'For the last 20 years we used to trade inside a trend. There's no trend anymore. The day to day trade right now is what is the soup du jour, what is the trade of the day,' said Scott Bauer, a floor trader on the Chicago Mercantile Exchange.

'For the last 20 years we used to trade inside a trend. There's no trend anymore. The day to day trade right now is what is the soup du jour, what is the trade of the day,' said Scott Bauer, a floor trader on the Chicago Mercantile Exchange.

Featured Trades: (WHY I COVERED MY GOLD SHORT), (GLD)

1) Why I Covered My Gold Short. I have to tell you that I was just not feeling the love from my gold short when I came into the office Wednesday morning. You would have thought that, with a double top on the charts in place, there would be a move of the same ferocity we saw two weeks ago, when the barbarous relic cratered $220 in days. But this time, when gold down $132 in 24 hours, the momentum suddenly vaporized.

There are now three possible scenarios for the yellow metal. The double top at $1,920 holds, and we collapse to $1,500-$1,600. We continue to bounce around like a ping pong ball between $1,700-$1,900. We break out to a new high to $2,000. Notice that my October puts, which I strapped on when gold was trading at $1,835, losses money in two out of three of these possibilities. Hence, time to heave-ho the gold short.

Hard earned experience has taught me that you never want to be short the precious metals whenever European Central Bank President Jean Claude Trichet speaks. He never fails to disappoint, befuddle, or outrage traders, giving new life to whatever flight to safety trades are out there.

There also is a risk that traders will reach for their barf bags once they hear Obama's jobs speech, triggering another globalized 'RISK OFF' leg. In any case, he will never get anything through the Tea Party dominated House of Representatives, so what we're likely to get is a round of campaign posturing. Many Republican congressmen have already indicated that they won't even attend. It is all moot.

I have done three gold trades this year, all from the short side, and all profitable. This is despite the fact that my long term belief is that it will eventually hit the old inflation adjusted high of $2,300. The spikes in this market are clearly more visible that the bottoms, which tend to be slow, grinding affairs. The next big call in this market will be what to do if we hit $1,920 again; to sell once more, or go long. When I figure this one out, I'll let you know.

The market gave me a gift on my exit, with gold plunging to $1,790 off the back of some momentary strengthening in the stock market. I whipped out a trade alert that enabled my Macro Millionaire followers to book a quick 28% profit on their puts, boosting their year to date return by 72 basis points. Better not to swing for a home run this time, and settle for a single.

For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put 'Macro Millionaire' in the subject line, as we are getting buried in emails.

-

-

Buy the Dips and Sell the Rips

Buy the Dips and Sell the Rips

Featured Trades: (HEDGE FUNDS RAMP UP MARKET SHORTS), (SPX), (SPY)

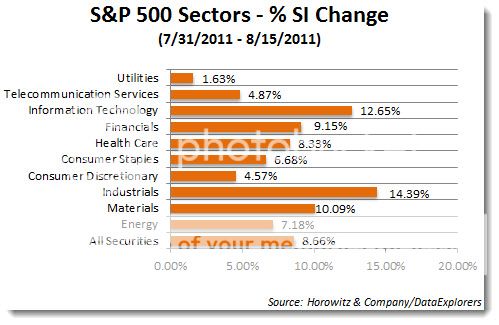

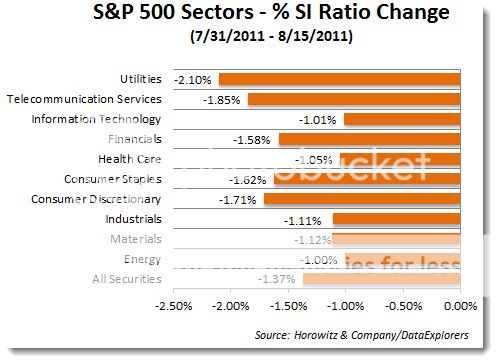

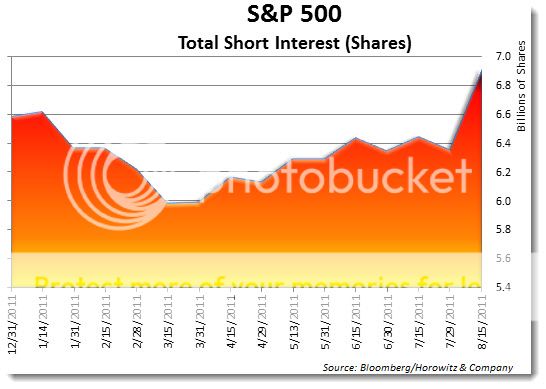

2) Hedge Funds Ramp Up Market Shorts. Hedge funds have gotten much more aggressive on the short side, as recent data show, with enviable results. According to Data Explorers, and independent research boutique, emboldened market timers and macro players increased their shorts in industrial stocks by 14.39% from July 31 to August 15, information technology by 12.65%, and materials by 10.09%. Industrials' share of total stock market capitalization fell by 1.11% during the same time frame, information technology dropped by 1.01%, and materials pared 1.11%.

This large scale selling, driven by an economic outlook that is fading fast, no doubt was a major contributor to the hellacious volatility we saw in August. Freshly sated, traders will no doubt come back to this well again, keeping volatility high. This is creating the enormous swings we are seeing in the market on an almost daily basis. The bad news for the rest of us is that hedge fund short positions are still only a tiny fraction of what we saw in 2008. There is plenty of dry powder to ramp them up much more from here.

I continue to believe that we will see some sort of 'RISK ON' rally in the Autumn, which might take us up 10%-20% from the August 8 low. There is at least a 50% chance that the bottom is in for this move, and that we rally from here, but in a highly choppy stop and start fashion. If I'm wrong, it will be by only a few dozen points into the 1,000 handle for the S&P 500 (SPX), (SPY). For the big crash, you are going to have to wait until next year.

What will be the driver for the next leg up? Corporations will once again deliver outstanding quarterly earnings for the season that begins at the end of September. The Fed will pour another gallon of gasoline on risk assets in some form, such as a 'twist' policy towards the debt markets. The esteemed government agency always seems to have some new tricks up its sleeve these days, so we may see some of those too. Finally, the bulked up shorts themselves will provide some ample tinder to get this fire going to the upside.

The longer term view, whether this rally lasts for weeks or months, is that this will be the last chance you have to unload equities before a much larger sell off in 2012. No matter how you cut it, the presidential election is not shaping up to be an equity friendly event, and it promises to drag out for another tortuous 14 months.

-

-

-

Hedge Fund Traders Are Getting More Aggressive With Their Shorts

Featured Trades: (IS THE SECOND SHOE ABOUT TO DROP ON THE EURO?),

(FXE), (FXF)

1) Is the Second Shoe About to Drop on the Euro? There were two pieces of news today that enabled the Euro (FXE) to benefit from a much needed relief rally. First, the German Supreme Court ruled in favor of the legality of the Greek bailout package. Then the Italian Senate approved a $70 billion austerity package that is a prerequisite for the rolling over of the country's existing debt.

With news this dramatic, you would expect the Euro to launch a major rally of three, four, or even five cents. But the best the damaged and suspect currency managed was a feeble one cent rally.

It is an old trader's nostrum that if you throw good news on a stock and it fails to go up, then you sell it. The European currency is starting to meet that qualification.

It's not like there is a shortage of reasons to dump the Euro. The sovereign debt crisis and the conjoined banking crisis have sent Europe's economy into a tailspin. GDP forecasts for the continent are rapidly crash landing down to zero.

It is only a matter of time before European Central Bank President Jean Claude Trichet admits that he committed a major policy error by raising interest rates for the Euro twice in the first half of the year. The inflationary fears that prompted him to stumble badly have proven to be a phantom. Oil alone has fallen by $25 since the last rate hike, and many other key commodities are now showing losses for the year.

The next move on interest rates has to be down, possibly as far as to zero. American interest rates are already at zero and can't go any lower. This is all hugely Euro negative and dollar positive.

Now that the Swiss franc (FXF) is out of the picture as a viable short, hedge fund traders are trolling for fresh meat to kill. Newly invigorated by the overnight fortune they made on the Swiss franc, the focus now has to be shifting to the Euro.

The break of the 50 moving average on the charts is signaling to technicians that we may be about to break out of the $1.40-$1.46 range that has prevailed all year to a new, lower $1.36-$1.40 range. Demolish that, and we could be eventually headed towards $1.17, and even parity against the buck.

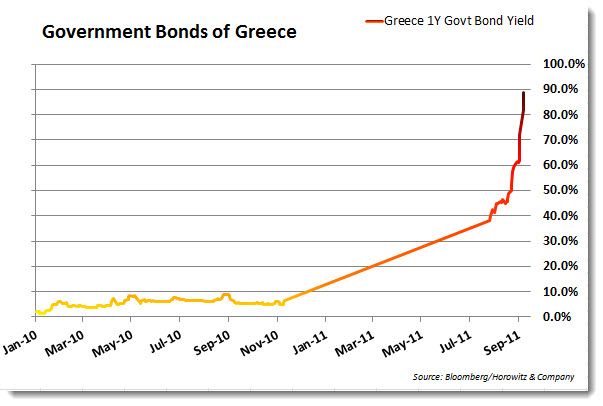

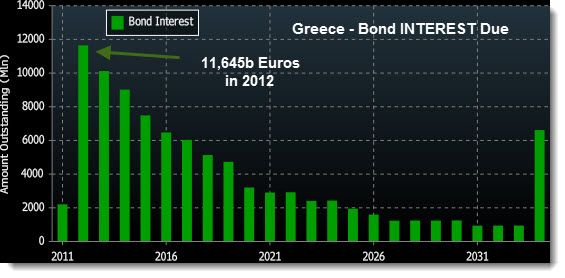

What will be the headline that finally blows down the European house of cards? The inevitable default of Greece, which after looking at the charts below, could happen at any time, with or without a bailout.

-

-

Brussels, We Have a Problem

'Go where the growth is, and where the debt isn't, and that is emerging markets,' said David Donabedian, the chief investment officer of Atlantic Trust Co., the private wealth management arm of Invesco.

'The Unites States government is in the business of securities manipulation,' said Jim Grant of the research boutique Interest Rate Observer.

Featured Trades: (AUGUST NONFARM PAYROLL TORPEDOES MARKET RALLY)

2) August Nonfarm Payroll Torpedoes Market Rally. Economist and market strategists alike were stunned by the August nonfarm payroll report showing zero job growth. The headline unemployment rate stayed unchanged at 9.1%.

The reports for June and July were revised down a gut punching 58,000. Employers obviously reacted to the damage the Tea Party was threatening to inflict on the global economy with a Treasury bond default by instituting an immediate hiring freeze.

The figures were further muddled by conflicting cross currents. The Verizon strike cut 45,000 from the reported total. At the same time, a return of state employees to work in Minnesota, which had been shut down over a budget impasse, boosted the figures by 22,000.

Health care lost 30,000 workers, government 17,000, and construction 5000. Professional and business services gained 28,000 jobs. What is really frightening here is that only 4,700 temps were hired, which normally lead the recovery stage in the economic cycle.

Risk assets everywhere fled in terror, while a monster rally launched in the bond markets. Yields for the ten year Treasury bond reached a new intraday low in the mid 1.90%'s, while the 30 year was seen well below $3.50%.

For me, the real stunner in the report was the revision to July government job losses up to an amazing 71,000. Clearly what is happening here is that as short term government stimulus programs run out, public workers are being let go in record numbers.

Congress deadlocked and the House is ideologically handcuffed, so there is no chance that any of these job creating programs will be renewed. This is going to get a lot worse before it gets better.

Will this cause me to lower my 2% GDP forecast for 2011? I don't think so. But it will force some permabulls, paid cheerleaders, and Kool-Aide drinkers to revise down their own overoptimistic targets from 4% and 3% down to my own more realistic and greatly subdued figure. Hint: This is not good for stock prices.

What organizations are currently advertising the greatest number of job openings? The US Air Force, at 134,000, followed by Taco Bell, the National Guard, and Staples. Looks like you better sharpen up your target practice or your Spanish if you want that paycheck bad enough.

Oops. There Goes the Economy

-

I Think I Have a Job in My Sights

'Patience is not a word that is fixated on two year election cycles. China has a five year plan. We have a five minute plan,' said Steven Roach, former non-executive chairman of Morgan Stanley Asia.

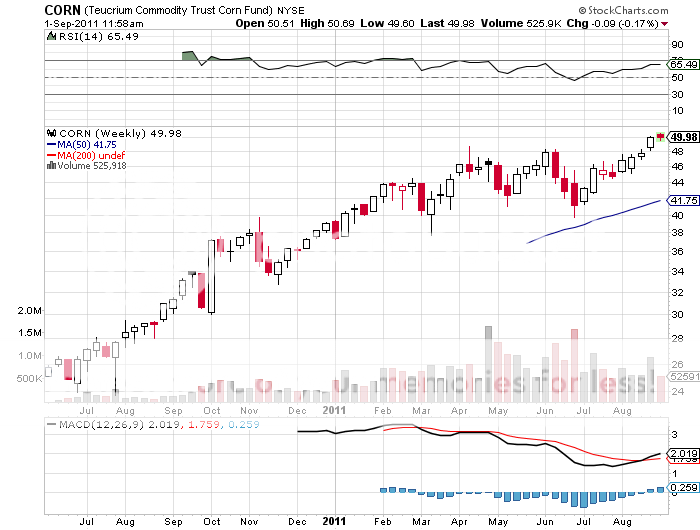

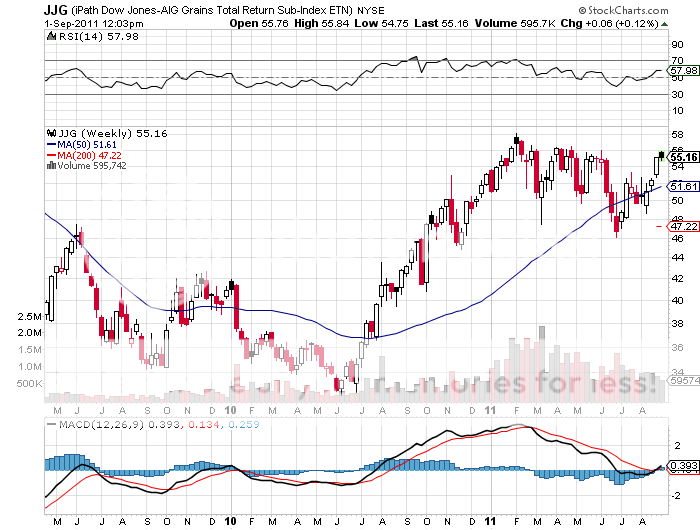

Featured Trades: (ITCHING TO GET INTO CORN),

(CORN), (JJG), (DBA), (POT), (MOS), (AGU), (CAT), (DE)

2) Itching to Get Into Corn. Long term readers of this letter know that I have long been banging away on the fact that the world is making people faster than the food to feed them. According to the World Bank, the world's population is expected to jump 2 billion, from 7 billion to 9 billion in the next 40 years. Half of that increase will come in the arid, food deficient Islamic world.

This is happing when the rate of increase of the world's agricultural productive capacity is rapidly declining. Ancient aquifers everywhere are falling, thanks to 'water mining', especially in India, Saudi Arabia, and the American mid-west. Insects have become immune to modern pesticides. The dividends of the 1960's 'green revolution' have reached diminishing returns.

The soil in many farmlands, especially in emerging markets, have become depleted, thanks to the overuse of advanced fertilizers, often contaminating local water supplies. Much food is still lost to waste in countries like India, where a primitive distribution and storage system see up to one third of its annual crop eaten by rats or rotting in silos. Oh, and has anyone heard of global warming?

The American corn crop this year has been particular interest. Huge rains hit during the spring and delayed seeding. Then a draught struck in the summer, with some states, like Texas, receiving no rain at all. Yields have plummeted. Approximately 86 million acres are planted with corn this year, producing some 1.299 billion bushels. But in recent weeks, yield estimates have been shrunk from 152.8 bushels per acre down to 151 bushels, and some farmers tell me that the 140's are in the cards.

Trading corn has been a nightmare this year, thanks to the Department of Agriculture, which has published enormous swings in crop expectations. China has thrown the fat on the fire, stepping in out of nowhere with enormous purchases of this essential foodstuff to deal with draught conditions back home.

That has created a roller coaster price for corn, with both limit up and down moves seen since January. I was hoping that during the August financial crisis, we would get a nice 30% pullback and a great entry point. It was not to be. After only a 6% hickey, it was off to the races again. The great thing about the ags in general is that they will move independent of all other asset classes, making them a great diversification play. This year has been no different.

As I write this, we are backing off of new multiyear highs at $7.75 a bushel. At least $9 a bushel seems to be in our immediate future, and $10 could be achieved with a spike. Strong corn prices have been pulling up other food prices as well, such as wheat and soybeans, and next time you buy a cup of coffee, you better not look at the price.

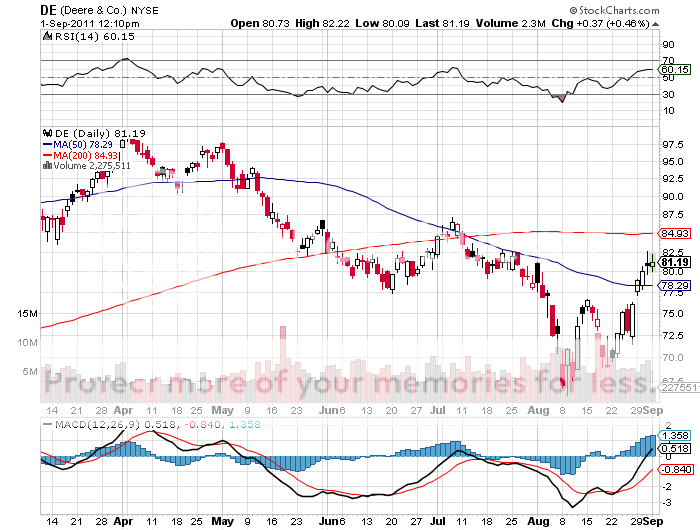

This all paints a rosy picture for the entire agricultural space. The corn ETF (CORN) is an easy vehicle to play this, if we ever get another pullback. Wheat and soybeans can be bought through the Chicago futures. Another good trading vehicle is the iPath Dow Jones-AIG Grains Total Return Sub index ETF (JJG), a basket of several grains. The PS DB Multi sector Agriculture ETF (DBA) also works also works. The fertilizer and seed companies should be bought, like Potash (POT), Mosaic (MOS), and Agrium (AGU). Equipment makers Caterpillar (CAT) and John Deere (DE) also have plenty of potential.

And the nice thing about food trades is that if they go wrong, you can always take delivery and east your positions. Anyone for a refrigerated rail car of pork bellies?

-

-

-

-

-

Can't Get Enough Corn

Featured Trades: (WHY I'M FLIPPING TO THE SHORT SIDE), (BAC)

1) Why I'm Flipping to the Short Side. We have had a nice run here on (BAC), posting a profit of 20% in just one week. The stock market is now at the top end of a one month range, so I am going to cut back some risk. The big gainers are always the first to go on the chopping block.

We have had a great 130 point rally off of the August 8 capitulation low. The market is getting artificially ramped up to overbought levels by month end window dressing, as portfolio seek to hide the damage caused by the worst month in the equity market in ten years.

Once we get through month end, I don't see any positive drivers for the market until Q3 corporate earnings releases begin at the end of September, or the FOMC meeting takes place on September 20-21, when some form of QE3 may be announced. An outlier would be a surprisingly good August nonfarm payroll report, to be released on Friday, September 2. This is an outlier that is way out there.

In a perfect world, we'll catch the next downdraft, take profits on our shorts, double up on our longs, and laugh all the way to the bank. Ah, yes, that perfect world. Something tells me that it will be harder than that.

The Justice Department's effort to block the AT&T and T-Mobile merger is definitely throwing a wet blanket on the market. The 3 cent pop in the Swiss franc this morning is also telling us that another round of 'RISK OFF' may be just around the corner.

Finally, I received a blizzard of emails from my Houston readers in the oil patch telling me 'great trade' on my recommendation to go short oil yesterday. They should know.

And for good measure, we are one headline away from another tape bomb, the next chapter in the unfolding disaster in Europe.

Add all this up, and it tells me to strap on more downside exposure. Hasta la vista Bank of America. Catch you again on the downswing. Well done Macro Millionaires! You have just added 100 basis points to your 2011 total performance!

In a perfect world, we'll catch the next downdraft in the markets, take profits on our shorts, double up on our longs, and laugh all the way to the bank. Ah, yes, that perfect world. Something tells me that it will be harder than that.

For these who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put 'Macro Millionaire' in the subject line, as we are getting buried in emails.

-

-

-

Flipping to the Short Side for a Trade

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.