Your Source For Winning Trade Alerts, Real Market Wisdom, and Global Economic Insights!

"*" indicates required fields

Sign up for free! and get my free research today!

"*" indicates required fields

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Mad Hedge Fund Trader (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

The current consensus for market strategists is that volatility will remain high. Please pinch me because I think I died and went to heaven. For every time the Volatility Index (VIX) tops $30, I make another 10%-15% for my followers. The bulk of market players are now obsessing whether we are entering a recession or

It’s time to give myself a dope slap. I have been pounding the table all year about the merits of a barbell strategy, with equal weightings in technology and domestic recovery stocks. By owning both, you’ll always have something doing well as new cash flows bounce back and forth between the two sectors like a

Suppose there was an exchange-traded fund that focused on the single most important technology trend in the world today. You might think that I was smoking California's largest export (it's not grapes). But such a fund DOES exist. The Global X Robotics & Artificial Intelligence ETF (BOTZ) drops a gilt-edged opportunity into investors' laps as a

https://www.madhedgefundtrader.com/wp-content/uploads/2019/08/What-the-Next-Recession-Will-Look-Like.jpg

400

400

Mad Hedge Fund Trader

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Mad Hedge Fund Trader2023-07-21 09:04:122023-07-21 15:33:10What the Next Recession Will Look Like

https://www.madhedgefundtrader.com/wp-content/uploads/2019/08/What-the-Next-Recession-Will-Look-Like.jpg

400

400

Mad Hedge Fund Trader

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Mad Hedge Fund Trader2023-07-21 09:04:122023-07-21 15:33:10What the Next Recession Will Look Like https://www.madhedgefundtrader.com/wp-content/uploads/2020/05/jt101.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2020-05-12 17:34:012021-04-05 14:00:23The Five Frontrunners in the Race for a COVID-19 VACCINE

https://www.madhedgefundtrader.com/wp-content/uploads/2020/05/jt101.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2020-05-12 17:34:012021-04-05 14:00:23The Five Frontrunners in the Race for a COVID-19 VACCINE https://www.madhedgefundtrader.com/wp-content/uploads/2020/02/leap-of-faith.jpg

400

400

Arthur Henry

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Arthur Henry2020-02-27 08:04:432020-05-12 22:29:43Get Ready to Take a Leap Back into Leaps

https://www.madhedgefundtrader.com/wp-content/uploads/2020/02/leap-of-faith.jpg

400

400

Arthur Henry

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Arthur Henry2020-02-27 08:04:432020-05-12 22:29:43Get Ready to Take a Leap Back into Leaps https://www.madhedgefundtrader.com/wp-content/uploads/2019/12/trade-alert-msft-expiration-blog.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2019-12-22 21:24:182020-04-10 14:54:28Trade Alert - (MSFT) - EXPIRATION

https://www.madhedgefundtrader.com/wp-content/uploads/2019/12/trade-alert-msft-expiration-blog.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2019-12-22 21:24:182020-04-10 14:54:28Trade Alert - (MSFT) - EXPIRATION https://www.madhedgefundtrader.com/wp-content/uploads/2019/12/the-eight-worst-trades-in-history-blog.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2019-12-22 21:23:042020-05-11 14:04:03The Eight Worst Trades in History

https://www.madhedgefundtrader.com/wp-content/uploads/2019/12/the-eight-worst-trades-in-history-blog.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2019-12-22 21:23:042020-05-11 14:04:03The Eight Worst Trades in History https://www.madhedgefundtrader.com/wp-content/uploads/2019/12/trading-the-new-apple-in-2020-blog.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2019-12-22 21:22:442020-05-11 14:03:54Trading the New Apple in 2020

https://www.madhedgefundtrader.com/wp-content/uploads/2019/12/trading-the-new-apple-in-2020-blog.jpg

400

400

JP

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

JP2019-12-22 21:22:442020-05-11 14:03:54Trading the New Apple in 2020 https://www.madhedgefundtrader.com/wp-content/uploads/2019/07/john-thomas-04.jpg

400

400

Mad Hedge Fund Trader

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Mad Hedge Fund Trader2019-07-24 10:04:382020-04-07 19:49:36They're Not Making Americans Anymore

https://www.madhedgefundtrader.com/wp-content/uploads/2019/07/john-thomas-04.jpg

400

400

Mad Hedge Fund Trader

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Mad Hedge Fund Trader2019-07-24 10:04:382020-04-07 19:49:36They're Not Making Americans Anymore https://www.madhedgefundtrader.com/wp-content/uploads/2019/07/john-thomas-05.jpg

400

400

MHFTR

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

MHFTR2019-07-24 10:02:392020-04-07 16:50:45The Death of the Financial Advisor

https://www.madhedgefundtrader.com/wp-content/uploads/2019/07/john-thomas-05.jpg

400

400

MHFTR

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

MHFTR2019-07-24 10:02:392020-04-07 16:50:45The Death of the Financial Advisor https://www.madhedgefundtrader.com/wp-content/uploads/2016/03/john-thomas-01.jpg

400

400

Mad Hedge Fund Trader

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Mad Hedge Fund Trader2016-03-24 01:06:432020-04-06 15:28:31Cyber Security is Only Just Getting Started

https://www.madhedgefundtrader.com/wp-content/uploads/2016/03/john-thomas-01.jpg

400

400

Mad Hedge Fund Trader

https://madhedgefundtrader.com/wp-content/uploads/2019/05/cropped-mad-hedge-logo-transparent-192x192_f9578834168ba24df3eb53916a12c882.png

Mad Hedge Fund Trader2016-03-24 01:06:432020-04-06 15:28:31Cyber Security is Only Just Getting Startedtastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Mad Hedge Fund Trader (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

Today is when you get off the fence and join!

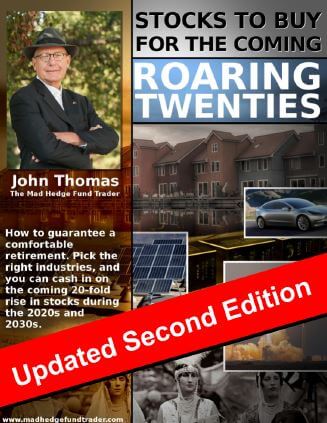

To make this offer utterly irresistible I will throw in a free copy of my best-selling book, Stocks to Buy for the Coming Roaring Twenties. Read it now before the companies I recommended double in value again!

After Monday’s 1,200-point swoon, the S&P 500 (SPY) has fallen 20.88% from its February peak. And we may still have a “Sell in May” ahead of us. This was one of the most overbought stock markets in my career. I have to think back to the March 2000 Dotcom Top and the Tokyo bubble in

I feel obliged to reveal one corner of this time of great turmoil that might actually make sense. By 2050, the population of California will soar from 40 million to 50 million, and that of the US from 340 million to 400 million, according to data released by the US Census Bureau and the CIA

Back in 1977, I met Chinese Premier Deng Xiaoping for the first time at the Foreign Correspondents Club of Japan. He was a cherubic 4’10” and I was a lanky 6’4” and when we shook hands, he craned his neck and laughed. When he asked me my name, I answered “Shorty” and we laughed again.

Learn from 24 of the best professionals in the market with decades of experience and the track records to prove it. They are offering a smorgasbord of successful trading strategies. Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate. Get the tools to build

Below, please find subscribers’ Q&A for the April 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV. Q: Is it time to get out of the (SH), which is the short S&P 500 LEAPS? A: I would say no. We're still very deep in the money for the LEAPS I put

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own FIVE in-the-money options positions that expire on Thursday, April 17, and I just want to explain to the newbies how to best maximize their profits. These involve the: Risk On (COST) 4/$840-$850 call spread 10.00% (TSLA)

Back in 1987, I flew my Cessna 340 twin from London to Rome to visit Morgan Stanley’s high-end Italian clients. Held over by meetings, I got a late start, and I didn’t get as far as the French Champagne country until midnight. Right then, at 20,000 feet, the gyroscope suddenly blew up with a great

I am one of those cheapskates who buy Christmas ornaments by the bucket load from Costco in January for ten cents on the dollar because my 11-month theoretical return on capital comes close to 1,000%. I also like buying flood insurance in the middle of the summer drought, when the forecast in California is for

I often get asked why I am still working after 55 years in the stock market. With five customers calling me this morning to thank me for saving their retirement funds, you might understand why. It is now clear that in retrospect and with the wisdom of 20/20 hindsight, corporate America flipped the switch on

Below please find subscribers’ Q&A for the April 2 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV. Q: Why are there days when both bonds and interest rates are going up? A: Well, there is a tug-of-war going on in the bond market. When recession fears are the dominant theme of

I just received an excited text message from an excited Concierge client. His long position in the (NVDA) April 17 2025 $90-$95 vertical bull call debit spread had just been called away. That meant he would receive the maximum profit a full 10 trading days before the April 17 option expiration. Whoever called away the

There is no doubt that the data released out on Friday were a complete disaster for stock investors. The Dow Average futures posted a 1,000-point swing, from up 200 in the overnight markets to down 800 intraday. Specifically, the Consumer Price Index came in at a hot 0.4%, which is 4.8% annualized. Five-year Inflation Expectations,

One of the most fascinating things I learned when I first joined the equity trading desk at Morgan Stanley during the early 1980s was how to parallel trade. A customer order would come in to buy a million shares of General Motors (GM), and what did the in-house proprietary trading book do immediately? It loaded

There is no doubt that the “underground” economy is growing. No, I’m not talking about violent crime, drug dealing, or prostitution. Those are all largely driven by demographics, which right now are at a low ebb. I’m referring to the portion of the economy that the government can’t see and therefore is not counted in

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder. It has in fact been deleted. That explains a lot about how markets have been trading this

Below please find subscribers’ Q&A for the March 19 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV. Q: I tried to get into ProShares Short S&P500 (SH), it seems pretty illiquid. How did you get in? A: Well, before I actually sent out the trade alert, I tested the liquidity of

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops

Demographics is destiny. If you ignore it as an investor, you will be constantly behind the curve wondering why your performance is so bad. Get ahead of it, and people will think you are a genius. I figured all this out when I was about 20. I realized then, back in 1972, that if I

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own four in-the-money options positions that expire on Friday, March 21, and I just want to explain to the newbies how to best maximize their profits. These involve the: Risk On (NVDA) 3/$88-$90 call spread

I have been learning a new language over the past few weeks (I already speak six). And like learning any new language, it has been a bumpy road. I remember a family dinner I had in Tuscany in 1968. The dessert was chocolate cake. I didn’t know how to say “cake” in Italian, so I

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.