis in Australia, we are now going through our eighth Covid wave, with many deaths being recorded.

Economic Calendar

Markets will have one hurdle to clear in the week ahead. On Thursday, investors will get the October personal consumption expenditures reading, which is the Federal Reserve’s preferred inflation gauge. It’s set to show a rise of 0.2%, down from the 0.7% rise in the prior month, according to FactSet consensus estimates.

In a nutshell, if the number is hotter than expected, it could call into question whether the Fed is done tightening. So, in other words, it could be negative for the markets if the number comes in worse than expected.

Several retailers are also set to report. Here’s a summary.

Monday, Nov 27

8 a.m. Building Permits final (October)

10 a.m. New Home Sales (October)

10:30 a.m. Dallas Fed Index (November)

Tuesday, Nov 28

9 a.m. FHFA Home Price Index (September)

9 a.m. S&P/Case Shiller comp. 20 HPI (September)

10 a.m. Consumer Confidence (November)

10 a.m. Richmond Fed Index (November)

Earnings: Hewlett Packard Enterprise, NetApp, Intuit

Wednesday, Nov 29

8:30 a.m. GDP Chain Price second preliminary (Q3)

8:30 a.m. GDP Second preliminary (Q3)

Earnings: Costco Wholesale, Synopsys, Dollar Tree, Hormel Foods

Thursday, Nov 30

8:30 a.m. Continuing Jobless Claims (11/18)

8:30 a.m. Initial Claims (11/25)

8:30 a.m. PCE Deflator (October)

8:30 a.m. Personal Consumption Expenditure (October)

8:30 a.m. Personal Income (October)

9:45 a.m. Chicago PMI (November)

10 a.m. Pending Home Sales Index (October)

Earnings: Ulta Beauty, Salesforce, Kroger

Friday, Dec. 1

9:45 a.m. Markit PMI Manufacturing final (November)

10 a.m. Construction Spending (October)

10 a.m. ISM Manufacturing (November)

Earnings: Dominion Energy, Cboe Global Markets, Cardinal Health, Gartner

Market Update:

Wall Street looks set to wrap up a strong month this week as stocks head for new highs heading into the year-end. The major averages have rallied after cooler inflation reports appeared to confirm the Federal Reserve is done hiking, raising hopes it can start cutting next year. The Nasdaq Composite is on pace to close out the month with a double-digit advance, up 10%.

Historically, the market has done well in the final quarter of a pre-election year, and even better for a first-term president seeking re-election, according to CFRA’s Stovall. Since World War II, the market has risen 6% on a total return basis and has never dropped.

Some analysts consider the market overbought now, and they are expecting the market to start to slow going into this week. We will have to wait and see who has called this market correctly.

I still see the S&P 500 rallying up towards 4,700 to 4,800 and I am looking for a double top in the Nasdaq before the market starts to pull back.

Gold is displaying a developing inverse Head and Shoulders continuation pattern. A sustained break above neckline resistance at $2,017 completes this bullish structure, yielding an upside target of $2,210 over the coming weeks.

The uptrend is still in progress in Bitcoin with a target of around $43,000.

What should you have in your portfolio for the long term?

Wall Street loves many of Warren Buffett’s stock picks.

These are two I would recommend.

Amazon (AMZN)

84% of Wall Street analysts rate this stock as a buy. Analysts argue that there is still a 22% upside from current prices. The company recently solidified a deal with Snap that allows users of the platform to purchase Amazon products without leaving the Snapchat application.

Snowflake (SNOW)

56% of Wall Street analysts rate SNOW as a buy with price targets giving the stock upside of 19% from current levels. The company is still in the early innings of growth.

Cheers,

Jacquie

Global Market Comments

November 27, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MELT UP),

(MSFT), (NLY), (BRK/B), (CCJ), (CRM), (GOOGL), (SNOW), (CAT), (XOM), (TLT)

If you think the market performance for the past month has been spectacular, you have seen nothing yet. We have two major positive catalysts that are about to hit stock prices.

On December 10, we will see a lower-than-expected Consumer Price Index, driving yet another stake through the heart of inflation. On December 13, we will also be greeted with a Federal Reserve decision to keep interest rates unchanged, as they will do over the next several meetings.

“Higher for shorter” is about to become the new market mantra.

That will give the market the shot in the arm it needs to reach my $4,800 yearend target, which was precisely the goal I laid out on January 1. Caution has been thrown to the wind and hedging downside risks has become a distant memory. One of the fastest market melt-ups in 100 years will do that. Complacency is the order of the day.

Equity-oriented mutual funds have seen $43 billion in inflows so far in November. Commodity Trading Funds, or CTA’s, have seen a breathtaking $60 billion piled into long equity strategies.

Hedge funds flipped from short to long and now have the most aggressively bullish positions in 22 years, mostly in big tech. All of this has taken the Volatility Index (VIX) down to a subterranean $12 handle. Bears are suddenly lonely….and afraid.

Yes, 55 years of practice makes this easy.

On October 28, it turns out that we reached a decade-high peak in bond investment when Treasuries were flirting with new highs in yields. With perfect rear-view mirror hindsight that’s when many investors cut stock holdings to the bone. They will spend the next several months desperately trying to get back in.

Oh yes, and Company buybacks are about to surge as companies race to pick up their own stocks before the yearend deadline. Apple is the top buyback stock followed by Alphabet (GOOGL) and Microsoft (MSFT). Heard these names before?

And while big tech is starting to look expensive, they are cheap when you factor in the trillions of dollars in profits that are headed their way over the next decade.

That’s what always happens.

What could pee on my victory parade? Ten-year US treasury bonds revisiting a 5.08% yield, crude oil popping back up to $100 a barrel, oil another new blacking swan alighting out of the blue, like a Chinese invasion of Taiwan, or Russia retaking the Baltic states. That’s all.

Avoid these and stocks will continue to rise, as will your retirement funds.

The Magnificent Seven will continue to lead, as will big financials, which are still at bargain-basement levels. Energy and commodities are already posting January sale prices, discounting a 2024 recession that isn’t going to happen. This is fertile LEAPS territory.

Weekly Jobless Claims Drop 24,000, to 209,000 in one of the sharpest declines this year. It makes last week’s jump look like an anomaly.

Consumer Inflation Expectations Rise, to 3.2%, a 12-year high. They are counting on a 4.5% in 2024. They are now looking at gasoline prices. There’s your mismatch. Any decline in inflation will be viewed as a shocker and drive share prices to new all-time highs.

US Gasoline Prices Hit Three-Year Low, on recession fears and replacement concerns by EVs. Energy stocks are tracing the downside tic for tic, pulling down all other commodities. Don’t buy this dip.

Pending Home Sales Plunge to 13-Year Low, down 4.1% in October, on a signed contracts basis. Sales were down 14.6% year over year. The median price of an existing home sold in October was $391,800, an increase of 3.4% from October 2022. These are the last poor sales numbers before the collapse in interest rates. At the end of October, there were 1.15 million homes for sale, down 5.7% from a year earlier. This is about half as many homes as were available for sale pre-Covid. At the current sales pace, that represents a 3.6-month supply. A six-month supply is considered a balanced market between buyer and seller.

Monster Pay Hikes Will Lead to Strong Japanese Yen, with whiskey maker Suntory offering 7% pay hikes. The prospect of falling US interest rates adds fuel to the fire. Buy (FXY) on dips.

Starship Two Blows Up, two minutes or 92 miles after launch. The test fire of the 33-engine spacecraft was considered a success. The massive 397-foot tall, 30-foot-wide rocket, the largest ever built, is crucial for the NASA moon launch in 2025 and the SpaceX Mars trip further down the road.

NVIDIA (NVDA) Beats, with a profit triple, but that stock sells off 6% on the news. It was a classic buy the rumor, sell the news move. Future earnings increases will not be as big. Keep "buy (NVDA) on dips" as a must-own.

Famed Short Seller Jim Chanos shut down after a massive short in Tesla shares blew up. His funds under management have plunged from $6 billion to $200 million since (TSLA) went public. Chanos had a few big wins, notably Enron in 2001. But he was also seen as a hedge against other long positions.

So far in November, we are up +12.62%. My 2023 year-to-date performance is still at an eye-popping +78.79%. The S&P 500 (SPY) is up +19.73% so far in 2023. My trailing one-year return reached +81.00% versus +18.91% for the S&P 500.

That brings my 15-year total return to +675.98%. My average annualized return has exploded to +48.57%, another new high, some 2.49 times the S&P 500 over the same period.

I am 100% fully invested, with longs in (MSFT), (NLY), (BRK/B), (CCJ), (CRM), (GOOGL), (SNOW), (CAT), and (XOM). I have one short in the (TLT).

Some 66 of my 61 trades this year have been profitable.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 27, at 8:30 AM EST, the New Home Sales are out.

On Tuesday, November 28 at 2:30 PM, the S&P National Home Price Index is released.

On Wednesday, November 29 at 8:30 AM, the Q2 GDP Growth Rate is published.

On Thursday, November 30 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, December 1 at 2:30 PM, the October ISM Manufacturing Index is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, When I landed in Tokyo in 1974, there were very few foreigners in the country. The WWII occupation forces had left, but the international business community had yet to arrive. You met a lot of guys who used to work for Douglas MacArthur.

There was only one way to stay more than 90 days on the standard tourist visa. That was to get another visa to study “Japanese culture.” There were only two choices: flower arranging or karate.

Since this was at the height of Bruce Lee’s career, I went for karate.

It was not an easy choice.

World War II was not that distant, and there were still hundreds of army veterans missing limbs begging for money under railroad overpasses. Some back then were still fighting on remote Pacific islands.

Many in the karate community believed that the art was a national secret and should never be taught to foreigners. So those who entered this tight-knit community paid the price and had the daylights beaten out of them. I was one of those.

To this day, I am missing five of my original teeth. There is nothing like taking a kick to the mouth and watching your front teeth fly across the dojo, skittering on the teak floor.

We trained three hours a day, five days a week. It involved punching a bloody hardwood makiwara at least 200 times. The beginners were paired with black belts who thoroughly worked us over. Then the entire class met up at a nearby public bath to soak in a piping hot ofuro. You always hurt.

During the dead of winter, we ran five miles around the Imperial Palace in our karate gi’s barefoot in freezing temperatures daily. Then we were hosed down with cold water and trained for three hours.

During this time, I was infused with the spirit of bushido, the thousand-year-old Japanese warrior code. I learned self-discipline, stamina, and concentration. In the end, karate is a form of meditation.

Knowing you’re indestructible and unassailable is not such a bad thing, especially when you’re traveling in some of the harsher parts of the world. When muggers in bad neighborhoods see me late at night, they cross the street to avoid me. I am not a guy to mess with. Utter fearlessness is a great asset to possess.

The highlight of the annual training schedule was the All-Japan Karate Championship held in the prestigious Budokan, headquarters of all Japanese martial arts near the ghostly Yasukuni Jinja, Japan’s National Cemetery. By my last year in Japan, I had my black belt, and my instructor, Higaona Sensei, urged me to enter.

Because I had such a long reach, incredibly, I made it to the finals. I was matched with a very tough-looking six-footer who was fighting for Japan’s national prestige, as no foreigner had ever won the contest.

I punched, he kicked, fist met foot, and foot won. My left wrist was broken. My opponent knew what happened and graciously let me fight on one hand for another minute to save face. Then he knocked me out on points.

The crowds roared.

It’s all part of a full life.

Losing the All-Japan National Karate Championship

1974 Higaona Sensei

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“If we’re able to produce a general purpose robot that could observe you and learn how to do a task, that would supercharge the economy to a degree that would be insane….Working could become a choice,” said Elon Musk, founder of PayPal, Space X, Tesla, Solar City, The Boring Company, Neuralink, and owner of “X”, the former Twitter.

(A THANKSGIVING TAKE ON THE MARKETS)

November 24, 2023

Hello everyone,

The market has just closed 100 points higher today. Our year-end rally continues. You may ask “What’s next after the end of the year?” Short term, may be some volatility; long term, the market is looking good.

Retailers are hard at work endeavoring to attract customers to Thanksgiving sales. Some people will always part with their money for what they think is a bargain. Others are more conscious of their spending and where their money is going. With all that being said, some items are worth a look – especially electronic items.

Bitcoin rose to a new high for the year on Friday – above $38,000. As I have said before, if you hold it, think about taking half off the table. It could come down to $20,000 or even lower before eventually rallying to new highs.

Don’t rule out a retest of 1900 in Gold before moving higher. Certainly, we could well test the 1940 to 1960 area. Within the next five years, Gold could move to around 2,800.

Be mindful that we could get another retest of the higher levels in yields. If the yield on the 10-year Treasury note begins to move above 4.55%, that could put some pressure on the equity market.

“Edge AI” will be the trend going forward in artificial intelligence. This theme involves running AI algorithms directly on a user’s device, be it a smartphone, laptop, or wearable, among other things. Morgan Stanley argues that 2023 has been all about Generative AI, cloud, GPUs, and hyperscales, and they will remain core to the secular machine learning trend. Edge AI can help save costs and reduce latency (or lag time), among many other benefits. Everyday examples of Edge AI include facial recognition on smartphones and voice recognition in smart speakers. Morgan Stanley points out that with the advent of Generative AI, the impetus for device upgrades to enable greater computational power natively on consumer hardware is accelerating and spanning beyond often narrowly used smart speakers. The bank goes on to say that such AI-driven consumer use cases will become integrated into everyday devices – presenting several opportunities for investors.

The bank named four companies that are set to be key beneficiaries of this trend and likely to outperform in 2024 and 2025.

Apple – well-positioned to expand all facets of Edge AI. The consumer trust in Apple’s data gathering and large user base gives Apple another leg up in using Edge AI applications to harness and apply new data. Price target - $210 or a potential upside of around 10%.

Dell – best positioned to capitalize on both the cyclical rebound in hardware markets and the long-term growth of AI-related infrastructure (PCs, Servers, Storage) over the next two years. Dell is expected to launch new AI-enabled laptops and workstations in the next 12 months. The price target is $89 or a potential upside of nearly 21%. (Watch for some volatility in this stock in the next few months).

MediaTek – the largest chip design house in Asia is gearing up for Edge AI. Price target is 1,000 New Taiwan dollars ($31.70) or a potential upside of 6%

STMicroelectronics – The key attribute of this stock will be its energy-efficient computing. Long-term value in its efficiency in automotive, mobile, healthcare, and industrial IoT. Price target of 48 euros ($52) or potential upside of nearly 16%.

Enjoy your break.

Cheers,

Jacquie

Global Market Comments

November 24, 2023

Fiat Lux

Featured Trade:

(MY UPDATED PERSONAL ECONOMIC INDICATOR),

(HMC), (NSANY), (GM), (F), (TSLA)

(HERE IS YOUR TOP PERFORMING INVESTMENT FOR THE NEXT FIVE YEARS),

(ITB), (PHM), (KBH), (DHI)

(TESTIMONIAL)

There is no limit to my desire to get an early and accurate read on the US economy, which at the end of the day is what dictates the future of all of our trades and investments.

I flew over one of my favorite leading economic indicators only last weekend at the controls of a vintage Cessna 172.

Honda (HMC) and Nissan (NSANY) import millions of cars each year through their Benicia, California facilities, where they are loaded onto thousands of rail cars for shipment to points inland as far as Chicago.

In 2009, when the US car market shrank to an annualized 8.5 million units, I flew over the site and it was choked with thousands of cars parked bumper to bumper, rusting in the blazing sun, bereft of buyers.

Then, “cash for clunkers” hit (remember that?).

The lots were emptied in a matter of weeks, with mile-long trains lumbering inland, only stopping to add extra engines to get over the High Sierras at Donner Pass.

The stock market took off like a rocket, with the auto companies leading.

I flew over the site last weekend, and guess what?

The lots are empty.

U.S. new vehicle sales, including retail and non-retail transactions, are estimated to reach 1,354,600 units in August, a 15.4% jump from a year earlier, according to the joint report by J.D. Power and GlobalData. Consumers are estimated to spend $47.8 billion on new vehicles, the highest on record for the month of August, and 10.5% higher than last year, the report said.

Japanese cars are suddenly selling so fast that vehicles are being sold even before they land on the dock.

It is all further evidence that my increasingly optimistic view on the US economy is correct, that multiple crises this year are fully discounted, and that the stock market is poised for new highs.

The conventional auto industry should lead to the upside, as it has already done, led by General Motors (GM) and Ford (F). But the move may not happen until the second half of 2024 when the market’s love affair with big tech stocks reaches the point of temporary exhaustion.

As for Tesla (TSLA), better to buy the car than the stock at these depressed prices. Once the EV price wars end, the stock should double again to new all-time highs.

This is a big deal because the auto industry directly and indirectly accounts for about 10% of the total US economy.

It is also the largest manufacturing employer, with the legacy Big Three accounting for 6 million jobs, 4.87% of the 124 million US total.

Not only do you have to include the big four automakers, but you also must include the vast number of parts suppliers, advertisers, and the national dealer networks.

Since so many car purchases are financed with loans, it turns out that the industry is a great play on falling interest rates.

There are $1.6 trillion in subprime auto loans on lenders’ books now.

If you don’t believe me, check out the resale market price of your wheels at Kelly Blue Book (click here for the site)

You will see they have recently risen steadily in value.

It is all further evidence of the hard data/soft data conundrum, which I have written about extensively in the past.

Look no further than Consumer Sentiment, which has held up remarkably well for the past three consecutive months.

Sorry the photo below is a little crooked, but it's tough holding a camera in one hand and a plane's stick with the other, while flying through the never-ending turbulence of the San Francisco Bay’s Carquinez Straight.

Air traffic control at nearby Travis Air Force Base usually has a heart attack when I conduct my research in this way, with a few joyriding C-130s having more than one near miss in recent years.

Will gold be your best-performing asset for the next five years?

Is it high-growth technology stocks?

Energy stocks?

Or maybe biotech shares?

How about French collectible postage stamps or vintage racing cars?

Nope, you’re not even close. I’ll give you a hint: you’re probably sitting in it.

Yes, the best-performing investment you will own for the next five years will most likely be the home you live in.

Psshaww you may say. Perhaps even balderdash!

However, if you look at the crucial data that drives this long-ignored sector, my conclusions are unassailable.

You can count on your home to appreciate at a 3%-4% annual rate until well into the next decade, and more if you are fortunate enough to live on the red-hot West Coast.

Net out the copious tax breaks that come with home ownership, and your take home will be even higher than that.

For a start, the Federal Reserve’s imminent interest rate cuts are hugely pro-housing.

The conventional 30-year fixed home mortgage can now be had for a bargain of 7.40%%. They are on their way to 5.0%. And many finance their properties with the 5/1 ARM’s that I have been recommending which are currently going for only 6.60%.

Wait a few quarters and you’ll probably get a lower rate than you can get now.

That is, assuming you still have a job and haven’t been replaced yet by an algorithm.

The good news for those homeowners who rely on the floating rates of an adjustable-rate mortgage is that this is not a low-interest-rate decade coming, but a low-interest-rate century.

Another big housing positive is plunging fuel prices, which have cratered 35% in two months.

Cheap fuel means that consumers have more money in their pockets with which to qualify for loans, buy houses, and meet their mortgage payments.

Not only will this be a low-interest-rate century, but it will also be a low-energy cost century as well. If solar energy costs continue their dramatic rate of improvement, around 50% every four years, it will nearly be free by 2030.

Not only will free energy provide a big underpinning under home values, but it will also increase the value of suburban homes where commuting is a major factor.

It gets better.

You know that Millennial of yours who’s been living in your basement since he graduated from college?

Go downstairs and take a look. Chances are he probably moved out when you weren’t looking, turning his prodigious gaming skills into a high-paying coding job.

What’s more, he’s now dating a girl. You know, the one with the nose ring, the streak of purple hair, and tattoos up and down both arms.

That leads to family formation.

And you know what? The most important trend affecting the economy that no one knows about is that THE UNITED STATES IS ABOUT TO ENJOY ANOTHER BABY BOOM!

That’s why new household formations are likely to jump from the current 1.2 to 1.5 million a year in the coming decade.

However, only 1 million homes a year are being built, thanks to the halving of construction capacity in the aftermath of the Great Recession. Subtract from that 250,000 houses a year that get demolished.

Does anyone hear the words “short squeeze”?

That means 86 million Millennials will be chasing the homes of only 55 Gen Xers. Americans aren’t the only ones buying homes.

Are you convinced now? Are you ready to jump into the real estate boom and participate more than just through your residence?

Fortunately, there are several ways you can achieve this.

Residential Real Estate Investment Trusts (REITs), like Anally Capital Management (NLY), offer the opportunities of both a high yield and capital appreciation.

Better yet is that all of these trade at deep discounts to book values because of the wreckage caused by the recent interest rate spike.

They include traditional new homebuilders, such as KB Homes (KBH), Pulte Homes (PHM), and DH Horton (DHI). Another option is to take a basket approach by picking up the iShares US Home Construction ETF (ITB).

See you at the next open house!

Dear John,

I want to thank you for the outstanding conference in Miami.

The hotel and food were first class along with the very informative presentations.

I felt that the information I learned will more than pay for the trip. Hope to see you in Incline Village.

Thanks

Rich

Detroit, Michigan

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.