“At some point, all the money that has been parked in bonds and money market funds over the last five years will go into equities,” said Julian Emanuel of investment bank BTIG.

Global Market Comments

March 10, 2020

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES IN TODAY’S MARKET),

(SPY), (VIX), (VXX), (AAPL), (CCL), (UAL), (WYNN)

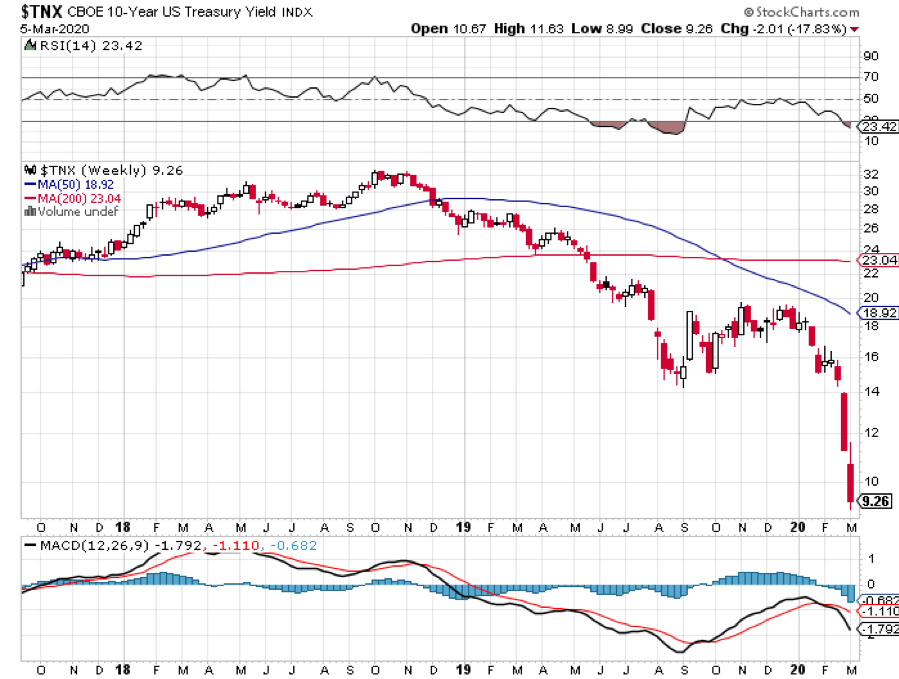

Today, we saw the largest point loss in market history, the first use of modern circuit breakers, and individual stocks down up to 40%. Ten-year US Treasury bond yields cratered to 0.39%. Virtually the entire energy and banking sectors vaporized.

What did I do? I did what I always do during major stock market crashes.

I took my Tesla out to get detailed. When I got home, I washed the dishes and did some laundry. And for good measure, I mowed the lawn, even though it is early March and it didn’t need it.

That’s because I was totally relaxed about how my portfolio would perform.

There is a method to my madness, although I understand that some new subscribers may need some convincing.

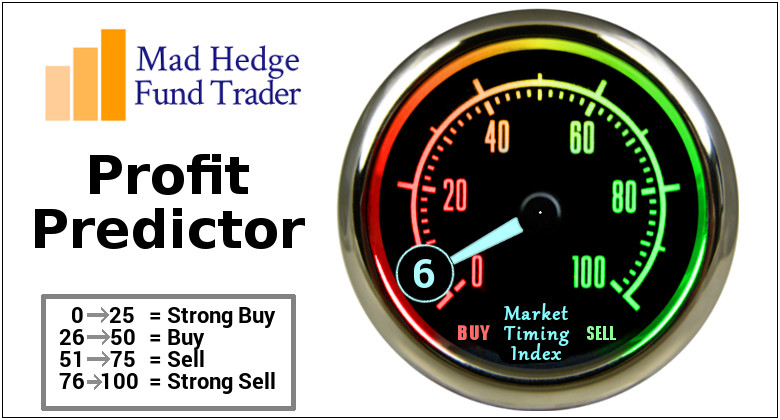

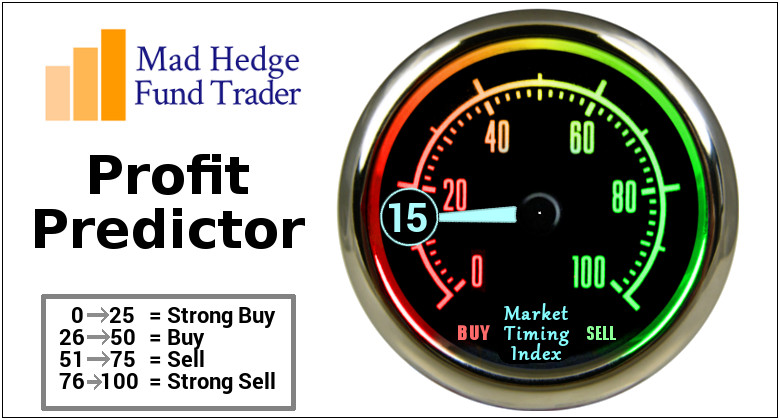

I always run hedged portfolio, with hedges within hedges within hedges, although many of you may not realize it. I run long calls and puts against short calls and puts, balance off “RISK ON” positions with “RISK OFF” ones, and always keep a sharp eye on multi-asset class exposures, options implied volatilities, and my own Mad Hedge Market Timing Index.

While all of this costs me some profits in rising markets, it provides a ton of protection in falling ones, especially the kind we are seeing now. So, while many hedge funds are blowing up and newsletters wiping out their readers, I am so relaxed that I could fall asleep at any minute.

Whenever I change my positions, the market makes a major move or reaches a key crossroads, I look to stress test my portfolio by inflicting various extreme scenarios upon it and analyzing the outcome.

This is second nature for most hedge fund managers. In fact, the larger ones will use top of the line mainframes powered by $100 million worth of in-house custom programming to produce a real-time snapshot of their thousands of positions in all imaginable scenarios at all times.

If you want to invest with these guys feel free to do so. They require a $10-$25 million initial slug of capital, a one-year lock-up, charge a fixed management fee of 2% and a performance bonus of 20% or more.

You have to show minimum liquid assets of $2 million and sign 50 pages of disclosure documents. If you have ever sued a previous manager, forget it. The door slams shut. And, oh yes, the best performing funds are closed and have a ten-year waiting list to get in. Unless you are a major pension fund, they don’t want to hear from you.

Individual investors are not so sophisticated, and it clearly shows in their performance, which usually mirrors the indexes less a large haircut. So, I am going to let you in on my own, vastly simplified, dumbed-down, seat of the pants, down and dirty style of risk management, scenario analysis, and stress testing that replicates 95% of the results of my vastly more expensive competitors.

There is no management fee, performance bonus, disclosure document, lock up, or upfront cash requirement. There’s just my token $3,000 a year subscription fee and that’s it. And I’m not choosy. I’ll take anyone whose credit card doesn’t get declined.

To make this even easier, you can perform your own analysis in the excel spreadsheet I post every day in the paid-up members section of Global Trading Dispatch. You can just download it and play around with it whenever you want, constructing your own best-case and worst-case scenarios. To make this easy, I have posted this spreadsheet on my website for you to download by clicking here. You have to be logged in to access and download the spreadsheet.

Since this is a “for dummies” explanation, I’ll keep this as simple as possible. No offense, we all started out as dummies, even me.

I’ll take Mad Hedge Model Trading Portfolio at the close of March 9, 2020, the date of a horrific 2,000 down day in the Dow Average. This was the day when margin clerks were running rampant, brokers were jumping out of windows, and talking heads were predicting the end of the world.

I projected my portfolio returns in three possible scenarios: (1) The market collapses an additional 5.3% by the March 20 option expiration, some 8 trading days away, (2) the S&P 500 (SPX) rises 10% by March 20, and (3) the S&P 500 trades in a narrow range and remains around the then-current level of $2,746.

Scenario 1 – The S&P 500 Falls Another 5.3% to the 2018 Low

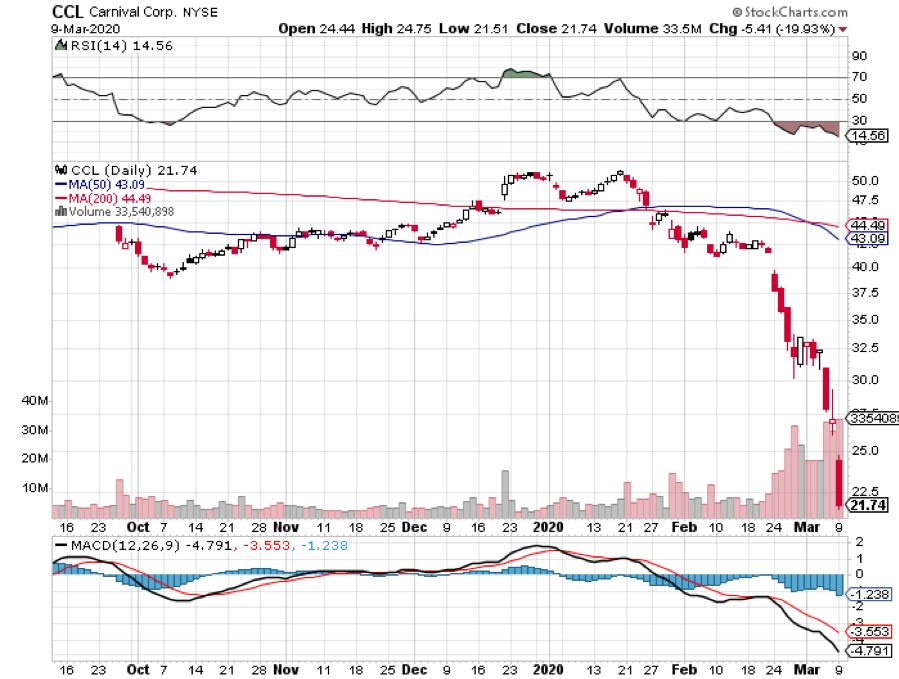

A 5.3% loss would take the (SPX) down to $2,600, to the 2018 low, and off an astonishing 800 points, or 23.5% down from the recent peak in a mere three weeks. In that situation the Volatility Index (VIX) would rise maybe to $60, the (VXX) would add another point, but all of our four short positions (AAPL), (UAL), (CCL), and (WYNN) would expire at maximum profit points.

In that case, March will end up down -3.58%, and my 2020 year-to-date performance would decline to -6.60%, a pittance really compared to a 23.5% plunge in the Dow Average. Most people would take that all day long. We live to buy another day. Better yet, we live to buy long term LEAPs at a three-year market low with my Mad Hedge Market Timing Index at only 3, a historic low.

Also, when the market eventually settles down, volatility will collapse, and the value of my (VXX) positions double.

Scenario 2 – S&P 500 rises 10%

The impact of a 10% rise in the market is easy to calculate. All my short positions expire at their maximum profit point because they are all so far in the money, some 20%-40%. It would be a monster home run. I would go back in the green on the (VXX) because of time decay. That would recover my March performance to +1.50% and my year-to-date to only -1.42%

Scenario 3 – S&P 500 Remains Unchanged

Again, we do great, given the circumstances. All the shorts expire at max profits and we see a smaller increase in the value of the (VXX). I’ll take that all day long, even though it cost me money. When running hedge funds, you are judged on how you manage your losses, not your gains, which are easy.

Keep in mind that these are only estimates, not guarantees, nor are they set in stone. Future levels of securities, like index ETFs, are easy to estimate. For other positions, it is more of an educated guess. This analysis is only as good as its assumptions. As we used to say in the computer world, garbage in equals garbage out.

Professionals who may want to take this out a few iterations can make further assumptions about market volatility, options implied volatility or the future course of interest rates. And let’s face it, politics is a major influence this year. Thanks Joe Biden for that one day 1,000 point rally to sell into, when I established most of my shorts and dumped a few longs.

Keep the number of positions small to keep your workload under control. Imagine being Goldman Sachs and doing this for several thousand positions a day across all asset classes.

Once you get the hang of this, you can start projecting the effect on your portfolio of all kinds of outlying events. What if a major world leader is assassinated? Piece of cake. How about another 9/11? No problem. Oil at $10 a barrel? That’s a gimme.

What if there is an American attack on Iranian nuclear facilities to distract us from the Coronavirus and stock market carnage? That might take you all two minutes to figure out. The Federal Reserve launches a surprise QE5 out of the blue? I think you already know the answer.

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

The first goal of risk control is to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. Therefore, I am pretty careful when it comes to risk control.

The other goal of risk control is the art of managing your portfolio to make sure it is profitable no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways. I do this on a regular basis.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times, no matter what the market does. You can’t eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb-proof. You never know when a flock of black swans is going to come out of nowhere or another geopolitical shock occurs causing the market crash.

"Legalize gay Marijuana," said a bumper sticker seen in Northern Nevada.

Global Market Comments

March 9, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SEARCHING FOR A BOTTOM),

(SPX), (VIX), (VXX), (CCL), (UAL), (WYNN)

OK, I’ll give it to you straight.

If the American Coronavirus epidemic stabilizes at current levels of infection, the double bottom in the S&P 500 (SPX) at 2,850 will hold, down 16% from the all-time high two weeks ago.

If it gets worse, it won’t, possibly taking the index down another 8.8% to 2,600, the 2018 low. Not only have we lost the 2019 stock market performance, we may be about to lose 2018 as well.

Of course, the problem is testing kits, which the government has utterly failed to provide in adequate numbers. The president is relying on disease figures provided by Fox News and ignoring those of his own experts at the CDC. And the president told us that the governor of Washington state, the site of the first US Corona hot spot, is a “snake,” and that the outbreak on the Diamond Princess is not his fault.

It’s not the kind of leadership the stock market is looking for at the moment. It amounts to an economic and biological “Pearl Harbor” where the government slept while the disease ran rampant. Until we get the true figures, markets will assume the worst. The real number of untested cases could be in the hundreds of thousands or millions, not the 350 reported. And stock prices will react accordingly.

There is an interesting experiment going on at the Grand Princess 100 miles off the coast of San Francisco right now which will certainly affect your health. Of the 39 showing Corona symptoms, 21 were found to have the disease and 19 of these were crew.

That means ALL of the passengers who took the last ten cruises were exposed, about 30,000 people, 90% of whom are back ashore. The Grand Princess may turn out to be the “Typhoid Mary” of our age.

You can see these fears expressed in the volatility index, which hit a decade high on Friday at $55, although it closed at $42. We live in a world now were all economic data is useless, earnings forecasts are wildly out of date, and technical analysis is ephemeral at best. Airlines, restaurants, and public events are emptying out everywhere and the deleterious effects on the economy will be extreme.

That is kind of hard to trade.

The good news is that this won’t last more than a couple of months. By June, the epidemic will be fading, or we’ll all be dead. All of the buying you see now is of the “look through” kind where investors are picking up once in a decade bargains in the highest quality companies in expectation of ballistic moves upward out the other side of the epidemic.

Enormous fortunes will be made, but at the cost of a few sleepless nights over the next few weeks. The bear market will end when everyone who needs tests get them and we obtain the results.

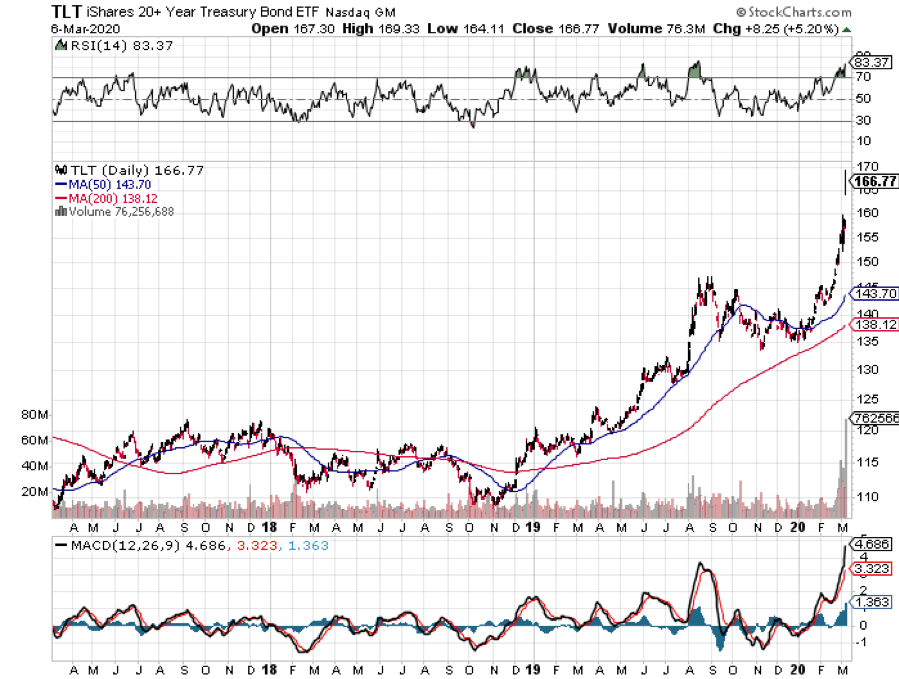

The Fed cut interest rates by 50 basis points taking the overnight rate down to 1.25%. They may cut again in two weeks. Traders were looking for some kind of global stimulus to head off a global recession. Markets are in “show me” mode and were down 300 prior to the announcement.

Quantitative Easing has become the cure for all problems. So, if it doesn’t work, try, try again? The Fed has now used up all its dry powder levitating the stocks, with the market already at a 1.00% yield for ten-year money. We need a vaccine, not a rate cut. New York schools close on virus fears.

The Beige Book says Corona is a worry, in their minutes from the last Fed meeting six weeks ago, mentioning it 48 times in yesterday’s report. No kidding? Travel and leisure are the hardest hit, and international trade is in free fall. The presidential election is also arising as a risk to the economy. Worst of all, the new James Bond movie has been postponed until November. The report only applies to data collected before February 24.

The next recession just got longer and deeper, as the Fed gives away the last of its dry powder. It’s the first time the central bank was used to fight a virus. It only creates more short selling and volatility opportunities for me down the line. Thanks Jay!

Gold ETF assets hit all-time high, both through capital appreciation and massive customer inflows. Fund values have exceeded the 2012 high, when gold futures reached $1,927. They saw 84 metric tonnes added to inventory in February. The barbarous relic is a great place to hide out for the virus. I expect a new all-time high this year and a possible run to $3,000.

Biotech & healthcare are back! Bernie’s thrashing last week in ten states takes nationalization of health care off the table for good. Biden should sweep most of the remaining states. There’s nothing left for Bernie but Michigan and Florida. Buy Health Care and Biotech on the dip!

The Nonfarm Payroll was up 273,000 in February, much higher than expectations. At least we HAD a good economy. The headline unemployment rate was 3.5%%. As if anyone cares. The only number right now that counts is new Corona infections. This may be the last good report for a while, possibly for years.

Private Payrolls were up 183,000, says the February ADP Report. No Corona virus here. Do you think companies believe this is a short-term ephemeral thing? What if they gave a pandemic and nobody came?

Mortgage Applications were up 26%, week on week, as free money keeps the housing market on fire. Don’t expect too much from the banks though. Mine offered a jumbo loan at 3.6%. Banks are not lining up to sell at the bottom.

The OPEC Meeting was desperate to stabilize prices and they failed utterly. But if they fail to deliver at least 1 million barrels a day in production slowdowns at their Friday Vienna meeting, Texas tea could reach the $30 a barrel handle in days.

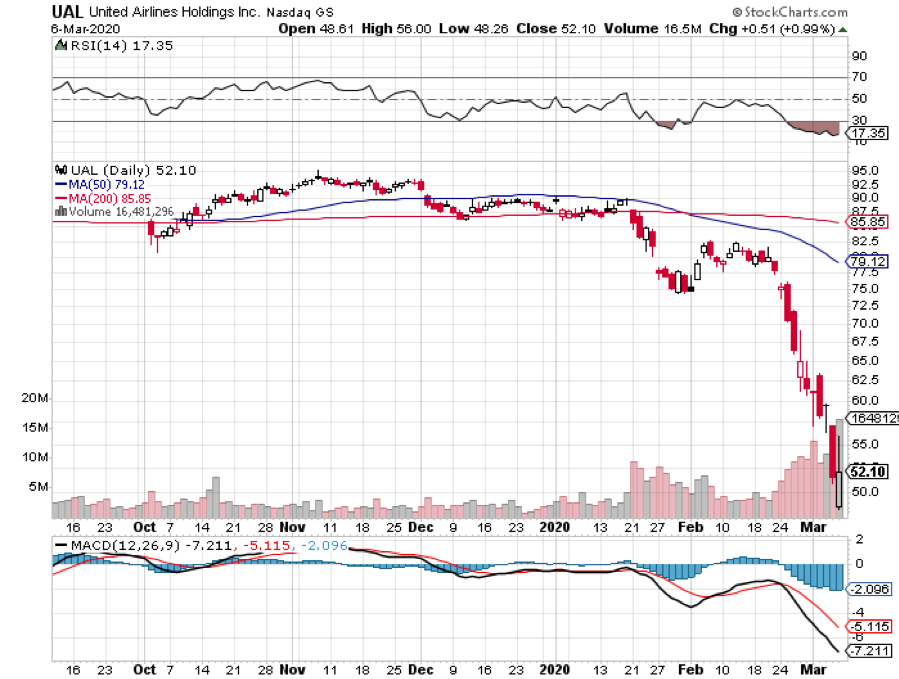

The airline industry will lose $113 billion from the virus, says IATA, the International Air Transport Association. All events everywhere have been cancelled, even my Boy Scout awards dinner for Sunday night and my flight to a wedding in April. Lufthansa just cancelled half of all it flights worldwide. Who knows where the bottom is for this industry? I bet you didn’t know that airline ticket sales account for 8% of all credit card purchases. Keeping my short in United Airlines (UAL).

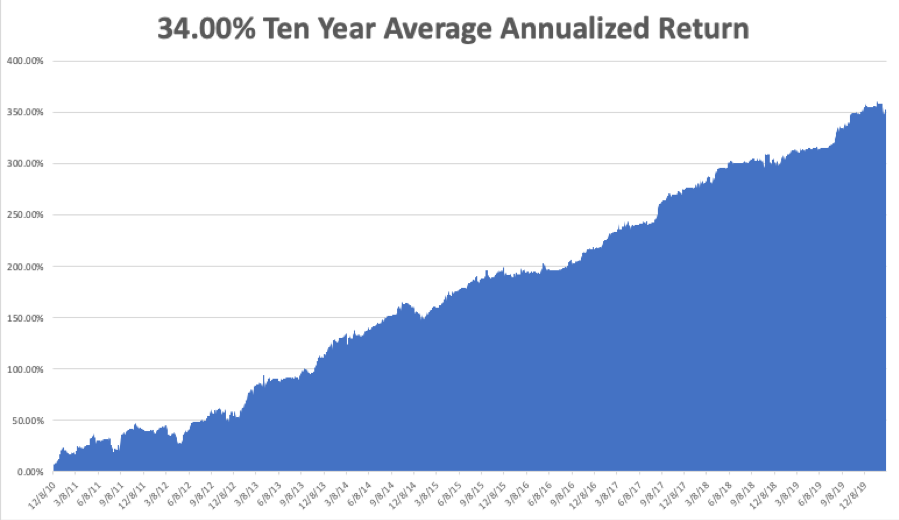

My Global Trading Dispatch performance took a shellacking, pulling back by -4.41% in March, taking my 2020 YTD return down to -7.33%. That compares to a return for the Dow Average of -16% at the Friday low. My trailing one-year return is stable at 48.44%. My ten-year average annualized profit ground back up to +34.00%.

I took my hit of the year on Friday, losing 4.4% on my bond short. A 9-point gap move has never happened in the long history of the bond market. Fortunately, my losses were mitigated by a five-point dip I was able to use to get out, a hedge within my bond position, and three short positions in Corona related-stocks, (CCL), (WYNN), and (UAL), which cratered.

All eyes will be focused on the Coronavirus still, with deaths over 3,000. The weekly economic data are virtually irrelevant now. This is usually the weakest week of the month on the data front.

On Monday, March 9 at 10:00 AM, the Consumer Inflation Expectations is out.

On Tuesday, March 10 at 5:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, March 11, at 7:30 AM, the Core Inflation Rate for February is printed.

On Thursday, March 12 at 8:30 AM, Initial Jobless Claims are announced. Core Producer Price Index for February is also out.

On Friday, March 13 at 9:00 AM, the University of Michigan Consumer Sentiment Index is published. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be shopping for a cruise this summer. I am getting offered incredible deals on cruises all over the world. Suddenly, every cruise line in the world is having sales of the century.

Shall it be a Panama Canal cruise for $99, a trip around the Persian Gulf for $199, or a voyage retracing the route of the HMS Bounty across the Pacific for $299. Of course, the downside is that I may be subject to a two-week quarantine on a plague ship on my return.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 6, 2020

Fiat Lux

Featured Trade:

(THE UNITED STATES OF DEBT),

(TLT), (TBT), ($TNX)

With ten-year US Treasury yields falling below 0.90% today a borrowing rampage of epic proportions is about to ensue. This is not a new thing.

We are, in fact, becoming the United States of Debt.

That Washington is taking the lead in this frenzy of borrowing is undeniable. Since the new administration came into power three years ago, the annual budget deficit has nearly tripled from $450 billion to $1.2 trillion.

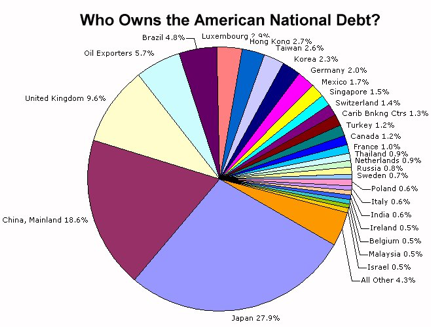

Add it all up and the United States government is on track to take the National Debt from $23 trillion to $30 trillion within a decade.

The National Debt exceeded US GDP in 2016, taking the debt to GDP ratio to the highest point since WWII.

Former Fed governor Janet Yellen recently confided to me saying, “It’s the kind of thing that should keep you awake at night.”

It gets worse.

According to the Federal Reserve Bank of New York, total personal debt topped $17 trillion by the end of 2019. An overwhelming share of personal consumption is now funded by credit card borrowing.

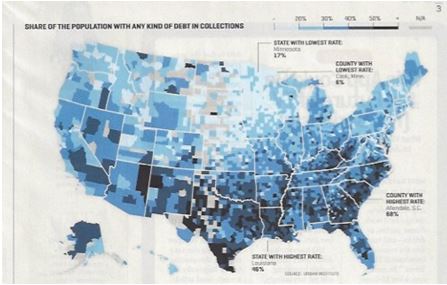

Some 33% of Americans now have debts in some form of a collection and that figure reaches an astonishing 50% in many southern states (see map below). Call it the Confederate States of Debt.

Corporations have also been visiting the money trough with increasing frequency taking their debt to $6.1 trillion, up by 39% in five years, and by 85% in a decade.

The debt to capital ratio of the top 1,000 companies has ballooned from 35% to 54% and is now the highest in 20 years.

Another foreboding indicator is that corporate debt is rising faster than sales, with debt rising by a breakneck 8.5% annualized compared to 4.6% for sales over the past decade.

Automobile debt now tops $1 trillion and with lax standards has become the new subprime market.

And remember that other 800-pound gorilla in the room? Student debt now exceeds $1.6 trillion and is rising, as is the default rate. Provisions in the last tax bill eliminate the deductibility of the interest on student debt making lives increasingly miserable for young borrowers. And you wonder why the US birth rate is so low.

Of course, you can blame the low interest rates that have prevailed for the past decade. Who doesn’t want to borrow when the inflation-adjusted long-term cost of money is FREE?

That explains why Apple (AAPL), with $270 billion in cash reserves held overseas, has been borrowing via ultra-low coupon 30-year bond issues even though it doesn’t need the money. Many other major corporations have done the same.

And while everything looks fine on paper now, what happens if interest rates ever rise?

The Feds will be in dire straight very quickly. Raise short term rates to the 6% seen at the peak of the last cycle and the nation’s debt service rockets from 4% to over 10% of the total budget. That’s when the sushi really hits the fan.

You can expect the same kind of vicious math to strike across the entire spectrum of heavily leveraged borrowers going forward, including you and me.

We are also witnessing the withdrawal of the Chinese as major Treasury bond buyers, who along with other sovereign buyers historically took as much as 50% of every issue. Declare a trade war on your largest lender and it plays hell with your cash flow.

Don’t expect them back until the dollar starts to appreciate again, unlikely in the face of ballooning federal deficits.

Rising supply against fewer buyers sounds like a recipe for eventually much higher interest rates to me.

Keep in mind that this is only a decade-long view forward. The next big move in interest rates will be down as we slide into the next recession, possibly all the way to zero. As with everything else in life, timing is everything.

So, like I said, things are about to get a whole lot better for the bond-shorting crowd. Just watch this space for the next Trade Alert regarding when to get back in for the umpteenth time.

Global Market Comments

March 5, 2020

Fiat Lux

SPECIAL MARKET BOTTOM ISSUE

Featured Trade:

(FRIDAY, APRIL 17 SAN FRANCISCO STRATEGY LUNCHEON),

(A LEAP PORTFOLIO TO BUY AT THE BOTTOM),

(TEN LONG-TERM BIOTECH & HEALTHCARE LEAPS TO BUY AT THE BOTTOM)

(UNH), (HUM), (AMGN), (BIIB), (JNJ), (PFE), (BMY)

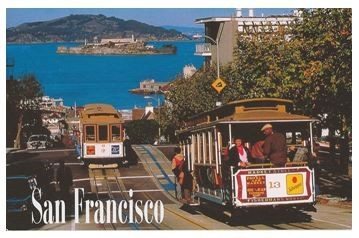

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update which I will be conducting in San Francisco on Friday, April 17, 2020. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I will also be bringing some artifacts from my recent trip to the WWII battlefield at Guadalcanal.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I’ll be throwing a few surprises out there too. Tickets are available for $229.

I’ll be arriving at 11:30 and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive private club in downtown San Francisco near Union Square, details of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.