Peak streaming — that’s what the indicators are telling us.

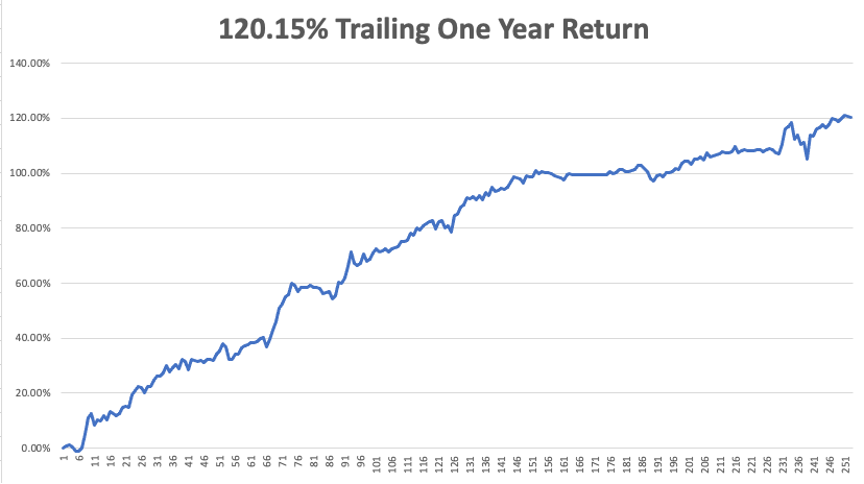

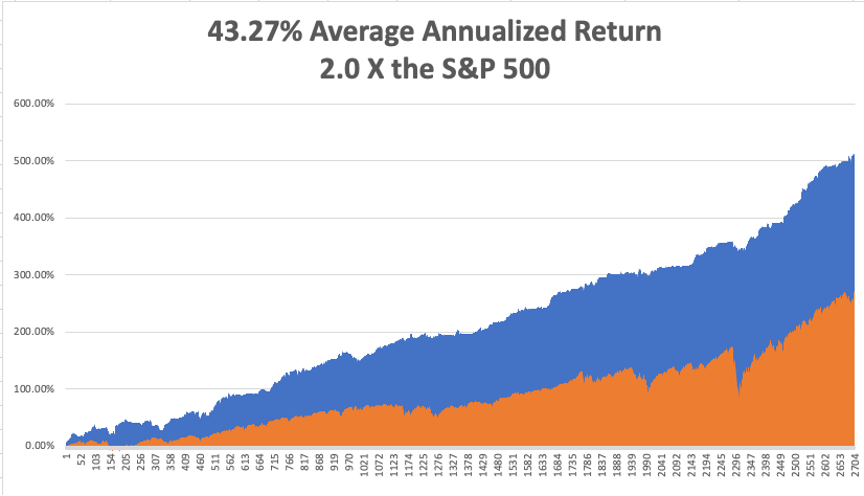

It’s been a good run — lots of money made so far.

The streaming industry is resting after the pandemic pulled revenue forward a few years.

It won’t be as easy now, as the maturity of the industry means that it becomes a war inside the war, instead of the tide-lifts-all-boats type of growth.

The latter is what everyone hopes, but doesn’t always get.

The world’s largest entertainment company, Disney, posted a significant slowdown in subscriber sign-ups at its flagship streaming service in the most recent quarter.

Disney+ added only two million subscribers last quarter bringing its total to 118.1 million.

Analysts had expected this quarter’s total to come to 125.3 million. During the previous quarter, Disney+ had added more than 12 million new subscribers.

First, the follow-through from consumers just wanting to experience outside and the services attached to them ring true.

The price hikes are also another net negative, as it makes consumers less enthused about signing up.

This had to be expected and many of these streaming companies would honestly admit that they couldn’t continue the pandemic era performance.

A reversion to the mean is not the end of streaming and Disney’s streaming services.

It is still on track to reach previous guidance of between 230 million and 260 million paid Disney+ subscribers globally by the end of fiscal 2024.

Dig deeper into the streaming data and it shows that customers in India didn’t sign up because of a delay of Indian Premier League cricket games that were to air on the service.

Another indicator of the pivot to outside business is the Disney theme park revenue climbing 99%.

The trend towards outdoor activities means a slew of cancellations of the monthly subscriptions.

Netflix was the rare streaming company that bucked the trend.

Netflix streaming service added 4.4 million subscribers—or about a million more than it had forecast—on the strength of new popular shows like “Squid Game.”

Moving forward, the bar rises quite a bit for the quality of content.

Viewers are demanding more or they are riding Space Mountain in Anaheim.

Streaming companies won’t be able to pedal out mediocre shows and movies, and secondly, there is no patience for customers as the number of streaming options has multiplied.

The deeper underbelly shows us that the general trend of linear TV cancellations and streaming signups appears to be continuing even if the rate of signups is slowing.

Disney, WarnerMedia, and AMC Networks all reaffirmed previous full-year and future year forecasts. And while pandemic gains may have slowed, production slowdowns and shutdowns have also ended, which will lead to a surge of new content for all of the streaming services.

Disney investors will be zeroed in to see if the company can pump out some blockbusters, but a glut of content might mean not enough eyeballs to digest these blockbusters.

Coronavirus-related production delays continue to disrupt its pipeline of content delivery.

Disney subscriber growth could ramp back up in the latter half of 2022 when they have better titles coming to market.

Another issue for Disney is if they are willing to produce more adult content and veer away from the younger cohort they are used to entertaining.

I don’t mean X rated, but the 25-44 aged bunch, everyone is sick of the superhero movies.

When it comes to attracting subscribers to Disney+, the company in November and December will be relying on a Beatles documentary, “The Beatles: Get Back,” additional Marvel Studios and Lucasfilm Ltd. shows and films that include a new “Home Alone” feature.

In April, Jeff Bezos said more than 175 million Amazon Prime members had streamed shows and movies in the past year.

Beyond the big three — Netflix, Disney+, and Amazon Prime — things get cloudier.

In July, NBCUniversal’s Peacock reported 54 million net new subscribers and more than 20 million monthly active accounts.

Other players with potentially strong platforms include WarnerMedia’s HBO Max, with a reported 69.4 million global subscribers, and Apple TV+, which is rumored to have about 20 million U.S. subscribers.

The major streaming competitors are also actively expanding their footprint abroad to acquire more growth, but the issue I have there is that the average revenue per user (ARPU) is nothing close to what it is in North America.

Although oversees revenue could provide a little bump to earnings, it won’t recreate their earnings composition.

Which leads me to a broader take on tech, it’s slowing down because we have been in the same cycle which was essentially initiated by the smartphone, the cloud, 3G super apps, and high-speed internet.

Those super levers are showing exhaustion.

It’s not a coincidence that Facebook’s Mark Zuckerberg was desperately trotting out his vision for the Metaverse and Apple removing personal data tracking from its ecosystem.

These are late cycle signs that shouldn’t be missed.

Big tech has become a great deal more mercantilist during the latter half of this bull market, yet we aren’t at the point of cannibalization, but I do envision that moment 5-7 years out from now.

Until then, high quality tech will grind higher while slowly raising their monthly prices, and the low-quality tech products will fall by the wayside because they lack the killer content.