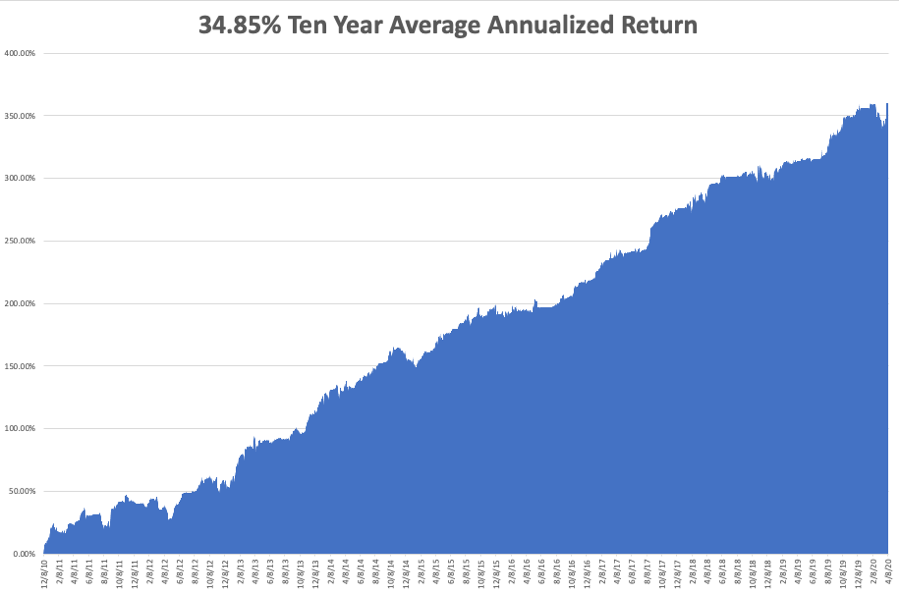

I am often asked how professional hedge fund traders invest their personal money. They all do the exact same thing. They wait for a market crash like we are seeing now, and buy the longest-term LEAPS (Long Term Equity Participation Securities) possible for their favorite names.

The reasons are very simple. The risk on LEAPS is limited. You can’t lose any more than you put in. At the same time, they permit enormous amounts of leverage.

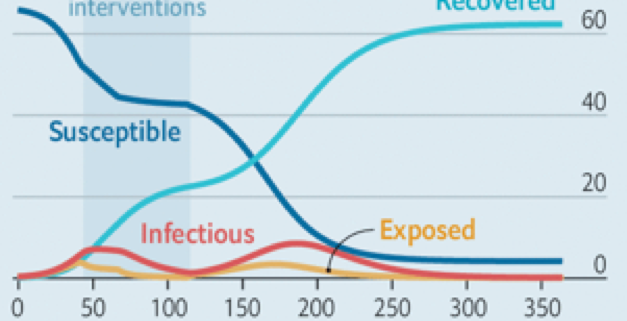

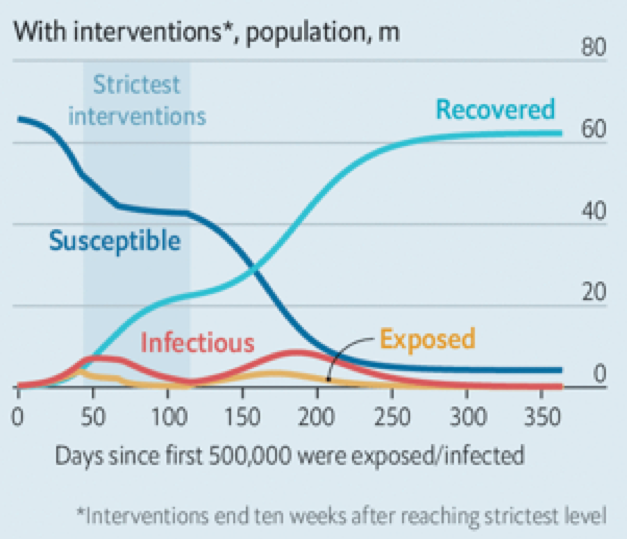

Two years out, the longest maturity available for most LEAPS, allows plenty of time for the world and the markets to get back on an even keel. Recessions, pandemics, hurricanes, oil shocks, interest rate spikes, and political instability all go away within two years and pave the way for dramatic stock market recoveries.

You just put them away and forget about them. Wake me up when it is 2022.

I put together this portfolio using the following parameters. I set the strike prices just short of the all-time highs set two weeks ago. I went for the maximum maturity. I used today’s prices. And of course, I picked the names that have the best long-term outlooks.

You should only buy LEAPS of the best quality companies with the rosiest growth prospects and rock-solid balance sheets to be certain they will still be around in two years. I’m talking about picking up Cadillacs, Rolls Royces, and even Ferraris at fire sale prices. Don’t waste your money on speculative low-quality stocks that may never come back.

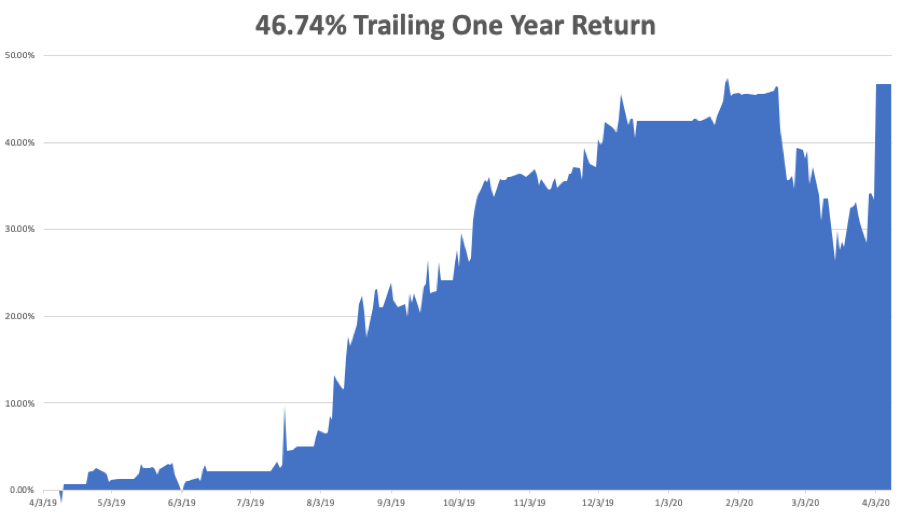

If you buy LEAPS at these prices and the stocks all go to new highs, then you should earn an average 131.8% profit from an average stock price increase of only 17.6%.

That is a staggering return 7.7 times greater than the underlying stock gain. And let’s face it. None of the companies below are going to zero, ever. Now you know why hedge fund traders only employ this strategy.

There is a smarter way to execute this portfolio. Put in throw-away crash bids at levels so low they will only get executed on the next cataclysmic 1,000-point down day in the Dow Average.

You can play around with the strike prices all you want. Going farther out of the money increases your returns, but raises your risk as well. Going closer to the money reduces risk and returns, but the gains are still a multiple of the underlying stock.

Buying when everyone else is throwing up on their shoes is always the best policy. That way, your return will rise to ten times the move in the underlying stock.

If you are unable or unwilling to trade options, then you will do well buying the underlying shares outright. I expect the list below to rise by 50% or more over the next two years.

Enjoy.

Microsoft (MSFT) - March 18 2022 $180-$190 bull call spread at $2.67 delivers a 274% gain with the stock at $190, up 16% from the current level. As the global move online vastly accelerates the world is clamoring for more computers and laptops, 90% of which run Microsoft’s Windows operating system. The company’s new cloud present with Azure will also be a big beneficiary.

Apple (AAPL) – June 17 2022 $210-$220 bull call spread at $6.47 delivers a 55% gain with the stock at $226, up 14% from the current level. With most of the world’s Apple stores now closed, sales are cratering. That will translate into an explosion of new sales in the second half when they reopen. The company’s online services business is also exploding.

Alphabet (GOOGL) – January 21 2022 $1,500-$1,520 bull call spread at $7.80 delivers a 28% gain with the stock at $226, up 14% from the current level. Global online searches are up 30% to 300%, depending on the country. While advertising revenues are flagging now, they will come roaring back

QUALCOMM (QCOM) – January 21 2022 $90-$95 bull call spread at $1.55 delivers a 222% gain with the stock at $95, up 23% from the current level. We are on the cusp of a global 5G rollout and almost every cell phone in the world is going to have to use one of QUALCOMM’s proprietary chips.

Amazon (AMZN) – January 21 2022 $2,100-$2,150 bull call spread at $17.92 delivers a 179% gain with the stock at $2,150, up 15% from the current level. If you thought Amazon was taking over the world before, they have just been given a turbocharger. Much of the new online business is never going back to brick and mortar.

Visa (V) – June 17 2022 $205-$215 bull call spread at $3.75 delivers a 166% gain with the stock at $215, up 16% from the current level. Sales are down for the short term but will benefit enormously from the mass online migration of new business only. They are one of a monopoly of three.

American Express (AXP) – June 17 2022 $130-$135 bull call spread at $1.87 delivers a 167% gain with the stock at $135, up 28% from the current level. This is another one of the three credit card processors in the monopoly, except they get to charge much higher fees.

NVIDIA (NVDA) – September 16 2022 $290-$310 bull call spread at $6.90 delivers a 189% gain with the stock at $310, up 19% from the current level. They are the world’s leader in graphics card design and manufacturing used on high-end PCs, artificial intelligence, and gaining. They befit from the soaring demand for new computers and the coming shortage of chips everywhere.

Walt Disney (DIS) – January 21 2022 $140-$150 bull call spread at $2.55 delivers a 55% gain with the stock at $116, up 31% from the current level. How would you like to be in the theme park, hotel, and cruise line business right now? It’s in the price. Its growing Disney Plus streaming service will make (DIS) the next Netflix.

Target (TGT) – June 17 2022 $125-$130 bull call spread at $1.40 delivers a 257% gain with the stock at $130, up 16% from the current level. Some store sales are up 50% month on month and lines are running around the block. Their recent online growth is also saving their bacon.