While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 27, 2018

Fiat Lux

Featured Trade:

(HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING),

(GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY),

(PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY),

(KODK), (SLV), (AAPL),

(TUESDAY, OCTOBER 16, 2018, MIAMI, FL,

GLOBAL STRATEGY LUNCHEON)

Mad Hedge Technology Letter

September 27, 2018

Fiat Lux

Featured Trade:

(THE RATS ARE LEAVING THE SINKING SHIP AT FACEBOOK)

(FB)

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy luncheon, which I will be conducting in Miami, Florida, on Tuesday, October 16, 2018.

A three-course lunch will be followed by an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

And to keep you in suspense, I’ll be tossing a few surprises out there, too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

I’ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a restaurant at a major downtown hotel.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, click here.

It could end up all in tears for Facebook (FB).

This was the key takeaway from shocking news that Instagram’s CEO Kevin Systrom and CTO Mike Krieger quit on the spot.

The ideal word to describe this new development is devastation.

Ultimately, this could pave the way for Facebook to screw up Instagram.

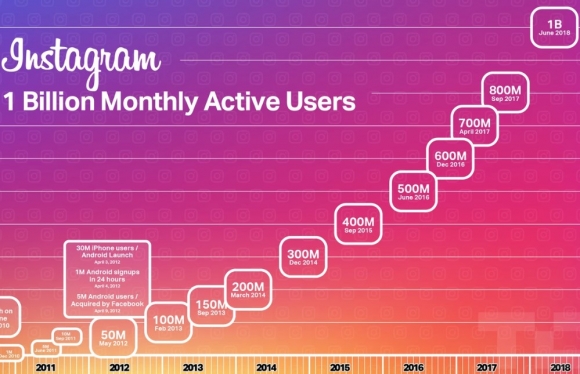

Instagram was the crown jewel in Facebook’s portfolio and recently topped the 1 billion monthly active user (MAU) mark.

Leonardo da Vinci once famously said, "Poor is the pupil who does not surpass his master.”

When founder Systrom sold his company to Facebook for $1 billion in 2012, Instagram had 50 million monthly active users.

Preconditioned in the contract, Systrom was promised a high degree of autonomy that would allow him to grow Instagram as he saw fit.

The relationship was harmonious until 2018 when the pupil surpassed his master in innovation.

Instagram’s growth trajectory has been the envy of Facebook for some time, but that could be explained by the law of numbers and Instagram starting from a small base of users.

Peel back the skin and the situation has been festering for some time.

It came to light that Mark Zuckerberg issued a “throttling back” promotion and marketing for Instagram that peeved Systrom.

This crushed the referral numbers on Instagram, and it almost appeared that Zuckerberg wanted to deliberately bottleneck the growth of Instagram.

On the product engineering side, complication started to mount.

In the past, an Instagram photo uploaded onto Facebook was labeled with an Instagram insignia clearly showing the photo source came from Systrom’s company.

Zuckerberg tweaked this detail and removed the Instagram logo, making it seem that the content originated from Facebook.

Facebook started taking credit for Instagram’s content, and that sent Systrom bouncing off the walls inside his own company that was promised autonomy.

Even though this disagreement seems irrelevant, it showed the intent of Facebook going forward.

This was the beginning of the meddling behind the scenes, and the founder of Instagram aborted ship while he could.

Facebook stealing content and innovation from Instagram damaged Instagram’s team spirit as well.

It came to the point where Systrom saw no way out. After an extended paternity leave that gave him some free time to refresh his vision, he thought the only choice that Zuckerberg left him was to throw in the towel.

I have said numerous times that for Facebook to move on, Zuckerberg must relinquish his role as CEO.

Any CEO in the world operating at the performance level of Zuckerberg would have been sacked long ago.

Zuckerberg is an anomaly because of his stranglehold on voter’s rights excludes him from ever firing himself.

Facebook COO Sheryl Sandberg is quoted as saying “people are fired at Facebook on a regular basis for not doing their jobs.”

People are fired at Facebook but not Zuckerberg.

Anytime the sushi hits the fan at Facebook, Zuckerberg conveniently fires others involved and washes his hands of the mess.

Granted, Instagram’s success was aided by Zuckerberg’s resources and Facebook’s embedded base, but this debacle is laid squarely on the Zuck’s shoulders.

Systrom and Krieger did not give a specific reason for the abrupt departure, which usually means they left unsatisfied.

Since they are the bosses of their own creation, the only factor could be personal or Facebook – easy to guess this one.

Instagram is starting to cannibalize its parent company - a major headwind for this company and stock.

Users are quitting Facebook in droves, and Zuckerberg’s only answer is to become Instagram, which Facebook already owns.

That is why the theft of credit due and engagement began in the first place.

The only bonkers move that could happen next is if Zuckerberg installs himself as the new CEO of Instagram.

Shareholders were biting their nails when they heard this news.

You would think Facebook would do everything they possibly could to entice Systrom and Krieger to stay.

They are the best thing going for Facebook right now.

In allowing this to happen, Facebook creates a massive leadership vacuum at the top of Instagram.

Whispers from Silicon Valley have one of Zuckerberg’s close friends taking over at Instagram, which would be a monumental error.

The outsized risk is if Instagram starts morphing into another Facebook, and engagement sours and usership drops like dead flies.

Facebook has demonstrated its misunderstandings of operating in a climate of big data concerns.

I have also documented how the digital ad industry will have a day of reckoning that is on the horizon, albeit not anytime soon.

Instagram’s CEO certainly closely observed how WhatsApp founders Jan Koum and Brian Acton ditched their brainchild after Zuckerberg rammed down their throats that he would accept the adoption of digital ads.

Former CEO Acton was in the news again, too. He harshly criticized the way Facebook operates, specifically slaughtering Sandberg’s greedy persona and unethical stance toward data privacy models.

In the same interview, he claims he was coached up to mislead European regulators and explain that combining these two data troves, Facebook and WhatsApp, would be near impossible when in reality it was not.

The European Commission fined Facebook $122 million two years later for false information in the original filing, and Facebook maintains these mistakes were unintentional.

If Facebook wants to use its business to practice crony capitalism and push the border of the truth, then it will catch up to them.

Zuckerberg’s imposing his will for the interests of himself and his best friends has been a growing trend at Facebook. As next quarter’s earnings season approaches, Facebook’s stock could get hit hard.

As momentum stagnates, shareholders are concerned that Zuckerberg is forcing out his best and brightest talents.

These decisions smell of desperation to control the company he created. And as fresh leaks about the mismanagement come to light, investors must stay away from Facebook.

Mismanagement at this company did not happen in one day.

Let’s trace back the performance of chief operating officer Sheryl Sandberg a few years ago or her lack of it.

The executive was busy on her book tour around America that took her to many cities promoting her book “Lean In.”

She also wrote another book on top of that.

She even had time to promote her books on daytime talk show Oprah.

At the same time, Zuckerberg was in the middle of completing his personal goal of visiting the 30 states he had never set foot in before.

His “personal challenges” brought him in touch with real Americans, which is almost absurd, since it almost sounds as if he had grown up in Bangladesh, barely spoke a word of English, and is not American, which he is.

Another “personal challenge” of Zuckerberg was learning Mandarin Chinese and running through the smog of Beijing while being pictured in front of the Forbidden City.

When did Zuckerberg and Sandberg have time to run Facebook?

While the executive management was out of the office, the seeds of chaos were sown that all came to light after Sandberg and Zuckerberg were back.

The engineering team had excavated Russian state-sponsored hacking on the platform.

But since the entire 127-member security team worked under the tutelage of Sandberg, the engineering team’s discoveries remained unacted on.

Facebook engineers had also unearthed fake news operations located in Macedonia running riot on its website.

Since most security flaws originate from the engineer side in the form of fake news and manipulation, it’s hard to fathom how there were no channels of communication between the security team and the engineering side.

Sources inside of Facebook note that Sandberg’s business side of Facebook, and Zuckerberg’s engineering side almost mimic “two separate businesses that share the same campus.”

Exposing the manner in which Facebook is run makes it simple to diagnose the extent of major problems cropping up.

Effectively, Facebook grew so fast the past few years that it invited any type of growth – good, bad, and the ugly.

And it did nothing to root out the nefarious actors ruining the platform.

Now comes the hard part of cleaning up the bad and the ugly while segmenting out the good, and persuading the healthy users not to quit.

This will be expensive, time consuming, and awful for the future stock price.

The spillover effects are far from over.

Instagram’s founder and CEO Kevin Systrom quitting isn’t the disease – it’s a side effect.

The disease still hasn’t been cured and remains in the system.

Avoid Facebook shares as the FANGs have decoupled from this digital ad legacy firm.

The days of stellar growth are in the rearview mirror, and the stock won’t experience the parabolic price action it saw in the past.

Facebook needs major internal surgery in its management ranks. Until then, it’s a dysfunctional titanic unsure of when the next iceberg will hit.

Expect surprises, but surprises to the downside.

Kevin Systrom Says Goodbye on His Instagram Profile

“Someone once described entrepreneurship to me as a series of happy accidents,” said founder and former CEO of Instagram Kevin Systrom.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

September 26, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Fed to Raise Interest Rates at 2:00 PM EST, and all is on hold until then. Technology is up (XLK); volatility is down (VIX). Click here.

2) Interest Payments to Become the Largest Government Expense Within a Decade, at $900 billion far outpacing the defense budget by 2028. Exploding deficits are already taking a toll, with the 30-year fixed home mortgage hitting a seven-year high at 4.95%. And you wonder why bonds (TLT) were falling? Click here.

3) Survey Monkey Goes Public, and it looks to be a hot issue. Why didn’t your broker get you in on this one? Maybe it’s time to take HIM out for a round of golf? Click here.

4) August Home Sales are Up 3.5%, after many months of declines. High interest rates and affordability are really starting to drag on this market. Click here.

5) Comcast Buys Sky TV, for $40 billion after a battle of the century. Apparently, more people watch soccer than we thought. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

SPECIAL CAR ISSUE:

(SAY GOODBYE TO THAT GAS GUZZLER),

(GM), (F), (TSLA), (GOOGL), (AAPL),

(DID SIRIUS OPEN UP PANDORA'S BOX?),

(SPOT), (P), (SIRI), (AAPL), (AMZN)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 26, 2018

Fiat Lux

SPECIAL CAR ISSUE

Featured Trade:

(SAY GOODBYE TO THAT GAS GUZZLER),

(GM), (F), (TSLA), (GOOGL), (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.