Global Market Comments March 13, 2013 Fiat Lux Featured Trade: (APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON), (BLACK SWANS ARE CIRCLING), (SPX), (A COW BASED ECONOMICS LESSON) S&P 500 Large Cap Index (SPX)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

Basking in the glow of my 31% gain so far this year, I have to start wondering what could go wrong. Call me a pessimist, a paranoid, and worrywart, but whenever things got this good in the past, they were about to turn very bad. It is not my intention to ruin your day. But

SOCIALISM You have 2 cows. You give one to your neighbor. COMMUNISM You have 2 cows. The State takes both and gives you some milk. FASCISM You have 2 cows. The State takes both and sells you some milk. NAZISM You have 2 cows. The State takes both and shoots you. BUREAUCRATISM You have 2

Global Market Comments March 12, 2013 Fiat Lux Featured Trade: (TRADE ALERT SERVICE ROCKETS TO 30% GAIN IN 2013), (SPY), (IWM), (F), (AIG), (FCX), (FXY), (YCS), ?(FXB), (FXE), (EUO), (VIX) (LOAD THE BOAT WITH THE CHINESE YUAN), (CYB), (HOW TO AVOID THE PONZI SCHEME TRAP), (TESTIMONIAL) SPDR S&P 500 (SPY) iShares Russell 2000 Index (IWM)

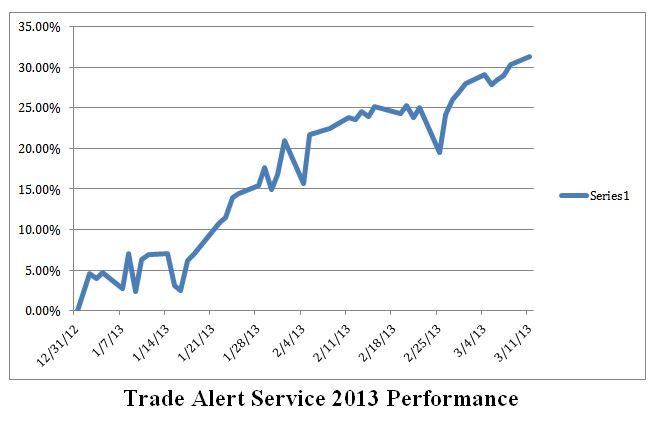

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 30.64% profit year to date, taking it to another new all time high. The 27-month total return has punched through to an awesome 86%, compared to a miserable 10% return for the Dow average during the same period. That raises the average

Any doubts that the Chinese Yuan is a huge screaming buy should have been dispelled when news came out that China had displaced Germany as the world?s largest exporter. The Middle Kingdom shipped $1.9 trillion in goods in 2012, compared to only $1.4 trillion for Deutschland. The US has not held the top spot since

I spent a sad and depressing, but highly instructional evening with Dr. Stephen Greenspan, who had lost most of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky's Tremont feeder fund; receiving convincing trade confirms and rock solid custody statements from the

Global Market Comments March 11, 2013 Fiat Lux Featured Trade: (WHY THE STOCK MARKET IS STILL GOING UP), (SPX), (SPY), (QQQ), (IWM), (OEX), (RSP), (KKR) (APL) (LINE) (RIG) (AXP), (BMY) (MURRAY SAYLE: THE PASSING OF A GIANT IN JOURNALISM) S&P 500 Large Cap Index (SPX) SPDR S&P 500 (SPY) PowerShares QQQ (QQQ) iShares Russell 2000

I have had an extremely hot hand this year, pushing the 2013 performance of my Trade Alert Service above a stellar 30%. So I am going out on a limb here and predict that the S&P 500 is about to grind up to a new all time high. Since 2009, Federal Reserve governor, Ben Bernanke,

According to my old friend, Rick Sopher, chairman of LCH Investments in London, the top ten hedge funds have earned $153 billion for their investors since inception. Rick, who runs his business from an elegant flat on posh Eaton Square, compiled the list after a comprehensive survey of the still operating 7,000 hedge funds worldwide.

One of my biggest disappointments with the Obama administration so far is his continued support of the ethanol boondoggle. The program was ramped up by the Bush administration to achieve energy independence by subsidizing the production of alcohol from domestically grown corn. Add clean burning moonshine (yes, it's the same alcohol - C2H5OH), whose combustion

Global Market Comments March 7, 2013 Fiat Lux Featured Trade: (APRIL 19 CHICAGO STRATEGY LUNCHEON), (HERE COMES THE NEXT PEACE DIVIDEND), (AAPL), (USO), (SPX), (UUP), (TLT), (GLD), (SLV), (CU), (CORN), (SOYB) Apple Inc. (AAPL) United States Oil (USO) S&P 500 Index (SPX) PowerShares DB US Dollar Index Bullish (UUP) iShares Barclays 20+ Year Treas Bond

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds, foreign

When communications between intelligence agencies suddenly spike, as has recently been the case, I sit up and take note. Hey, you don?t think I talk to all of those generals because I like their snappy uniforms, do you? The word is that the despotic, authoritarian regime in Syria is on the verge of collapse, and

Global Market Comments March 6, 2013 Fiat Lux Featured Trade: (APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON), (INVESTING IN A STATE SPONSOR OF TERRORISM), (AFK), (GAF), (EZA), (THE LONG VIEW ON EMERGING MARKETS), (EWZ), (RSX), (PIN), (FXI) Market Vectors Africa Index ETF (AFK) SPDR S&P Emerging Middle East & Africa (GAF) iShares MSCI South Africa Index

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

How about a country whose leaders have stolen $400 billion in the last decade and have seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years. Still interested? How about a country that suffers one of the world?s highest AIDs rates, endures regular insurrections where all of the Westerners get

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London. Jim thinks that it is still the early days for the space, and that these

Global Market Comments March 5, 2013 Fiat Lux Featured Trade: (THE GREAT YAWN OF 2013), (INDUSTRIES THAT YOU WILL NEVER HEAR FROM ME ABOUT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.