Global Market Comments

August 28, 2018

Fiat Lux

Featured Trade:

(VERTICAL BULL CALL SPREADS REVISITED),

(HD), ($INDU),

(THE RECEPTION THAT THE STARS FELL UPON),

(TESTIMONIAL)

Global Market Comments

August 28, 2018

Fiat Lux

Featured Trade:

(VERTICAL BULL CALL SPREADS REVISITED),

(HD), ($INDU),

(THE RECEPTION THAT THE STARS FELL UPON),

(TESTIMONIAL)

For those readers looking to improve their trading results and create the unfair advantage they deserve, I have posted training video on How to Execute a Vertical Bull Call Spread.

This is a pair of positions in the options market that will be profitable when the underlying security goes up, sideways, or down small in price over a defined period of time.

It is the perfect position to have onboard during markets that have declining or low volatility, much like we have experienced over the past year.

I have strapped on quite a few of these babies across many asset classes over the years and they are a major reason why I am up 54.28% on a trailing 12-month basis, with the Dow Average gaining a lowly 6.3%.

To understand this trade, I’ll outline the math on a Home Depot (HD) vertical bull call spread which I executed on August 7.

Followers of my Trade Alert service received text messages and emails to add the following position:

Trade Alert - (HD) - BUY

BUY the Home Depot (HD) September, 2018 $180-$185 in-the-money vertical BULL CALL spread at $4.10 or best

To accomplish this, they can execute the following trades:

Buy 24 September 2018 (HD) $180 calls at…….………$17.60

Sell short 24 September 2018 (HD) $185 calls at……….$13.50

Net Cost:………………………….…………..…….….....$4.10

Potential Profit: $5.00 - $4.10 = $0.90

(24 X 100 X $0.90) = $2,150 or 21.95% in 32 trading days.

This gets traders into the position at $4.10, which cost them $9,840 ($4.10 per option X 100 shares per option X 24 contracts).

The vertical part of the description of this trade refers to the fact that both options have the same underlying security (HD), the same expiration date (September 21, 2018) and only different strike prices ($180 and $185).

The great thing about these positions is that your risk is defined. You can’t lose any more than the $9,840 you put up.

If Home Depot goes bankrupt, we get a flash crash, or suffer another Brexit type event, you will never get a margin call from your broker in the middle of the night asking for more money. This is why hedge funds like them so much.

As long as Home Depot traded at or above $184.10 (The lower $180 strike price plus your $4.10 cost) on the September 21 expiration date, you will make a profit on this trade.

At the time I sent out this trade alert, Home Depot traded at $196.15. So, the stock could have fallen by $12.05, or a hefty 6.14% over the next 32 trading days, and you would still make a profit on the trade.

The shares only need to close at $185 on expiration day for you to capture the maximum potential profit, which can be calculated as:

$5.00 expiration value - $4.10 cost = $0.90 profit

($0.90 profit X 100 contracts per option X 24 contracts) = $2,160, or a gain of 21.95%.

That is not a bad profit in this ultra-low return world in only 32 days.

As it turned out my timing was perfect and Home Depot Shares have since risen to $202.06 a share. The current market value of the Home Depot (HD) September, 2018 $180-$185 in-the-money vertical BULL CALL spread is now $4.90.

This means you can take 88.88% of the maximum potential profit now without having to wait the extra 18 trading days until the September 21 option expiration.

Now you know why I like Vertical Bull Call Spread so much. So, do my followers.

Occasionally, these things don’t work. As hard as it may be to believe, I am not infallible.

So, if I’m wrong and I tell you to buy a vertical bull call spread, and the shares fall not a little, but a lot, you will lose money.

On those rare cases when that happens, I’ll shoot out a Trade Alert to you with stop-loss instructions before the damage gets out of control.

To watch the video edition of How to Execute a Vertical Bull Call Spread, complete with more detailed instructions on how to execute the position with your online platform, please click here.

While we’re all sitting on our hands waiting for the Fed to make their move, or non-move, it is time to reminisce about the good old days.

My friend was having a hard time finding someone to attend a reception who was knowledgeable about financial markets, White House intrigue, international politics, and nuclear weapons.

I asked who was coming. She said Reagan’s Treasury Secretary George Shultz, Clinton’s Defense Secretary William Perry, and Senate Armed Services Chairman Sam Nunn. I said I’d be there wearing my darkest suit, cleanest shirt, and would be on my best behavior, to boot.

When I arrived at San Francisco’s Mark Hopkins Hotel, I was expecting the usual mob scene. I was shocked when I saw the three senior statesmen making small talk with their wives and a handful of others.

It was a rare opportunity to grill high-level officials on a range of top secret issues that I would have killed for during my days as a journalist for The Economist magazine. I guess arms control is not exactly a hot-button issue these days. I moved in for the kill.

I have known George Shultz for decades, back when he was the CEO of the San Francisco-based heavy engineering company, Bechtel Corp.

I saluted him as “Captain Schultz,” his WWII Marine Corp rank, which has been our inside joke for years.

Since the Marine Corps didn’t know what to do with a PhD in economics from MIT, they put him in charge of an anti-aircraft unit in the South Pacific, as he already was familiar with ballistics, trajectories, and apogees.

I asked him why Reagan was so obsessed with Nicaragua, and if he really believed that if we didn’t fight them there, we would be fighting them in the streets of Los Angeles.

He replied that the socialist regime had granted the Soviets bases for listening posts that would be used to monitor U.S. West Coast military movements in exchange for free arms supplies. Closing those bases was the true motivation for the entire Nicaragua policy.

To his credit, George was the only senior official to threaten resignation when he learned of the Iran-contra scandal.

I asked his reaction when he met Soviet Premier Mikhail Gorbachev in Reykjavik in 1986 when he proposed total nuclear disarmament.

Shultz said he knew the breakthrough was coming because the KGB analyzed a Reagan speech in which he had made just such a proposal.

Reagan had in fact pursued this as a lifetime goal, wanting to return the world to the pre-nuclear age he knew in the 1930s, although he never mentioned this in any election campaign.

As a result of the Reykjavik Treaty, the number of nuclear warheads in the world has dropped from 70,000 to under 10,000. The Soviets then sold their excess plutonium to the U.S., which today generates 20% of the total U.S. electric power generation.

Shultz argued that nuclear weapons were not all they were cracked up to be. Despite the U.S. being armed to the teeth, they did nothing to stop the invasions of Korea, Hungary, Vietnam, Afghanistan, and Kuwait.

I had not met William Perry since the late 1990s when I bumped into his delegation at Tokyo’s Okura Hotel during defense negotiations with the Japanese. He told me that the world was far closer to an accidental Armageddon than people realized.

Twice during his term as Defense Secretary, he was awoken in the middle of the night by officers at the NORAD early warning system to be told that there were 200 nuclear missiles inbound from the Soviet Union.

He was given five minutes to recommend to the president to launch a counterstrike. Four minutes later, they called back to tell him that there were no missiles, that it was just a computer glitch.

When the U.S. bombed Belgrade in 1999, Russian president, Boris Yeltsin, in a drunken rage, ordered a full-scale nuclear alert, which would have triggered an immediate American counter response. Fortunately, his generals ignored him.

Perry said the only reason that Israel hadn’t attacked Iran yet, was because the U.S. was making aggressive efforts to collapse the economy there with its oil embargo.

Enlisting the aid of Russia and China was key, but difficult since Iran is a major weapons buyer from these two countries.

His argument was that the economic shock that a serious crisis would bring would damage their economies more than any benefits they could hope to gain from their existing Iranian trade.

I told Perry that I doubted Iran had the depth of engineering talent needed to run a full-scale nuclear program of any substance.

He said that aid from North Korea and past contributions from the AQ Khan network in Pakistan had helped them address this shortfall.

Ever in search of the profitable trade, I asked Perry if there was an opportunity in nuclear the plays, like the Market Vectors Uranium and Nuclear Energy ETF (NLR) and Cameco Corp. (CCR), that have been severely beaten down by the Fukushima nuclear disaster.

He said there definitely was. In fact, he personally was going to lead efforts to restart the moribund U.S. nuclear industry. The key here is to promote fifth-generation technology that uses small, modular designs, and alternative low risk fuels like thorium.

I had never met Senator Sam Nunn and had long been an antagonist, as he played a major role in ramping up the Vietnam War. Thanks to his efforts, the Air Force, at great expense, now has more C-130 Hercules transport planes that it could ever fly because they were assembled in his home state of Georgia. Still, I tried to be diplomatic.

Nunn believes that the most likely nuclear war will occur between India and Pakistan. Islamic terrorists are planning another attack on Mumbai. This time India will retaliate by invading Pakistan. The Pakistanis plan on wiping out this army by dropping an atomic bomb on their own territory, not expecting retaliation in kind.

But India will escalate and go nuclear, too. More than 100 million would die from the initial exchange. But when you add in unforeseen factors, such as the broader environmental effects and crop failures (CORN), (WEAT), (SOYB), (DBA), that number could rise to 1 billion to 2 billion.

Nunn applauded current administration efforts to cripple the Iranian economy, which has caused its currency to fall 50% in the past two years. The strategy should be continued, even if innocents are hurt.

He argued that further arms control talks with the Russians could be tough. They value these weapons more than we do, because that’s all they have left.

Nunn delivered a stunner in telling me that Warren Buffett had contributed $50 million of his own money to enhance security at nuclear power plants in emerging markets.

I hadn’t heard that.

As the event drew to a close, I returned to Secretary Shultz to grill him some more about the details of the Reykjavik conference held some 26 years ago.

He responded with incredible detail about names, numbers, and negotiating postures. I then asked him how old he was. He said he was 94. I responded, “I want to be like you when I grow up.”

He answered that I was “a promising young man.” It was the best birthday gift I could have received.

Mad Hedge Technology Letter

August 28, 2018

Fiat Lux

Featured Trade:

(SPOTIFY STILL HAS SOME UPSIDE),

(SPOT), (AMZN), (AAPL), (P)

Hey John,

Bought a leap on LRCX. It’s up more than 50% in one day. My account is small,

but I’m up 26% in two months. Take a look at this screen shot:

Well done Andrew. The student becomes the teacher.

John Thomas

Investors sulking about Spotify’s (SPOT) inability to make money do not get the point.

Yes, the job of every company to be in the black, but the No. 1 responsibility for a modern tech company is to grow, and grow fast.

Tech investors pay for growth, period.

As investors have seen from Netflix, companies can always raise prices after seizing market share because of the stranglehold on eyeballs inside a walled garden.

That potent formula has been the bread and butter of powerful tech companies of late.

Spotify is a captive of the music industry, of which it is entirely dependent for its source of goods, in this case songs.

At the same time, the music industry has fought tooth and nail to destroy the likes of Spotify, which benefits immensely from distributing the content it creates.

History is littered with failed music streaming services outgunned in the courtroom. Pandora (P) is the biggest public name out there whose share price has tanked over the long haul.

The music industry will battle relentlessly to exterminate Spotify and force up the royalties these Internet giants must pay as their main input.

But that does not mean Spotify is a bad company or even a bad stock.

Every company has its share of pitfalls. Throw in the mix that Amazon (AMZN) and Apple (AAPL) have music streaming services that do not even need to make a profit, and you will understand why some might be wary about putting new money to work in music streaming business stocks.

The primary reason that Spotify shares will outperform for the foreseeable future is because it is the preeminent music streaming platform.

Also, there is favorable latitude to make way toward the goal of monetization, and ample space to improve gross margins.

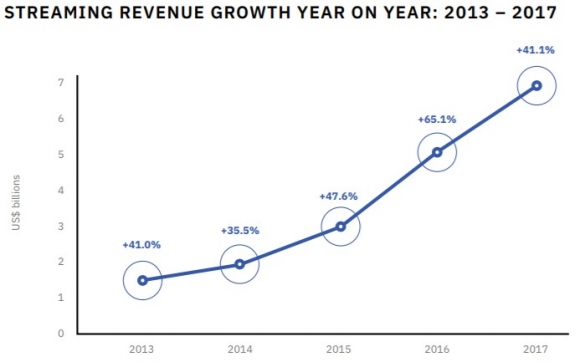

Global streaming revenue growth has gone ballistic as the migration to mobile and cord cutting has exacerbated the monetization prospects of the music industry.

Streaming revenue was a shade under $2 billion in 2013, and continued to post a growth trajectory of more than 40% each year since.

As it stands now, total global streaming revenue registered just a tick under $7 billion per year in 2017, and that was an improvement of 41.1% from 2016.

There are no signs of yielding as more avid music fans push into the music streaming space.

Social media platforms have helped publicize popular artists’ content.

Music is effectively a strong part of youth culture, which will eventually see the youth integrate a music streaming app into their daily lives for the rest of their adult lives.

The choice among choices is Spotify in 2018.

The company was dogged by many years of famous artists removing their proprietary content from the platform citing unfavorable terms.

A prime example was in 2009 when Lady Gaga’s hit song “Poker Face” only received $167 in royalty payments from Spotify for the first million streams. This highlighted the rock-solid position Spotify has curated inside the music industry.

Individual artists’ fight against Spotify has been dead on arrival from the outset, but the benefits and exposure from cooperating with the company far outweigh the drawbacks.

Eventually, almost all artists have relented and reinstalled their music on Spotify. They depend on alternative moneymaking avenues to compensate for lack of royalties, which is mainly live music.

That is why it costs an arm and a leg to go see Taylor Swift in living flesh now, and why those summer festivals dotted around America such as Coachella command premium ticket prices.

How does Spotify make money?

It earns its crust of bread through paid subscriptions but lures in eyeballs using an ad-supported free version of its platform.

Naturally, the paid version is ad-less, and this subscription is around $5 to $15 per month.

In the second quarter, Spotify’s paid subscription volume surpassed 83 million, a sharp uptick of 40% YOY.

Ad-supported users came in at more than 101 million, even under the damage that General Data Protection Regulation (GDPR) did to western tech companies.

The ad-supported subscribers rose 23% YOY, and the paid version expects between 85 million to 88 million paid subscribers in the third quarter.

Many of the new paid subscribers are converts from its free model.

Spotify is poised to increase revenue between 20%-30% for the rest of the year.

The rise of Spotify's developing data division could extract an additional $580 million of revenue in 2023, making up 2% of total revenue.

Remember that Spotify’s reference price set by the New York Stock Exchange (NYSE) was $132 in April 2018. The parabolic move in the stock on the verge of eclipsing $200 undergirds the demand for high-quality tech companies.

When Spotify did go public, the robust price action was with conviction, making major investors - such as China’s Tencent, which possess a 9.1% stake and Tiger Global Management, which owns 7.2% - happy stakeholders.

In the last quarter’s earnings report, Spotify CFO Barry McCarthy reiterated the company’s goal to push gross margins from the mid-20% range to “gross margins in the 30% to 35% range.”

A jump in gross margins would go a long way in making Spotify appear more profitable, and that is the imminent goal right now.

The path to real profitability is still a long way down the road and small victories will offer short-term strength to the share price.

If Spotify can retrace to around the $185, that would serve as a perfect entry point into a stock that has given investors few chances in which to participate.

July and August have only offered meager entry points into this stock, one around the $180 level in August, and another around $170 in July.

Spotify enjoyed a great first day of being public after its unorthodox IPO ending the day at $149. The momentum has continued unabated while Spotify has posted all the growth targets investors come to expect from companies of this ilk.

Bask in the glow of the growth sweet spot Spotify finds itself in right now.

The long-term narrative of this stock is intact for a joyous ride upward, and only whispers of Amazon and Apple meaningfully attempting to monetize this segment could derail it.

For the time being, the music part of Amazon and Apple are just a side business. They have other priorities, such as Apple’s battle to avoid being exterminated from communist China, and Amazon’s integration of Whole Foods and new-fangled digital ad business.

________________________________________________________________________________________________

Quote of the Day

“Ever since Napster, I’ve dreamt of building a product similar to Spotify,” – said cofounder and CEO of Spotify Daniel Ek.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

August 27, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) U.S. and Mexico Reach a Bilateral NAFTA Deal. Yes, we’re leaving Canada out in the cold. I never trusted them anyway since they can’t say “about” correctly. Guacamole is back! At least the stock market thinks so; it’s up 270 points. Click here.

2) The Aramco Deal is Off. Saudi Arabia will not take its oil (USO) monopoly public. Maybe oil isn’t going to crash after all. Click here.

3) So is the Tesla Privatization Offer. The $420 bid is off the table. Maybe the Saudis didn’t have the cash after the Aramco deal was canceled. But the shares hold $320. Buy the car, not the stock. Click here.

4) Stocks Hit New All-Time Highs. Is this the outbreak of trade peace I have been warning about? Stocks could melt up to the end of the year. Click here.

5) Chinese Yuan Hits a Four-Week High, as trade peace breaks out, even though it is on the other side of the world. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD),

(AAPL), (TLT), (SPY),

(BIDDING MORE FOR THE STARS),

(SPY), (INDU), (AAPL), (AMZN),

(WHY ALIBABA IS THE FIRST STOCK TO BUY WITH THE OUTBREAK OF TRADE PEACE),

(BABA), (GOOGL), (AMZN), (YELP), (MSFT), (MU), (ZTE), (HUAWEI)

Mad Hedge Hot Tips

August 24, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Powell Says Interest Rate Rises to Remain Slow, stocks love it, Washington be damned! Buy the dips! Click here.

2) Gap (GPS) Gets Crushed on Earnings Fail. Not all retailers are staging a dramatic comeback. DON’T buy this dip. Click here.

3) China is Playing Hardball in Trade Talks. Don’t expect a resolution anytime soon now that they sense weakness in Washington. Click here.

4) SEC Rejects Another Seven Bitcoin ETFs. Don’t count on them to approve Ponzi schemes anytime soon. And ETFs were supposed to by the big crypto currency salvation. Click here.

5) Don’t Plan That Hawaii Getaway this Weekend. Some 40 inches of rain have already fallen on the Big Island. I called all my Hawaiian subscribers before the lines went down as a precaution. Click here.

Published today in the Mad Hedge Global Trading Dispatch:

(AUGUST 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BIDU), (BABA), (VIX), (EEM), (SPY), (GLD), (GDX), (BITCOIN),

(SQM), (HD), (TBT), (JWN), (AMZN), (USO), (NFLX), (PIN),

(TAKING A BITE OUT OF STEALTH INFLATION)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.