My friend, Ian Bremmer of the Eurasia Group, a global risk analyst who I regularly follow, has published an outstanding book entitled The End of the Free Markets: Who Wins the War Between States and Corporations. I find this highly depressing, as it takes me as long to read one of Ian's books as it takes him to write another one. To read a review of his highly insightful tome published in 2008, The Fat Tail: The Power of Political Knowledge for Strategic Investing, please click here. The world is reaching a tipping point. For the past 40 years, global multinationals with unfettered access to capital, consumer, and labor markets have driven the world economy. There is now a new competitor on the scene, the "state capitalist," where political considerations trump economic ones in the allocation of resources. Of course, China is the main player, joined by several other emerging nations. The Middle Kingdom has posted double-digit annual growth for the past 30 years without freedom of speech, economic rules of the road, and independent judiciary, and credible property rights. China's leadership is clearly worried that Western style freedoms will enable wealth to be generated outside their control and be used to orchestrate their overthrow. Private Western companies can only engage in transactions, which stand on their own economically and deliver the short-term profits, which their shareholders demand. In China, long-term political goals enable them to pay through the nose to obtain stable supplies of oil, gas, minerals, and materials. That keeps the country's massive work force employed, off the streets, and politically neutered. The bottom line is that there are now two competing forms of capitalism. The recent financial crisis has accelerated their entrance to the global stage, moving us from a G7 to a G20 dominated world. Globalization is not ending, but it is definitely entering a new chapter. For those of us who read tealeaves to ascertain major, market moving economic trends, this will be a must read. To buy the book at Amazon, please click here.

Global Market Comments

June 19, 2013

Fiat Lux

Featured Trade:

(JULY 8 LONDON STRATEGY LUNCHEON),

(TRADE ALERT SERVICE RANKS SIXTH AMONG HEDGE FUNDS)

(THE HISTORY OF TECHNOLOGY),

(THE FUTURE OF CONSUMER SPENDING),

(EEM), (PIN), (IDX), (EWC)

iShares MSCI Emerging Markets Index (EEM)

PowerShares India (PIN)

Market Vectors Indonesia Index ETF (IDX)

iShares MSCI Canada Index (EWC)

Come join me for lunch for the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I'll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

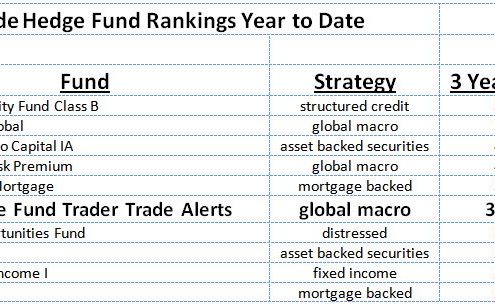

The Trade Alert service of the Mad Hedge Fund Trader ranked as the sixth top-performing hedge fund in the world, according to statistics compiled by Barron's. The Dow Jones subsidiary tallied results of the top 100 funds from a potential global universe of over 10,000. It then ranked results according to their three-year compound annual returns.

The Red Bank, New Jersey based Zais Opportunity Fund Class B came in at number one, with an eye popping 52.39% return? (https://www.zaisgroup.com/about.aspx ). They were followed by Quantedge Global in New York (http://www.quantedge.com/about/overview.php).

I peruse the list when it comes out every quarter to see how my friends in the industry are doing, and to study which strategies are delivering the winning numbers. No surprise that bond managers dominated the ranks, as we are just winding up a 60-year bull market in that once sought after asset class. However, investors in the four funds that employed bond strategies are about to get a rude wake up call, as May was the worst month in that market in many years.

Funds that employed a global macro approach, as I do, were catapulted to the top by correctly betting on Japan. This has been one of the toughest strategies to execute in recent years, as the massive liquidity provided by the Federal Reserve so grievously separates international assets from their fundamentals. Many such funds have been getting killed by their short positions in equities this year. Two funds in the Barron's table executed specialized niche strategies in asset-backed strategies, while one focused on distressed securities.

As of last week, the Trade Alert Service of the Mad Hedge Fund Trader boasted an enviable averaged annualized return of 35.50%. My own biggest earnings of the year have been in short yen, short gold, and long US equities. Followers have been laughing all the way to the bank (click here for the link to the testimonials).

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at http://madhedgefundradio.com, find the "Global Trading Dispatch" box on the right, and click on the lime green "SUBSCRIBE NOW" button.

Trade Alert Service Since Inception

Trade Alert Service Since Inception

I have just finished leisurely reading Tom Standage's book The Victorian Internet: The Remarkable Story of the Telegraph and the Nineteenth Century On-Line Pioneers.

Standage discusses the creation and development of the telegraph system and how it revolutionized communication in the nineteenth century. The book claims that Modern Internet users are in many ways the heirs of the telegraphic tradition, meaning that how people used the telegraph during the nineteenth century parallels how people use the Internet today.

Standage goes on to suggest that by studying how the telegraph developed and created certain trends in society, we can learn a lot about the challenges, opportunities, and pitfalls of the Internet today. From discussing the social impact of both systems with the development of online social interactions to the way that business and work was revolutionized, the book has it all!

You can laugh about how Victorians flirted and developed romantic connections over Morse code and you can marvel at the way getting more rapid information, particularly with the invention of the stock ticker, allowed financial markets to emerge and grow. If you Bloomberg slaves are looking for an educational and entertaining read, click here to purchase from Amazon.

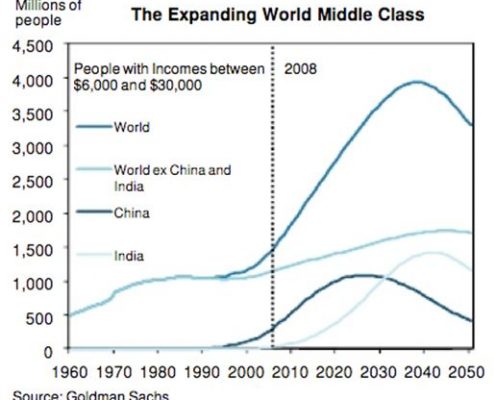

As part of my never ending campaign to get you to move more money into emerging markets, please take a look at the chart below from Goldman Sachs. It shows that the global middle class will rise from 1.8 billion today to 4 billion by 2040, with the overwhelming portion of the increase occurring in emerging markets.

The chart defines middle class as those earning between $6,000 and $30,000 a year. Adding 2.2 billion new consumers in these countries is creating immense new demand for all things and the commodities needed to produce them. This explains why these countries will account for 90% of GDP growth for at least the next ten years. It's all a great argument for using this dip to boost your presence in ETF's for emerging markets (EEM), China (FXI), Brazil (EWZ), and India (PIN).

Of course, you don't want to rush out and buy these things today. Emerging markets have been one of the worst performing asset classes of the year. But the selloff off is creating a once in a generation opportunity to get into the highest growing sector of the global economy on the cheap. I'll let you know when it is time to pull the trigger.

In the meantime, store this chart in your data base so when people ask why your portfolio is packed with Mandarin, Portuguese, and Hindi names, you can just whip it out.

Global Market Comments

June 18, 2013

Fiat Lux

Featured Trade:

(JULY 2 NEW YORK STRATEGY LUNCHEON),

(THE HIGH OIL MYSTERY), (USO), (UNG),

(SCAM OF THE WEEK),

(DECODING WHAT?S IN YOUR POCKET)

United States Oil (USO)

United States Natural Gas (UNG)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $209.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill.

?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.?

The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds.

Thank Freemason Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s historical adventure movie ?National Treasure.? The balanced scales in the seal are certainly wishful thinking and a bit quaint if they refer to the Federal budget. Study the buck closely, because there are soon going to be a lot more of them around.

What Did You Really Mean, Ben?

What Did You Really Mean, Ben?

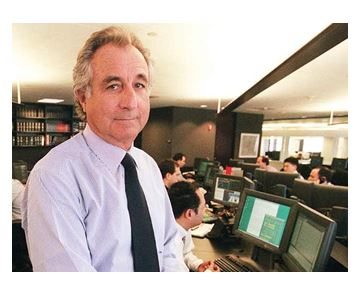

Having trouble raising capital for your new hedge fund? Just list Warren Buffet as your ?Honorary Chairman.? That?s what California prison guard, Ottoniel Medrano, did. To help his marketing efforts, he also claimed that he had $4.8 billion in assets under management as well as massive real estate holdings in Asia.

With this scam, Medrano?s International Realty Holdings managed to raise $700,000 from individuals, which he promptly shipped to offshore bank accounts, before the Feds shut him down.

When you think you?ve heard everything, something like this pops up. Unbelievable. You would think that people have heard of ?due diligence? by now. It all brings back unpleasant memories of Bernie Madoff, now a permanent resident at the federal prison in Butner, North Carolina.