Talk about a game changer, a disruption of the status quo of the first order.

With the election of Donald Trump as president of the United States, and the retaining of the House of Representatives and the Senate by the Republican Party, we are looking at nothing less than a new world order.

After staying awake for the past 48 hours, speaking to seasoned money managers, strategists, and even senior economic advisors to the new president, I think I have a sense of the immediate trading opportunities that have been placed before us, as well as the long-term impacts.

What we are looking at are permutations of permutations of permutations.

Call it a trader?s dream come true, and it is heralding the greatest sector rotation of all time.

Donald Trump?s campaign was so far off the grid that it couldn?t be measured by traditional tools used by Democrats, Republicans, or even Trump himself.

There is no way Google (GOOG) was going to be able to effectively analyze a demographic that doesn?t know how to use a computer or use electricity. And no one was more surprised than Trump.

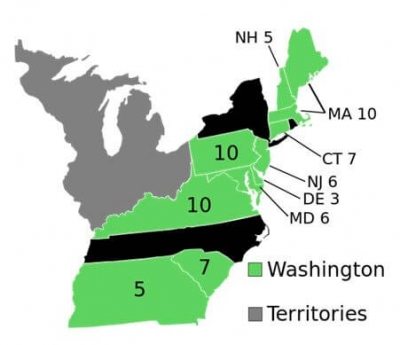

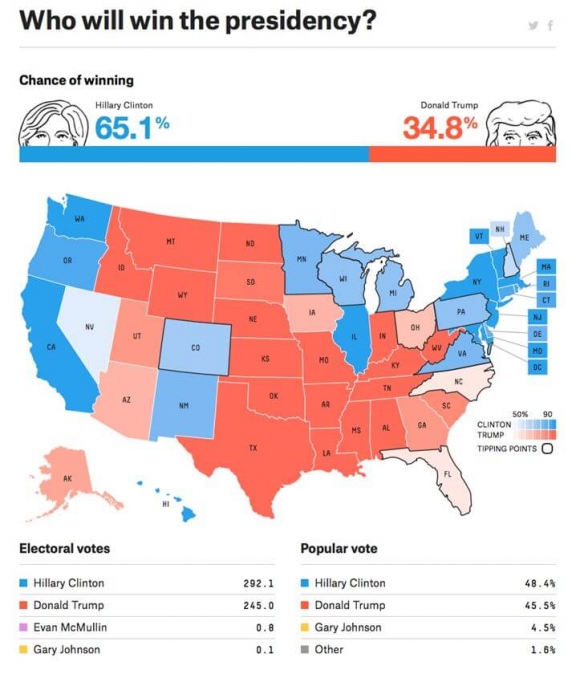

While Hillary Clinton won the popular vote, a highly vocal minority turned out to be large enough to win 278 Electoral Votes, sufficient for a Trump win.

All it took was a swing of 60,000 votes that came out of nowhere in rural Pennsylvania. The butterfly flaps its wings.

We trade the market we have, not the one we want. So let's get on with the important business of making money.

We got the 1,000 point sell off I predicted for the Dow Average. Who knew we would make a round trip? in hours.

Did you like the effect Ben Bernanke?s quantitative easing (QE) 1,2,3, and 4 had on your asset prices? Donald Trump just handed you QE 5 in the form of his proposed $1 trillion infrastructure budget.

Dumping this amount of cash on the economy will raise GDP growth for the short term, but also invite an earlier return of inflation and higher interest rates.

For years, analysts searched the horizon for causes of the next recession and found none. Now we have an obvious one, a US growth spurt that sparks inflation and leads to another Fed induced series of interest rate spikes. This could be a 3-4 year time horizon.

The bond markets are telling us as much, with ten year Treasury bond yields (TNX) rocketing an eye popping 17 basis points today, smashing through 2.02%.

What this brings us is a higher high in stock prices, followed by another crash a few years down the road. This is simply the boom and bust cycle that has been a hallmark of capitalism since time immemorial.

I?ll start with a clear list of winners and losers from a Trump administration.

WINNERS

Banks

Health Care

Big Oil

US Dollar

Infrastructure

Commodities

Gold

Domestic Businesses

The Wealthy

Russian Ruble

The Midwest Rust Belt States

LOSERS

Alternative Energy

Solar

Gun makers

Bonds

Utilities

REITS

Emerging Markets

Technology

Large Multinationals

The Poor

The Euro and Yen

The Mexican Peso

The Coasts

Here is the interesting thing for stock traders:

The sectors benefiting from the New Order have been in long-term secular bear markets. The losers have been in bull markets and are just coming off of all time highs.

So there are a series of sector rotations going on here which, if you get them right, could deliver out performance for years to come.

Let me spell it out for you. Buy domestic plays like commodities (FCX), infrastructure, construction (CAT), steel (X), banks (BAC), energy (XOM), and health care (XLV).

Sell international plays such as technology (AAPL), semiconductors (QCOM), large multinationals (AMZN), emerging markets (EEM) (EWW), yield plays, utilities, telecommunications (T), REITs (SPG), solar (FSLR), and other alternative energy stocks (SCTY).

I?ll make a few quick comments on each asset class.

Banks will benefit from steeply rising interest rates, the repeal of Dodd-Frank, and the end of the Volker Rule limiting risk taking. So the starting gun has been fired for the next financial crisis years off.

Health care will prosper from the end of Obama Care and the freedom to raise prices at will. Narrow monopolies will persist, and price gouging will grow.

The energy industry will face a double-edged sword. Big oil will love the rollback of environmental regulation.

On the other hand, a trade war with China will slow growth there, the world?s largest new consumer of energy, keeping oil prices lower for longer.

With a big infrastructure spend on the way, commodities, steel, and construction are all obvious plays.

Big tax cuts will favor companies with large domestic businesses and income, but not so much for those with large international trade.

Of course, the big winners are the One Percent, who will see their fabulous tax breaks preserved, if not expanded, especially the golden ?net operating loss carry forward? that Trump has mined so successfully.

Concerning the losers, now that the denial of global warming is official government policy, you can pretty much kiss solar energy goodbye.

The various tax incentives for investment there will soon be a distant memory. Notice that Tesla (TSLA) shares were down $10 today during a massively strong market.

Tougher trade deals and the tearing up of international treaties come at the expense of every emerging stock market.

Bonds are now in a 20-year bear market, but then we already knew that. That?s why I have been selling every rally in the Treasury bond market (TLT) for the past three months.

What?s on the table now is a prolonged move that could take yields up to 6% in coming years.

Adding a turbocharger will be the $10 trillion in new government debt Trump?s combination of tax cuts and spending hikes will bring. Remember, Trump is a "debt guy" big time.

Throw in a new war with Iran, or anyone else, and you can double that figure, taking our total national debt up to $40 trillion. Recall that Trump said on many occasions that ?We?ll bomb the s? out of them.? We?ll find out how real that sentiment is.

Oh, and an abrogation of the Iran nuclear deal gives them an operational weapon within a year. Stick that in your pipe and smoke it. Hope you don?t have any draft age sons.

Gold (GLD) will sniff out the coming inflation sooner rather than later, and resume its new bull trend. Did you notice the $50 knee jerk move last night? That?s what that was all about.

Of course, the US dollar will love all this, as it will become the preeminent high-yielding currency for the next several years. Woe to the Euro (FXE), the Japanese yen (FXY), and the Australian dollar (FXA).

Fortunately, I saw this one coming, and went into the election short the euro, which provided a nice hedge for my equity plays.

Real estate, both residential (LEN) and commercial, will have a spurt in the short term, as buyers rush to beat rising home mortgage rates.

However, we know that this always ends in a bubble and a crash, probably within three years.

It?s that capitalism thing again.

I was looking forward to a quiet and easy retirement in the years ahead. It looks like that is just not in the cards for me.