Global Market Comments

March 5, 2021

Fiat Lux

Featured Trade:

(MARCH 3 BIWEEKLY STRATEGY WEBINAR Q&A),

(BRKB), (CRM), (ZM), (AAPL), (AMD), (DIS), (CRSP),

(BRKB), (PLTR), (NVDA), (TLT), (TSLA), (GLD),

(SLV), (VSAT), (EUO), (GME)

Global Market Comments

March 5, 2021

Fiat Lux

Featured Trade:

(MARCH 3 BIWEEKLY STRATEGY WEBINAR Q&A),

(BRKB), (CRM), (ZM), (AAPL), (AMD), (DIS), (CRSP),

(BRKB), (PLTR), (NVDA), (TLT), (TSLA), (GLD),

(SLV), (VSAT), (EUO), (GME)

Below please find subscribers’ Q&A for the March 3 Mad Hedge Fund Trader Global Strategy Webinar broadcast from frozen Incline Village, NV.

Q: Are SPACs here to stay?

A: Yes, but I think that in the next bear market, 80% of these SPACs (Special Purpose Acquisition Companies) will disappear, will deliver large losses, and will continue charging you enormous fees until then. It’s either that or they won’t invest their money at all and give it back, net of the fees. So, I’m avoiding the SPAC craze unless it's associated with a very specific investment play that I know well. The problem with SPACs is that they all come out expensive—there are no bargain basement SPACs on launch day. Me, being the eternal cheapskate that I am, always want to get a great bargain on everything. The time to buy these is actually in the next bear market, if they still exist, because then investors will be throwing their positions away at 10 or 20% discounts. That’s always what happens with specialized ETF, closed-end funds, and so on. They are roach motel investments; you can check-in, but you can never check out.

Q: What do you think of Elizabeth Warren's asset tax idea?

A: It’s idiotic. It would take years to figure out how much Jeff Bezos is worth. And even then, you probably couldn't come within ten billion dollars of a true number. We already pay asset taxes, our local county real estate taxes, and those are bad enough, delivering valuations that are miles from true market prices. There are many other ways to fix the tax system and get billionaires paying their fair share. There are only three things you really have to do: get rid of carried interest so hedge funds can’t operate tax-free, get rid of real estate loss carry forwards which allow the real estate industry to basically operate tax-free, and get rid of the oil depletion allowance, which has enabled the oil industry to operate tax-free for nearly 90 years. So those would be three easy ones to increase the fairness of the tax system without any immense restructuring of our accounting system.

Q: When will share buybacks start?

A: They’ve already started and have been happening all year. There are two ways the companies do this: they either have an outside accounting firm, buying religiously every day or at the end of every month or something like that, so they can’t be accused of insider trading; or they are in there buying on every dip. Certainly, all the big cash-heavy companies like Berkshire Hathaway (BRKB) or Apple (AAPL) were buying their shares like crazy last March and April because they were trading such enormous discounts. So that is another trillion dollars sitting under the market, waiting to come in on any dip, which is yet another reason that we are not going to see any major sell-offs this year—just the 5%-10% variety that I have been predicting.

Q: Is it time to buy Salesforce (CRM)?

A: Yes, Marc Benioff’s goal is to double sales in two years, and the stock is relatively cheap right now because they’ve had a couple of weak quarters and are still digesting some big acquisitions.

Q: Is CRISPR Therapeutics (CRSP) good buy?

A: Yes, I would be buying right here; it’s a good LEAP candidate because the stock could easily double from here. We’ve only scratched the surface on CRISPR technology being adopted and the potential growth in this company is enormous—I'm surprised they haven’t been taken over already.

Q: Will you start a letter for investing advisors on how to deal with the prolific numbers of Bitcoin?

A: There are already too many Bitcoin newsletters; there are literally hundreds of them and thousands of experts on Bitcoin now because there’s nothing to know and nothing to analyze. It’s all a belief system; there are no earnings, there are no dividends, and there is no interest. So, you purely have to invest in the belief that somebody else is going to take you out at a higher price. I think there is a big overhang of selling in that when they raise the number of Bitcoin, we’ll get another one of those 90% crashes that Bitcoin is prone to. So, go elsewhere for your Bitcoin advice; your choices are essentially unlimited now, and they are much cheaper than me. In fact, people are literally giving away Bitcoin advice for free, which means you’re getting what you’re paying for. I buy Bitcoin when they have a customer support telephone number.

Q: Zoom (ZM) has come down a lot after a big earnings report—do you like it?

A: Long term, yes. Short term, no. You want to avoid all the stay-at-home stocks because no one is staying at home anymore. However, there is a long-term story in Zoom once they find their bottom because even after we come out of the pandemic, we’re all still using Zoom. I have like five or ten Zoom meetings a day, and my kids go to school on Zoom all day long. They’re also bringing out new products like telephone servers. They’re also raising their prices—I happen to be one of Zoom’s largest customers. I’m paying $1,100/month now, and that’s rising at 10% a year.

Q: What would be the best LEAP for Salesforce (CRM)?

A: The rule of thumb is that you want to go 30% out of the money on your first strike. So, find a current stock price; your first strike is up 30%, and then your second strike is up 35%. And all you need to double your money on that is a bounce back to the highs for this year, which is not unrealistic. That’s the lay-up there with Salesforce. That’s the basic formula; Advanced Micro Devices (AMD), Walt Disney (DIS), Berkshire Hathaway (BRKB), Palantir (PLTR), and Nvidia (NVDA) are all good candidates for LEAPS.

Q: How often do you update the long-term stock portfolio?

A: Twice a year, and we just updated in January, which is posted on the website in your membership area. If you can't find it, just email customer support at support@madhedgefundtrader.com and they’ll tell you where to find it. And we only do this twice a year because there just aren't enough changes in the economy in six months to justify a more frequent update.

Q: When do you think real estate will come back?

A: It never left. We’ve had the hottest real estate market in history, with 20% annual gains in many cities in 2020. And that will continue, but not at the 20% rate, probably at a more sustainable 5% or 6% rate. Guess what the best inflation play in the world is? Real estate. If you’re worried about inflation, you want to run out and buy a house or two. The only thing that will really kill that market is a rise in 30-year fixed-rate mortgages to 5%, and that is years off. Or a rise in the ten-year treasury to 5% or 6%—that is several years off also. So, I think we’ve got a couple of good years of gains ahead of us. I at least want the market to stay hot until my kids get out of high school, and then I can sell my house and go live on some exotic tropical island with great broadband.

Q: When you’re doing LEAPS, do you just do the calls only or do you do these as spreads?

A: You can do both. Just do the math and see what works for you on a risk/reward basis. You can do a 30% out of the money call 2 years out and get anywhere from a 1,000% to a 10,000% return—people did get 10,000% returns buying deep out of the money LEAPS in Tesla (TSLA) a year ago (that’s where all the vintage bourbon is coming from). Or you can do it more conservatively and only make 500% in two years on Tesla spread. For example; do something like a Tesla January 2023 $900-$950 call spread. If Tesla shares rise to $950, that position is an easy quadruple. But do the numbers, figure out the cost today, what the expiration value is in two years, and there you go.

Q: Do you think overnight rates could go negative as some people predict?

A: Not for a long time. They will go negative at the next recession because we’re starting off such a low base—or when we get the next pandemic, which could be as early as next year. We could get another one at any time from a completely different virus, and it would generate the same stock market results that we got last time—down 40% in a month. We’re not out of the pandemic business, we’re just having a temporary break waiting for the next one to come along out of China or some other country, or even right here in the USA. So that may be a permanent aspect of investing in the future. It could be the price we pay having a global population that's at 7 billion heading to 9 billion.

Q: Expiration on LEAPS?

A: I always go out two years. The second year is almost free, that’s why. So why not go for the second year? It gives you twice as much time to be right, always useful.

Q: My two-year United States Treasury Bond Fund (TLT) $125 put LEAPS have turned very positive. Is this a good trade?

A: That is a good trade, which you should put on during the next (TLT) rally. If you think we’re going to $105 in 2 years, do something like a $127-$130 two-year put LEAP, and there's a nice four bagger right there.

Q: Your Amazon (AMZN) price target was recently listed at $3,500, below last year's high, but I’ve also seen a $5,000 forecast in two years. Are you sticking with that?

A: Yes, I think when you get a major recovery in the economy, Amazon will be one of the only pandemic plays that keeps on going. It’s just taking a rest here with the rest of big tech. The breakup value of Amazon is easily $5,000 a share or more. Plus, they’re still going gangbusters growing into new industries that they’ve barely touched so far, like pharmaceuticals, healthcare, and so on. So yes, I would definitely be a buyer of LEAPS, and you could do something like the January 2023 $3700-$4000 LEAP two years out and make a killing on that.

Q: Anything you can do in gold (GLD)?

A: Not really. Although gold and silver (SLV) have been a huge disappointment this year, I think this could be the beginning of a capitulation selloff in gold which will bring us a final bottom, but it may take another month or two to get there.

Q: How can I sell short the dollar?

A: You sell short the (UUP), or there are several 1X and 2X short ETFs in the currencies that you can do, like the ProShares Ultra Short Euro ETF (EUO). That is the way to do it.

Q: What is the best timing for buying LEAPS?

A: Buy at market bottoms. A year ago, I was sending out lists of 10 LEAPS at a time saying please buy all of these. You need both a short-term selloff in the stock, and then an upside target much higher than the current price so your LEAP expires at its maximum profit point. And if you’re in the right names, pretty much all the names that we talk about here, you will have 30%, if not 300% or 3,000% gains in them in the next two years.

Q: Do you think Tesla’s Starlink global satellite system will disrupt the cell tower industry?

A: Yes, that is the goal of Starlink—to wipe out all ground communication for WIFI and for cell phones. It may take them several years to do it, but if they do pull it off, then it just becomes a matter of pricing. The last Starlink pricing I looked at cost about $500 to set up, open the account, and get your dish installed. And the only flaw I see in the Starlink system is that the satellite dishes are tracking dishes, which means they lock onto satellites and then follow them as they pass overhead. Then when that signal leaves, it locks onto a new satellite; at any given time they’re locked onto four different satellites. That means moving parts, and you want to be careful of any industry that has moving parts—they wear out. That’s the great thing about software and online businesses; no moving parts, so they don’t wear out. And that’s also why Tesla has been a success; they eliminated the number of moving parts in cars by 80%. I’m waiting for Starlink to get working so I can use it, because I need Internet access 24 hours a day, even if all the local hubs are out because of a power outage. I’m now using something called Viasat (VSAT), which guarantees 100 megabyte/second service for $55 a month. It's not enough for me because I use a gigabyte service landline, but when that’s not available then I can go to satellite as a backup.

Q: Is there too much Fed liquidity in the market already? Why is the $1.9 trillion rescue package still positive for the market?

A: Firstly, there is too much liquidity in the market; that is screamingly obvious. If you look at liquidity over the decades, we are just staggeringly high right now. M2 is growing at 26% against the normal rate of 5%-6%. What the stimulus package does is get money to the people who did not participate in the bull market from last year. Those are low-income people, cities, and municipalities that are broke and can’t pay teachers, firemen, and policemen. It also goes to individual states which were not invested in the stock market. It turns out that states that were invested in the stock market like California have money coming out of their ears right now. And it gets money to low wage workers with kids who are certainly struggling right now. So, it is rather efficiently designed to get the money to people who need it the most. There is still half the country that doesn't own any stocks or even have savings of any kind. One or two people might get it who don’t deserve it but try doing anything in a 330 million population country and have it be 100% efficient.

Q: Is inflation coming?

A: Only incrementally in tiny pieces, so not enough to affect the stock market probably for several years. I still believe technology is advancing so fast that it wipes out any effort to raise prices or increase wages, and that may be what the perennially high 730,000 weekly jobless claims is all about. Those jobs that might have been there a year ago have been replaced by machines, have been outsourced overseas, or the demand for the product no longer exists. So, as long as you have a 10% unemployment rate and a weekly jobless claim at 730, inflation is the last thing you need to worry about.

Q: Is there any way to cash in on Reddit’s Wall Street Bets action?

A: No, and I would bet the majority of people who are trading off of these emojis and Reddit posts are losing money. You only hear about these things after it’s too late to do anything about them. I don't think you’ll get any more $4 to $450 moves like you did with GameStop (GME) because in that one case only, there was a short interest of 160%, which should have been illegal. All the other high short interest stocks have already been hit, with short interests all the way down to 30%, so I think that ship has sailed. It has no real investing merit whatsoever.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

December 16, 2020

Fiat Lux

Featured Trade:

(THE NEW SALESFORCE)

(NOW), (CRM), (SAP), (ORCL), (IBM), (MSFT)

During Bill McDermott’s leadership as CEO, German software firm SAP's market value increased from $39 billion to $156 billion.

No doubt that this experience at SAP paved the way to become one of the fastest-growing major cloud vendors in 2020.

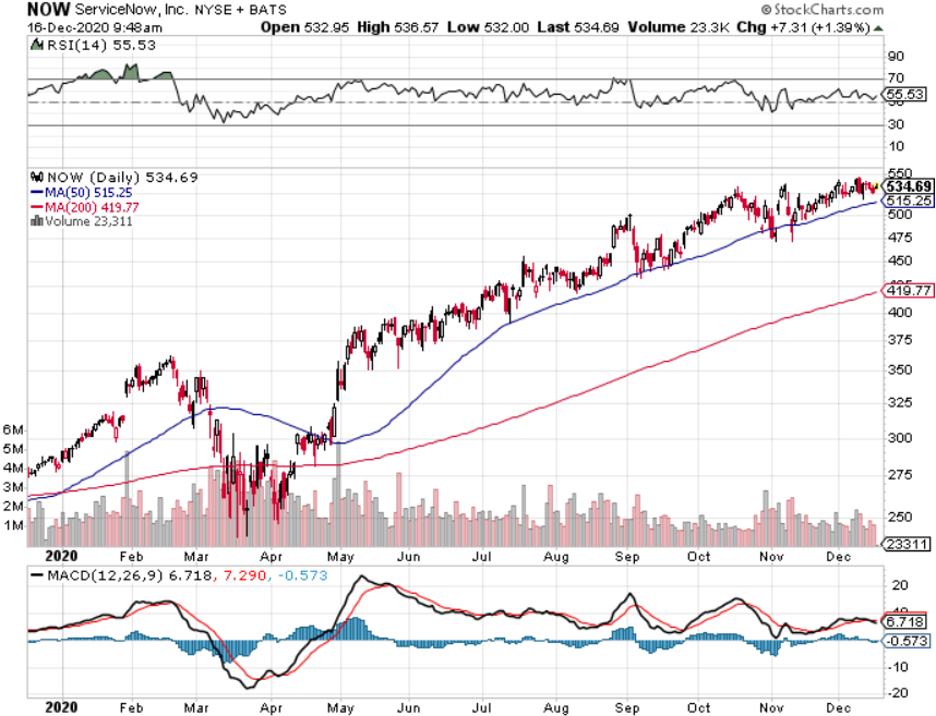

McDermott is now CEO of ServiceNow (NOW), a company that offers specific IT solutions. It allows you to manage projects and workflow, take on essential HR functions, and streamline your customer interaction and customer service. It does all of this, thanks to a comprehensive set of ServiceNow web services, as well as various plug-ins and apps.

Their market value has doubled to $100 billion and this is just the beginning.

ServiceNow almost doesn’t exist after numerous attempts to be acquired, like the time it was almost sold to VMware for $1.5 billion.

Company founder Fred Luddy, who is now chairman, and the board of directors were intrigued by the VMware offer, but venture-capital firm Sequoia Capital argued that $1.5 billion wasn’t a premium at that time let alone market rate for this burgeoning cloud player.

Then-CEO Frank Slootman was eventually replaced by former eBay Inc. (EBAY) CEO John Donahoe in February 2017, who took the company to $3.46 billion in annual 2019 sales.

Donahoe then bolted for Nike Inc. (NKE), and McDermott joined from SAP, locking in the firm for a new era of meteoric growth.

ServiceNow is now on its way to become the defining enterprise-software company of the 21st century and if you look at their position in the market today, they’re the only born-in-the-cloud software company to have surpassed $100 billion market cap without large-scale M&A.

This underdog cloud company whose automation software is deployed to improve productivity is leading to what is known as a “workflow revolution.”

Their set of software tools fused with the sudden emphasis on digital tracking of employees and business systems — has played into ServiceNow’s strengths.

The seismic shift is accelerating: By 2025, most of the millennial generation will work from home permanently, based on internal company reports.

It expects revenue of $4.49 billion in fiscal 2020 and still has a mountain to climb with revenue of just 20% of Salesforce, one-sixth of SAP, and one-ninth of Oracle Corp. (ORCL).

But ServiceNow is catching up as corporations and government agencies pour billions of dollars into their digital infrastructures.

So far, more than $3 trillion has been invested in digital transformation initiatives. Yet only 26% of the investments have delivered meaningful returns on investment.

This is launching the workflow revolution, where ServiceNow is the missing cog that can integrate systems, silos, departments, and processes, all in simple, easy-to-use cross-enterprise workflows.

A demand surge for “workflow automation” technology went parabolic in 2020 and is part of the puzzle helping ServiceNow sustain 25%-plus revenue growth.

ServiceNow most recently raised its full-year guidance after disclosing it has 1,012 customers with more than $1 million in annual contract value, up 25% year-over-year.

That included 41 such transactions in the third quarter, with new customers such as the U.S. Senate and New York City’s Mount Sinai Hospital.

ServiceNow raised guidance for the full year on subscription-revenue range to between $4.257 billion and $4.262 billion, up 31% year-over-year in constant currency.

The company has detailed a goal of $10 billion in annual sales as something feasible in the mid-term and its bevy of strategic relationships will help, like in July, Microsoft Corp. (MSFT) expanded its relationship with ServiceNow; shortly thereafter, Accenture (CAN) and IBM created new business units in partnership with ServiceNow to develop new opportunities.

In March, ServiceNow added a new computing platform, Orlando, that added artificial intelligence and machine learning that lets the MGM Macau casino resort, for example, use a virtual agent to automate and handle repetitive requests.

The integration of virtual agents will supplement casino employees with 24/7 support experiences when human staff is unavailable.

After hitting the $100 billion market cap, McDermott has identified M&A as the catalyst to take NOW higher with the CEO squarely looking at artificial intelligence targets.

ServiceNow has enabled firms to unite front, middle and back office functions, increasing productivity during this time period when speed and simplicity matter the most to digital customers.

I would describe NOW as a baby brother to Salesforce and its entrance into the first and most likely continuous acquisition cycle will most probably result in higher share prices.

ServiceNow turns out to be placed in the perfect position benefitting from Americans moving their careers online with the added effect of the broad-based secular digital migration to remote work.

As long as this firm is generating revenue in the mid-20% annually, it will be a constant buy-the-dip candidate for the foreseeable future regardless of whether there is a pandemic or not.

Global Market Comments

December 7, 2020

Fiat Lux

FEATURED TRADE:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A DICEY LANDING)

(SPY), (TLT), (AMZN), (TSLA), (CRM), (JPM), (CAT), (BABA),

(FCX), (GLD), (SLV), (UUP), (FXE), (FXA), (FXB), (FXY), (FXI), (EWZ), (THD), (EPU)

Landing my 1932 de Havilland Tiger Moth biplane can be dicey.

For a start, it has no brakes. That means I can only land on grass fields and hope my tail skid catches before I run out of landing strip. If it doesn’t, the plane will hit the end, nose over, and dump a fractured gas tank on top of me. Bathing in 30 gallons of 100 octane gasoline with sparks flying is definitely NOT a good long term health plan.

The stock market is starting to remind me of landing that Tiger Moth. On Friday, all four main stock indexes closed at all-time highs for the first time since pre-pandemic January. A record $115 billion poured into equity mutual funds in November. This has all been the result of multiple expansion, not newfound earnings.

Yet, stocks seem hell-bent on closing out 2020 at the highs.

And there is a major factor that the market is completely ignoring. What if the Democrats win the Senate in Georgia?

If so, Biden will have the weaponry to go bold. The economy goes from zero stimulus to maybe $6 trillion raining down upon it over the next six months. That will go crazy, possibly picking up another 10%, or 3,000 Dow points on top of the post-election 4,000 points we have seen so far.

That is definitely NOT in the market.

The other big decade-long trend that is only just starting is the weak US dollar. Lower interest rates for longer were reaffirmed by the appointment of my former economics professor Janet Yellen as Treasury Secretary.

A feeble dollar brings us a fading bond market, as half the buyers are foreigners. A sickened greenback also provides the launching pad for all non-dollar assets to take off like a rocket, including commodities (FCX), precious metals (GLD), (SLV), Bitcoin, and the currencies (UUP), (FXE), (FXA), (FXB), (FXY), and emerging stock markets like China (FXI), Brazil (EWZ), Thailand (THD), and Peru (EPU).

All of this is happening in the face of a US economy that is clearly falling apart. Weekly jobless claims for November came in at 245,000, compared to a robust 638,000 in October, taking the headline unemployment rate down to 6.9%. The real U6 unemployment rate stands at an eye-popping 12.0%, or 20 million.

Some 10.7 million remain jobless, 900,000 higher than in February. Transportation and Warehousing were up 140,000, Professional & Business Services by 60,000, and Health Care 46,000. Retail was down 35,000 as stores shut down at a record pace.

OPEC cuts a deal, adding 500,000 barrels a day to the global supply. The hopes are that a synchronized global recovery can take additional supply. Texas tea finally busts through a month's long $44 cap, the highest since March. Avoid energy. I’d rather buy more Tesla, the anti-energy.

Black Friday was a disaster, with in-store shopping down 52%. Long lines and 25% capacity restrictions kept the crowds at bay. If you don’t have an online presence, you’re dead. In the meantime, online spending surged by 26%.

Amazon (AMZN) hires 437,000 in 2020, probably the greatest hiring binge since WWII, and is continuing at the incredible rate of 3,000 a week. That takes its global workforce to 1.2 million. Most are $12 an hour warehouse and delivery positions. The company has been far and away the biggest beneficiary of the pandemic as the world rushed to online commerce.

Tesla’s (TSLA) full self-driving software may be out in two weeks, instead of the earlier indicated two years. The current version only works on freeways. The full street to street version could be worth $8,000 a car in upgrades. Another reason to go gaga over Tesla stock.

Goldman Sachs raised Tesla target to $780, the Musk increased market share to a growing market. No threat from General Motors yet, just talk. Volkswagen is on the distant horizon. In the meantime, Tesla super bear Jim Chanos announced he is finally cutting back his position. He finally came to the stunning conclusion that Tesla is not being valued as a car company. Go figure. Short interest in Tesla has plunged from a peak of 35% in March to 6% today. It’s learning the hard way.

The U.S. manufacturing sector pauses, activity in the U.S. manufacturing sector barely ticked up in November as production and new orders cratered, data from a survey compiled by the Institute for Supply Management showed on Tuesday. The ISM Manufacturing Report on Business PMI for November stood at 57.5, slipping from 59.3 in October.

Salesforce (CRM) overpays for workplace app Slack, knocking its stock down 9%. This is worth a buy the dip trade in the short-term and this is still a great tech company which is why the Mad Hedge Tech Letter sent out a tech alert on Salesforce on the dip.

Weekly Jobless Claims dive, with Americans applying for unemployment benefits falling last week to 712,000 down from 787,000 the week before. The weakness is unsurprising as we head into seasonal Christmas hiring.

The end of the tunnel for Boeing (BA) as they bring to an end an awful 2020. Irish-based airline Ryanair Holdings placed a large order for a set of brand new Boeing 737 MAX aircraft, giving the plane maker a shot in the arm as the single-aisle jet comes off an unprecedented 20-month grounding.

Ryanair, Europe’s low-cost carrier, has 135 Boeing 737 MAX jets on order and options to bring the total to 200 or more. Hopefully, they won’t crash this time around. My fingers are crossed.

Dollar Hits 2-1/2 Year Low. With global economies recovering, the next big-money move will be out of the greenback and into the Euro (FXE), the Aussie (FXA), the Looney (FXC), the Japanese yen (FXY), the British pound (FXB), and Bitcoin. Keeping interest rates lower for longer will accelerate the downtrend.

When we come out the other side of this pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Global Trading Dispatch catapulted to another new all-time high. December is up 5.34%, taking my 2020 year-to-date up to a new high of 61.78%.

That brings my eleven-year total return to 417.69% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.00%. My trailing one-year return exploded to 64.56%. I’m running out of superlatives, so there!

I managed to catch the 50%, two-week Tesla melt-up with a 5X long position, which is always nice for performance.

The coming week will be a slow one on the data front. We also need to keep an eye on the number of US Coronavirus cases at 14.5 million and deaths at 285,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, December 7 at 4:00 PM EST, US Consumer Credit is out.

On Tuesday, December 8 at 11:00 AM, the NFIB Business Optimism Index is published.

On Wednesday, December 9 at 8:00 AM, MBA Mortgage Applications for the previous week are released.

On Thursday, December 10 at 8:30 AM, the Weekly Jobless Claims are published. At 9:30 AM, US Core Inflation is printed.

On Friday, November 11, at 9:30 AM EST, the US Producer Price Index is announced. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, at least there is one positive outcome from the pandemic. Boy Scout Christmas tree sales are absolutely through the roof! We took delivery of 1,300 trees from Oregon for our annual fundraiser expected to sell them in two weeks. We cleared out our entire inventory in a mere six days!

We sold trees as fast as we could load them. With the scouts tying the knots, only one fell onto the freeway on the way home. An “all hands on deck” call has gone out to shift the inventory.

It turns out that tree sales are booming nationally. The $2 billion a year market places 21 million trees annually at an average price of $8 and are important fundraisers for many non-profit organizations. It seems that people just want something to feel good about this year.

Governor Gavin Newsome’s order to go into a one-month lockdown Sunday night inspired the greatest sales effort I have ever seen, and I worked on a Morgan Stanley sales desk! We shifted the last tree hours before the deadline, which was full of mud with broken branches and had clearly been run over by a truck at a well-deserved 50% discount.

I can’t wait until next year!

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

December 2, 2020

Fiat Lux

Featured Trade:

(SALESFORCE TRIES TO STAY RELEVANT IN THE CLOUD)

(CRM), (WORK), (MSFT), (GOOGL)

This was basically a deal they had to do even though I believe Salesforce (CRM) massively overpaid for Slack (WORK).

The other option would be to fall even further behind Microsoft (MSFT) who has hit a home run with their own in-house iteration of Slack-ish software called Microsoft Teams.

In fact, this is the biggest acquisition in Salesforce’s software history and purchasing the software developer Slack for over $27 billion marks a new chapter in their history.

Through a combination of cash and stock, Salesforce is purchasing Slack for $26.79 a share and .0776 shares of Salesforce.

Other big software deals such as IBM’s $34 billion purchase of Red Hat in 2018, the largest in its history, followed by Microsoft’s $27 billion acquisition of LinkedIn in 2016 are also noteworthy.

Last year, the London Stock Exchange agreed to buy data provider Refinitiv for $27 billion, though the deal has yet to be cleared by European regulators.

Salesforce has decided to grow via M&A as CEO Marc Benioff hopes to stave off a growth downturn by pre-emptively addressing these potential problems.

His goal is to get more investors on board for the long haul.

In the short term, the jury is out on whether Salesforce can “grow into” the high valuation which they agreed to pay for Slack.

Other deals made by Salesforce are when the company spent $15.3 billion on data visualization company Tableau in 2019 and, a year earlier, they captured MuleSoft for $6.5 billion whose back-end software connects data stored in disparate places.

The future of enterprise software is transforming the way everyone works in the all-digital, work-from-anywhere world and Salesforce will be one of the leading voices in how this plays out.

Don’t forget that Salesforce started the enterprise cloud revolution, and two decades later, they are still tapping into all the possibilities it offers to transform the way we work.

For Slack, this is a major victory because they had begun to see the writing on the wall with two uninspiring earnings reports which signaled that Microsoft was having their cake and eating it too.

For Salesforce to pay a 30%-40% premium for Slack reveals the sense of desperation permeating into the ranks of Salesforce management.

Another takeaway is that enterprise software is putting their money where their mouth is convinced that the shelter-in-home economy will last long after the brutal public health crisis is over.

I tend to agree with this diagnosis, but I don’t agree with overpaying for Slack at the degree in which they did.

However, the climate of cheap rates and high liquidity feeds into the normalcy of overpaying for quality assets.

What’s so bad about Slack?

Slack has blamed the downturn in fortunes on some of its small business customers being hurt by the pandemic.

The company has loosened contract structures and extended credits to help them out which is a major red flag.

The slowdown has only fueled nervousness that Microsoft (MSFT) Teams’ ascent is weighing on Slack’s growth potential.

Teams now has more than 115 million users while Slack has a fraction of that, despite having the edge in the minds of most in terms of user interface.

Slack’s slowing growth, in turn, hurt its sentiment and ultimately its stock price.

Salesforce could have acquired Slack for a discount in a year or two, but by that time, Salesforce would be left in the dust.

Salesforce had to act with urgency even if Slack still expects to post a net loss this fiscal year. It’s unclear when Slack will turn a profit-making company even less attractive.

Salesforce will need to subsidize Slack’s losses for the time being.

What’s in it for Salesforce?

Salesforce could help easily scale up Slack to more high-paying corporate customers in a major challenge to Microsoft Teams which would vastly help Slack’s margins.

There are also numerous synergies in being under the Salesforce umbrella which would only strengthen the profit potential of the communications platform.

By acquiring Slack, a business chat service with over 130,000 paid customers, Salesforce is bolstering its portfolio of enterprise applications and filling out its broader software roster as it seeks additional growth engines.

Salesforce obviously believes that the sum of the parts will be greater than each individual segment and I agree.

Salesforce’s annualized revenue topped $20 billion in the fiscal second quarter, with growth of 29%. But the forecast for the full year of 21% to 22% growth would represent the company’s slowest rate of expansion since 2010.

Microsoft and Salesforce are direct rivals at this point and Salesforce is the dominant player in customer relationship management software, where Microsoft is a distant challenger. Both companies tried to buy LinkedIn, the professional networking site, but Microsoft was the ultimate winner.

The company’s core Sales Cloud product for keeping track of current and potential customers delivered $1.3 billion in revenue, up 12% year over year and that’s simply not good enough to be considered a “growth asset.”

Many investors won’t bite at the bid unless a burgeoning tech company is north of 20% and preferably plus 30%.

Salesforce will now embark on a narrative of engineering growth to fit its investors’ preferences, but I do hesitate to think that this will most likely mean continuing to overpay for software companies.

Salesforce does have the resources to absorb this pricey endeavor but is it sustainable when the likes of Microsoft, Google, and so on are competing for the same assets?

Does this mean that Twitter would be $60 billion in today’s climate?

That’s a scary thought.

M&A could disappear soon from tech because the valuations might reach some sort of peak that even cash-rich Silicon Valley firms might balk at.

Yes, we are getting to that stage of tech. Tech is becoming a luxury.

In the short term, buy Salesforce’s dip as some investors will sell as a way to signal to Salesforce that they aren’t happy with their capital allocation strategy and ultimately this isn’t a guarantee of adding growth and could possibly backfire in Benioff’s face.

Mad Hedge Technology Letter

November 30, 2020

Fiat Lux

Featured Trade:

(THE GREEN LIGHT FOR E-COMMERCE)

(AMZN), (W), (OSTK), (WMT), (TGT), (MELI), (EBAY), (CRM), (ADBE)

Data from Adobe Analytics is in and it suggests that e-commerce is delivering on its expected domination over retail.

I can’t ignore the helping hand of the pandemic which has deemed pedestrian shopping malls too dangerous to set foot in and for analog businesses that survive, it is essentially coming down to whether a digital footprint has been developed or not.

There is only so much a PPP loan can do to paper over the cracks of a non-digital business.

At some point, CEOs will need to wake up and understand that survival means a migration to digital.

Forecasts show that Black Friday online sales will register between $8.9 billion and $10.6 billion, which represents growth of up to 42% year over year.

The data firm expects Black Friday and Cyber Monday to become the two largest online sales days in history as consumers shift more spending toward e-commerce amid the public health crisis.

By last Friday morning, Salesforce projected online sales in the U.S. for Black Friday to spike 15% to $11.9 billion.

The truth is that many shoppers got their shopping done even before Thursday and Friday with digital sales in the U.S. spiking 72% year over year on Tuesday and were up 48% on Wednesday.

E-commerce companies front-ran the actual holidays to eke out more profit in the anticipation of competitors offering earlier sales.

According to Adobe, Thanksgiving sales hit a record $5.1 billion, up 21.5% over 2019 and this aggressive growth rate can be considered the new normal.

Smartphones continued to account for an increasing segment of online sales, with this year’s $3.6 billion up 25.3%, while alternative deliveries — a sign of the e-commerce space maturing — also continued to grow, with in-store and curbside pickup up 52% on 2019.

Shopify said that over 70% of its sales are being made using smartphones.

What are the hot gift items?

Electronics, tech, toys, and sports goods being the most popular categories — at the right price will help retailers continue to experience elevated sales volume.

Adobe said a survey of consumers found that 41% said they would start shopping earlier this year than previous years due to much earlier discounts.

This season is headed for record-breaking levels as consumers power online sales for both holiday gifts and necessities.

Not all big-box retailers were open over the holidays and getting that extra surge from the likes of daily needs such as paper towels, cleaning products, and garbage bags has boosted the top-line growth as well.

We have seen the perfect storm of elements fuse together to help the bottom line records of the likes we have never observed.

Comps will be difficult to beat next year if the vaccine solution starts coming online by next winter and considering that the worst economic damage is behind us.

Next year, the U.S. consumer will have more to spend setting up a tough but possible beat to next year’s numbers along with the high likelihood that tech stocks will experience another leg up.

There will be a lot happening in between, such as a new U.S. administration that is primed for a different economic polic; but it’s impossible not to love the narrative of certain e-commerce companies such as Shopify (SHOP), MercadoLibre (MELI), Target (TGT), Walmart (WMT), Etsy (ETSY), Wayfair (W), eBay (EBAY), Overstock.com (OSTK), Amazon (AMZN) and the companies that measure their data like Salesforce (CRM) and Adobe (ADBE).

If we ever could anoint when a year became the year of technology, then this would be it in 2020.

The base case for next year is that the borders and states will still grapple with the virus and the knock-on effects to society, economy, and politics as the capacity to produce the virus won’t meet demand for at least a year.

Tech stocks are primed to outperform non-tech next year and even though multiples are high, the momentum suggests that this group of stocks will be the gift that keeps giving as the Fed has offered generous liquidity conditions to tech investors.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.