While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 4, 2018

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, APRIL 6, INCLINE VILLAGE, NEVADA, GLOBAL STRATEGY LUNCHEON),

(WHY YOU SHOULD CARE ABOUT THE LIBOR CRISIS), (DB),

(ARE YOU A FINANCIAL ADVISOR LOOKING FOR NEW CLIENTS?)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Incline Village, Nevada, on Friday, April 6, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $218.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier restaurant in Incline Village, Nevada, on the sparkling shores of Lake Tahoe. Those who live there already know what it is. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

You know those bond shorts you're carrying on my recommendation? They are about to pay off big time.

We are only one more capitulation sell-off day in the stock market from bonds starting to fall like a rock.

There is a financial crisis taking place overseas, which you probably don't know, or care about.

Here is my one-liner on this: You should care.

The London Interbank Offered Rate (LIBOR) is a measure of the cost of short-term borrowing in Europe. It is essentially their version of our own Fed funds rate. And here's the problem. It has been rising almost every day for two months.

If you read the financial press, you probably already know about LIBOR as the subject of a bid rigging scandal that prompted billion-dollar fines and jail terms for the parties involved.

You can take this as the opening salvo in the coming credit crisis. It probably won't start to seriously bite here in the US for two years. But it is already hurting the profitability of European banks now.

A staggering $350 trillion in loans in the US and abroad are tied to LIBOR-based loans, including $1.2 trillion in mortgages for high-end homeowners. Rising interest rates for this debt bring immediate pain.

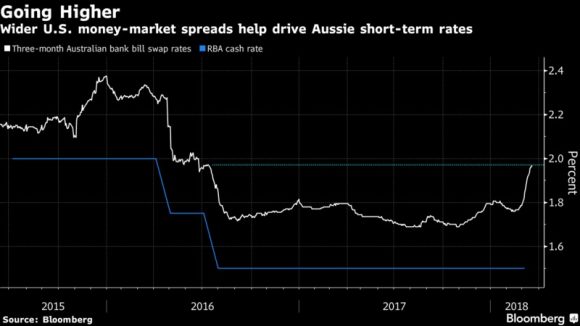

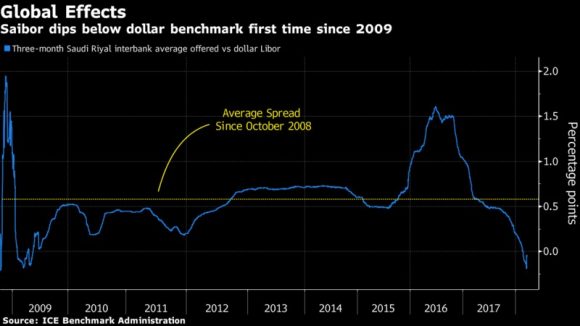

You can see this clearly is the cost of funds around the world, as outlined by the charts below.

Saudi Arabia's cost of funds, or SAIBOR, historically a net supplier of funds to the continent thanks to its perennial oil surplus, has just been raised 60 basis points, the first such move in a decade.

It is causing cash squeeze in Hong Kong, as seen through escalating HIBOR rates. Even Australian banks, normally seen as the bedrock of the global financial system, have seen the sharpest rise in interest rates in eight years.

Of course, the reasons for the global credit squeeze here at home are screamingly obvious. The US government is in the process of tripling its annual borrowing needs, as the budgets deficit soars from $400 billion to $1.2 trillion.

Exacerbating the influence on the markets is the US Treasury's new preference for short-term borrowing instead of the long-term kind, thus boosting the cost of shorter-term money.

This is to reduce the immediate up-front cost of borrowing. Like so many administration policies, it is reaping a short-term paper advantage for a very much higher long-term real cost.

As we are just entering a 20-year bear market for bonds, the Feds should be borrowing as much long-term money as they possibly can.

This is what private corporations are doing, such as Apple (AAPL) and Goldman Sachs (GS), issuing 30- to 100-year bonds, even though they don't need the money.

The tax bill passed at the end of 2017 also has had the unintended side effect of raising European rates. US companies now are mobilizing some $2.5 trillion to bring home at minimal tax rates.

That has brought them to unload longer term investments and shift the funds into overnight commercial paper, further boosting rates.

You normally don't see this kind of divergence in domestic and foreign costs of money without some kind of credit crisis.

Nervous eyes are cast toward Germany's Deutsche Bank (DB), holder of the world's largest derivatives book, and whose share price has plunged a stunning 30% in two months. Clearly, the insider money is getting out. Expect to hear a lot more about Deutsche Bank in the coming months.

I have said all along that the true cost of the tax bill won't be in the immediate up-front price tag, but the long-range unintended consequences.

You don't turn America's $20.5 trillion economy on a dime without creating a lot of disruption. And now they want to pass a second tax bill!

Spiking Rates are Becoming a Real Headache

Mad Hedge Technology Letter

April 4, 2018

Fiat Lux

Featured Trade:

(SPOTIFY KILLS IT ON LISTING DAY),

(SPOT), (DBX), (GOOGL), (AAPL), (AMZN), (CRM), (NFLX), (FB)

Practically every day, I get emails from readers asking me to take over management of their money so I can execute my Trade Alerts for them.

With an 80% success rate and a 34% average annualized return, why wouldn't they?

Unfortunately, I have to turn down these invitations.

Watching the markets, doing the research for new Trade Alerts, keeping up with a global speaking and conference schedule, and running the Mad Hedge Fund Trader empire is so demanding that I have little time for anything else.

On top of that, I have my unpaid "hobby" of advising various arms of the United States government, including the US Treasury, The Federal Reserve, and the Joint Chiefs of Staff.

When the call comes from Washington, D.C. to jump, I have to ask "How high?"

Any other patriot would do the same.

In any case, actively managing someone else's money would raise conflicts of interest and regulatory problems.

I learned early on at Morgan Stanley decades ago to stay miles away from the "gray" areas. Leave those marginal lines of business to competitors, and they will inevitably blow up.

However, there is one way I can help. I can turn these contacts over to you, a professional financial advisor.

The assets of my readers looking for execution help can vary anywhere from $10,000 to $1 billion.

Their financial sophistication will range from entry-level beginner to a seasoned pro who would rather spend time on a golf course than in front of a screen.

So this could be the ideal opportunity for a starting financial advisor to build a new business, or an established firm to fill up the dance card for some junior staff. Invest in your customers, and they will pay you handsomely over the long term.

I won't know all these people personally, as I have thousands of followers. You'll have to get to know them on your own. All I know is that they had the smarts to buy my service and have stuck with it.

If you think your business would benefit from my own customer contacts, please send an email to Nancy at customer support at support@madhedgefundtrader.com and put "FINANCIAL ADVISOR AVAILABLE" in the subject line.

Please include your contact information, including phone number, address, email contact, and years of experience in the industry.

We will add it to our list of "Preferred Financial Advisors" and send it out when reader inquiries come in.

Any financial advisor who knows which end of a stock to hold upward should be able to add value for these new clients.

Knowledge of stocks and ETFs is standard now. Some experience in options trading is also helpful, as I often use these risk-controlling instruments in my Trade Alerts.

And, of course, you will be getting excellent guidance from myself as a reader of this newsletter.

My goal here is to see that my readers get the most out of our services, and participate in the Mad Hedge Fund Trader global trading and investment community.

Anything I can do to enhance your profits and level the dreadfully uneven playing field with Wall Street is a win for me.

My only request here is that you subscribe to my Mad Hedge Fund Trader Pro newsletter and trade alert service, but only after your new client funds his account.

Good luck and good trading.

John Thomas

The Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.