Global Market Comments

October 2, 2019

Fiat Lux

Featured Trade:

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

(COFFEE WITH RAY KURZWEIL), (GOOG)

Global Market Comments

October 2, 2019

Fiat Lux

Featured Trade:

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

(COFFEE WITH RAY KURZWEIL), (GOOG)

I have never been one to run with the pack.

I’m the guy who eternally marches to a different drummer, not in the next town, but the other hemisphere.

I would never want to join a club that would lower its standards so far that it would invite me as a member. (Groucho Marx told me that just before he died).

On those rare times that I do join the lemmings, I am punished severely.

Like everyone and his brother, his fraternity mate, and his long-lost cousin, I thought bonds would fall this year and interest rates would rise.

After all, this is normally what you get in the eleventh year of an economic recovery. This is usually when corporate America starts to expand capacity and borrow money with both hands, driving rates up.

Of course, looking back with laser-sharp 20/20 hindsight, it is so clear why fixed income securities of every description have refused to crash.

I will give you 10 reasons why bonds won’t crash. In fact, they may not reach a 3% yield for decades.

1) The Federal Reserve is pushing on a string, attempting to force companies to increase hiring, keeping interest rates at artificially low levels.

My theory on why this isn’t working is that companies have become so efficient, thanks to hyper-accelerating technology, that they don’t need humans anymore. They also don’t need to add capacity.

2) The U.S. Treasury wants low rates to finance America’s massive $22.5 trillion and growing national debt. Move rates from 0% to 6% and you have an instant financial crisis, and maybe even a government debt default.

3) Constant tit-for-tat saber-rattling by the leaders of China and the United States has created a strong underlying flight to safety bid for Treasury bonds.

The choices for 10-year government bonds are Japan at -0.25%, Germany at -0.50%, and the U.S. at +1.62%. It all makes our bonds look like a screaming bargain.

4) This recovery has been led by consumer spending, not big-ticket capital spending.

5) The Fed’s policy of using asset price inflation to spur the economy has been wildly successful. But bonds are included in these assets, and they have benefited the most.

6) New rules imposed by Dodd-Frank force institutional investors to hold much larger amounts of bonds than in the past.

7) The concentration of wealth with the top 1% also generates more bond purchases. It seems that once you become a billionaire, you become ultra conservative and only invest in safe fixed-income products. The priority becomes “return of capital” rather than “return on capital.”

This is happening globally. For more on this, click here for “The 1% and the Bond Market.”

8) Inflation? Come again? What’s that? Commodity, energy, precious metal, and food prices are disappearing up their own exhaust pipes. Industrial revolutions produce deflationary centuries, and we have just entered the third one in history (after No. 1, steam, and No. 2, electricity).

9) The psychological effects of the 2008-2009 crash were so frightening that many investors will never recover. That means more bond buying and less buying of all other assets.

10) The daily chaos coming out of Washington and the extreme length of this bull market is forcing investors to hold more than the usual amount of bonds in their portfolios. Believe it or not, many individuals still adhere to the ancient wisdom of owning their age in bonds.

I can’t tell you how many investment advisors I know who have converted their practices to bond-only ones.

Call me an ornery, stubborn, stupid old man.

Hey, even a blind squirrel finds an acorn once a day.

Global Market Comments

July 26, 2019

Fiat Lux

Featured Trade:

(JULY 24 BIWEEKLY STRATEGY WEBINAR Q&A),

(FCX), (VIX), (VXX), (UUP), (TLT), (EEM), (ELD), (CEW), (GLD),

(FXA), (FXE), (FXC), (FXY), (FXB), (AMZN),

(TESTING TESLA’S SELF DRIVING TECHNOLOGY),

(TSLA)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader July 24 Global Strategy Webinar broadcast from Zermatt, Switzerland with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What are your thoughts on the Freeport McMoRan (FCX) long position here?

A: We could take a profit here. We probably have about 50% of the maximum potential profit, but I want to hang on and go to the max on this because we’re so far in the money. Cash always has a premium ahead on any Fed interest rate decision. But long term, I think the stock could double, and with the earnings report now out of the way, we have room to run.

Q: What can you say about semiconductor stocks?

A: Long term we love them, short term they are too high to chase here. I would wait for any kind of pullback and, better yet, pull back from the other side of the next recession. We’re not seeing an improvement in prices or orders so this is strictly a technical/momentum-driven trade right now.

Q: How do you play the Volatility Index (VIX)?

A: There are numerous ways you can do it; you can buy call options on the (VIX), you can buy futures on the (VIX), or you can buy the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX). We are probably a week away from a nice entry point on the long side here.

Q: Does a languishing U.S. dollar mean emerging market opportunities?

A: It absolutely does. If we really start to get a serious drop in the U.S. dollar (UUP)—like 5-10%—it will be off to the races for commodities, bonds (TLT), emerging stock markets (EEM), emerging bond markets (ELD), emerging currencies (CEW), and gold (GLD). All of your weak dollar plays will be off to the races—that’s why I went straight into bonds, the Aussie (FXA), and copper through Freeport McMoRan (FCX). All of these trades have been profitable.

Q: When should we sell the U.S. dollar?

A: How about now? For any kind of strength in a dollar against the (FXA), (FXE), (FXC) and (FXY), I would be buying any dips on those foreign exchange ETFs. We’re about to enter a six-month - one-year period weakness on the dollar. It could be the easiest trade out there. The only one I would avoid is the British pound (FXB) because of its own special problems with Brexit. You never want to go long the currency of a country that is destroying itself, which is exactly what’s happening with the pound.

Q: Should I start selling pounds?

A: It’s pretty late in the pound game now. We went into Brexit with the pound at $1.65 and got all the way down to $1.20. We’re a little bit above that now at $1.21. If for some reason, you get a surprise pop in the pound, say to $1.25, that’s where I would sell it, but down here, no.

Q: I missed the (FCX) trade—would you get in on the next dip?

A: Yes, we may not get many dips from here because the earnings were out. Today, they were not as bad as expected, and that was keeping a lot of buyers out of the market on (FCX), so any dips you can get, go a dollar out on your strikes and then take it because this thing could double over the medium term. If the trade war with China ends, this thing could make it to the old high of $50.

Q: Is now a good time to refi my home?

A: Yes, because by the time you get the paperwork and approvals and everything else done (that’ll take about 2 months), rates will likely be lower; and in any case you’re looking to refi either a 7/1 ARM or a 15-year fixed, and the rates on those have already dropped quite substantially. I was offered 3.0% for a 15-year fixed loan on my home just the other day.

Q: On trades like (FCX), why not sell short the put spread?

A: It’s really six of one, half dozen of the other. The profit on either one should be about the same. If it isn’t, an options market maker will step in and arbitrage out the difference. That’s something only an algorithm can do these days. I recommend in-the-money call spreads versus shorting sell short vertical bear put credit spreads because for beginners, in-the-money call spreads are much easier to understand.

Q: The Mueller hearings in Congress are today. Is there any potential impact on the market?

A: The market has completely detached itself from Washington—it couldn't care less about what’s happening there. I don't think politics have the capacity to affect stock prices. The only possible impact was the prospect of the government shutdown in September. That seems to have been averted in the latest deal between the House and the White House.

Q: What about Amazon (AMZN)?

A: Like the rest of technology, long term I love it, but short term it’s overdue for a small correction. I’m looking for Amazon to go to $3,000 a share—it’s essentially taking over the world. The antitrust threats will go absolutely nowhere; Congress doesn’t even understand what these companies do, let alone know how to break them up. I wouldn’t worry about it.

Q: I just received an email inviting me to buy a new Bitcoin auto trading system that is guaranteed to make me a millionaire in four months. It is being promoted by Nicole Kidman. Do you think I should try it?

A: I wouldn’t touch this with a ten-foot pole. No, wait. I wouldn’t touch this with a 100-foot pole! Whenever a new type of security comes out, these types of "get rich quick" investment scams come out of the woodwork. Cryptocurrency is no different. Nicole Kidman was probably paid $500,000 to make the pitch by a promotor. Or more likely, Nicole Kidman has nothing to do with these people and they just swiped her picture off the Internet. I hear about these things daily. Follow their plan and you are more likely to get completely wiped out than become a millionaire. There are NO get rich quick schemes. There are only get rich slowly strategies, such as following this newsletter. Click here to see the above-mentioned scam which you should avoid at all cost. Gee, do you think Nicole Kidman would be interested in promoting the Mad Hedge Fund Trader?

Global Market Comments

April 24, 2019

Fiat Lux

Featured Trade:

(WHY ARE BOND YIELDS SO LOW?)

(TLT), (TBT), (LQD), (MUB), (LINE), (ELD),

(QQQ), (UUP), (EEM), (DBA)

(BRING BACK THE UPTICK RULE!)

Investors around the world have been confused, befuddled, and surprised by the persistent, ultra-low level of long-term interest rates in the United States.

At today’s close, the 30-year Treasury bond yielded a parsimonious 2.99%, the ten years 2.59%, and the five years only 2.40%. The ten-year was threatening its all-time low yield of 1.33% only three years ago, a return as rare as a dodo bird, last seen in the 19th century.

What’s more, yields across the entire fixed income spectrum have been plumbing new lows. Corporate bonds (LQD) have been fetching only 3.72%, tax-free municipal bonds (MUB) 2.19%, and junk (JNK) a pittance at 5.57%.

Spreads over Treasuries are approaching new all-time lows. The spread for junk over of ten-year Treasuries is now below an amazing 3.00%, a heady number not seen since the 2007 bubble top. “Covenant light” in borrower terms is making a big comeback.

Are investors being rewarded for taking on the debt of companies that are on the edge of bankruptcy, a tiny 3.3% premium? Or that the State of Illinois at 3.1%? I think not.

It is a global trend.

German bunds are now paying holders 0.05%, and JGBs are at an eye-popping -0.05%. The worst quality southern European paper has delivered the biggest rallies this year.

Yikes!

These numbers indicate that there is a massive global capital glut. There is too much money chasing too few low-risk investments everywhere. Has the world suddenly become risk averse? Is inflation gone forever? Will deflation become a permanent aspect of our investing lives? Does the reach for yield know no bounds?

It wasn’t supposed to be like this.

Almost to a man, hedge fund managers everywhere were unloading debt instruments last year when ten-year yields peaked at 3.25%. They were looking for a year of rising interest rates (TLT), accelerating stock prices (QQQ), falling commodities (DBA), and dying emerging markets (EEM). Surging capital inflows were supposed to prompt the dollar (UUP) to take off like a rocket.

It all ended up being almost a perfect mirror image portfolio of what actually transpired since then. As a result, almost all mutual funds were down in 2018. Many hedge fund managers are tearing their hair out, suffering their worst year in recent memory.

What is wrong with this picture?

Interest rates like these are hinting that the global economy is about to endure a serious nosedive, possibly even re-entering recession territory….or it isn’t.

To understand why not, we have to delve into deep structural issues which are changing the nature of the debt markets beyond all recognition. This is not your father’s bond market.

I’ll start with what I call the “1% effect.”

Rich people are different than you and I. Once they finally make their billions, they quickly evolve from being risk takers into wealth preservers. They don’t invest in start-ups, take fliers on stock tips, invest in the flavor of the day, or create jobs. In fact, many abandon shares completely, retreating to the safety of coupon clipping.

The problem for the rest of us is that this capital stagnates. It goes into the bond market where it stays forever. These people never sell, thus avoiding capital gains taxes and capturing a future step up in the cost basis whenever a spouse dies. Only the interest payments are taxable, and that at a lowly 2.59% rate.

This is the lesson I learned from servicing generations of Rothschilds, Du Ponts, Rockefellers, and Gettys. Extremely wealthy families stay that way by becoming extremely conservative investors. Those that don’t, you’ve never heard of because they all eventually went broke.

This didn’t use to mean much before 1980, back when the wealthy only owned less than 10% of the bond market, except to financial historians and private wealth specialists, of which I am one. Now they own a whopping 25%, and their behavior affects everyone.

Who has been the largest buyer of Treasury bonds for the last 30 years? Foreign central banks and other governmental entities which count them among their country’s foreign exchange reserves. They own 36% of our national debt with China in the lead at 8% (the Bush tax cut that was borrowed), and Japan close behind with 7% (the Reagan tax cut that was borrowed). These days they purchase about 50% of every Treasury auction.

They never sell either, unless there is some kind of foreign exchange or balance of payments crisis which is rare. If anything, these holdings are still growing.

Who else has been soaking up bonds, deaf to repeated cries that prices are about to plunge? The Federal Reserve which, thanks to QE1, 2, 3, and 4, now owns 13.63% of our $22 trillion debt.

An assortment of other government entities possesses a further 29% of US government bonds, first and foremost the Social Security Administration with a 16% holding. And they ain’t selling either, baby.

So what you have here is the overwhelming majority of Treasury bond owners with no intention to sell. Ever. Only hedge funds have been selling this year, and they have already done so, in spades.

Which sets up a frightening possibility for them, now that we have broken through the bottom of the past year’s trading range in yields. What happens if bond yields fall further? It will set off the mother of all short-covering squeezes and could take ten-year yield down to match 2012, 1.33% low, or lower.

Fasten your seat belts, batten the hatches, and down the Dramamine!

There are a few other reasons why rates will stay at subterranean levels for some time. If hyper accelerating technology keeps cutting costs for the rest of the century, deflation basically never goes away (click here for “Peeking Into the Future With Ray Kurzweil” ).

Hyper accelerating corporate profits will also create a global cash glut, further levitating bond prices. Companies are becoming so profitable they are throwing off more cash than they can reasonably use or pay out.

This is why these gigantic corporate cash hoards are piling up in Europe in tax-free jurisdictions, now over $2 trillion. Is the US heading for Japanese style yields, of zero for 10-year Treasuries?

If so, bonds are a steal here at 2.59%. If we really do enter a period of long term -2% a year deflation, that means the purchasing power of a dollar increases by 35% every decade in real terms.

The threat of a second Cold War is keeping the flight to safety bid alive, and keeping the bull market for bonds percolating. You can count on that if the current president wins a second term.

Global Market Comments

September 28, 2018

Fiat Lux

Featured Trade:

(WHAT WILL TRIGGER THE NEXT BEAR MARKET?)

(JPM), (SNE), (TLT), (ELD), (AMZN),

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON

GLOBAL STRATEGY LUNCHEON)

To paraphrase Leo Tolstoy in Anna Karenina, all bull markets are alike; each bear market takes place for its own particular reasons.

Now that the wreckage of the past financial crises is firmly in our rearview mirror, it is time for us to start pondering the causes of the next one. I’ll give you a hint: It will all boil down to excessive debt…again.

Global quantitative easing has been going on for a decade now, keeping interest rates far too low for too long. The unintended consequences will be legion, and the day of atonement may be a lot closer than you think.

The 1991 bear market was prompted by the Savings & Loan Crisis, where too many unsophisticated financial institutions in a newly unregulated world dreadfully mismatched asset and liabilities.

Every time I drive by a former Home Savings and Loan branch, with its unmistakable quilt decorations and accents, I remember those frightful days. Back then, when I looked at buying a home in San Francisco, the seller burst into tears when the price I offered would have generated a negative equity bill due for him.

The 2000 Dotcom crash can easily be explained by the monstrous amounts of debt provided to stock speculators. The 2008 crash was produced by massive, unregulated, and largely unknown lending to the housing sector through complex derivatives that virtually no one understood, especially the buyers.

So, here we are in 2018 nearly a decade out of the last crisis. Potential disasters are lurking everywhere under the surface while blinder constrained investors blithely power ahead. Once they metastasize, they rapidly feed into each other, creating a domino effect. They always do.

Emerging Market Debt

Lacking domestic capital markets with any real depth, companies in emerging economies prefer to borrow in U.S. dollars. When the dollar is weak that’s great because it means liabilities on the balance sheet shrink when brought back into the home currency. When the greenback is strong, the opposite happens. Dollar debt can grow so large that it can wipe out a company’s total equity.

This is already happening in a major way in Turkey, where the lira has plunged 50% in the past year, effectively doubling their debt. And once it starts, a global contagion kicks in as all emerging companies become suspect. This is not a small problem. Emerging market debt has rocketed from 55% to 105% of GDP since 2008.

The Rise of Junk Borrowers

In recent years there has been a massive expansion in borrowing by marginal credits. This is taking place because fixed income investors are willing to accept a large increase in the amount of risk for only a small marginal rise in interest rates.

There is now $1.4 trillion in low grade BBB bonds outstanding, with one-third of this one downgrade away from junk. There has also been a dramatic rise in “covenant lite” issuance, which minimizes the rights of bond holders in the event of default. When the next round of trouble arrives, you can expect this market to shut down completely, as it did in 2008.

Student Loans

These have been the sharpest rising form of borrowing over the past decade, doubling to $1.5 trillion. Some 10% are now in default. This acts as a major drag on the economy as heavily indebted students don’t borrow, buy homes or cars, or really participate in the economy in any way, banned by lowly FICO scores. This is why millennials in general have been slow to enter the housing market for the first time.

Shadow Banking

Would you like to know today’s equivalent of subprime the lending that took the financial system down in 2008? That would be shadow banking, or off the books, unreported lending by hedge funds, private equity funds, and mortgage companies. Again, this is all in pursuit of high interest rates in a low interest rate world.

Yes, liars’ loans are back, just not to the extent we saw 10 years ago…yet. I’m waiting for my cleaning lady to get offered a great refi package again, just as she was in the run-up to the last crisis. How many of these loans are out there? No one has any idea, especially the Fed. As a result, nearly 50% of all mortgage lending is now from unregulated nonbank sources.

The Outlier

Remember when Sony (SNE) was almost put out of business by a hack attack from North Korea? What if they had done this to JP Morgan (JPM)? That would have created a chain reaction of defaults throughout the financial system that would have been impossible to stop. When this happened in 2008, it took the Fed three months to reopen markets such as commercial paper. If big bankers need a reason to lie awake at night, this is it.

I’m not saying that markets can’t go higher before they go lower. In fact, I dove back into Amazon (AMZN) only this morning.

However, as an Australian farmer told me on my last trip down under, “Be careful when you cross the field, mate. Deadly snakes abound.” Add up all the above and it will turn into a giant headache for investors everywhere.

Global Market Comments

September 11, 2018

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS,

OR OPTIONS CALLED AWAY), (MSFT),

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

Boy, did we have a great run in emerging markets during the 2000s!

A global commodity boom caused many of these markets to rise tenfold or more.

Go back to the earliest newsletters published by the Diary of a Mad Hedge Fund Trader in 2008, and you will find them chock full of recommendations to buy hard assets, emerging market ETFs, debt, and currencies.

As former colonies, many of these countries still base their economies on production of the precious and base metals, energy, and foodstuffs they once supplied the motherland.

And as a former correspondent for The Economist magazine covering this territory, I knew them well.

Then in 2011, the party abruptly ended, and a vicious five-year bear market ensued.

Oil peaked first, eventually nosediving some 82.5%, from $149 to $26.

Remember Dr. Copper, the only commodity with a PhD in economics? He gave up 57.9%.

And gold, that ultimate store of value for Armageddonists and conspiracy theorists everywhere? It plunged by 48.2%.

There are still a lot of unhappy American gold eagles sitting in bank deposit boxes around the country gathering dust, thanks to those ridiculous theories.

It didn?t help that a raging bull market in developed market government bonds sucked even more money out of these beleaguered countries.

The Emerging market debt ETF (ELD), collapsed by 32%. The emerging market currency ETF (CEW) dropped by 35.5%.

My long-term subscribers can already see where this is going.

The wonderful thing about all of these cross asset class declines is that they have a leveraged effect on each other.

So while the ishares MSCI Emerging Market ETF (EEM) fell by 38.9%, in dollar terms it declined by more than half.

Then a funny thing happened during the second week of January 2016.

Gold took off like a rocket.

It was closely followed by silver, oil copper, palladium, platinum, and iron ore. Only the ags failed to participate.

The bull market was back!

Portfolio managers were given a simple choice.

Should they chase developed market assets trading at all time highs with yields approaching zero. Or should they load up on emerging assets at decade lows with yields approaching 12%?

Yields that high can cover up a lot of mistakes and preserve principal.

If you voted for the latter, you deserve a brass ring.

Here we are some eight months later, and the emerging bull market is alive and well. In fact, it is about to take another substantial new leg upwards.

My money is on emerging market handily beating the major US stock indexes for the rest of 2016.

The reasons for this are many and complex.

For a start, the iShares MSCI Emerging Market ETF (EEM) is still cheap.

It has to rise by 21.6% just to get back up to its 2011 highs. As a laggard play, it is beyond reproach.

In emerging market debt, the positive carry is enormous.

The Wisdom Tree Emerging Market Local Debt Fund (ELD) is yielding 5.46%, some 390 basis points high than the ten year Treasury bond (TLT).

And if you want to go with individual rifle shots in single countries, you can earn as much as 11.90% in Brazil.

The ?lower for longer? philosophy of the Fed just shines a giant great spotlight on this paper.

And guess what happened while you weren?t looking?

Emerging market debt has ?emerged.?

Five years of balance sheet repair means their credit quality has improved.

Local credit markets have grown up too.

Once dominated by huge inflows and outflows from foreign investors, markets are now much more in balance, thanks to the rise of? local institutional investors and pension funds.

The fundamentals of these countries have been steadily improving.

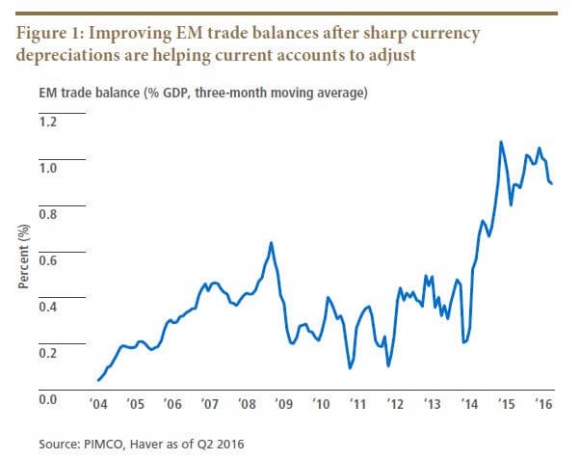

Falling currencies gave them a competitive advantage that allowed? trade surpluses to dramatically improve.

Political stability is improving. During my journalist days, you used to be able to count on one good coup d??tat or revolution in the area a year. No more.

Many business friendly, pro trade governments have come into power, such as in Argentina, India and Peru.

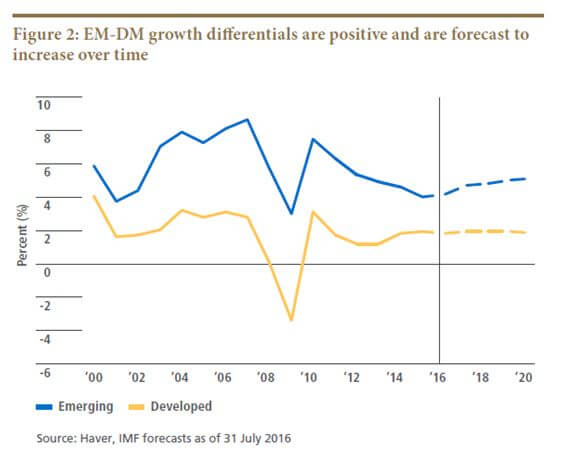

Emerging market GDP growth rates are still double those found in developed markets.

Markets themselves are improving. Spreads for stocks and bonds are now much tighter in emerging markets and liquidity has improved. They are ?roach motel? markets no more, where you can check in, but you can?t check out.

Get this one right, and the cross asset class hockey stick effect we saw on the downside will work just as well on the upside.

In short, there is a lot more to the emerging market dollar than there used to be. It is just a matter of time before financial markets figure this out.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.