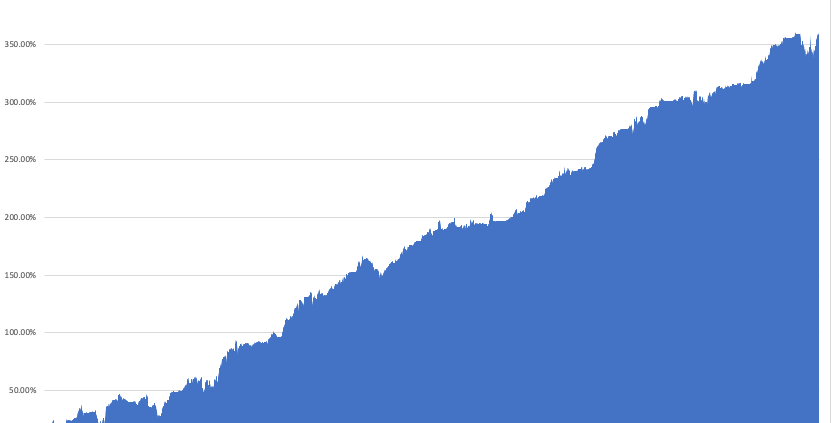

Thanks for the great newsletter and advice. I truly enjoy it. You are one of a kind! Credits to you as my financial navigator, as I am finally making some serious money after years of doing it the hard and wrong way. Kind regards Rolf

Global Market Comments May 28, 2020 Fiat Lux Featured Trade: (THE IRS LETTER YOU SHOULD DREAD), (PANW), (CSCO), (FEYE), (CYBR), (CHKP), (HACK), (SNE)

Global Market Comments May 27, 2020 Fiat Lux Featured Trade: (JOIN THE JUNE 4 TRADERS & INVESTORS SUMMIT), (IT’S NOT YOU FATHER’S MARINE CORPS)

This being the week for Memorial Day, I think I will be forgiven for posting one more military piece. Most Americans don’t know that the US Marine Corps is the oldest government institution in the United States. It was founded at Tun Tavern on Water Street in Philadelphia on November 10, 1775, nearly eight months

“By the time you spot a bandwagon, it is too late to get on,” said Sir Martin Franklin, co-chairman of the APi Group.

Global Market Comments May 26, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or LOOKING FOR THE NEW AMERICA), (FB), (AAPL), (NFLX), (GOOGL), (MSFT), (TSLA), (VIX)

We are getting some tantalizing tastes of the new America that will soon arise from the wreckage of the pandemic. Companies are evolving their business models at an astonishing rate, digitizing what’s left and abandoning the rest, and taking a meat cleaver to costs. The corporate America that makes it through to the other side

Global Market Comments May 22, 2020 Fiat Lux SPECIAL MEMORIAL DAY ISSUE Featured Trade: (A TRIBUTE TO A TRUE VETERAN)

Global Market Comments May 21, 2020 Fiat Lux Featured Trade: (MAY 20 BIWEEKLY STRATEGY WEBINAR Q&A), (GLD), (SDS), (TSLA), (VIX), (ROM), (SPY), (TLT), (TBT), (DRI), (CCI), (BOTZ) (TESTIMONIAL)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 20 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Do you believe chairman Powell when he says no negative rates? A: I do believe that he does not want negative

Global Market Comments May 20, 2020 Fiat Lux Featured Trade: (THE HYPER-ACCELERATION OF 5G) (AMZN), (5G), (CCI), (MSFT), (NFLX), (APPL)

I will explain to everyone why a wonky side effect of coronavirus is supercharging the 5G revolution. Market valuations reflect the state of expected future cash flows in a company. Under this assumption, some could argue that most tech companies with staying power are almost a good buy at any price. No-brainers would include a

Global Market Comments May 19, 2020 Fiat Lux Featured Trade: (THE 2020 DARK HORSES OF BIOTECH) (AMRN), (THOR), (SAN), (NBSE), (OHRP), (MRNA), (MRK), (AZN), (VRTX), (RGLS), (ARWR)

One of our dark horses came in a big winner this morning. No, I did not go to the Golden Gate Fields race track on San Francisco Bay and win big on a horse with 5:1 odds, although I might as well have. Moderna (MRNA) soared to $85 this morning on news of a successful

“A market has never before come out of a recession with stocks at peak earnings multiples,” said Jonathan Golub, Chief Equity Strategist at Credit Suisse.

Global Market Comments May 18, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE MARKET IS BRACKETED) (SPY), (TLT), (VIX), (DIS)

We are all living the Bill Murray movie “Groundhog Day” over and over again. Every day seems to blend seamlessly into the next, ad infinitum. I think it’s Monday, but I’m not sure. The stock market is open so that must mean it’s Monday to Friday. The trash goes out tomorrow, so it might be

Global Market Comments May 15, 2020 Fiat Lux Featured Trade: (WHY CONSUMER STAPLES ARE DYING), (XLP), (PG), (PEP), (PM), (WMT), (AMZN), (WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Global Market Comments May 14, 2020 Fiat Lux Featured Trade: (TEN UGLY MESSAGES FROM THE BOND MARKET), (TLT), (TBT), (USO), (GLD), (GS), (SPY)

The global bond markets have been screaming an ugly message at us loud and clear, and I’m afraid that it’s not a positive one. Amazingly, US Treasury bonds have soared early this year, taking the (TLT) up a stunning 40 points. In the meantime, stocks have suffered the sharpest crash in history, plunging ten times

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.