Mad Hedge Technology Letter

August 29, 2018

Fiat Lux

Featured Trade:

(THE BEST TECH STOCK YOU’VE NEVER HEARD OF),

(TTD), (AMZN), (GOOGL), (NFLX), (BIDU), (BABA), (SPOT), (P), (FB)

Mad Hedge Technology Letter

August 29, 2018

Fiat Lux

Featured Trade:

(THE BEST TECH STOCK YOU’VE NEVER HEARD OF),

(TTD), (AMZN), (GOOGL), (NFLX), (BIDU), (BABA), (SPOT), (P), (FB)

If you asked me which is the best company that most people do not know about then there is one clear answer.

The Trade Desk (TTD).

This company was founded by one of the pioneers of the ad tech industry Jeff Green, and he has spent the past 20 years improving data-based digital advertising.

Green established AdECN in 2004 and its claim to fame was the world’s first online ad exchange.

After three years, Microsoft gobbled up this firm and Green stayed on until 2009 when he launched The Trade Desk. This is where he planned to infuse everything he learned about the digital ad agency into his own brainchild.

Green concluded that creating a self-service platform, avoiding privacy issues, and harnessing big data for digital ad campaigns was the best route at the time.

Green hoped to avoid the pitfalls that damaged the digital ad industry mainly bundling random ads together that diluted the quality and potency of the ad campaigns.

It did not make sense that a digital ad for baby diapers could be commingled with an ad for retirement homes.

Green created real-time bidding (RTB), which is a process in which an ad buyer bids on a digital ad and, if won, the buyer’s ad is instantly displayed on the selected site.

This revolutionary method allowed ad buyers to optimize ad inventory, prioritize ad channels, and boost the effectiveness of campaigns.

(RTB) is a far better way to optimize digital ad campaigns than static auctions, which group ads by the thousand.

In real time, advertisers are able to determine a bespoke ad for the user to display on a website. Green used this model to develop his company by building a platform tailor-made to execute (RTB).

Naturally, he won over many naysayers and his company took off like a rocket.

Results, in a results-based business, were seen right away by ad buyers.

A poignant example was aiding a performance-based ad agency in trimming ad waste by more than 50% for a national fast food chain with thousands of locations across America.

It took just one year for The Trade Desk to carve out a profitable business as ad agencies flocked to its platform desiring to take advantage of (RTB) or also commonly known as programmatic advertising.

Customer satisfaction is evident in its client retention rate of 95% for the past few years highlighting the dominating position The Trade Desk possesses in the digital ad industry.

The Trade Desk has not raised fees for ad buyers lately, but the value added from The Trade Desk to customers is accelerating at a brisk pace.

A great value proposition for potential clients.

The vigor of the business was highlighted when Green cited that each second his company is “considering over 9 million ad opportunities” for their ad inventory shows how The Trade Desk is up to date on almost every single ad permutation out there.

This speaks volume of the ad tech, which is the main engine powering the bottom lines at Google search and rogue ad seller Facebook (FB).

Google only gets 63,000 searches per second and shows that The Trade Desk has pushed the envelope in providing the best platform for ad buyers to seek its perfect audience.

Green’s mission of supporting big ad buyers optimize their ad budget has really caught fire and in a way that is completely transparent and objective.

The foundations that Green has assembled became even more valuable when Alphabet (GOOGL) chose to remove DoubleClick IDs, which would now prevent ad buyers from cross-platform reporting and measurement.

Previously, DoubleClick ID could cull data from assorted ads and online products based on a unique user ID named DoubleClick ID.

Ad purchasers then would data transfer to pull DoubleClick log files and measure them against impressions served from other ad servers across the web.

Effectively, ad buyers could track the user through the whole ad process and determine how useful an ad would be to that specific user.

In an utter conservative move to satisfy Europe’s General Data Protection Regulation (GDPR), DoubleClick IDs are no longer available for use, and tracking the ad inventory performance from start to finish became much harder.

Cutting off the visibility of the DoubleClick ID in the DoubleClick ecosystem was a huge victory for The Trade Desk because DoubleClick ID measured 75% of the global ad inventory.

Ad buyers would be forced to find other measurement systems to help calculate ad performance.

Branding and executing as the transparent and fair ad platform helping ad agencies was a great idea in hindsight with the world becoming a great deal more sensitive to data privacy.

The Trade Desk is perfectly placed to reap all the benefits and boast excellent technology to capitalize on this changing big data landscape. It is already seeing this happen with new business wins including large global brands such as a major food company, a global airline, and another large beverage company.

The global digital ad market is a $700 billion market today and trending toward $1 trillion in the next five to seven years

The generational shift to mobile and online platforms will invigorate The Trade Desk’s bottom line as more big ad buyers will make use of its proprietary platform to place programmatic ads.

Content distribution systems are fragmenting into skinny bundles hyper-targeting niche content users such as Sling TV, FuboTV, and Hulu.

There are probably 30 different ways to watch ESPN now, and these 30 platforms all require ad placement and optimization.

Some of the names The Trade Desk is working with are the who’s who of digital content ownership or distribution including Baidu (BIDU), Google, Alibaba (BABA), Pandora (P), and Spotify (SPOT) -- and the names are almost endless.

It’s the Wild West of ads and content these days because TV distribution has never been more fragmented.

Content creation avenues are desperate to boost ad income and are increasingly attempting to go direct to consumers.

Ad-funded Internet TV barely existed a few years ago. And ad inventory is all up for grabs benefitting The Trade Desk.

All of this explains why the stock is up more than 180% in 2018, and this is just the beginning.

The growth numbers put Amazon (AMZN) and Netflix (NFLX) to shame.

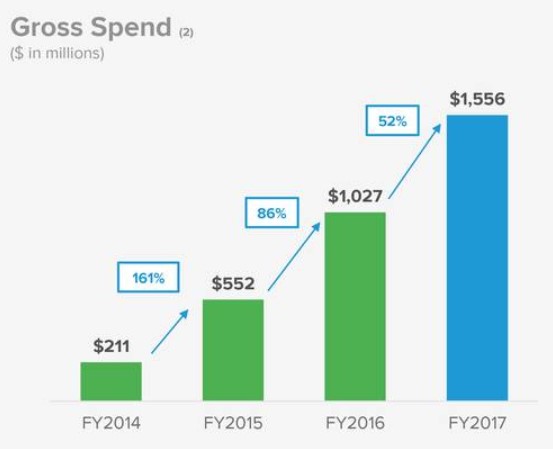

The Trade Desk scale on inventory has spiked by more than 700% YOY.

The option to hyper-target increases as more ad inventory is stocked.

Management mentioned in its second-quarter performance that “nearly everything went right. We executed well and one of the most dynamic environments we've seen.”

It is one of the most bullish statements I have heard from a public company.

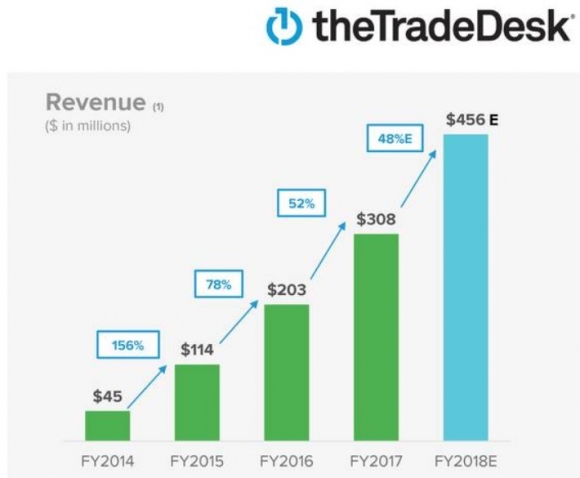

Quarterly revenue ballooned 54% YOY to a record $112 million, and the 54% YOY growth equaled the 54% YOY growth in Q2 2017.

Ad Age's top 50 worldwide advertisers doubled ad spend in the past year positioning The Trade Desk for continued hyper-growth, not only for 2018 but in 2019 and beyond.

Mobile spend jumped nearly 100% YOY, accounting for 45% of ad spend on the platform, which is 400% higher than the industry average for mobile ad spend according to eMarketer.

Data spend was also a huge winner rising by nearly 100% smashing another record.

In the meantime, the overseas business continued its robust growth in Europe and Asia, up 85% YOY.

The Trade Desk confidence in its performance chose to increase guidance to $456 million for the year, a 48% YOY improvement.

When upper management says “when we see surprises, they typically are to the upside” you take notice, because this tech company is perfectly placed in a growth sweet spot.

Massive developing markets are just starting to dabble with programmatic advertising. Markets such as China will see it become the new normal soon, opening up even more business for The Trade Desk.

The Trade Desk is also rolling out new products that will automate more of the process and reduce the number of clicks.

Wait for the pullback to get into this ad tech stock because even though it is up big this year, we are still in the early innings, and shares will march even higher.

________________________________________________________________________________________________

Quote of the Day

“I have a deep respect for the fundamentals of television, the traditions of it, even, but I don't have any reverence for it,” – said Netflix chief content officer Ted Sarandos.

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Houston, Texas on Wednesday, October 17, 2018.

A three course lunch will be followed by a wide ranging discussion and an extended question-and-answer period.

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be tossing a few surprises out there, too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $228.

I'll be arriving an hour early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private downtown Houston club that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

Come join me for lunch for the Mad Hedge Fund Trader's Global Strategy luncheon, which I will be conducting in Miami, Florida, on Tuesday, October 16, 2018.

A three-course lunch will be followed by an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate.

And to keep you in suspense, I'll be tossing a few surprises out there, too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

I'll be arriving at 11:30 AM and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a restaurant at a major downtown hotel.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets click here.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

August 28, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Markets Hit New All-Time High. The market action is broadening. The year-end melt-up has begun. Buy dips in everything, keeping in mind that the Mad Hedge Profit Predictor is entering scary “SELL” territory! Click here.

2) U.S. Consumer Confidence Hits an 18-Year High. It’s always like this at the top. Max out that credit card! Click here.

3) Trump Tries for a Trade Trifecta, with a deadline for a Canadian deal this Friday. I give it a 25% chance, so look for a buyable dip in the markets after that. Click here.

4) The U.S. Trade Deficit Soars. It turns out that beating up your trade partners doesn’t encourage them to buy more of your exports, especially since new tariffs and a strong dollar are making them much more expensive. Click here.

5) Trumps Attacks Google, claiming the company suppresses positive news stories about him. The stock (GOOG) barely moves. Don’t piss off Silicon Valley or strange things will start to happen. The Valley also accounts for 50% of all U.S. profits and generated most of the stock market gains since Trump’s election, so be careful who you abuse. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(VERTICAL BULL CALL SPREADS REVISITED),

(HD), ($INDU),

(THE RECEPTION THAT THE STARS FELL UPON),

(TESTIMONIAL),

(SPOTIFY STILL HAS SOME UPSIDE),

(SPOT), (AMZN), (AAPL), (P)

Come join me for the Mad Hedge Fund Trader's Global Strategy Luncheon, which I will be conducting in Atlanta, Georgia on Monday, October 15. 2018 at 12:00 noon. A three-course lunch will be followed by an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be tossing a few surprises out there, too.

Tickets are available for $238.

The lunch will be held at an exclusive private club in the downtown area of the city that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.