FANGS, FANGS, FANGS! Can’t live with them but can’t live without them either.

I know you’re all dying to get into the next FANG on the ground floor, for to do so means capturing a potential 100-fold return, or more.

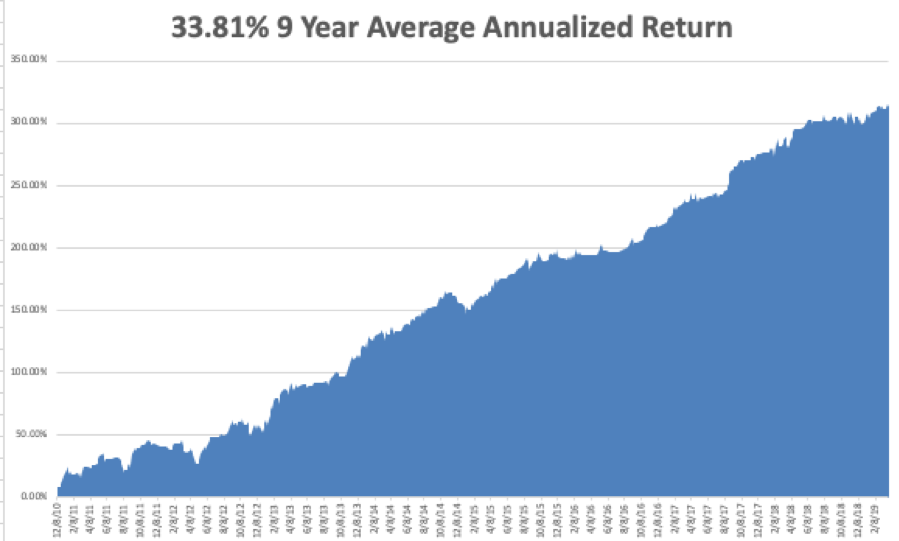

I know because I’ve done it four times. The split adjusted average cost of my Apple shares is only 25 cents compared to today’s $174, so you can understand my keen interest. My average on Tesla is $16.50.

Uncover a new FANG and the riches will accrue rapidly. Facebook (FB), Amazon AMZN), Netflix (NFLX), and Alphabet (GOOGL) didn’t exist 25 years ago. Apple (AAPL) is relatively long in the tooth at 40 years. And now all four are in a race to become the world’s first trillion-dollar company.

One thing is certain. The path to FANGdom is shortening. It took Apple four decades to get where it is today, Facebook did it in one. As Steve Jobs used to tell me when he was running both Apple and Pixar, “These overnight successes can take a long time.”

There is also no assurance that once a FANG always a FANG. In my lifetime, I have seen far too many Dow Average components once considered unassailable crash and burn, like Eastman Kodak (KODK), General Electric (GE), General Motors (GM), Sears (SHLD), Bethlehem Steel, and IBM (IBM).

I established in an earlier piece that there are eight essential attributes of a FANG, product differentiation, visionary capital, global reach, likeability, vertical integration, artificial intelligence, accelerant, and geography.

We are really in a “What have you done for me lately” world. That goes for me too. All that said, I shall run through a short list for you of the future FANG candidates we know about today.

Alibaba (BABA)

Alibaba is an amalgamation of the Chinese equivalents of Amazon, PayPal, and Google all sewn together. It accounts for a staggering 63% of all Chinese online commerce and is still growing like crazy. Some 54% of all packages shipped in China originate from Alibaba.

The juggernaut has over half billion active users, and another half billion placing orders through mobile phones. It is a master of AI and B2B commerce. There is nothing else like it in the world.

However, it does have some obvious shortcomings. Its brand is almost unknown in the US. It has a huge problem with fakes sold through their sites.

It also has an ownership structure for foreign investors that is byzantine, to say the least. It is a contractual right to a share of profits funneled through a PO box in the Cayman Island. The SEC is interested, to say the least.

We also don’t know to what extent founder Jack Ma has sold his soul to the Beijing government. It’s probably a lot. That could be a problem if souring trade relations between the US and the Middle Kingdom get worse, a certainty with the current administration.

Tesla (TSLA)

Before you bet on a new startup breaking into the Detroit Big Three, go watch the movie “Tucker” first. Spoiler Alert: It ends in tears.

Still, Tesla (TSLA) has just passed the 270,000 mark in the number of cars manufacturered. Tucker only got to 50.

Having led my readers into the stock after the IPO at $16.50, I am already pretty happy with this company. Owning three of their cars helps too (two totaled). But Tesla still has a long way to go.

It all boils down to the success of the $35,000, 200-mile range Tesla 3 for which it already has 500,000 orders. So far so good.

It’s all about scale. If it can produce these cars in sufficient numbers, it will take over the world and easily become the next FANG. If it can’t, it won’t. It’s that simple.

To say that a lot is already built into the share price would be an understatement. Tesla now trades at ten times revenues compared to 0.5 for Ford (F) and (General Motors (GM). That’s a relative overvaluation of 20:1.

Any of a dozen competing electric car models could scale up with a discount model before they do, such as the similarly priced GM Bolt. But with a ten-year lead in the technology, I doubt it.

It isn’t just cars that will anoint Tesla with FANG sainthood. The firm already has a major presence in rooftop solar cell installation through Solar City, utility sized solar plants, industrial scale battery plants, and is just entering commercial trucks. Consider these all seeds for FANGdom.

One thing is certain. Without Tesla, there wouldn’t be s single mass-market electric car on the road today.

For that, we can already say thanks.

Uber

In the blink of an eye, ride sharing service Uber has become essential for globe-trotting travelers such as myself.

Its 2 million drivers completely disrupted the traditional taxi model for local transportation which remains unchanged since the days of horses and buggies.

That has created the first $75 billion of enterprise value. It’s what’s next that could make the company so interesting.

It is taking the lead in autonomous driving. It could also replace FeDex, UPS, DHL, and the US post office by offering same day deliveries at a fraction of the overnight cost.

It is already doing this now with Uber Foods which offers immediate delivery of takeouts (click here if you want lunch by the time you finish reading this piece.)

UberCopters anyone? Yes, it’s already being offered in France and Brazil.

Uber has the potential to be so much more if it can just outlive its initial growing pains.

It is a classic case of the founder being a terrible manager, as Travis Kalanick has lurched from one controversy to the next. The board finally decided he should spend much time on his new custom built 350-foot boat.

Its “bro” culture is notorious, even in Silicon Valley.

It is also getting enormous pushback from regulators everywhere protecting entrenched local interests. It has lost its license in London, the only place in the world that offered a decent taxi service pre-Uber. Its drivers are getting beaten up in Paris.

However, if it takes advantage of only a few of the doors open to it, status as a FANG beckons.

Walmart (WMT)

A few years ago, I was heavily criticized for pointing out that half the employees at my local Walmart (WMT) were missing their front teeth. They have since received a $2 an hour's pay raise, but the teeth are still missing. They don’t earn enough money to get them fixed.

The company is the epitome of bricks and mortar in a digital world with 12,000 stores in 28 countries. It is the largest private employer in the US, with 1.4 million workers, mostly earning minimum wage.

The Walmart customer is the very definition of the term “late adopter.” Many are there only because unlike Amazon, Wal-Mart accepts cash and Food Stamps.

Still, if Walmart can, in any way, crack the online nut, it would be a turbocharger for growth. It moved in this direction with the acquisition of Jet.com for $3 billion, a cutting-edge e-commerce firm based in Hoboken, NJ.

However, this remains a work in progress. Online sales account for only 4% of Walmart’s total. But they could only be a few good hires at the top away from success.

Microsoft (MSFT)

Talk about going from being the 800-pound gorilla to an 80 pound one, and then back to 800 pounds.

I don’t know why Microsoft (MSFT) lost its way for 15 years, but it did. Blame Bill Gates’s retirement from active management and his replacement by his co-founder Steve Ballmer.

Since Ballmer’s departure in 2014, the performance of the share price has been meteoric, rising by some 125% over the past two years.

You can thank the new CEO Satya Nadella who brought new vitality to the job and has done a complete 180, taking Microsoft belatedly into the cloud.

Microsoft was never one to take lightly. Windows still powers 90% of the world’s PCs. No company can function without its Office suite of applications (Word, Excel, and PowerPoint). SQL Server and Visual Studio are everywhere.

That’s all great if you want to be a public utility, which Microsoft shareholders don’t.

LinkedIn, the social media platform for professionals, could be monetized to a far greater degree. However, specialization does come at the cost of scalability.

It seems that the future is for Microsoft to go head to head against next door neighbor Amazon (AMZN) for the cloud services market while simultaneously duking it out with Alphabet (GOOGL).

My bet is that all three win.

Airbnb

This is another new app that has immeasurably changed my life for the better. Instead of cramming myself into a hotel suite with a wildly overpriced minibar for $600 a night, I get a whole house for $300 anywhere in the world, with a new local best friend along with it.

Overnight, Airbnb has become the world’s largest hotel chain without actually owning a single hotel. At its latest funding round in 2017, it was valued at $31 billion.

The really tricky part here is for the firm to balance out supply and demand in every city in the world at the same time. It is also not a model that lends itself to vertical integration. But who knows? Maybe priority deals with established hotels are to come.

This is another firm that is battling local regulation, that great barrier to technological innovation. None other than its home town of San Francisco now has strict licensing requirements for renters, a 30 day annual limitation, and a $1,000 a day fine for offenders.

The downtowns of many tourist meccas like Florence, Italy and Paris, France have been completely taken over by Airbnb customers, driving rents up and locals out.

IBM (IBM)

There was a time in my life when IBM was so omnipresent we thought like the Great Pyramids of Egypt it would be there forever. How times change. Even Oracle of Omaha Warren Buffet became so discouraged that he recently dumped the last of his entire five-decade long position.

A recent 20 consecutive quarters of declining profits certainly hasn’t helped Big Blue’s case. It is one of the only big technology companies whose share price has gone virtually nowhere for the past two years.

IBM’s problem is that it stuck with hardware for too long. An entrenched bureaucracy delayed its entry into services and the cloud, the highest growth areas of technology.

Still, with some $80 billion in annual revenues, IBM is not to be dismissed. Its brand value is still immense. It still maintains a market capitalization of $144 billion.

And it has a new toy, Watson, the supercomputer named after the company’s founder, which has great promise, but until now has remained largely an advertising ploy.

If IBM can reinvent itself and get back into the game, it has FANG potential. But for the time being, investors are unimpressed and sitting on their hands.

The Big Telecom Companies

My final entrant in the FANGstakes would be any combination of the four top telecommunication companies, Verizon (VZ), AT&T (T), Comcast (CMCSA), and Time Warner (TWX), which now control a near monopoly in the US.

There is a reason why the administration is blocking the AT&T/Time Warner merger, and it is not because these companies are consistently cited in polls as the most despised in America. They are trying to stop the creation of another hostile FANG.

Still, if any of the big four can somehow get together, the consequences would be enormous. Ownership of the pipes through which the modern economy courses bestows great power on these firms.

And Then….

There is one more FANG possibility that I haven’t mentioned. Somewhere, someplace, there is a pimple-faced kid in a dorm room thinking up a brand-new technology or business model that will take the world by storm and create the next FANG.

Call me crazy, but I have been watching this happen for my entire life.

I want to thank my friend, Scott Galloway, of New York University’s Stern School of Business, for some of the concepts in this piece. His book, “The Four” is a must read for the serious tech investor.

Creating the Next FANG?