Global Market Comments

September 20, 2018

Fiat Lux

SPECIAL VOLATILITY ISSUE

Featured Trade:

(SHOPPING FOR FIRE INSURANCE IN A HURRICANE),

(VIX), (VXX), (XIV),

(THE ABC’s OF THE VIX),

(VIX), (VXX), (SVXY)

Global Market Comments

September 20, 2018

Fiat Lux

SPECIAL VOLATILITY ISSUE

Featured Trade:

(SHOPPING FOR FIRE INSURANCE IN A HURRICANE),

(VIX), (VXX), (XIV),

(THE ABC’s OF THE VIX),

(VIX), (VXX), (SVXY)

Mad Hedge Technology Letter

September 20, 2018

Fiat Lux

Featured Trade:

(THE BULL CASE FOR NETFLIX),

(NFLX), (AAPL), (GOOGL), (FB)

Last quarter’s earnings report sent Netflix shares nosediving to the depths of the ocean floor, and the wreckage saw Netflix’s stock down 24% in 5 weeks.

The short-term weakness in shares was justified after Netflix miscalculated on their quarterly subscriber numbers.

Netflix is still a buy because the wreckage can be salvaged.

In fact, it was never a wreckage to begin with because Netflix boasts the highest grade online streaming product in the industry.

An industry that is benefitting from massive secular tailwinds at its back, from cord cutters and the widespread pivot to mobile platforms.

Netflix has the best product on the market because they have the best strategy – throw $8 billion on content alone and hire the best production team money can buy to churn out content.

The method to their madness has worked and the haul of 23 Emmy’s was a result of this winning formula.

The 23 Emmy’s tied HBO, whose premier series Game of Thrones is still captivating audiences with its mix of graphic sexual exploits and violent tropes.

Several of Netflix’s award winners saluted Netflix’s hands-off approach, who allow these highly paid production specialists the creative freedom to inspire audiences.

For all of Hollywood’s razzmatazz, director’s and actor’s number one major gripe has been that the leash is tight with minimal wiggle room.

It’s not straightforward to change a culture that has developed over a century.

Cross-pollinating Silicon Valley’s lean business model with Hollywood top-grade content was the trick that removed the shackles from the director’s ankles.

The end-product has been the main beneficiary.

Scoping out Netflix’s end of year lineup has viewers drooling.

The tail end of the year sees Netflix reintroduce some hard-hitting content from Orange Is The New Black, Ozark, Daredevil, Narcos, and Making a Murderer, side by side with fresh content involving Simpsons creator Matt Groening and blockbuster names like Jonah Hill and Emma Stone.

As well as shelling out $8 billion for original content, Netflix upped its marketing budget from $1.28 billion to $2 billion in 2018.

The $2 billion budget is a classy touch but at this point, this product more or less sells itself.

The brand awareness is that far-reaching.

The platform is optimized by tweaking Netflix’s proprietary recommendation algorithm herding the audience into viewing more content that the algorithm deems likely viewable.

The man who is in charge of this is Greg Peters - Netflix chief product officer.

Kelly Bennett, Netflix chief marketing officer, will work with Peters to wield the massive $2 billion marketing budget in the most effective way possible.

To insulate the company from any potential Facebook-like data slipups, Netflix poached Rachel Whetstone from Facebook to head up the public relations division.

Who said there were no winners from Facebook’s PR disaster?

Whetstone’s professional year of hell offers valuable insight into how not to pull another Facebook (FB) stinker.

She previously worked for Google and Uber and is a veteran PR spinner.

Earlier this year CEO Reed Hastings detailed the possibility of using ads in Netflix’s ad-less platform by saying this about why Netflix has no ads:

“It is a core differentiator and again we're having great success on the commercial-free path. That's what our brand is about. So we're going to continue to expand the relevance of a commercial free service around the world and make that so popular that consumers are very used to it and appreciate Netflix.”

The relevancy of his statement is more meaningful now after a recently released report confirming that Netflix is testing the usage of ads to promote its content.

This would be a huge shift in the company’s ethos, and if the algorithms give Hastings the green light, this could alienate a big chunk of their subscriber base.

In a survey conducted about the implementation of ads, 23% said they would quit the service if ads are rolled out onto Netflix’s platform.

Only 41% said they would “definitely” or “probably” keep Netflix if ads are introduced.

In the same survey, if Netflix lowers the monthly cost by $3 while integrating ads, the cancellation rate falls from 23% to 16%, and half said they would keep Netflix.

The most important number of the survey was that only 8% would cancel if they increased monthly prices by $2, but if it went up by $5, 23% would say goodbye to the streaming service.

All signs point to an incremental price increase in the near future, partly helping to offset the mind-boggling amount of content spend this year.

Netflix subscribers are still willing to absorb price increases which is a great sign for future profitability.

But it is also worth mentioning that Netflix is a profitable company now, and margins have been slowly creeping up for the past few years.

The tests demonstrate that Hastings is serious about profitability at a time when the premier profit machines in tech are Apple (AAPL) and Alphabet (GOOGL).

These two behemoths blaze the trail for the tech sector and offer important lessons on the potential future profitability of Netflix.

It will take time for Netflix to reach that level of profitability, but the pillars are in place to ramp up the monetization drive.

The treasure trove of data will surely help decision making for the management, but to make their platform more like Facebook (FB) would be a huge error of epic proportions.

It’s proven that digital ads are annoying like a swath of mosquitoes trapped in your bedroom at 2am.

To dilute the quality of their product would fly in the face of what the company represents.

So how on earth will Netflix’s shares go from the mid-$300’s and reach the glorious heights of $400-plus and stay there?

One word – India.

It’s no secret that Netflix has been charging hard to rev up international business.

India is the trump card.

India boasts around 78 million middle class dwellers who can afford Netflix’s service.

In the next two years, it’s feasible that 10% of this socioeconomic class could be tuning into Netflix.

That foothold into India could mushroom, and potentially expand with an audience whose DNA is comprised of a strong film culture.

As broad-brand broadband expansion and smartphone penetration heating up in India, Netflix’s timely arrival could make Netflix look genius.

Their arrival coincides with a slew of American tech companies looking to tap revenue out of the largest democracy in Asia.

The unrealized potential cannot be ignored.

Netflix has primed their strategy by focusing on locally-produced content that will resonate with the Indian viewer.

Netflix’s India strategy started red hot with crime thriller Sacred Games imbued with a level of unfiltered, real filmmaking unseen in India.

The dark crime drama is already facing a legal battle concerning its lusty, foul-mouthed content that presses on the outer limits of what modern Indian society can handle.

The stereotype breaking series directed by Vikramaditya Motwane and Anurag Kashyap is Netflix’s first Indian feather in their cap as Netflix looks to accelerate the momentum.

Netflix has not produced back to back quarters where they failed to meet subscriber growth forecasts since 2012.

I firmly believe Netflix will continue this successful streak and beat subscriber estimates in the third quarter.

Initial indications show that Indians have gravitated towards Netflix’s original content, and with the 2018 Russian World Cup in the history books, the path has opened up for some nice surprises to the upside.

________________________________________________________________________________________________

Quote of the Day

"Health care and education, in my view, are next up for fundamental software-based transformation." – Said Silicon Valley Venture Capitalist Marc Andreessen

Mad Hedge Hot Tips

The Five Most Important Things That Happened Today

(and what to do about them)

September 19, 2018

Fiat Lux

1) Meet the Mad Hedge Fund Trader in Miami on October 16. Touch him, shake his hand, and see if he is real. Join John Thomas for a global all asset class review and get a great lunch as well by clicking here.

2) UPS to Hire 100,000 for Christmas deliveries. They are expecting one heck of a holiday season. Should you too? Click here.

3) New China Trade Tariffs Trigger Monster Stock Rally. So, cutting off only two of your fingers instead of 2 ½ is good news? What a strange world we live in! The resulting $20 billion in new taxes are coming out of YOUR pocket! Click here.

4) But They Also Trigger Massive Chinese Selling of US Treasury Bonds (TLT), taking the market down a gut punching two points. Suddenly, the Chinese have gone off all things American. I wonder why? Click here.

5) What is the Worst Performing Major Stock This Year? It is China’s Tencent Holdings (TCTZF), down a heart throbbing 27%, which has been slapped around by Chinese government regulation and a trade war with the US. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE QUANTUM COMPUTER IN YOUR FUTURE),

(AMZN), (GOOG),

(WEDNESDAY OCTOBER 17 HOUSTON STRATEGY LUNCHEON INVITATION)

(IBM’S SELF DESTRUCT),

(IBM), (BIDU), (BABA), (AAPL), (INTC), (AMD), (AMZN), (MSFT), (ORCL)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 19, 2018

Fiat Lux

Featured Trade:

(THE QUANTUM COMPUTER IN YOUR FUTURE),

(AMZN), (GOOG),

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON

GLOBAL STRATEGY LUNCHEON)

Mad Hedge Technology Letter

September 19, 2018

Fiat Lux

Featured Trade:

(IBM’S SELF DESTRUCT),

(IBM), (BIDU), (BABA), (AAPL), (INTC), (AMD), (AMZN), (MSFT), (ORCL)

International Business Machines Corporation (IBM) shares do not need the squeeze of a contentious trade war to dent its share price.

It is doing it all by itself.

Stories have been rife over the past few years of shrinking revenue in China.

And that was during the golden years of China when American tech ran riot on the mainland before the dynamic rise of Baidu (BIDU), Alibaba (BABA), and Tencent, otherwise known as the BATs.

Then the Oracle of Omaha Warren Buffett drove a stake through the heart of IBM shares earlier this year by announcing he was fed up with the company’s direction and dumped a 35-year position.

Buffett unloaded all of his shares in favor of putting down an additional 75 million shares in Apple (AAPL) in the first quarter of 2018.

Topping off his Apple position now sees Buffett owning a mammoth 165.3 million total shares in the resurgent tech company.

Buffett’s shrewd decision has been rewarded, and Apple’s stock has rocketed more than 20% since he jovially declared his purchase in May.

IBM has been a rare misstep for Buffett, who took a moderate loss on his IBM position disclosing an average cost basis of $170 on 64 million shares that Berkshire bought in 2011.

IBM has flatlined since that Buffett interview, and slid around 25% since its peak in mid-2014.

IBM is grappling with the same conundrum most legacy companies deal with – top line contraction.

In 2014, IBM registered a tad under $93 billion in annual revenue, and followed up the next three years with even lower revenue.

A horrible recipe for success to say the least.

In an era of turbo-charged tech companies whose value now comprise over a quarter of the S&P, IBM has really fluffed its lines.

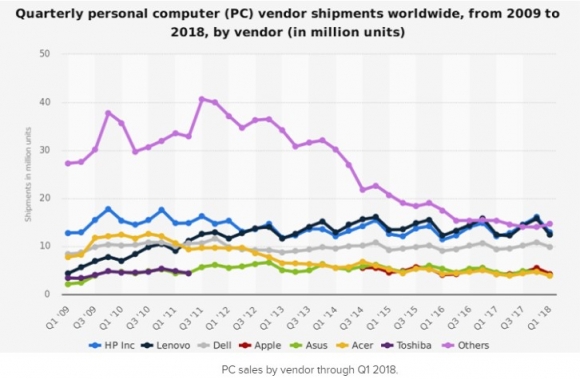

IBM’s prospects have been stapled to the PC market for years.

A recent JP Morgan note revealed the PC market could contract by 5% to 7% in the fourth quarter because of CPU shortages from Intel (INTC).

The report’s timing couldn’t have been worse for IBM.

The PC industry has been tanking for the past six consecutive years unable to shirk shrinking volume.

Intel is another company I have been lukewarm on lately because it is being outmaneuvered by chip competitor Advanced Micro Devices (AMD).

Even worse, this year has been a bad one for Intel’s management, which saw former CEO Brian Krzanich resign for sleeping with a coworker.

The poor management has had a spillover effect with Intel needing to delay new product launches as well.

To read more about my timely recommendation to pile into AMD in mid-August at $19, please click here.

Meanwhile, AMD shares have gone parabolic and surpassed an intraday price of $34 recently.

Investors should ask themselves, why invest in IBM when there are so many other tech companies that are growing, and growing revenue by 20% or more per year?

If IBM does manage to eke out top line growth in 2018, it will be by 1% to 2%, similar to Oracle’s recent performance.

Unsurprisingly, the price action of Oracle (ORCL) for the past year has been flatter than a bicycle ride around Beijing.

Live by the sword and die by the sword.

Thus, the Mad Hedge Technology Letter has been ushering readers into high-performance stocks that will bring technological and societal changes.

If you put a gun to my head and forced me to give sage investment advice, then the answer would be straightforward.

Buy Amazon (AMZN) and Microsoft (MSFT) on the dip and every dip.

This is a way to print money as if you had a rich uncle writing you checks every month.

Legacy tech is another story.

The IBMs and the Oracles of the world are bringing up the tech sector’s rear.

To add insult to injury, the lion’s share of IBM’s revenue is carved out from abroad, and the recent surge in the dollar is not doing IBM any favors.

IBM’s Watson initiative was billed as the savior for Big Blue.

The artificial intelligence initiative would integrate health care data into an actionable app.

The expectations were high hoping this division would drag up IBM from its long period of malaise.

IBM bet big on this division ploughing more than $15 billion into it from 2010-2015, predicting this would be the beginning of a new renaissance for the historic American company.

This game changing move fell on deaf ears and has been a massive bust.

IBM swallowed up three companies to ramp up this shift into the AI world - Phytel, Explorys, and Truven.

The treasure trove of health care data and proprietary analytics systems these companies came with were what this division needed to turn the corner.

These three companies were strong before the buy out and engineers were upbeat hoping Watson would elevate these companies to another level.

Wistfully, IBM Management led by CEO Ginni Rometty grossly mishandled Watson’s execution.

Phytel boasted 160 engineers at the time of IBM’s purchase and confusingly slashed half the workforce earlier this year.

Engineers at the firm even lamented that now, even smaller firms were “eating them alive.”

Unimpressed with the direction of the artificial intelligence division at IBM, many of these three companies’ best and brightest engineers jumped ship.

The inability for IBM to integrate Watson reared its ugly head in plain daylight when MD Anderson Cancer Center in Texas halted its Watson project after draining $62 million.

This was one of many errors that Watson AI accrued.

The failure to quicken clinical decision-making to match patients to clinical trials was an example of how futile IBM had become.

In short, a spectacular breakdown in execution mixed with an abrupt brain drain of AI engineers quickly imploded the prospect of Watson ever succeeding.

In 2013, IBM confidently boasted that Watson would be its “first killer app” in health care.

Internal leaks shined a brighter light on IBM’s subpar management skills.

One engineer described IBM’s management as having “no idea” what they were doing.

Another engineer said they were uncertain of a “road map” and “pivoted many times.”

Phytel, an industry leader at the time focusing on population health management, was bleeding money.

The engineers explained further, chiming in that IBM’s management had zero technical experience that led management wanting to create products that were “simply impossible.”

Not only were these products impossible, but they in no way took advantage of the resources these three companies had at their disposal.

Do you still want to invest in IBM?

Fast forward to today.

IBM is being sued in federal court with the plaintiff’s, former employees at the firm, claiming the company unfairly discriminated against elderly employees, firing them because of their age.

The documents submitted by the plaintiff’s state that “IBM has laid off 20,000 employees who were over the age of 40” since 2012.

This prototypical legacy company has more problems than the eye can see in every nook and cranny of the company.

If you have IBM shares now, dump them as soon as you can and run for cover.

It’s a miracle that IBM shares have eked out a paltry gain this year. And this thesis is constant with one of my overarching themes – stay away from all legacy tech firms with no cutting-edge proprietary technologies and stagnating growth.

________________________________________________________________________________________________

Quote of the Day

“Some say Google is God. Others say Google is Satan. But if they think Google is too powerful, remember that with search engines unlike other companies, all it takes is a single click to go to another search engine,” said Alphabet cofounder Sergey Brin.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.