Global Market Comments

July 24, 2019

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE),

E (THE DEATH OF THE FINANCIAL ADVISOR),

Global Market Comments

July 24, 2019

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE),

E (THE DEATH OF THE FINANCIAL ADVISOR),

You can count on a bear market hitting sometime in 2038, one falling by at least 25%.

Worse, there is almost a guarantee that a financial crisis, severe bear market, and possibly another Great Depression will take place no later than 2058 that would take the major indexes down by 50% or more.

No, I have not taken to using a Ouija board, reading tea leaves, nor examining animal entrails in order to predict the future. It can be much easier than that.

I simply read the data just released from the National Center for Health Statistics, a subsidiary of the federal Centers for Disease Control and Prevention (click here for their link).

The government agency reported that the US birth rate fell to a new all-time low for the second year in a row, to 60.2 births per 1,000 women of childbearing age. A birth rate of 125 per 1,000 is necessary for a population to break even. The absolute number of births is the lowest since 1987. In 2017, women had 500,000 fewer babies than in 2007.

These are the lowest number since WWII when 17 million men were away in the military, a crucial part of the equation.

The reason the American birth rate is such an important number is that babies grow up, or at least most of them do. In 20 years, they become consumers, earning wages, buying things, paying taxes, and generally contributing to economic growth.

In 45 years, they do so quite substantially, becoming the major drivers of the economy. When these numbers fall, recessions and bear markets occur with absolute certainty.

You have long heard me talk about the coming “Golden Age” of the 2020s. That’s when a two-decade long demographic tailwind ensues because the number of “peak spenders’ in the economy starts to balloon to generational highs. The last time this happened, during the 1980s and 1990s, stocks rose 20-fold.

Right now, we are just coming out of two decades of demographic headwind when the number of big spenders in the economy reached a low ebb. This was the cause of the Great Recession, the stock market crash and the anemic 2% annual growth since then.

The reasons for the maternity ward slowdown are many. The great recession certainly blew a hole in the family plans of many Millennials. Falling incomes always lead to lower birth rates, with many Millennial couples delaying children by five years or more. Millennial mothers are now having children later than at any time in history.

Burgeoning student debt, which just topped $1.5 trillion, is another. Many prospective mothers would rather get out from under substantial debt before they add to the population.

The rising education of women overall, a global trend, also contributes to the lag on having children. And spouses focused on career building often have a delayed interest in starting families.

Women are also delaying having children to postpone the “pay gaps” that always kicks in after they take maternity leave. Many are pegging income targets before they entertain starting families.

As a result of these trends, one in five children last year were born to women over the age of 35, a new high.

This is how some Latin American countries moved from eight to two-child families in only one generation. The same is about to take place in African countries where standards of living are rising rapidly, thanks to the eradication of several serious diseases.

The sharpest falls in the US have been with minorities. Since 2017, the birthrates for Latinos have dropped by 27% from a very high level, African Americans 11%, whites 5%, and Asian 4%.

Europe has long had the same problem with plunging growth rates but only much worse. Historically, the US has made up for the shortfall with immigration, but that is now falling, thanks the current administration policies. Restricting immigration now is a guaranty of slowing economic growth in the future. It’s just a numbers game.

So watch that growth rate. When it starts to tick up again, it’s time to buy….in about 20 years. I’ll be there to remind you with this newsletter.

As for me, I’ve been doing my part. I have five kids aged 14-34, and my life is only half over. Where did you say they keep the Pampers?

About one-third of my readers are professional financial advisors who earn their crust of bread telling clients how to invest their retirement assets for a fixed fee.

They used to earn a share of the brokerage fees they generated. After stock commissions went to near zero, they started charging a flat 1.25% a year on the assets they oversaw.

So, it is with some sadness that I have watched this troubled industry enter a long-term secular decline that seems to be worsening by the day.

The final nail in the coffin may be the new regulations announced by the Department of Labor, at the end of the Obama administration, which controls this business.

Brokers, insurance agents, and financial planners were already held to a standard of suitability by the government, based on a client’s financial situation, tax status, investment objectives, risk tolerance, and time horizon.

The DOL proposed raising this bar to the level already required of Registered Investment Advisors, as spelled out by the Investment Company Act of 1940.

This would have required advisors to act only in the best interests of their clients, irrespective of all other factors, including the advisor’s compensation or conflicts of interest.

What this does is increase the costs while also greatly expanding advisor liability. In fact, the cost of malpractice insurance has already started to rise. All in all, it makes the financial advisor industry a much less fun place to be.

As is always the case with new regulations, they were inspired by a tiny handful of bad actors.

Some miscreants steered clients into securities solely based on the commissions they earned, which could reach 8% or more, whether it made any investment sense or not. Some of the instruments they recommended were nothing more than blatant rip-offs.

The DOL thought that the new regulations will save consumers $15 billion a year in excess commissions.

Legal action by industry associations has put the DOL proposals in limbo. Unless it appeals, it is unlikely to become law. So, there will be a respite, at least until the next administration.

Knowing hundreds of financial advisors personally, I can tell you that virtually all are hardworking professionals who go the extra mile to safeguard customer assets while earning incremental positive returns.

That is no easy task given the exponential speed with which the global economy is evolving. Yesterday’s “window and orphans” safe bets can transform overnight into today’s reckless adventure.

Look no further than coal, energy, and the auto industry. Once a mainstay of conservative portfolios, all of these sectors have, or came close to filing for bankruptcy.

Even my own local power utility, Pacific Gas & Electric Company (PGE), filed for chapter 11 in 2001 because they couldn’t game the electric power markets as well as Enron.

Some advisors even go the extent of scouring the Internet for a trade mentoring service that can ease their burden, like the Diary of a Mad Hedge Fund Trader, to get their clients that extra edge.

Traditional financial managers have been under siege for decades.

Commissions have been cut, expenses increased, and mysterious “fees” have started showing up on customer statements.

Those who work for big firms, like UBS, Morgan Stanley, Goldman Sacks, Merrill Lynch, and Charles Schwab, have seen health insurance coverage cut back and deductibles raised.

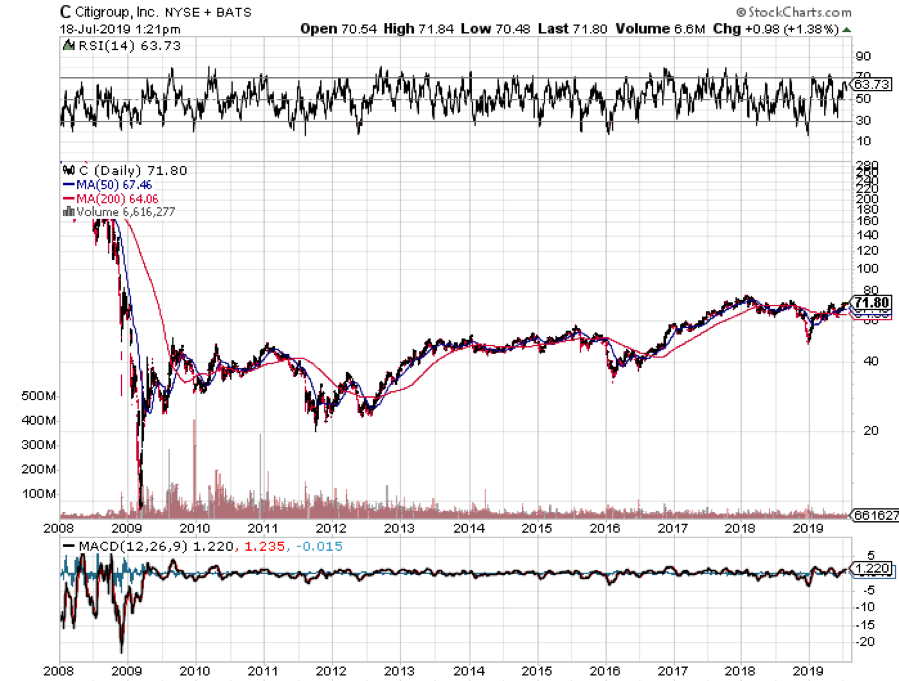

The safety of custody with big firms has always been a myth. Remember, all of these guys would have gone under during the 2008-09 financial crash if they hadn’t been bailed out by the government. It will happen again.

The quality of the research has taken a nosedive, with sectors like small caps no longer covered.

What remains offers nothing but waffle and indecision. Many analysts are afraid to commit to a real recommendation for fear of getting sued, or worse, scaring away lucrative investment banking business.

And have you noticed that after Dodd-Frank, two-thirds of a brokerage report is made up of disclosures?

Many financial advisors have, in fact, evolved over the decades from money managers to asset gatherers and relationship managers.

Their job is now to steer investors into “safe” funds managed by third parties that have to carry all of the liability for bad decisions (buying energy plays in 2014?).

The firms have effectively become toll-takers, charging a commission for anything that moves.

They have become so risk-averse that they have banned participation in anything exotic, like options, option spreads, (VIX) trading, any 2X leveraged ETF’s, or inverse ETFs of any kind. When dealing in esoterica is permitted, the commissions are doubled.

Even my own newsletter has to get compliance review before it is distributed to clients, often provided by third parties to smaller firms.

“Every year, they try to chip away at something”, one beleaguered advisor confided to me with despair.

Big brokers often hype their own services with expensive advertising campaigns that unrealistically elevate client expectations.

Modern media doesn’t help either.

I can’t tell you how many times I have had to convince advisors not to dump all their stocks at a market bottom because of something they heard on TV, saw on the Internet, or read in a competing newsletter warning that financial Armageddon was imminent.

Customers are force-fed the same misinformation. One of my main jobs is to provide advisors with the fodder they need to refute the many “end of the world” scenarios that seem to be in continuous circulation.

In fact, a sudden wave of such calls has proven to be a great “bottoming” indicator for me.

Personally, I don’t expect to see another major financial crisis until 2032 at the earliest, and by then, I’ll probably be dead.

Because of all of the above, about half of my financial advisor readers have confided in me a desire to go independent in the near future, if they are not already.

Sure, they won’t be ducking all these bullets; but at least they will have an independent business they can either sell at a future date, or pass on to a succeeding generation.

Overheads are far easier to control when you own your own business, and the tax advantages can be substantial.

A secular trend away from non-discretionary to discretionary account management is a decisive move in this direction.

There seems to be a great separating of the wheat from the chaff going on in the financial advisory industry.

Those who can stay ahead of the curve, both with the markets and their own business models, are soaking up all the assets. Those who can’t are unable to hold onto enough money to keep their businesses going.

Let’s face it, in the modern age, every industry is being put through a meat grinder. Thanks to hyper accelerating technology, business models are changing by the day.

Just be happy you’re not a doctor trying to figure out Obamacare.

Those individuals who can reinvent themselves quickly will succeed. Those who can't will quickly be confined to the dustbin of history.

Global Market Comments

July 23, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE JULY 24 GLOBAL STRATEGY WEBINAR),

(HOW THE MAD HEDGE MARKET TIMING ALGORITHM WORKS),

(TESTIMONIAL)

My next global strategy webinar will be held live from Zermatt, Switzerland on Wednesday, July 24, 2019 at 12:00 PM EST.

Co-hosting the show will be Mad Day Trader Bill Davis.

I’ll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour-long. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - July 24, 2019" or click here to register in advance.

Global Market Comments

July 22, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR BRACE YOURSELF),

(SPY), (TLT), (FXA), (FCX), (MSFT),

(TESTIMONIAL)

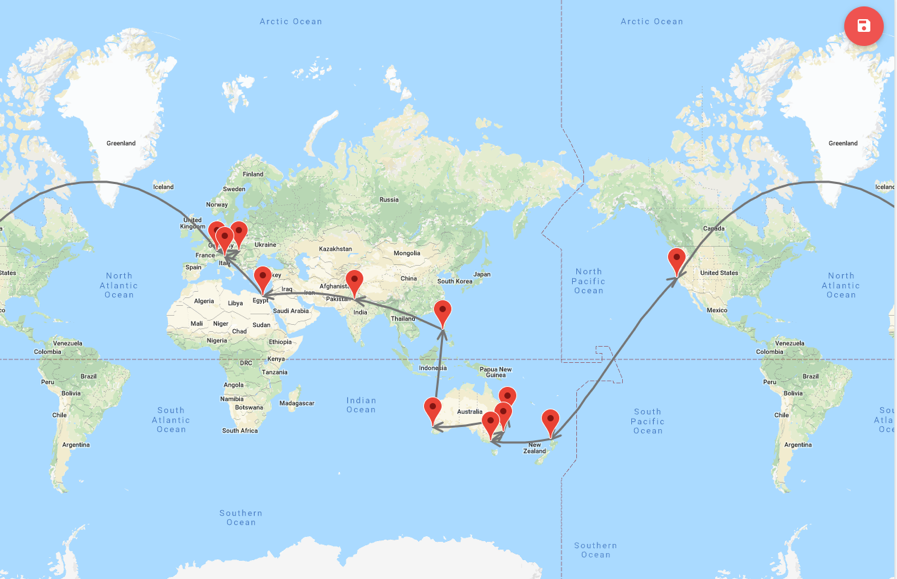

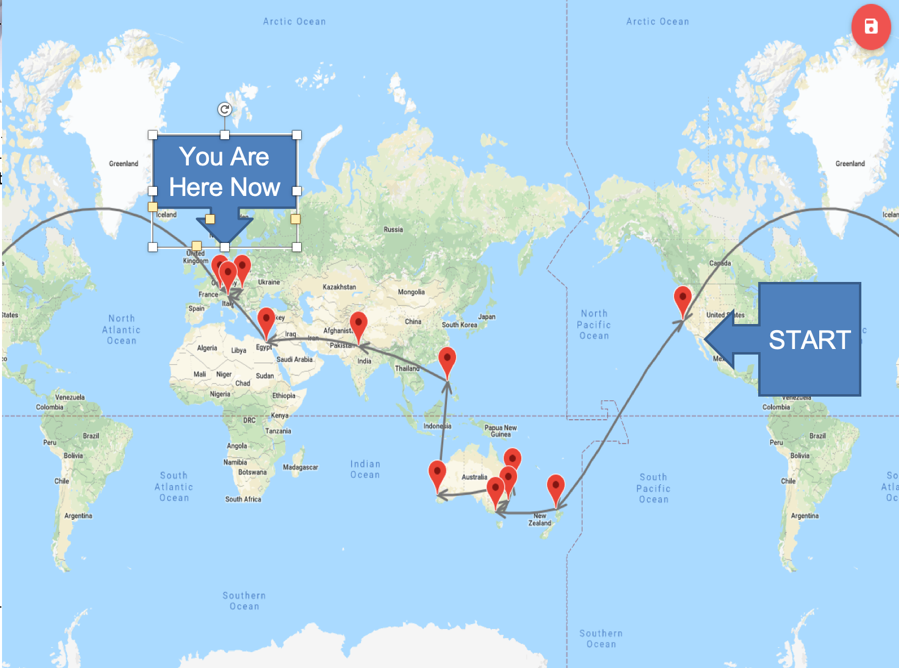

When you have constant jet log, you often have weird dreams. Take this morning, for example.

I dreamed that Fed governor Jay Powell invited me over to his house for breakfast. While he was cooking the bacon and eggs, Donald Trump started to call him every five minutes ordering him to lower interest rates. Jay got so distracted that the bacon caught fire, the house burned down, and we all died.

Fortunately it was only a dream. But like most dreams, parts of it were borrowed from true life.

Brace yourself, this could be the deadest, least interesting, most somnolescent week of the year. Thanks to all of those “out of office” messages we are getting with our daily newsletter mailings, I know that most of you will be out on vacation. Trading desks everywhere are now manned by “B” teams.

Then, the most important data release of the month doesn’t come out until Friday morning. It will be weak, but how weak? Q1 came in at a robust 3.1%. Q2 could be under 1%. The bigger unknown is how much of this widely trumpeted slowdown is already in the market?

Given the elevated levels of stock markets everywhere, most traders will rather be inclined to bet on which of two flies crawls up a wall faster. Such are the dog days of summer.

We here in Europe are bracing for the next ratchet up in climate change, where every temperature record is expected to be broken. It is forecast to hit 92 in London, 106 in Paris, and 94 in Berlin. Still, that's a relief from India, where it was 120. Five more years of global warming and India will lose much of its population as it will become uninhabitable.

I shall have to confine my Alpine climbing to above 8,000 feet where hopefully it can reach the 70s. By the way, the air conditioning in Europe sucks, and the bars always run out of ice early.

While the Fed is expected by all to cut interest rates a quarter point next week, we have suddenly received a raft of strong economic data points hinting that it may do otherwise.

Inflation hit an 18-month high, with the CPI up a blistering 0.3% in June. That’s why bonds (TLT) took a sudden four-point hit. Soaring prices for apparel (the China trade war), used cars, rents, and healthcare costs led the charge. Is this the beginning of the end, or the end of the beginning?

The Empire State Factory Index hits a two-year high, leaping from -8.6 in June to 4.3 in July. No recession here, at least in New York.

Microsoft (MSFT) blew it away, with spectacular Q2 earnings growth, wiping out conservative analyst forecasts. Azure, the company’s cloud business, rose a spectacular 64%. Nothing like seeing your number one stock pick for 2019 take on all comers. Buy (MSFT) on every dip.

An early read on Q2 GDP came in at a sizzling 1.8%. Many forecasts were under 1%, thanks to the trade wars, soaring budget deficits, and fading tax revenues. That’s still well down from the 3.1% seen in Q1. It seems no one told Main Street, where retail sales and borrowing are on fire, according to JP Morgan’s Jamie Diamond.

US Retail Sales rose a hot 0.4% in June, raising prospects that the Fed may not cut interest rates after all. Stocks and bonds both got hit. Don’t panic yet, it’s only one number.

If the Fed only looks at the data above, it would delay a rate cut for another quarter. If they choose that option, the Dow Average would plunge 1,000 points in a week. The market-sensitive Fed knows this too.

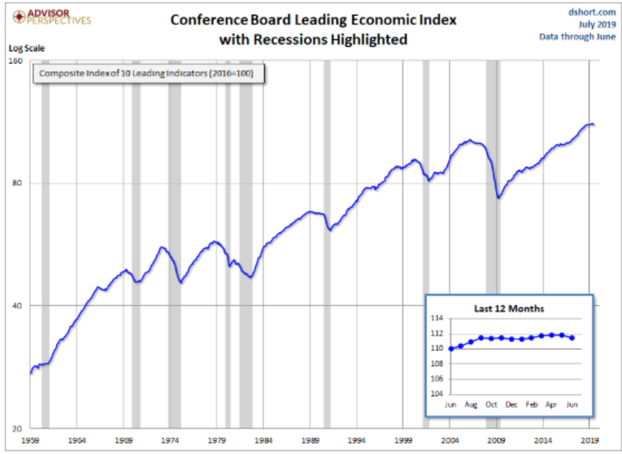

However, the Fed has to be maintaining a laser-like focus on the Conference Board Index of Leading Economic Indicators, which lately have been rolling over like the Bismarck and always presage a recession. For your convenience, I have included a 60-year chart below with the recessions highlighted.

And there were a few soft spots in the numbers as well.

China growth slowed to 6.2%, a 27-year low. Never mind that the real rate is probably only 3%. The slowdown is clearly the outcome of the trade war. That’s what happens when you make war on your largest customer. Markets rallied because it was not worse.

Banks beat on earnings, but stocks yawned, coming off an “OK” quarter. It’s still the sector to avoid with a grim backdrop of sharply falling interest rates. They’re also getting their pants beat by fintech, from which there is no relief.

There is no end to the China trade war in sight, as Trump once again threatened another round of tariff increases. It looks like the trade war will outlast the presidential election, since the Chinese have no interest in helping Trump get reelected. The puzzle is that the stock market could care less.

Trump’s war on technology expanded. First, Facebook (FB) got hit with a $5 fine over privacy concerns. Now Google (GOOGL) is to be investigated for treason for allegedly helping the Chinese military. In the meantime, Europe is going after Amazon (AMZN) on antitrust concerns. If the US isn’t going to dominate technology, who will. Sorry, but this keyboard doesn’t have Chinese characters.

June US Housing Starts fell 0.9%, while permits dove 6%. If builders won’t build in the face of record low interest rates, their outlook for the economy must be grim. Maybe the 36% YOY decline in buying from Chinese has something to do with it.

Oil popped on the US downing of an Iranian drone in the Straits of Hormuz, which I flew over myself only last week on my way to Abu Dhabi. Expect this tit for tat, “Phony War” to continue, making Texas tea (USO) untradeable. In the meantime, the International Energy Agency has cut oil demand forecasts, thanks to a slowing global economy.

My strategy of avoiding stocks and only investing in weak dollar plays like bonds (TLT), foreign exchange (FXA), and copper (FCX) has been performing well. After spending a few weeks out of the market, it’s amazing how clear things become. The clouds lift and the fog disperses.

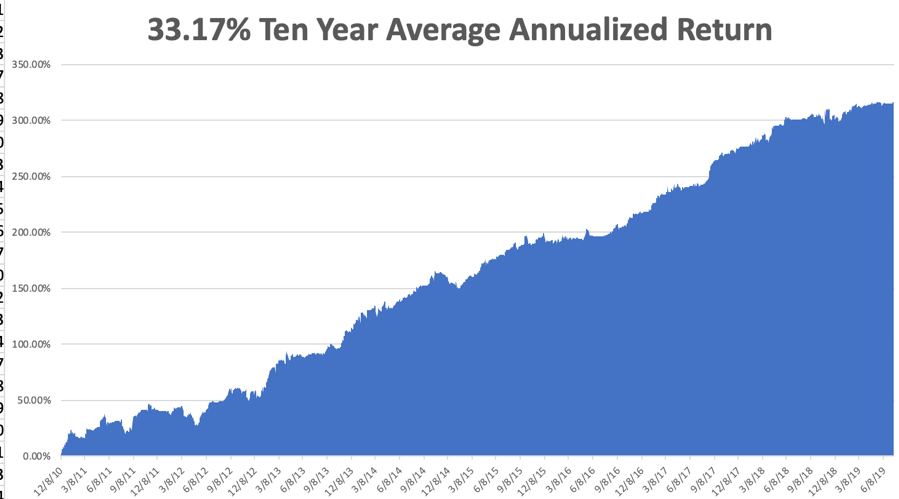

My Global Trading Dispatch has hit a new high for the year at +17.78% and has earned a respectable 2.54% so far in July. Nothing like coming out of the blocks for an uncertain H2 on a hot streak.

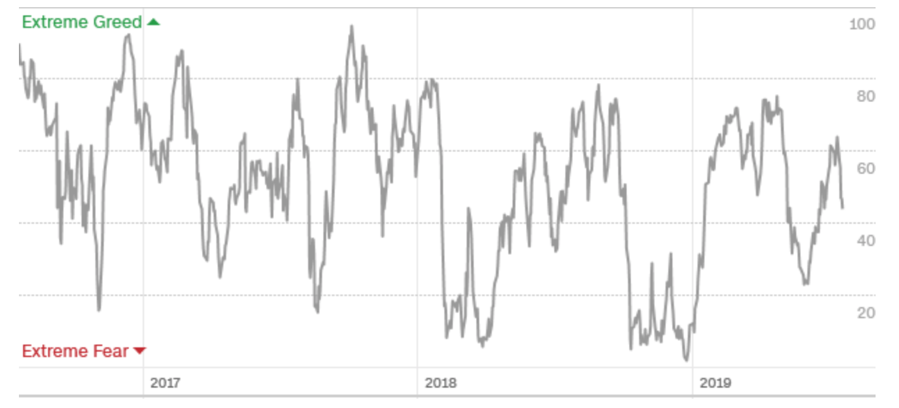

My ten-year average annualized profit bobbed up to +33.12%. With the markets now in the process of peaking out for the short term, I am now 70% in cash with Global Trading Dispatch and 100% cash in the Mad Hedge Tech Letter. If there is one thing supporting the market now, it is the fact that my Mad Hedge Market Timing Index has pulled back to a neutral 44. It’s a Goldilocks level, not too hot and not too cold.

The coming week will be a fairly sedentary one on the data front after last week’s fireworks, except for one big bombshell on Friday.

On Monday, July 22, the Chicago Fed National Activity Index is published.

On Tuesday, July 23, we get a new Case Shiller National Home Price Index. June Existing Home Sales follow.

On Wednesday, July 24, June New Home Sales are released.

On Thursday, July 25 at 8:30 AM EST, the Weekly Jobless Claims are printed. So are June Durable Goods.

On Friday, July 26 at 8:30 AM EST, we get the most important release of the week, the advance release of US Q2 GDP. The numbers are expected to be weak, and anything above 1.8% will be a surprise, compared to 3.1% in Q1. Depending on the number, the market will either be up big, down big, or flat. I can already hear you saying “Thanks a lot.”

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be attending a fund raiser tonight for the Zermatt Community band held in the main square in front of St. Mauritius church. If you don’t ski, there isn’t much to do in the winter here but practice your flute, clarinet, French horn, or tuba.

We’ll be eating all the wurst, raclete, beer, and apple struddle we can. As an honorary citizen of Zermatt with the keys to the city, having visited here for 51 years, I get to attend for free.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

July 19, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE JULY 24 GLOBAL STRATEGY WEBINAR)

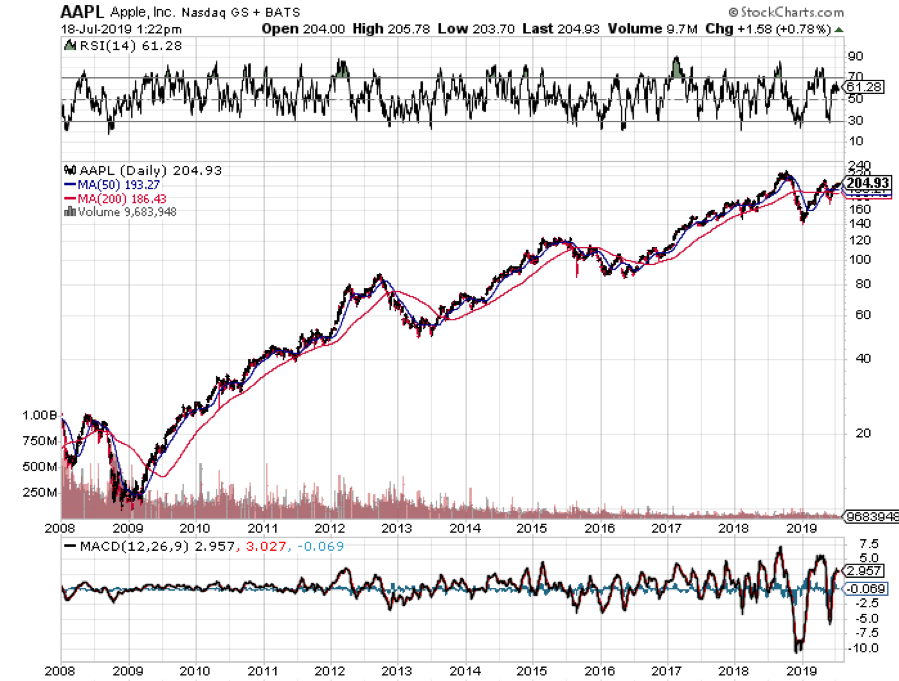

(WHAT’S HAPPENED TO APPLE?), (AAPL)

(STORAGE WARS)

(MSFT), (IBM), (CSCO), (SWCH)

One of the great mysteries of the tech world has at last been answered.

Apple’s brand new spaceship-designed headquarter, one of the world’s most valuable buildings, has finally had a value put on it.

New figures released this week show the tech giant’s circular headquarters in Cupertino, CA was assessed at a breathtaking $3.6 billion by Santa Clara County for property tax purposes. The valuation doesn’t perfectly coincide with its market value — how much it would sell for — but is based off a detailed appraisal of the building, which opened in 2017.

If you include computers, furniture, and even farm equipment to take care of the property’s abundant peach trees, the figure rises to $4.17 billion for the fiscal year that ended in June, the assessor’s office said.

Beyond its giant 2.8 million-square-foot size, Apple Park’s high-end materials, abundant glass, and intricate design make it a standout in Silicon Valley. The building is so big it even has its own weather.

Unfortunately, the share prices of companies that spend billions on flashy new designer headquarters do not have a great history. Ride around Manhattan in an Uber cab and you’ll quickly understand that time has not been kind to the extravagant: the Chrysler Building, the Pan Am Building, and the AT&T building to name just a few.

Citicorp’s HQ, with its horizon-defining slant-edged roof, is still in business, but the stock is still down 75% from its pre-crash high. Is Apple headed in the same direction?

Looking at the share price performance of the past year, which has been zero, you might be forgiven for thinking so. Other tech stocks have risen by 50% or more during the same period.

Apple Park is among the world’s dozen most expensive buildings despite its relatively modest four-storey height.

America’s tallest spire, the 1,776-foot One World Trade Center in New York, cost $3.9 billion to build according to the Port Authority of New York and New Jersey which owns the building and has 3.5 million square feet. Singapore’s Marina Bay Sands resort reportedly topped $5 billion in costs, while Finland’s Olkiluoto 3 nuclear reactor exceeded $6 billion.

Saudi Arabia’s holy city of Mecca is home to two of the most valuable buildings in the world: the $15 billion Abraj Al Bait Towers and the $100 billion Great Mosque of Mecca.

Apple Park was assessed at more than twice the amount of Salesforce Tower, San Francisco’s tallest building, which was valued at $1.7 billion by San Francisco. Salesforce Tower has about half as much office space as Apple Park despite being 57 stories taller.

With property taxes in Santa Clara County running around 1.25%, Apple would owe around $50 million annually.

The building is a manageable expense for Apple’s profit machine. In its most recent quarter, Apple reported a mind-numbing $58 billion in revenue and $11.5 billion in net income.

Apple was Santa Clara County’s largest property taxpayer for the 2017-18 fiscal year, with $56 million in taxes paid.

Investors have been frustrated with Apple’s recent performance, although it did make back most of the 40% hickey it suffered last fall.

Its business plan seems well on track, shifting from a hardware company to one that focuses on software and services. If anything, the shift has been taking place faster than expected, with the cloud, iTunes, Apple Wallet, Apple Care, the App Store, and other services accounting for a growing share of earnings.

All will become clear when the company announces their Q3 earnings on Tuesday, July 30 after the stock market close.

No, I think the problem with Apple is that it is suffering from the China Disease. Employing a million people who produce 225 million iPhones a year, Apple is the preeminent hostage in the US-China trade dispute. That, undoubtedly, has been a dead weight on the shares.

However, after covering this field for half a century, I can tell that trade wars start, trade wars play out, and trade wars end. Unlike other trade wars, this one has a specific end date. That would be on Wednesday, January 20, 2021, or in 18 months, the date of the next presidential inauguration.

As for me, I am waiting to upgrade my current iPhone X until it includes 5G wireless technology early next year. I bet 225 million others are as well. Dump the trade war and Apple shares could rocket up towards my old long-term target of $250 a share in a heartbeat.

By the way, there is one other headquarter that may be about to join the dustbin of history. That would be 725 Fifth Avenue, NY, NY 10022, which has been appraised at a mere $371 million and carries a hefty $100 million in debt. In is now partly owned by the US Justice Department, which will soon sell its stake.

Locals know it as Trump Tower.

Global Market Comments

July 18, 2019

Fiat Lux

Featured Trade:

(THE DEATH OF THE MALL),

(SPG), (MAC), (TCO),

(QUANTITATIVE EASING EXPLAINED TO A 12-YEAR-OLD)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.