It is often said that the stock market has discounted 12 out of the last four recessions.

While the market is discounting another recession now, I believe it is one of the many previously forecast that will never happen, a lot like to 18% swoon in the futures markets we saw last summer.

If anything, the reported hard data are showing that the economy is strengthening now, not weakening. The December nonfarm payroll hit a one-year high at 292,000. Christmas sales were off the charts for online merchants.

Auto production topped an 18 million rate. And this is an industry that was bankrupt only seven years ago.

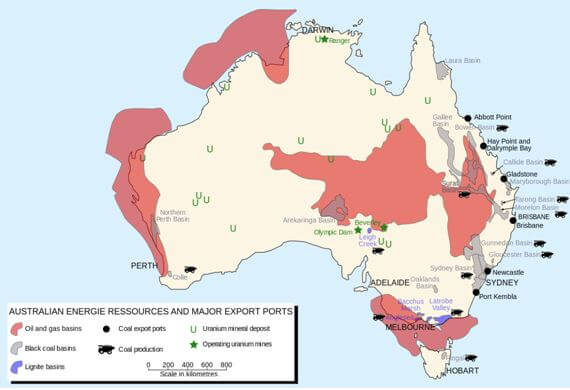

But what else would you expect from a global economy that just has a $2 trillion annual tax cut dumped in its lap, thanks to lower energy prices.

I therefore think we are within days of the final capitulation of this move. That means the Volatility Index (VIX) will peak as well, probably around $30, the top that defined the top of every spike for all of 2015, except for the August 24 flash crash day. That apex is probably only days away.

I am one of those cheapskates who buys Christmas ornaments by the bucket load from Costco in January for ten cents on the dollar, because my eleven month theoretical return on capital comes close to 1,000%.

I also like buying flood insurance in the middle of the summer when the forecast here in California is for endless days of sunshine.

That is what we are facing now with the volatility index (VIX) where premiums have just doubled, from $15 to near $30. Get this one right, and the profits you can realize are spectacular.

Watch carefully for other confirming trends to affirm this trade is unfolding. Those would include a strong dollar, collapsing stocks, and oil in free fall, and a weak Japanese yen, Euro.

I don?t know about you, but I am seeing seven out of seven cross asset confirming price action.

The CBOE Volatility Index (VIX) is a measure of the implied volatility of the S&P 500 stock index, which has been rallying hard since oil began its precipitous slide three weeks ago.

You may know of this from the many clueless talking heads, beginners, and newbies who call this the ?Fear Index?. Long-term followers of my Trade Alert Service profited handsomely after I urged them to sell short this index three years ago with the heady altitude of 47%.

For those of you who have a PhD in higher mathematics from MIT, the (VIX) is simply a weighted blend of prices for a range of options on the S&P 500 index. The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front month and second month expiration's.

The (VIX) is the square root of the par variance swap rate for a 30 day term initiated today. To get into the pricing of the individual options, please go look up your handy dandy and ever useful Black-Scholes equation. You will recall that this is the equation that derives from the Brownian motion of heat transference in metals. Got all that?

For the rest of you who do not possess a PhD in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don?t know what an SAT test is, this is what you need to know. When the market goes up, the (VIX) goes down. When the market goes down, the (VIX) goes up. End of story. Class dismissed.

The (VIX) is expressed in terms of the annualized movement in the S&P 500, which today is at 1,800. So a (VIX) of $14 means that the market expects the index to move 4.0%, or 72 S&P 500 points, over the next 30 days.

You get this by calculating $14/3.46 = 4.0%, where the square root of 12 months is 3.46. The volatility index doesn?t really care which way the stock index moves. If the S&P 500 moves more than the projected 4.0%, you make a profit on your long (VIX) positions.

Probability statistics suggest that there is a 68% chance (one standard deviation) that the next monthly market move will stay within the 4.0% range. I am going into this detail because I always get a million questions whenever I raise this subject with volatility-deprived investors.

It gets better. Futures contracts began trading on the (VIX) in 2004, and options on the futures since 2006. Since then, these instruments have provided a vital means through which hedge funds control risk in their portfolios, thus providing the ?hedge? in hedge fund.

But wait, there?s more. Now, erase the blackboard and start all over. Why should you care? If you sell short the (VIX) here at $24, you are picking up a derivative at a nice overbought level. Only prolonged, ?buy and hold? bull markets see volatility stay under $14 for any appreciable amount of time. That?s probably what we have now.

If you are a trader you can sell short the (VIX) futures somewhere over $20 and expect an easy profit sometime in the coming weeks. If we get another 5% rally somewhere along that way, that would do it.

If you don?t want to sell the (VIX) futures or options outright, then you can always sell short the iPath S&P 500 VIX Short Term Futures ETN (VXX). Better yet, you can buy a short (VIX) ETN outright, the Velocity Shares Daily Inverse VIX Short Term ETN (XIV).

If you make money on this trade, it will offset losses on other long positions.

No one who buys fire insurance ever complains when their house doesn?t burn down.