Global Market Comments

October 30, 2014

Fiat Lux

Featured Trade:

(FAREWELL TO QUANTITATIVE EASING),

(SPY), (TLT), (TBT), (FXE), (EUO), (FXY), (YCS),

(LNG), (BIDU), (TSLA),

(BAC), (MS), (GS), (AXP),

(AN EVENING WITH JAMES BAKER III),

(CONNECTING UP AMERICA)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

Cheniere Energy, Inc. (LNG)

Baidu, Inc. (BIDU)

Tesla Motors, Inc. (TSLA)

Bank of America Corporation (BAC)

Morgan Stanley (MS)

The Goldman Sachs Group, Inc. (GS)

American Express Company (AXP)

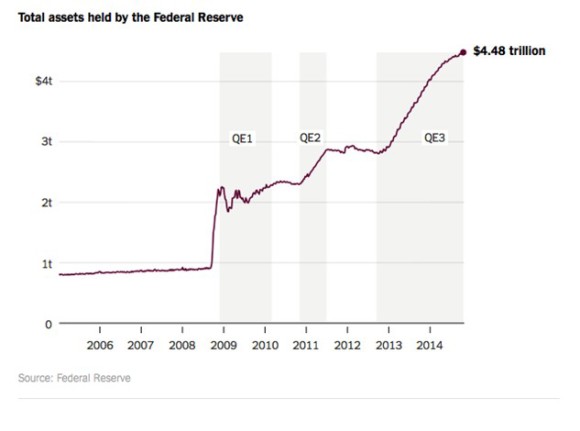

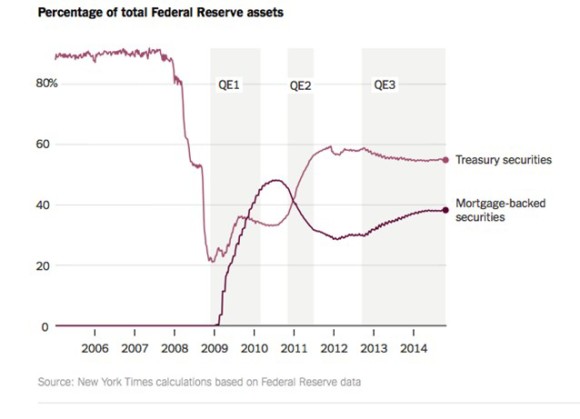

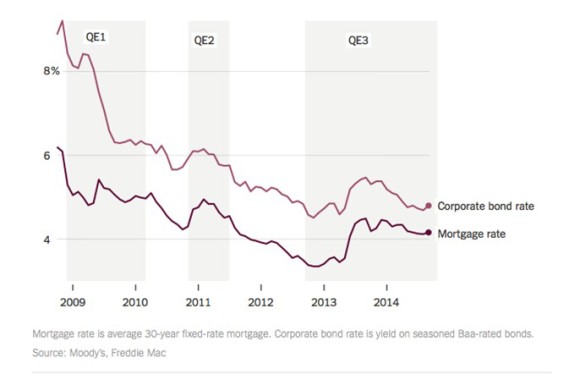

Finally, at long last, after infinite amounts of speculation and false starts, the Federal Reserve has decided to end quantitative easing.

After five years of soaking up both public and private debt in the marketplace, some $4.5 trillion worth, America?s central bank will quit picking up paper sometime next month. The printing presses are getting turned off and put into cold storage, job well done.

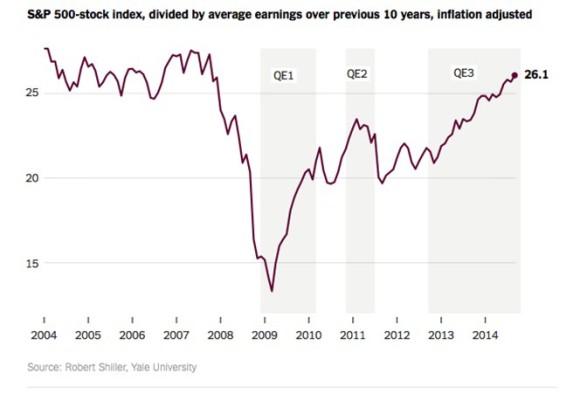

Boy, that was one hell of a monetary stimulus program, the likes of which has not been seen since the Great Depression. So much money flooded into the economy that homes values doubled on the bottom, stock indexes tripled, enriching quite a few traders along the way, including many followers of the Mad Hedge Fund Trader.

Who ended up making most of the money? Risk takers, equity owners, and the 1%. Everyone else was left in the dust, still waiting for the economic recovery to begin.

Since the controversial program was dreamed up and implemented by the former Fed governor, Ben Bernanke, five years ago, some $12 trillion was added to the value of equities alone. Some of my picks, like Cheniere Energy (LNG), Baidu (BIDU), ad Tesla (TSLA) soared by nearly 20 times.

Conservatives hated QE, fearing that such easy money would lead to hyperinflation and the collapse of the US dollar. The only problem is that the Consumer Price Index didn?t get the memo, with deflation now the country?s greatest economic threat. As I write this, the greenback is tickling new multiyear highs.

What QE did do was pull the US away from the brink of complete economic collapse. As far as the Fed is concerned, mission accomplished.

The other message that emanated from the Fed today is that it may raise interest rates sooner than expected. That trashed the bond market, taking Treasury bond yields to 2.35%, off an amazing 40 basis points from the low only two weeks ago.

There are some important points to take here for our trading strategy going forward.

First of all, the final top in bonds is looking more convincing by the day.

Second, the top in bonds, and slightly hawkish tone taken by the Fed today are extremely positive for the banks. I have already loaded up followers with Bank of America (BAC), which just pierced $17 on the upside and appears poised to claim new highs for the year.

I am inclined to add to this position on dips, and expand to my exposure to other names. On the menu are Morgan Stanley (MS), Golden Sachs (GS), JP Morgan (JPM), Wells Fargo (WFC), and American Express (AXP).

The dollar rocketed. Those who followed my recent Trade Alerts to aggressively sell short the Euro (FXE), (EUO) and the yen (FXY), (YCS) were sent laughing all the way to the bank.

I spoke to my colleague after the close today, ace Mad Day Trader, Jim Parker. We concluded that if the market doesn?t show any weakness Thursday morning, we could continue a straight line run up into the month end book closing on Friday, and then on to new all time highs.

I know it?s not gentlemanly to say ?I told you so,? but I told you so.

If you are bemoaning the loss of quantitative easing, don?t worry, it may not be gone for long.

When the economy goes into the tank in two or three years, it may well return from the dead in all its glory, especially if the inflation rate peaks in this cycle at an Appalachian 2.5% and then heads for negative numbers.

Will Quantitative Easing Return From the Dead?

Will Quantitative Easing Return From the Dead?

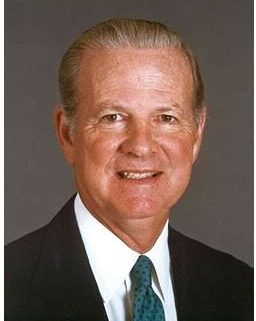

?We have 3,500 nuclear weapons left over from the cold war we don?t need, they take 20 seconds to re-aim, we?re not afraid to use them. And by the way, they?re already aimed at you.? That is the approach James Baker III thinks America should take with Iran, Ronald Reagan?s Chief of Staff and Secretary of the Treasury and George H.W. Bush?s Secretary of State.

At the same time we should be talking to the regime in Tehran, while doing everything we can to support the reformers, tighten sanctions, and enlist Europe?s help. Baker does not see a military solution in Iran, even though their potential to create instability in the region is enormous. This was one of dozens of amazing insights I gained chatting with the wily Texas lawyer during an evening in San Francisco.

Baker is happy to take on the ?America Bashers?, pointing out that the US still plays a dominant role in the UN, NATO, the IMF, and the World Bank. It accounts for 25% of global GDP, and its military is unmatched. The US spread globalization, and the spectacular growth of China and India is largely the result of open American trade policies, raising standards of living globally.

But the US can?t take its leadership role for granted. The biggest threats to American dominance are the runaway borrowing and entitlements. US debt to GDP will soar to over 100% in the near future, the highest level since WWII. This is unsustainable, is certain to bring a return of inflation, and unless dealt with, will lead to a long term American decline on the world stage.

Massive trade and capital flow imbalances also have to be addressed. The 84-year-old ex-Marine, who confesses to being the only Treasury Secretary in history who never took an economics class, believes that the advantageous rates that the government now borrows at are not set in stone.

Baker is the man who engineered an end to the cold war with a whimper, and not a bang. He thinks that ?even our power has its limits,? and that there is a risk of strategic overreach.? With the US politically evenly divided, Congress has degenerated from debating teams into execution squads, and consensus is impossible. The media are partly to blame, especially bloggers who propagate wild conspiracy theories, as confrontation sells better than accommodation.

Regarding the financial crisis, we need to end ?too big to fail? and embark on re-regulation, not strangulation. All in all, it was a fascinating few hours spent with a piece of living history who still maintains his excellent contacts in the diplomatic and intelligence communities.

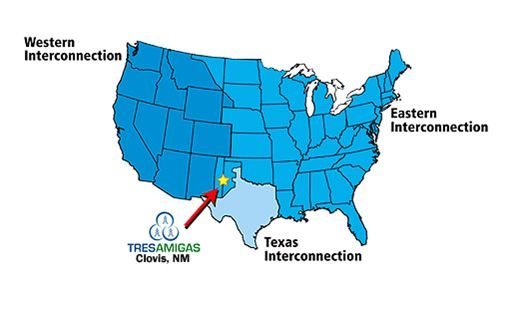

Until now, the country?s power grid has been divided into three unconnected, noncompetitive kingdoms (in the spirit of Game of Thrones), making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from periodic brown outs and sky-high prices, electricity was given away virtually for free in Texas.

A group of power companies is now building the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. Construction is expected to reach completion in 2014.

The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms in the Lone Star State to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada. With the Department of Energy having already sent tidal waves of government cash towards the sector, the timing couldn?t be better.

Global Market Comments

October 29, 2014

Fiat Lux

Featured Trade:

(WHY WARREN BUFFETT HATES GOLD),

(GLD), (ABX),

(DINNER WITH ELIOT SPITZER)

(GRAPES OF WRATH REDUX),

(TESTIMONIAL)

SPDR Gold Shares (GLD)

Barrick Gold Corporation (ABX)

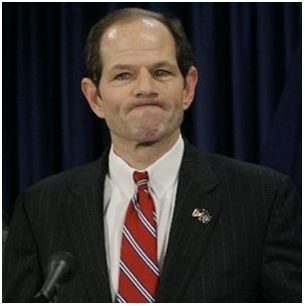

I couldn?t for the life of me figure out why New York?s former governor and federal prosecutor, Eliot Spitzer, wanted to invite me to dinner. He wasn?t flogging a book or promoting a movie, and he certainly wasn?t running for office again. But I went anyway, thinking perhaps the notorious ?Client No.9? might let me peek at his famous black book.

Eliot, who showed up wearing a classic New York blue pin stripped suit that seems oddly out of place in San Francisco, is currently running his family?s commercial real estate business.

He told me that the advantages that the US enjoyed over the rest of the world in 1945, such as a monopoly in skilled labor, are now long gone. The driver of the world economy has switched from America to Asia in the nineties.

As a result, income distribution here has morphed from a bell shaped curve to a barbell, with both the wealthy and the poor increasing in numbers, squeezing the middle class. The financial crisis compressed 30 years of change into two, taking us from libertarian Ayn Rand to pay Czar Ken Feinberg in one giant leap.

Having cut his teeth prosecuting the Gambino crime family in the eighties, Eliot had some views on the need for more regulation. We only need to enforce the laws on the books, not pass new ones. The ?white collarization? of organized crime has been a secular trend since the sixties.

He said the ethical lapses in the run up to the crash were best characterized by a quote from Merrill Lynch?s Jack Robins; ?What used to be a conflict of interest is now a synergy.?

AIG getting 100 cents on the dollar from the federal government was the greatest scam in history. The US did not extract a high enough price from top paid executives and shareholders of financial institutions for failure, and should have let more firms go under.

As for his own scandal, Eliot admitted that he failed, that his flaws were made publicly apparent, and that other politicians should be smarter than he was.

Although Eliot had some good ideas, I was still puzzled over what this was all about as I ploughed through my cr?me brulee. Perhaps the governor has a pathological need to be in front of the spotlight, even at the risk of flaming out.

And no luck with the black book.

Global Market Comments

October 28, 2014

Fiat Lux

Featured Trade:

(GOLDILOCKS IS BACK!), (SPY), ($INDU),

(CHINA?S VIEW OF CHINA),

(FXI), (EEM)

SPDR S&P 500 ETF (SPY)

Dow Jones Industrial Average ($INDU)

iShares China Large-Cap (FXI)

iShares MSCI Emerging Markets (EEM)

Her red Tesla is parked in the driveway, her potted plants are back on the balcony, and the closet is once again filled with designer shoes.

Goldilocks is back!

It?s not like she was ever going to be gone for long. Once a woman of a certain maturity gets accustomed to the lifestyle of the rich and famous, it?s hard to give up the better things in life.

However, there were some doubts.

When the Dow Average opened down 400 points on October 15, a gigantic capitulation move saw $70 billion worth of stock sold at market at the absolute low of 15,850, and a spectacular 315 million shares of the S&P 500 ETF (SPY) were unloaded.

One might have thought that Goldilocks had changed her name and moved into a nunnery for good.

It was not to be.

The rally that ensued off of that print was one of the most ferocious in history. After having cleaned out hedge fund trader longs on the downside, the market then ripped their faces off on the upside.

It has not been a good year for hedge funds. It has been a fantastic year for high frequency traders, with September the most profitable month in the history of this arcane, computer trading strategy.

As for me, I never had any doubt that Goldilocks was coming back. As I miraculously pound into my followers on a daily basis, it?s all about the numbers. It?s always about the numbers.

The strength of the economy is such that the sudden 10% swoon we witnessed was in no way justified. All that was really required was that an extreme overbought condition in stocks we say six weeks ago be remedied. Now that is done, it is up, up, and away.

Corporate earnings obliged, with an eye-popping 80% delivering upside surprises. Corporate earnings are now growing at a robust year on year 11% annual rate.

Instead of focusing in on Ebola, Russia and ISIS, traders are now looking at improving Purchasing Managers Indexes in both Europe and China. The Middle East has gone quiet. There were even rumors, later quashed, of an extended quantitative easing for the US.

The European Central Bank announced the results of its bank stress test, and guess what? Almost everyone passed! Only 12 banks need to raise $12 billion in new capital.

Of course, this was never more than a window dressing exercise designed to make us all feel warm and fuzzy about the beleaguered continent.

It worked!

Capital spending also remains robust for the first time in eight years. But I think most analysts are missing the reason why this is happening. It is too late for companies to add capacity for this economic cycle.

They are instead building factories now to accommodate demand for the next economic and financial boom in the early 2020?s, when the stiff demographic headwind created by the baby boomers flips to a brisk tailwind provided by the Gen Xer?s.

The true 800-pound gorilla on the trading landscape these days is the price of oil, which broke the $80 handle yesterday morning. As with every move by every financial instrument everywhere, the more it goes down, the more dire the forecasts become. The savings in energy costs at this level amount to $12,000 per family per year. Do the math.

$10 a barrel? Really?

I think it is safe to say, like interest rates, energy prices will stay lower for longer than anyone imagines possible. So add another 1% to US GDP growth this year, next year and the one after that.

When the stock market figures this out, new highs will follow, probably before year end.

Has Goldilocks Moved Back in For Good?

Has Goldilocks Moved Back in For Good?

Global Market Comments

October 27, 2014

Fiat Lux

Featured Trade:

(THE TRUTH ABOUT EBOLA), (SPY),

(AMERICA?S DEMOGRAPHIC TIME BOMB),

(TESTIMONIAL)

SPDR S&P 500 ETF (SPY)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.