I used to do a lot of skydiving from 20,000 feet. There’s nothing like a freefall, feeling the wind rip at your jumpsuit as you plunge towards the earth at terminal velocity of 125 miles per hour. In the beginning, the ground looks very far away. Then it suddenly gets very close, very fast.

I used to do this during the 1960s with WWII surplus silk parachutes with a “double L” cut. You hit the ground like a ton of bricks. Sometimes, we’d swing back and forth from the wings of the airplane before letting go just to have fun and freak out the pilot who had no chute.

Over time, you develop a very accurate sense of how fast the ground is approaching and when to pull the ripcord. If you’re wrong, you die.

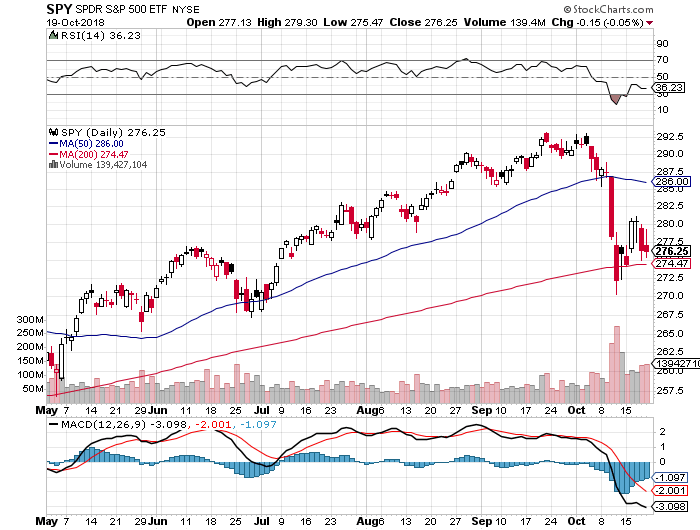

That’s how I felt when markets went into freefall last Monday. However, after a half-century of trading, I have a highly developed sense of where the bottom is.

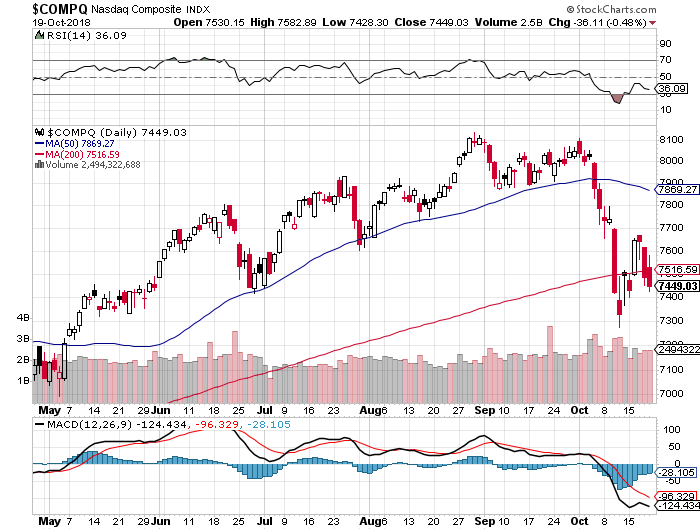

So, I piled on the “bet the ranch” longs in technology stocks and shorts in the bond market right at the absolute bottom. And to make sure everyone to a man got in, shares swooshed down one final time when rumors spread that Trump was escalating the trade war with China once again.

By Wednesday morning, the Mad Hedge Fund Trader model portfolio had booked its largest two day gain since the inception of this letter 11 years ago, some 12%. By miracle of miracles, we ended up positive for October, virtually the only one to do so in the entire hedge fund industry.

I would like to think that 50 years of toil in the markets is finally starting to pay off for me. The truth is, the harder I work, the luckier I get.

Stocks lost $2 trillion in market value in October, off 6.9%. Other than that, how was the play, Mrs. Lincoln? Tech took the worst hit in a decade, with many favorites down 20%-30%.

I am raising as much cash as I can ahead of the Midterm Elections tomorrow. Democrats seizing the House of Representatives is priced into the market already.

If the Republicans end up keeping the House, you can count on at least a 1,000-point rally in the Dow Average in the next few days as the door is now open for more tax cuts, more deregulation, and more deficit spending.

If the Democrats end up taking both the Senate and the House you can look for a 1,000 point drop in the Dow. That would bring on a huge “flight to safety” bid in the bond market and yet another opportunity to sell short at great prices.

Either way, I want more dry powder with which to take advantage of any extreme moves that may take place. “Extreme” seems to be the order of the day.

By the way, we are so far in the money with our remaining positions that even with a 1,000 point drop we should still reap the maximum profit with the November 16 option expiration in only 9 trading days.

Not that it matters, but October Nonfarm Payroll Report came in at a red-hot 250,000. The headline Unemployment Rate remained at a two-decade low at 3.7%. The Broader U-6 “Discouraged worker” unemployment rate fell 0.1% to 7.4%.

For the first time in yonks, no sector lost jobs last month. HealthCare added 36,000 jobs, Manufacturing 32,000 jobs, and Leisure & Hospitality 42,000 jobs.

However, the real blockbuster was that Average Hourly Earnings exploded to a 3.1% YOY rate, the highest in ten years. Yes, ladies and gentlemen, this is what inflation looks like, up close and ugly.

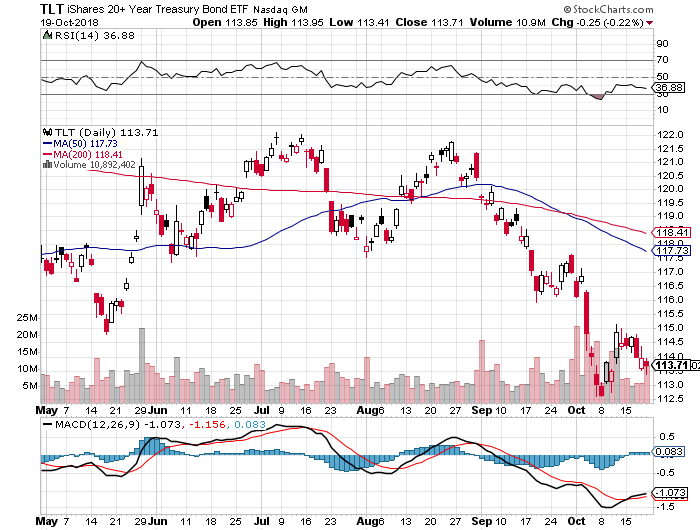

The number immediately knocked the wind out of the bond market taking it to a new low for the year. Yes, this is what double short positions in bonds are all about. I saw this coming a mile off.

The backdrop for the bond market is looking worse than ever. The budget deficit is about to break $1 trillion for the first time since the 2009 crash. Rising interest rates mean the government’s debt burden is about to grow by leaps and bounds, eventually becoming its largest expenditure.

The US Treasury is hitting the markets daily with massive new issuance, and the Chinese are dumping what US bonds they have to support the Yuan, now at a ten-year low. This is what Armageddon looks like in slow motion.

Last week was dominated by a China trade war that was on again, then off, then on one more time. The stock market ratcheted four-digit figures every time this happened.

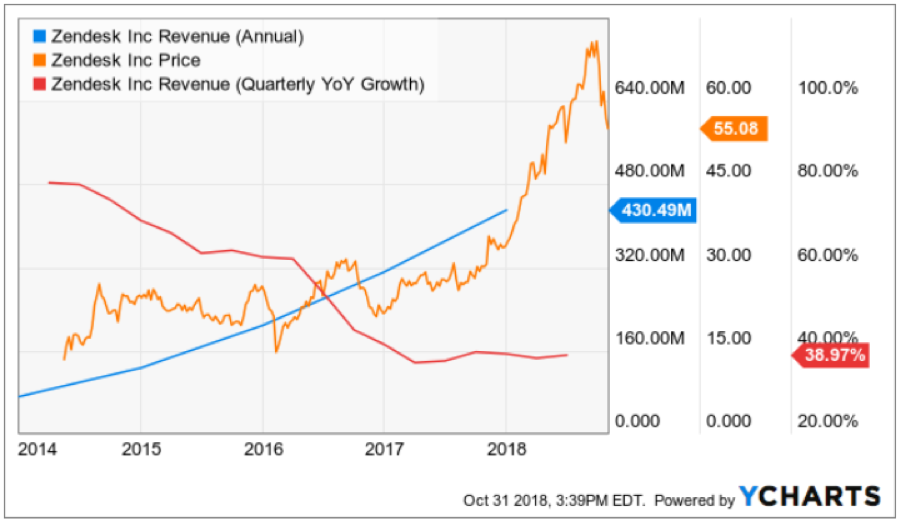

Apple (AAPL) announced record profits yet again but countered with cautious forward sales guidance. Social media pariah Facebook (FB) delivered an earnings report beyond all expectations popping the stock $10.

IBM took over Red Hat (RHT) for $33 billion, the third largest merger in history. It’s too little too late for Big Blue as the stock falls on the news. It all reeks of a “Hail Mary.”

General Electric (GE) cut its dividend from 12 cents a share to one cent after reporting a breathtaking $22.8 billion loss. The Feds have opened a criminal investigation into accounting practices. This may define the final bottom in the stock. Take another look at those long-term LEAPS.

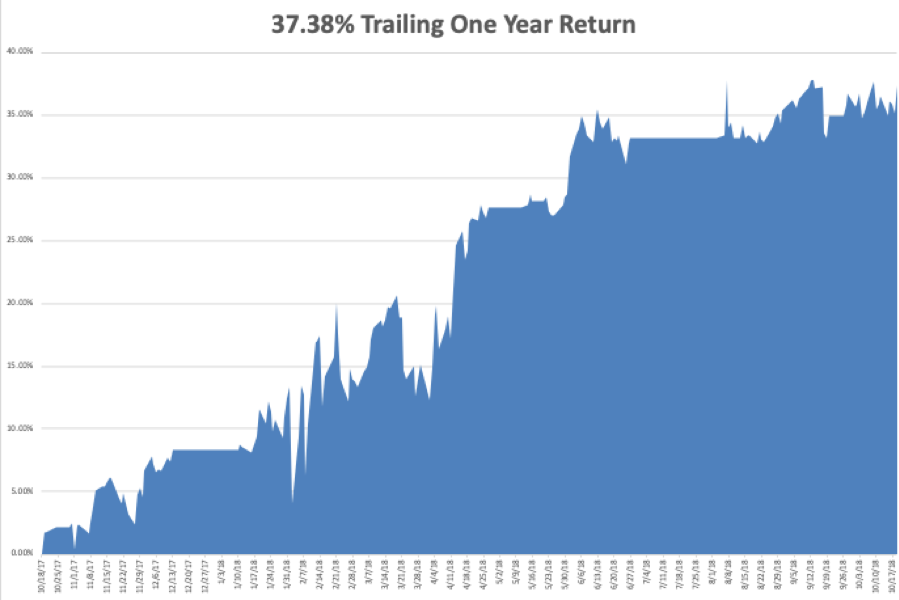

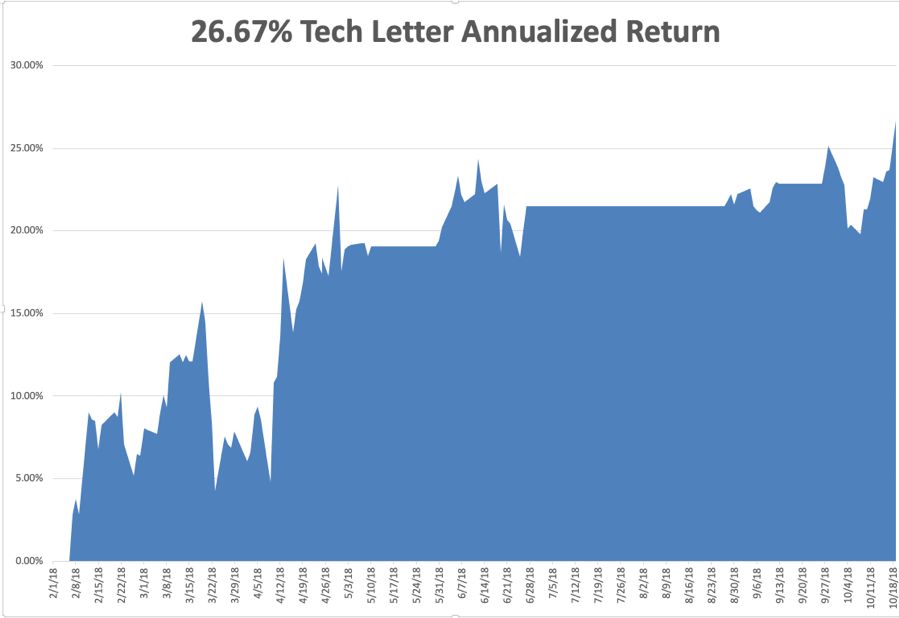

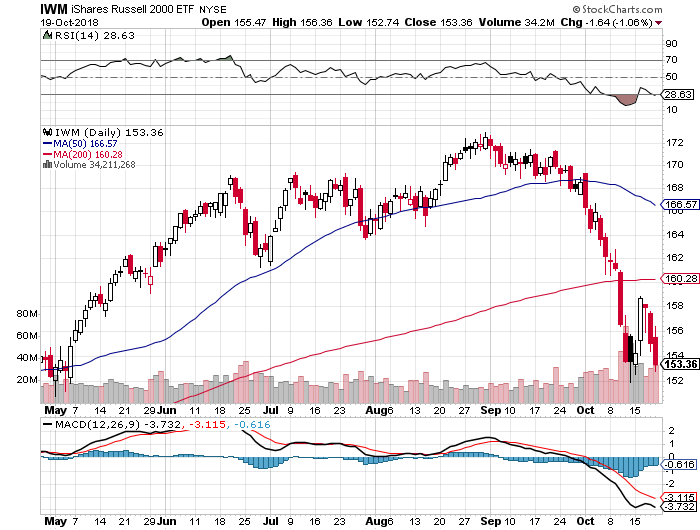

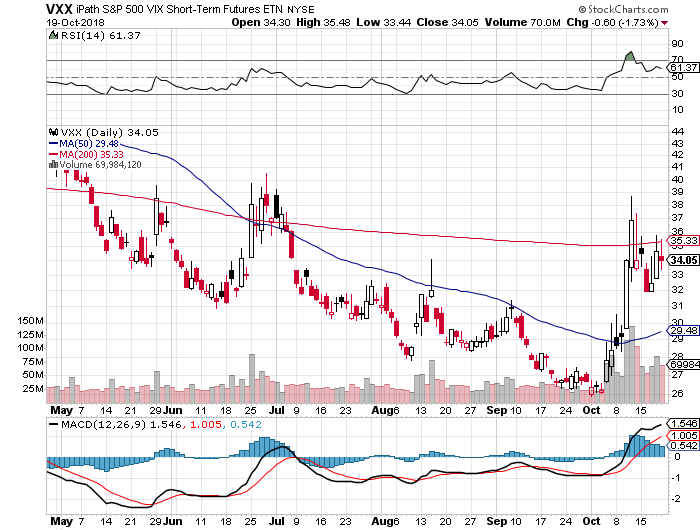

My year-to-date performance rocketed to a new all-time high of +33.17%, and my trailing one-year return stands at 37.57%. October finished at +1.24% and that includes an ill-fated -4.23% loss in the iPath S&P 500 VIX Short Term Futures ETN (VXX).

And this is against a Dow Average that is up a miniscule 1.9% so far in 2018. So far in November, we are up an eye-popping +3.54%.

Incredible as it may seem, the Mad Hedge Fund Trader has been up 18 consecutive months. That’s what you pay for and that’s what you’re getting. There’s nothing more fulfilling in life than making promises to friends, then delivering in spades.

As the market collapses, I scaled into longs in Amazon (AMZN), the S&P 500 (SPY), the Russell 2000 (IWM), and Salesforce (CRM). I used the flight to safety bid in the bond market to double up my short position there, and am kicking myself for not going triple weight.

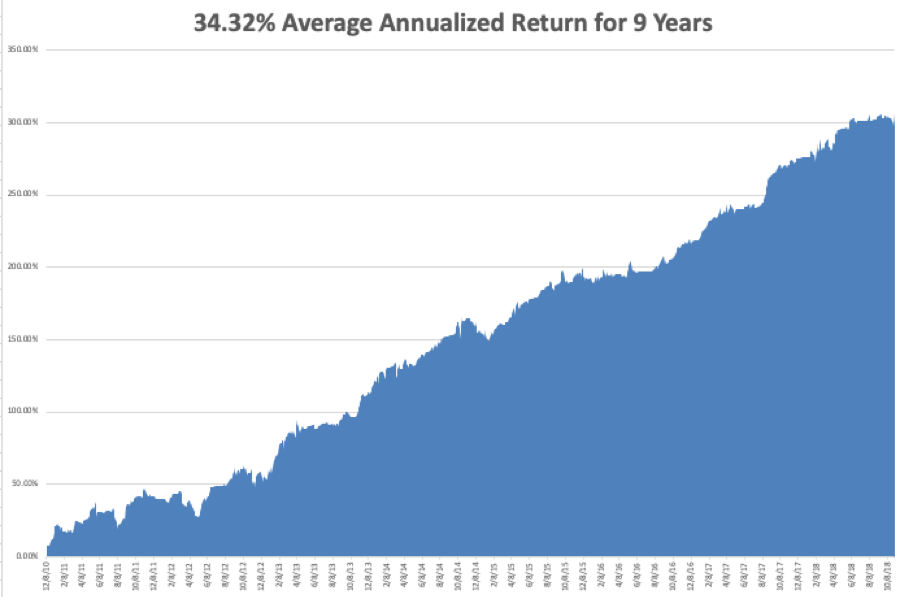

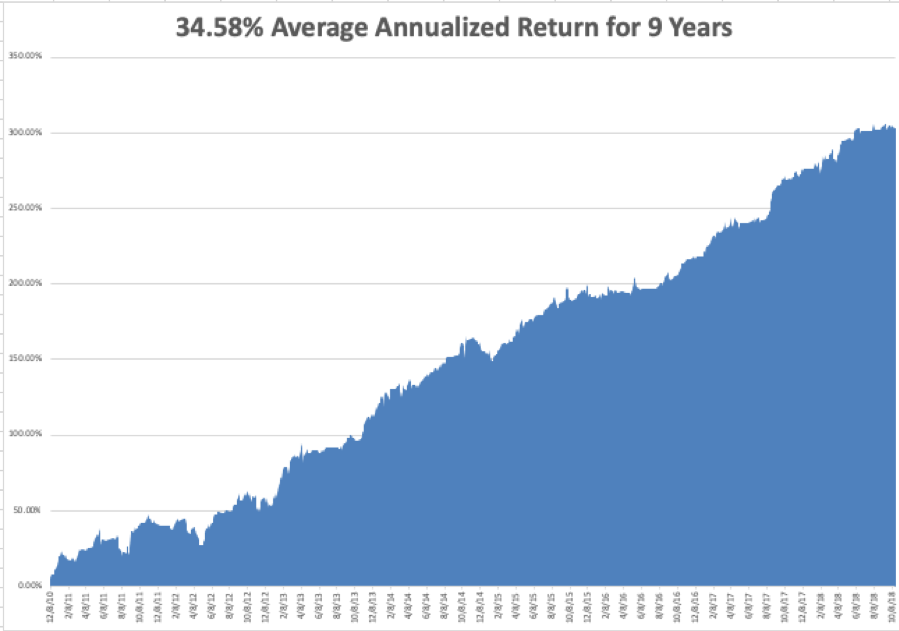

My nine-year return ballooned to 309.64%. The average annualized return stands at 34.72%.

All the BSDs are done reporting Q3 earnings and only a few tag ends are left to report. The carnage is over until we restart the cycle once again in February. In any case, economic data pales in comparison to the election in terms of market impact.

On Monday, November 5 at 10:00 AM, the ISM Manufacturing Index is out.

On Tuesday, November 6 is Election Day. Trading will be a subdued affair and the results will start coming out at 11:00 EST after the west coast polls close.

On Wednesday, October 24 we have the election aftermath to deal with. Up 1,000, down 1,000, or unchanged, who knows?

At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, October 25 at 8:30, we get Weekly Jobless Claims. The Federal Open Market Committee meets to discuss interest rates but will take no action.

On Friday, October 26, at 8:30 AM, the October Producer Price Index is out, an important read on inflation.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I made a massive amount of money personally in the October crash. I am going to plop down $150,000 and buy a brand new Tesla Model X for myself. The ashtrays are full on the old one, and besides, there is a tiny nick in the windshield from driving up to Lake Tahoe. I hear the new one has new “Summon” technology that allows it to drive into a parking lot by itself and drive around until it finds an empty space, then back into it, all untouched by human hands.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Knowing When You Hit the Ground is Crucial