I rarely make changes to the Mad Hedge Long Term Model Investment Portfolio. This is my shot at recommending portfolios of assets and individual stocks that investors never have to touch. You just put your money in, and don’t cash in until you hit your retirement age of 65 or 70. After all, changes in

Global Market Comments October 16, 2019 Fiat Lux Featured Trade: (A NOTE ON ASSIGNED OPTIONS OR OPTIONS CALLED AWAY), (MSFT) (DECODING THE GREENBACK),

With stock market volatility greatly elevated and trading volumes through the roof, there is a heightened probability that your short options position gets called away. If it does there, is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit on your

Global Market Comments October 15, 2019 Fiat Lux Featured Trade: (HOW TO HANDLE THE FRIDAY, OCTOBER 18 OPTIONS EXPIRATION), (ONLY TEN MORE DAYS UNTIL THE MAD HEDGE LAKE TAHOE, NEVADA CONFERENCE, OCTOBER 25-26, 2019)

Followers of the Global Trading Dispatch have the good fortune to own THREE deep in-the-money options position that expires on Friday, October 18, and I just want to explain to the newbies how to best maximize their profits. These involves the: the Russell 2000 (IWM) October 2019 $137-$142 in-the-money vertical Bull call spread at $5.00

Global Market Comments October 14, 2019 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or UNICORNS AND CANDY CANE) (AAPL), (FDX), (SPY), (IWM), (USO), (WMT), (AAPL), (GOOGL), (X), (JPM), (WFC), (C), (BAC)

I have to tell you that flip-flopping from extreme optimism to extreme pessimism and back is a trader’s dream come true. Volatility is our bread and butter. Long term followers know that when volatility is low, I struggle to make 1% or 2% a month. When it is high, I make 10% to 20%, as

Global Market Comments October 11, 2019 Fiat Lux Featured Trade: (TEN SURPRISES THAT WOULD DESTROY THIS MARKET), (USO), (AMZN), (MCD), (WMT), (TGT)

Global Market Comments October 10, 2019 Fiat Lux Featured Trade: (IS AIRBNB YOUR NEXT TEN BAGGER?)

Global Market Comments October 9, 2019 Fiat Lux Featured Trade: (HOW FINTECH IS EATING THE BANKS’ LUNCH), (BAC), (C), (WFC), (SQ), (PYPL), (WCAGY), (FISV), (INTU), (BABA),

It was another dreadful DAY for the banks. All bank shares are now down in 2019 with the sole exception of JP Morgan, which is up a modest 10% since January 1. Although their core business is good, the share price hasn’t even bothered to mail it in. So, I thought it would be time

Global Market Comments October 8, 2019 Fiat Lux Featured Trade: (HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING), (GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY), (PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY), (KODK), (SLV), (AAPL),

Global Market Comments October 7, 2019 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WILL HE OR WON’T HE?) (INDU), (USO), (TM), (SCHW), (AMTD), (ETFC), (SPY), (IWM), (USO), (WMT), (AAPL), (GOOGL), (SPY), (C)

Once again, the markets are playing out like a cheap Saturday afternoon matinee. We are sitting on the edge of our seats wondering if our hero will triumph or perish. The same can be said about financial markets this week. Will a trade deal finally get inked and prompt the Dow Average to soar 2,000

Global Market Comments October 4, 2019 Fiat Lux Featured Trade: (LAST CHANCE TO BUY THE NEW MAD HEDGE BIOTECH AND HEALTH CARE LETTER AT THE FOUNDERS PRICE) (SEPTEMBER 18 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (VIX), (USO), (ROKU), (TLT), (BA), (INDU), (GM), (FXI), (FB), (SCHW), (IWM), (AMTD)

This weekend, we are closing down our discount offer page to buy the New Mad Hedge Biotech and Healthcare Letter at the Founders Price for only $997. There are two stock sectors that will most likely deliver 80% of the total market return over the coming decade. You already know one of them. The other

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader October 2 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Would you do the S&P 500 (SPY) bull call spread if you didn’t have time to enter the short leg yesterday?

Global Market Comments October 3, 2019 Fiat Lux Featured Trade: (GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING), (GOOGL), (IBM) (AI AND THE NEW HEALTHCARE), (XLV), (BMY), (AMGN)

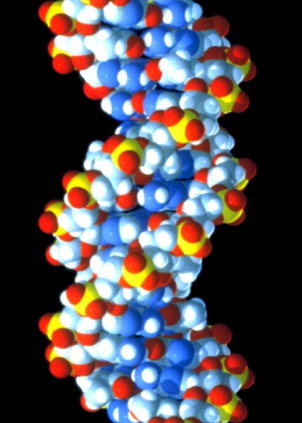

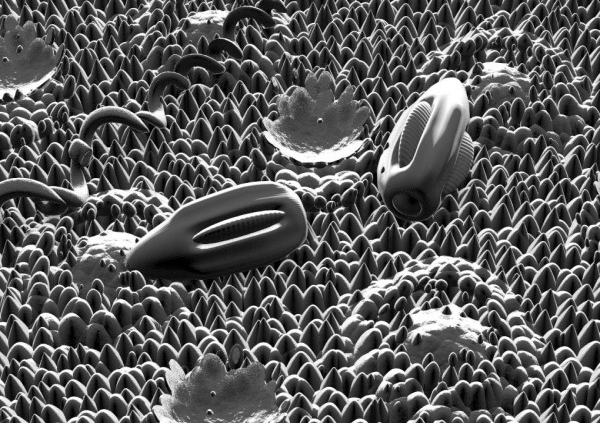

The first major industry to be fundamentally disrupted by artificial intelligence will be healthcare, America’s last 19th-century industry. Major diseases are being cured at such a dramatic pace that if you can survive the next decade, chances are you can live forever. DNA is the software of life and spending $3 billion to decode it by

Global Market Comments October 2, 2019 Fiat Lux Featured Trade: (TEN MORE REASONS WHY BONDS WON’T CRASH), (TLT), (TBT), (ELD), (MUB) (COFFEE WITH RAY KURZWEIL), (GOOG)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.