This trade was an unmitigated disaster, and hopefully it will be the worst of the year. I?m glad we had one of these because it provides a wonderful opportunity to illustrate everything that can go on with a trade. Every loss is a learning opportunity, and a loss not learned from is an opportunity wasted, and dooms one to repetition. Let me count the ways:

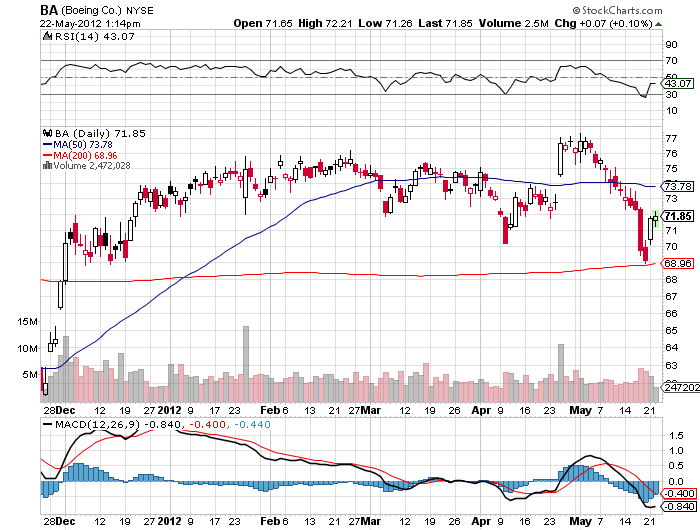

1) I was too aggressive on the strike. I should have matched my long August $70 strike with a short May $70 strike instead of reaching for the extra income by selling the $72.50?s. I got away with this on the (PHM) trade. Not so on (BA).

2) I shouldn?t have leveraged up with a 1:2 ratio. Those who did straight 1:1 spreads did much better and slept well at night. They saw only a slight opportunity cost as some losses were offset by profits in the August $70 puts as intended.

3) I was not aware that individual investors were so harshly treated by margin clerks. Hedge funds only get charged margin on the delta plus some small maintenance, which they then continuously rehedge. Most retail investors were prevented from doing this trade by broker policies banning naked put selling.

4) The Morgan Stanley guy who decided to price the Facebook (FB) issue on an options expiration day has to have a hole in his head. That only succeeded in increasing market volatility. I?m sure that when they made the call, they thought this would make (FB) go up faster. Instead, the reverse happened. On Friday, everyone?s portfolio effectively turned into a long Facebook position, tracking (FB) tick for tick. This did not end well.

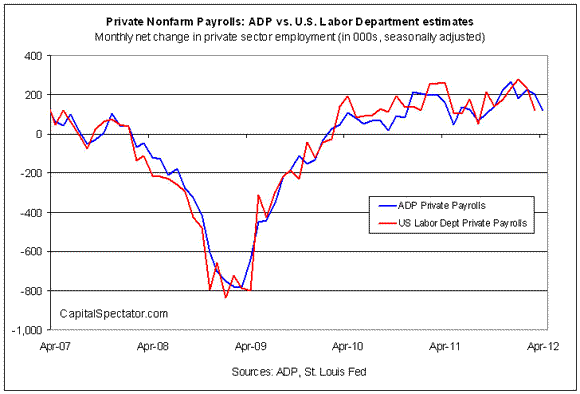

5) This was a really unlucky trade. Although the global macro situation is pretty much unfolding as I expected, I didn?t think the rot would spread so fast once it set in. Even a one-day short covering rally on Friday would have turned this trade profitable. Thank Greece for that. Facebook too. It took one of the longest continuous market moves down, 12 out of 13 days, for this trade to lose money.

6) The only consolation is that those who had puts exercised against them and saw stock delivered into their accounts Monday morning at a cost of $72.50 were granted a huge short covering rally to sell into, with (BA) rising $2.85 back up to $72. This enabled shareholders to recover 85% of their losses on the position.

Taking in the entire May short option expiration play, and it is clear that this didn?t work. Add up all the P&L?s and this is what the damage came to:

(FXE) $127 puts? +$950

(FXE) $132 calls? +$950

(FXY) $121 puts? +$1,500

(PHM) $8 puts? +$980

(IWM) $77 Puts? -$5,544

(BA) $72.50 puts -$8,708

Total?? -$9,872, or ?9.87% for the notional $100,000 model portfolio.

Of course, this loss was more than offset by the enormous profits that we took in on our long put positions in the recent market meltdown. Since I initiated the short put strategy on May 3, the long put positions added a welcome 30% to the value of the portfolio.

We did get the protection against a sideways market that had been killing my performance in April. So it did perform its insurance function as intended. As I often remind readers, when you buy fire insurance, you don?t complain to the company when your house doesn?t burn down.

The way this strategy usually works is that you make money like clockwork all year, then one bad month wipes out two thirds of your total profits. That means repeating this play will probably work for the rest of 2012.

This also illustrates how the neophytes who attempt this strategy with tenfold leverage regularly get wiped out. What looks like easy money on the outside quickly becomes toxic waste on your position sheet. The rich uncle morphs into a serial killer overnight. When I look at those miracle 100% a year track record regularly touted on the Internet, this is usually what I find.

These calculations assume that you sold your (BA) at the close on Friday, which was a new low for the year. The net loss on the short (BA) May $72.50 puts comes to ($72.50 - $69.15 + $0.24 = $3.11). This subtracts (100 X 28 X -$3.11) = -$8,708, or -8.70% for the notional $100,000 model portfolio.

Oops

?

? ?

? ?

? ?

?