After the market closes every night, I usually don a 60 pound backpack and climb the 2,000 foot mountain in my back yard.

To pass the time, I listen to audio books on financial and historical topics, about 200 a year (I?ve really got President Grover Cleveland nailed!). That?s if the howling packs of coyotes don?t bother me too much.

I also engage in mental calisthenics, engaging in complex mathematical calculations. How many grains of sand would you have to pile up to reach from the earth to the moon? How many matchsticks to circle the earth?

For last night?s exercise, I decided to quantify the impact of this year?s oil price crash on the global economy.

The world is currently consuming about 92 million barrels a day of Texas tea, or 33.6 billion barrels a year. In May, at the $107.50 high, that much oil cost $3.6 trillion. At today?s $53.60 low you could buy that quantity of oil for a bargain $1.8 trillion.

Buy a barrel of crude, and you get one for free!

This means that $1.8 trillion has suddenly been taken out of the pockets of oil producers, and put into the pockets of oil consumers. Over the medium term, this is fantastic news for oil consumers. But for the short term, things could get very scary.

$1.8 trillion is a lot of money. If you had that amount in hundred dollar bills, it would rise to 180 million inches, 15 million feet, or 2,840 miles, or 1.2% of the way to the moon (another mental exercise).

The global financial system cannot move this amount of money around on short notice without causing some pretty severe disruptions.

For a start, there is suddenly a lot less demand for dollars with which to buy oil. This has triggered short covering rallies in the long beleaguered Japanese Yen (FXY) and the Euro (FXE), which are just now backing off of long downtrends. The fundamentals for these currencies are still dire. But the short term trend now appears to be an upward one.

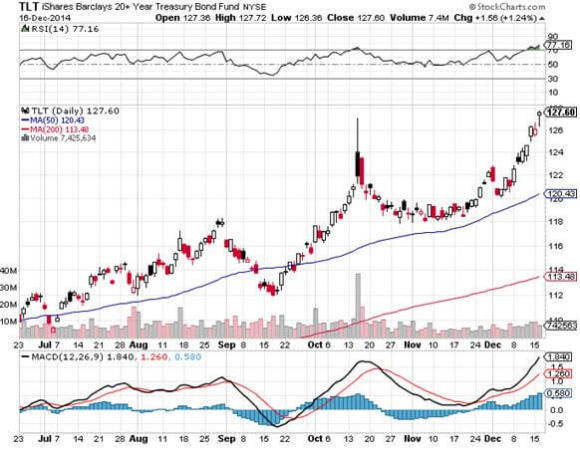

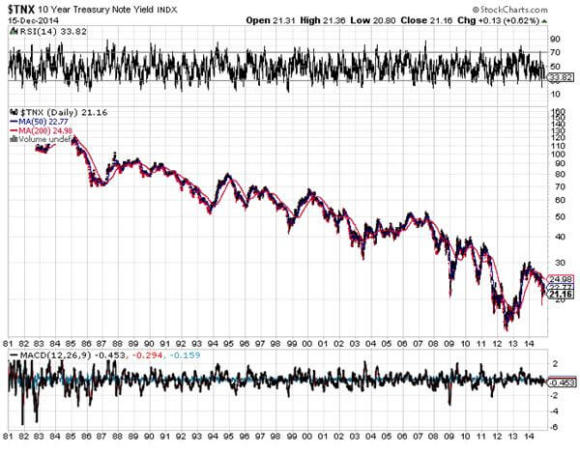

The US Federal Reserve certainly sees the oil crash as an enormously deflationary event. The use of energy is so widespread that it feeds into the cost of everything. That firmly takes the chance of any interest rate rise off the table for 2015. The Treasury bond market (TLT) has figured this out and launched on a monster rally.

Traders are also afraid that the disinflationary disease will spread, so they have been taking down the price of virtually all other hard commodities as well, like coal (KOL), iron ore (BHP), and copper (CU). For more depth on this, see yesterday?s piece on ?The End of the Commodity Super Cycle?.

The precipitous fall in energy investments everywhere will be felt principally in the 15 US states involved in energy production (Texas, Oklahoma, Louisiana, and North Dakota, etc.). So, the consumers in the other 35 states should be thrilled.

However, the plunge in energy stocks is getting so severe, that it is dragging down everything else with it. ALL shares are effectively oil shares right now. In fact, all asset classes are now moving tic for tic with the price of oil.

Throw on top of that the systemic risk presented by the ongoing collapse of the Russian economy. The Ruble has now fallen a staggering 70% in six months, and there is panic buying of everything going on in Moscow stores. The means that the dollar denominated debt owed by local firms has just risen by 70%. Any foreign banks holding this debt are now probably regretting ever watching the film, Dr. Zhivago.

Russian interest rates were just skyrocketed from 10.50% to 17%. The Russian stock market (RSX) is the world?s worst performing bourse this year. How do you spell ?depression? in the Cyrillic alphabet?

And guess what the new Russian currency is?

IPhone 6.0?s, of which Apple is now totally sold out in Alexander Putin?s domain!

Thankfully, this is more of a European than an American problem. But nobody likes systemic risks, especially going into illiquid yearend trading conditions. It?s a classic case of being careful what you wish for.

Of the $1.8 trillion today, about $430 billion is shifting between American pockets. That amounts to a hefty 2.5% of GDP.

Money spent on oil is burned. However, money spent by newly enriched consumers has a multiplier effect. Spend a dollar at Wal-Mart, and the company has to hire more workers, who then have more money to spend, and so on. So a shifting of funds of this magnitude will probably add 1% to U.S. economic growth next year.

Unfortunately, we will lose a piece of this from the obvious slowdown in housing. Deflation means that home prices will stagnate, or even fall. This is a major portion of the US economy which, for the most part, has been missing in action for most of this recovery.

Ultimately, cheap energy as far as the eye can see is a key element of my ?Golden Age? scenario for the 2020?s (click here for ?Get Ready for the Coming Golden Age? ).

But you may have to get there by riding a roller coaster first.