"Success is the ability to go from one failure to another with no loss in enthusiasm," said the wartime British Prime Minister, Winston Churchill.

Global Market Comments

June 24, 2019

Fiat Lux

Featured Trade:

(WEDNESDAY, JULY 10 BUDAPEST, HUNGARY STRATEGY LUNCHEON)

(THE TWO CENTURY DOLLAR SHORT), (UUP)

Global Market Comments

June 21, 2019

Fiat Lux

Featured Trade:

(MONDAY, JULY 8 VENICE, ITALY STRATEGY LUNCHEON)

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS), (TLT)

(WHY TECHNICAL ANALYSIS DOESN’T WORK)

(FB), (AAPL), (AMZN), (GOOG), (MSFT), (VIX)

Global Market Comments

June 20, 2019

Fiat Lux

Featured Trade:

(FRIDAY, JULY 5 CAIRO, EGYPT STRATEGY DINNER)

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD)

(AAPL)

(THE CODER BOOM)

Global Market Comments

June 19, 2019

Fiat Lux

Featured Trade:

(TUESDAY, JULY 2 NEW DELHI, INDIA STRATEGY LUNCHEON)

(SHORT SELLING SCHOOL 101),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments

June 18, 2019

Fiat Lux

Featured Trade:

(TAKING OFF FOR THE 2019 MAD HEDGE WORLD TOUR)

Terrorist attacks, trade wars, and crashing airlines all spell one thing to me.

Travel bargains!

Of course, my first choice for a vacation destination this year was the civil war in Syria, so I could find out on the ground what is really happening out there. In addition, I could shop for a refugee camp in Jordan for one of my non-profits to help support.

Unfortunately, my family was not too hot on this idea, not wishing to buy me back from kidnappers at an inflated price, again (the last time was Cambodia in 1976).

The Joint Chiefs were not too thrilled either. At my advanced age, I simply know too much to fall into the wrong hands. They said I would last a day.

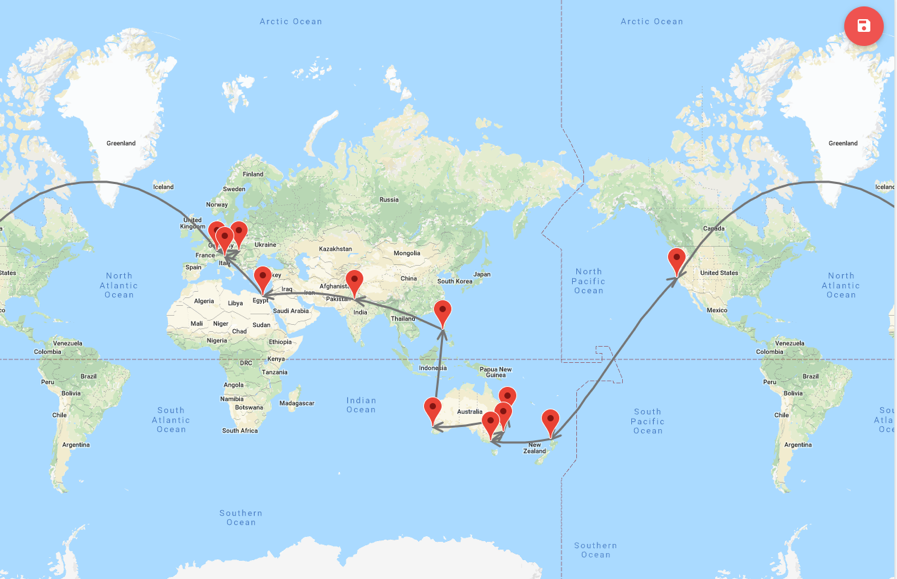

So I compromised. This summer will find me flying around the world to meet my many disparate readers. I’ll be diving on the Great Barrier Reef in Australia, riding elephants near the Taj Mahal in India, and enjoying a dinner cruise on the Nile in Egypt. If you spot someone wearing a fedora hat on a gondola in Venice Italy, it’s probably me.

I’ll end up at my chalet in Zermatt, Switzerland where I traditionally restart my year. Weather permitting, I'll climb the 14,692-foot Matterhorn again. Is it seven times this year, or eight? Otherwise, I’ll rejoin Zermatt Search and Rescue again pulling lost Americans off of Alpine slopes. It seems I’m the only one up there who has a sense of humor.

To make things exciting this year, I’ll have two teenaged daughters into tow, aged 14 and 15. Who said I didn’t like challenges?

The five-star hotels are booked, our passports are loaded with exotic visas, and the limo is waiting outside. The Cessna is fully fueled, and the flight plan filed.

I have worked the hardest in my life the past year, and it is time for a break. I have also put myself through the most grueling training regimen ever, hiking 2,000 miles in torrential rains and snowshoeing another 600, all with a 60-pound pack.

Every year it seems to get harder to keep the calendar at bay.

Along the way I will be meeting with other hedge fund managers, senior government officials, CEOs at major banks and Fortune 500 companies, large institutional investors, and a Nobel Prize winner or two.

Getting out into the real world and soaking up new data and opinions is invaluable in shaping my own global view, and your performance benefits from it.

Since I don’t stumble across these people in my living room, I have to travel the world and seek them out. You can soak up all the online data you want, but nothing beats contact with the real world.

I will be traveling with my laptop and keeping touch with the markets. While 18th century Internet service is passable, the bandwidth can be snail-like. So, unless I see something extraordinary, I will cut back on new Trade Alerts.

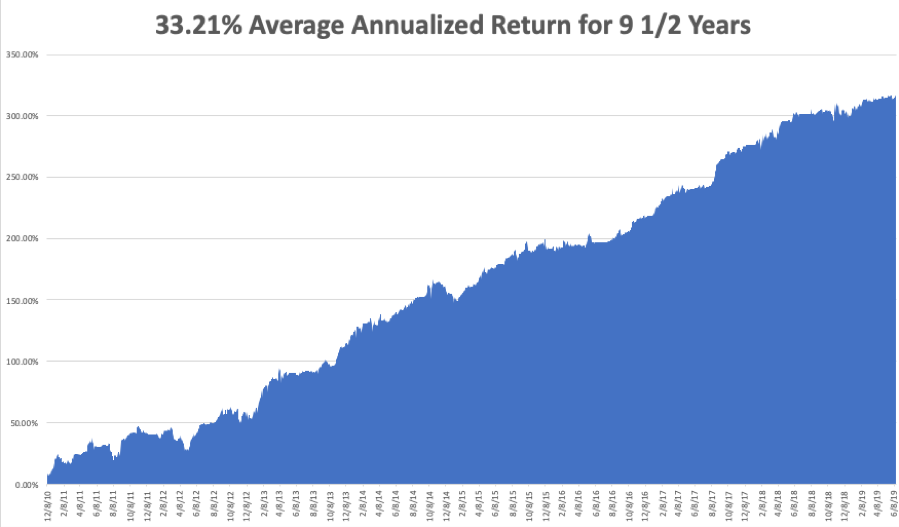

After running up a 315% return in nine and a half years and beating 99.9% of the hedge funds in the industry, I deserve a break. I need to spend some time alone on a mountaintop, communing with the spirits, attempting to discover the new long-term market trends through the mist.

While on the road, I will continue writing my newsletter, giving you my daily dose of market insight. I will also be re-running some of my favorite research pieces from the past when my travel schedule does not allow Internet access.

This is to expose my thousands of new subscribers to the golden oldies and to remind the legacy readers who have since forgotten them.

I will be back in San Francisco in early August, glued to my screens once again for another year of toil in the salt mines. In the meantime, please feel free to email me.

Mad Hedge Technology Letter author Arthur Henry and Mad Day Trader Bill Davis will be working straight through the summer. No rest for the wicked!

In the meantime, I shall be raising a glass to all of you at dinner, the loyal readers of The Diary of a Mad Hedge Fund Trader. Salute! Prost! Kampai, and Cheers! Thanks for making this letter a huge success!

If you want to take the opportunity to meet me in person, please find my strategy luncheon schedule below. To purchase tickets for the luncheons, please go to my online store here and click on “LUNCHEONS”, and select the country and city of your choice.

Friday, June 21 12:30 PM Auckland, New Zealand

Monday, June 24 12:30 PM Melbourne, Australia

Tuesday, June 25 12:30 PM Sydney, Australia

Wednesday, June 26 12:30 PM Brisbane, Australia

Friday, June 28 12:30 PM Perth, Australia

Sunday, June 30 12:30 PM Manila, Philippines

Tuesday, July 2 12:30 PM New Delhi, India

Friday, July 5 12:30 PM Cairo, Egypt

Monday, July 8 12:30 PM Venice, Italy

Wednesday, July 10 12:30 PM Budapest, Hungary

Friday, July 19, 3:00 PM Zermatt, Switzerland

I look forward to seeing you there, and thanks for supporting my research.

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Global Market Comments

June 17, 2019

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SCARY THING ABOUT THE MARKETS)

(SPY), (TLT), (GLD), (TSLA)

There’s one big scary thing about the markets right now. As I mentioned last week, the major indexes are sitting on a precipice of a right shoulder of a ‘Head and Shoulders” top.

Traders are expecting a trade war settlement and a Fed interest rate cut in July. While the economy in no way needs a rate cut, stock markets desperately do. In fact, they need another dose of steroids just to remain level. It reminds me of a certain recent California governor (I’ll be back).

If we get them, markets will grind up a few percentage points to a new all-time high. If we don’t, the top is in, possibly for this entire economic cycle, and a 25% swan dive is in the cards.

It's what traders call “Asymmetric risk.” If we get the bull case, you make sofa change. If we don’t, you lose dollars. It’s what I call picking up pennies in front of a steamroller. But in the 11th year of a bull market, that’s all you get. The truly disturbing part of this is that this setup is happening with valuation close to a historic high at a 17.5X price earnings multiple.

We’ll get a better read on Wednesday at 2:00 PM EST when the Fed announces its decision on interest rates. The post meeting statement will be more crucial than usual. What’s in a word, Shakespeare might have asked? If the Fed drops the word “Patient”, then a July interest rate cut is a sure thing. The algos reading the release at the speed of light will be the first to know.

It was initially off to the races last Monday when the one-week trade war with Mexico came to an end and some immigration issues were settled.

The tariffs are off, even though the Mexicans say the terms were already agreed to months ago.

There is no big ag buy either. The economy is still sliding into a recession, and the bond market has already discounted three of the next five quarter point rate cuts.

US exports are in free fall, with Long Beach, America’s busiest port, seeing seven straight months of declines in shipping volumes. They were off 19.5% in May alone. Recession indicator no. 199.

Buy bonds (TLT), gold (GLD), and short the US dollar (UUP), says my old friend, hedge fund legend Paul Tudor Jones. He is certainly reading the writing on the wall. The legendary trading billionaire believes that plunging interest rate cuts are going to dominate the scenery for the rest of 2019.

Tanker attacks sent oil soaring. After 50 years of waiting, it finally happened, torpedo attacks against two tankers in the Straits of Hormuz bound for China. Oil rocketed 4%, then gave up the rally, and stocks are amazingly up on the day.

Go figure. A decade ago, this would have been a down 1,000-point day for stocks and Texas tea would have soared to $100. Clearly, tensions in the Middle East are ratcheting up, but with the US now the swing oil producer, why bother?

With US oil production climbing to 17 million barrels a day by 2024, up from 5 million b/d in 2005, the Middle East can blow itself up and nobody cares. The US by then will have created an entire Saudi Arabia’s worth of new oil production over a 20-year period. US troops there are defending China’s oil supply, not ours.

The US budget deficit soared by 38.7% YOY, to $739 billion. It’s the fastest growth in government borrowing since WWII. Much of today’s economic growth in on credit and this can only end in tears. Enjoy the good times while they last.

Major semiconductor maker Broadcom (AVGO) disappointed hugely on earnings, tanking the market, and the stock plunged a heartbreaking 12%. The trade war gets the entire blame. It turns out that Broadcom’s biggest customer is the ill-fated Huawei whose CFO is now sitting in a Canadian jail awaiting extradition to the US. Other semiconductor stocks especially got slammed. The canary in the coal mine just died.

China’s industrial production hit a 17 year low, and yes, it’s because of the trade war, trade war, trade war. When your biggest customers come down with the Asian flu, you at the very least catch a severe cold. Start shopping for Robitussin.

Global Trading Dispatch closed the week up 15.38% year-to-date and is down by -0.34% so far in June. That’s show business. You work your guts out trying to understand this market and it turns out to be for free. Or worse yet, you get a bill without an amount due. This is something that regular salary earners don’t understand.

My nine and a half year profit appreciated to +315.52%, pennies short of a new all-time high. I think I’ll be flatlining at a high for a while to create a base from which I can jump to new highs. The average annualized return ticked up to +33.21%. With the trade war with China raging, I am now 100% in cash with Global Trading Dispatch and 100% cash in the Mad Hedge Tech Letter.

My twin bets on Tesla (TSLA) worked out very nicely and I took profits on both. It was an option play whereby I expected that (TSLA) shares would not fall below $150 or rise above $240 by the June 21 option expiration.

Several followers have seen good success using every Tesla dip below $200 to go naked short August $100 or $125 Tesla puts in small quantities for a decent amount of change.

The long view here is to wait for some kind of summer meltdown and then go long into a year-end rally as 2020 election-related turbochargers start to hit the market.

The coming week will be all about waiting for the Fed to jump. We also get some important updates on housing data.

On Monday, June 17 at 8:30 AM EST the Empire State Manufacturing Index is out.

On Tuesday, June 18, 8:30 AM EST, the May Housing Starts are released.

On Wednesday, June 19 at 2:00 PM EST, the Federal Reserve decision on interest rates is announced. Vital is whether the word “Patient” remains in their statement.

On Thursday, June 20 at 8:30 AM, the Weekly Jobless Claims are printed. We also get the Philadelphia Fed Manufacturing Index.

On Friday, June 21 at 10:00 AM, we learn May Existing Home Sales. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, by the time you read this, I will be winging my way somewhere over the Pacific Ocean. It’s a 14-hour flight from California to New Zealand, and the plane carries two crews.

It’s a genuine four movie flight. I’ll take off on Sunday and don’t arrive until Tuesday because I’ll be crossing the International Dateline. When I arrive, I’ll feel like death warmed over. It’s all in the name of research and finding that next great trading idea.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 14, 2019

Fiat Lux

Featured Trade:

(WEDNESDAY JUNE 26 BRISBANE, AUSTRALIA STRATEGY LUNCHEON)

(MAY 29 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (BYND), (AMZN), (GOOG), (AAPL), (CRM), (UT), (RTN), (DIS), (TLT), (HAL), (BABA), (BIDU), (SLV), (EEM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.