I have always been a big fan of buying a dollar for 30 cents. That appears to be the opportunity now presented by the Japanese software giant, Softbank (SFTBY). This gorilla of the Internet space was founded and run by my old friend, Masayoshi Son, who many refer to as a combination of the Jeff

Global Market Comments November 22, 2013 Fiat Lux Featured Trade: (TAKING PROFITS ON CITIGROUP), (C), (XLF), (WFC), (MS), (GS), (JPM), (WATCH OUT FOR THE JOBS TRAP), (FDX), (UPS), (WATCH THOSE MONETARY AGGREGATES) Citigroup, Inc. (C) Financial Select Sector SPDR (XLF) Wells Fargo & Company (WFC) Morgan Stanley (MS) The Goldman Sachs Group, Inc. (GS) JPMorgan

I have discovered a correlation in the market that you can use for the rest of this year, for all of 2014, and probably for the next 20 years. Whenever the Treasury bond market (TLT) takes a dive, bank shares rocket. This is a particularly happy discovery, as my model-trading portfolio is long bank shares

We are about to get some wild, seasonal gyrations to the jobs numbers, and I think you will be well advised to know about them in advance. A large part of our economy is moving online more rapidly than most people and governments realize. According to ComScore, a marketing data research firm, online sales leapt

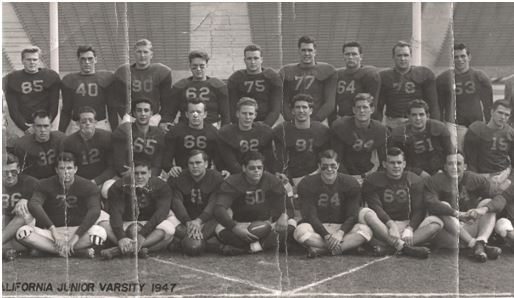

Call me a nerd, but instead of spending my Sundays watching football, I pour over data analyzing the monetary aggregates. That?s a tough thing to say for someone whose dad was a lineman on the University of Southern California?s legendary 1947 junior varsity football team. This is so I can gain insights into the future

Global Market Comments November 21, 2013 Fiat Lux Featured Trade: (CASHING IN ON OBAMACARE), (XLV), (GILD), (AET), (WPT), (THE FLASH CRASH RISK IS RISING), (SPX), ($INDU), (TESTIMONIAL) Health Care Select Sector SPDR (XLV) Gilead Sciences Inc. (GILD) Aetna Inc. (AET) World Point Terminals, LP (WPT) S&P 500 Index (SPX) Dow Jones Industrial Average ($INDU)

Not a day, an hour, or a minute goes by without the media blasting at me about how terrible Obamacare is. I wondered, how terrible can it be? There?s got to be a trade in there somewhere. After intensively researching several industries I concluded that the investment opportunities created by the president?s signature legislative accomplishment

Those who lived through the cataclysmic ?flash crash? that occurred precisely at 2:45 pm EST on May 6, 2010, have been dreading a replay ever since. Their worst nightmares may soon be realized. That is when the Dow Index (INDU) dropped a gob smacking 650 points in minutes, wiping out nearly $1 trillion in market

I sit here painfully typing this letter, as my fingertips have been worn down to bloody stumps. I have been pounding out the Trade Alerts since the month started, sending out 37, and the month is only half over. That works out to a 3.3636 Trade Alerts a day! I have been so busy that

Global Market Comments November 20, 2013 Fiat Lux Featured Trade: (THE MARKET TAKES A BREAK), (SPY), (IWM), (FXY), (AAPL), (C), (TLT), (RINGING THE REGISTER WITH THE AUSSIE), (FXA), (EWA), (FXI), (THE MYSTERY OF THE BRASHER DOUBLOON) SPDR S&P 500 (SPY) iShares Russell 2000 (IWM) CurrencyShares Japanese Yen Trust (FXY) Apple Inc. (AAPL) Citigroup, Inc. (C)

I often use my own profit and loss statement as a leading market indicator. Whenever I am blessed with a windfall profit, it is frequently time to sell. On those rare occasions when I take a big hit, it is invariably time to buy. This is one of those times. Since November 1, the Trade

This is our 13th consecutive closing profitable position, and 19th consecutive profitable Trade Alert when you include our remaining open positions. I have only seven more winners to go before I break my old record of 25. Since I strapped on this trade last week, the (FXA) has popped a full 1 ? points to

The Chinese government has announced the most revolutionary changes to its economy in nearly four decades. The implications for global stock markets are hugely positive, and until now, under appreciated. The Middle Kingdom?s state controlled media, never prone to hyperbole, are calling it ?a new historical starting point.? Chinese stocks have rocketed since word of

Global Market Comments November 19, 2013 Fiat Lux Featured Trade: (CHINESE REFORMS AND THE US STOCK MARKET), (FXI), (CHL), (CYB), (RUBBING SHOULDERS WITH THE ?1%? AT INCLINE VILLAGE) iShares China Large-Cap (FXI) China Mobile Limited (CHL) WisdomTree Chinese Yuan (CYB)

If you really want to get a read on how ?the 1%? are faring these days, take a ski vacation to the tony hamlet of Incline Village on the pristine shores of Nevada?s Lake Tahoe. Each morning, I trekked to Starbucks, one of the few local sources for the Wall Street Journal and the New

Global Market Comments November 18, 2013 Fiat Lux Featured Trade: (NOVEMBER 20 GLOBAL STRATEGY WEBINAR), (MAD HEDGE FUND TRADER MELTS UP TO 56% 2013 PERFORMANCE), (SPY), (IWM), (FXA), (TLT), (AAPL), (XLI), (C), (THE YEN IS DEAD MEAT), (FXY), (YCS), (DXJ), (TM), (SELLING BONDS AGAIN), (TLT), (TBT) SPDR S&P 500 (SPY) iShares Russell 2000 (IWM) CurrencyShares

Last week, I begged you, pleaded with you, and even pounded the table to get you to increase your shorts in the Japanese yen (FXY), (YCS), and longs in the Japanese stock market (DXJ). I was certain that Japan?s beleaguered currency was about to break out of its tedious six month trading range and plumb

You all know well my antipathy to the bond market, which I believe hit a 60-year peak on August 18, 2012 at 10:32 AM EST. I managed to catch the exact top of the one-month post taper bond market rally, and sent the Trade Alerts to sell bonds showering upon you. I quickly closed all

The Trade Alert service of the Mad Hedge Fund Trader has posted yet another new all time high in performance, taking in 51.13%. The November month to date record is now an enviable 6.67%. The three-year return is an eye popping 106.18%, compared to a far more modest increase for the Dow Average during the

Global Market Comments November 15, 2013 Fiat Lux Featured Trade: (WATCHING THE CASH ROLL IN), (SPY), (IWM), (FXE), (XLI), (C), (FXA), (AAPL), (HOPPING ON THE AUSSIE), (FXA), (EWA), (FCX), (LUNCH WITH ROBERT REICH) SPDR S&P 500 (SPY) iShares Russell 2000 (IWM) CurrencyShares Euro Trust (FXE) Industrial Select Sector SPDR (XLI) Citigroup, Inc. (C) CurrencyShares Australian

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.