The Fed?s decision not to taper, and therefore keep interest rates lower for longer, gave a great flashing green light to the bond market. It has been off to the races ever since, with the iShares Barclays 20+ Year Treasury Bond Fund (TLT) blasting through resistance this morning to new two month high. As this

Global Market Comments September 24, 2013 Fiat Lux Featured Trade: (APPLE?S BLOWOUT NUMBERS SEND BEARS SCAMPERING), (AAPL), (QCOM), (CHL), (SSNLF), (MSFT), (GOOG), (EXPIRATION OF MY YEN BEAR PUT SPREAD), (MY PERSONAL LEADING ECONOMIC INDICATOR), (NOTICE TO MILITARY SUBSCRIBERS) Apple Inc. (AAPL) QUALCOMM Incorporated (QCOM) China Mobile Limited (CHL) Samsung Electronics Co. Ltd. (SSNLF) Microsoft Corporation

Apple?s (AAPL) report this morning that it sold a stunning 9 million model 5s and 5c iPhones has bowled over even the company?s most optimistic cheerleaders and sent the bears running. The consensus estimate had been only for 5 million units. At the opening highs, shares were up $30 to $497, well above the $468

Add this one to the ?WIN? column. I strapped on this position because I believed that the world was adding risk, expecting major bull moves, once it becomes clear that the multiple disasters now threatening the world don?t actually happen. The list includes war with Syria, the taper, the Bernanke replacement, the debt ceiling crisis,

One of the joys of having small children is that you get to know the guy at the local plumbing supply shop really well. It?s amazing what will fit down a toilet these days. He once told me that when Troll Dolls hit the market, every plumber in the country was guaranteed a job for

To the dozens of subscribers in Iraq, Afghanistan, and the surrounding ships at sea, thank you for your service! I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you cash out. Nobody is going

Global Market Comments September 23, 2013 Fiat Lux Featured Trade: (NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON), (TAKE A LOOK AT OCCIDENTAL PETROLEUM), (OXY), ($WTIC), (USO), (TESTIMONIAL) Occidental Petroleum Corporation (OXY) Light Crude Oil ($WTIC) United States Oil (USO)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

I have kept oil companies in my long term model portfolio for many years now. But there are a lot of belles at the ball, but you can?t dance with all of them. While a student at UCLA in the early seventies, I took a World Politics class, which required me to pick a country,

Global Market Comments September 20, 2013 Fiat Lux Featured Trade: (SEPTEMBER 25 GLOBAL STRATEGY WEBINAR), (REPORT FROM THE MATTERHORN SUMMIT)

From where I stand, the rolling foothills of Northern Italy spread out below me to the south. On my left lie the distinctive peaks of the Dolomite Alps. On my right I can see the massive expanse of Mont Blanc, at 15,781 feet the highest mountain in Europe. I am standing at the summit of

Global Market Comments September 19, 2013 Fiat Lux Featured Trade: (BEN GIVES GREEN LIGHT TO BULL MARKETS), (SPY), (USO), (TLT), (FXE), (FXA), (FXY), (FXB), (YCS), (GLD), (SLV), (HOW TO AVOID PONZI SCHEMES), (PLAY CHINA?S YUAN FROM THE LONG SIDE), (CYB), ($SSEC), (EEM) SPDR S&P 500 (SPY) United States Oil (USO) iShares Barclays 20+ Year Treas

I told you so! Ben Bernanke?s decision not to taper $85 billion a month of Federal Reserve bond purchases came as a surprise to everyone, but me. The reasons were legion. Blame Syria, blame the weak August nonfarm payroll, blame a near zero inflation rate, blame the coming debt ceiling crisis. The bottom line is

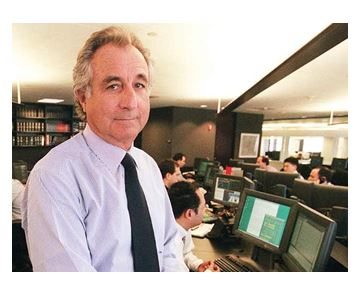

I spent a sad and depressing, but highly instructional evening with Dr. Stephen Greenspan, who lost most of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky?s Tremont feeder fund; receiving convincing trade confirms and rock solid custody statements from the Bank

One of the oldest games in the foreign exchange market is to always buy the currencies of strong countries that are growing, and to sell short the currencies of the weak countries that are shrinking. Any doubts that China?s Yuan is a huge screaming buy should have been dispelled when news came out that it

This has been a real peach of a trade. In just eight days, (FCX) shares have jumped by 8%, taking the Freeport McMoRan October $28-$30 bull call spread from $1.68 to $1.93, a gain of 15%. And we did this by only risking 10% of our capital. We managed to achieve this profit when the

Global Market Comments September 18, 2013 Fiat Lux Featured Trade: (THE ULTRA BULL ARGUMENT FOR GOLD), (GLD), (GDX), (ABX), (SLV), (AN EVENING WITH BILL GATES, SR.) SPDR Gold Shares (GLD) Market Vectors Gold Miners ETF (GDX) Barrick Gold Corporation (ABX) iShares Silver Trust (SLV)

We sit here in the calm before the storm awaiting the Federal Reserve?s decision to taper a little, a lot, or not at all. Every asset class on the planet is in a holding pattern until then. So I?ll take this opportunity to review the current state of play in gold (GLD). Since it peaked

I had a chat with Bill Gates, Sr. recently, co-chairman of the Bill and Melinda Gates Foundation, the world?s largest private philanthropic organization. There, a staff of 800 helps him manage $30 billion. The foundation will give away $3.1 billion this year, a 10% increase over last year. Some $1.5 billion will go to emerging

Global Market Comments September 17, 2013 Fiat Lux Featured Trade: (JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE), (IT?S ALL ABOUT LARRY), (SPY), (TLT), (FXY), (YCS), (FXA), (MSFT), (LUNCH WITH ROBERT REICH) SPDR S&P 500 (SPY) iShares Barclays 20+ Year Treas Bond (TLT) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) CurrencyShares

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.