My daughter needed a desk so she could go to high school from her bedroom. So, I drove around Northern Nevada to get the perfect piece, visiting Reno, Sparks, Carson City, and Minden. It is one of the most conservative parts of the country, probably 90% republican.

What I saw was amazing.

There were Biden/Harris signs everywhere. Yes, there will still some Trump signs, but they were in a definite minority. Four years ago, you only saw Trump signs. The rare Clinton/Kaine sign was full of bullet holes, torn down, or copiously marked with offensive graffiti.

I thought, hmm, there must be a trade here.

We seem to be on the verge of massive changes in the US economy. Get in front of them and you’ll make a fortune. Lag behind, and you’ll be seen driving an Uber cab.

Technology undoubtedly led the decade, bringing in a 30% annual return since 2009. Industrial and other domestic stocks brought in no more than 12%. The “Roaring Twenties” could bring the reverse.

Technology will continue to do OK. Ever falling prices and greater service is a tough business model to beat. But let’s face it, none of these things are cheap. Apple (AAPL) going from a 9X multiple to 45X?

Industrials could be playing a massive catch up game initiating a new supercycle as they did from 2000-2010 when tech lagged in the wake of the Dotcom Bust.

This switch is made easier by the fact that most big industrial companies are now de facto technology ones. They all now use advanced cloud software, sophisticated robots, and state of the art distribution systems. Caterpillar (CAT) even has a 290-ton dump truck that drives itself like a giant Tesla (TSLA)!

Many of these companies I have covered for nearly 50 years, when they last belonged to the Nifty Fifty. So, for me, it’s a matter of dusting off my old research, seeing who is left, and giving them a modern spin. The great thing about these stocks is that many pay decent dividends.

I’ll give you a short list of where to buy the dips.

Banks – JP Morgan (JPM), Bank of America (BAC)

Railroads – Norfolk Southern (NSC), Union Pacific (UNP)

Credit Cards – Visa (V), Master Card (MA)

Couriers – FedEx (FDX), UPS (UPS)

Consumer Discretionary – International Paper (IP)

Hmm, a market where everything goes up. I like it! Dow 120,000 here we come!

Trump ordered all Stimulus Negotiations to cease, and then changed his mind six hours later. Clearly, the president has given up on the election and wants the next administration to inherit a Great Depression. Or is this Covid-19 talking? It’s the perfect scorched earth strategy. Write off another 2 million small businesses. Down ticket republican candidates will be beaten like a red-headed stepchild. Stocks plunged 600, with airlines in free fall, then bounced 700.

Jay Powell REALLY wants a stimulus package, claiming the economy desperately needs fiscal help to maintain a recovery or face a prolonged depression. “The risks of overdoing it seem, for now, to be small,” the central bank chief told the National Association for Business Economics. Are his pleas falling on deaf ears in Washington? Trump just gave our Fed governor the middle finger salute.

Share Buybacks vaporized T\this year and will be miniscule next year, with companies whose earnings have been crushed by the pandemic not participating. The ban on bank share buybacks imposed by the Fed continues. This has been the largest portion of net stock buying for the past decade. The good news is that foreign investors stepped in as big buyers in 2020, taking the indexes to new highs.

Apple to announce new 5G iPhone this week. The release came a month late, thanks to the pandemic. Scheduled for October 13, the event is called “High Speed”. Apple’s biggest sales quarter in history has just begun. Buy dips in (AAPL).

The Election is Noise and its best to focus on the bull market that has just begun, says JP Morgan. Record fiscal stimulus and quantitative easing in the face of near-zero interest rates create a perfect storm in favor of equities. The best stock to own going into the October 13 Prime Day?

Weekly Jobless Claims edged down to 840,000, still missing 200,000 from California, due to an upgrading computer system. California stopped reporting data so they can rebuild the antiquated computer system of the Employment Development Department, which has been breaking down due to overwhelming demand. Some 26.5 million workers are now claiming unemployment benefits.

Banks are making record trading profits on the back of the US Treasury market where volume has exploded. Even though there has been little net movement in prices in six months, the two-way bets have been enormous. It helps to have a massive home refi boom, incredible QE, and a government that is printing new debt like there’s no tomorrow.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch maintained a new all-time high last week by staying 100% in cash. I was just as grateful for having no positions on the up 600-point days as I was on the down 600-point days. Safe to say that I will be an increasingly more aggressive buyer on ever smaller dips.

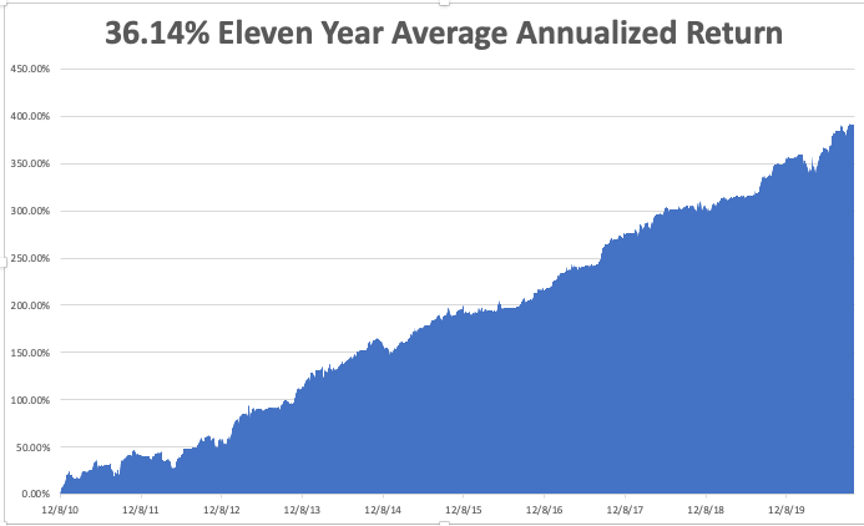

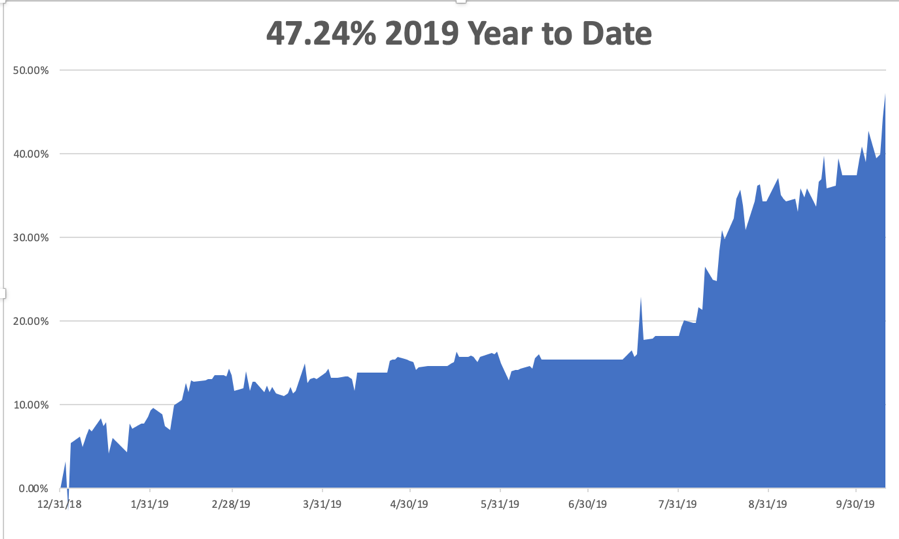

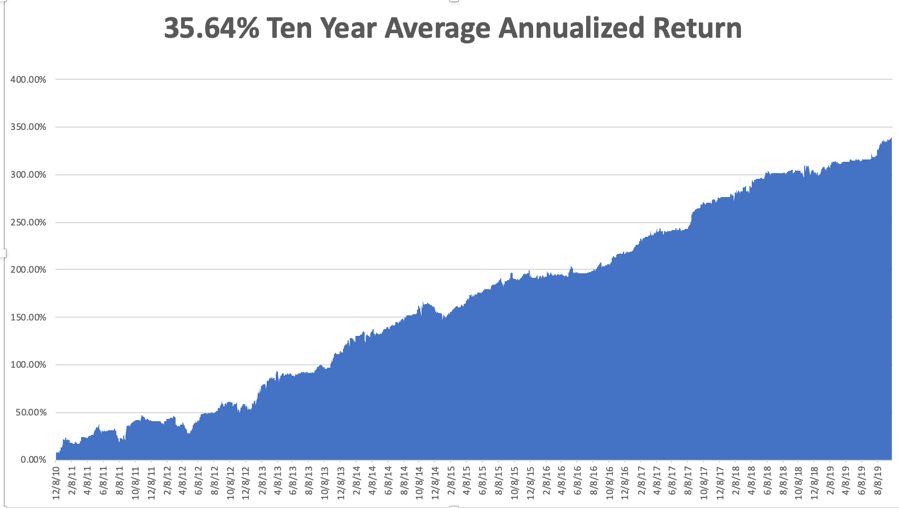

That keeps our 2020 year-to-date performance at a blistering +35.46%, versus a gain of 0.5% for the Dow Average. That takes my eleven-year average annualized performance back to +36.14%. My 11-year total return stood at new all-time high of +391.37%. My trailing one-year return dropped to +44.26%.

The coming week will be a dull one on the data front. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, now at 210,000, which you can find here.

On Monday, October 12 at 8:30 AM EST, the government is closed for Columbus Day so there will be no data releases, even though the stock market is open.

On Tuesday, October 13 at 9:00 AM EST, the US Inflation Rate for September is out.

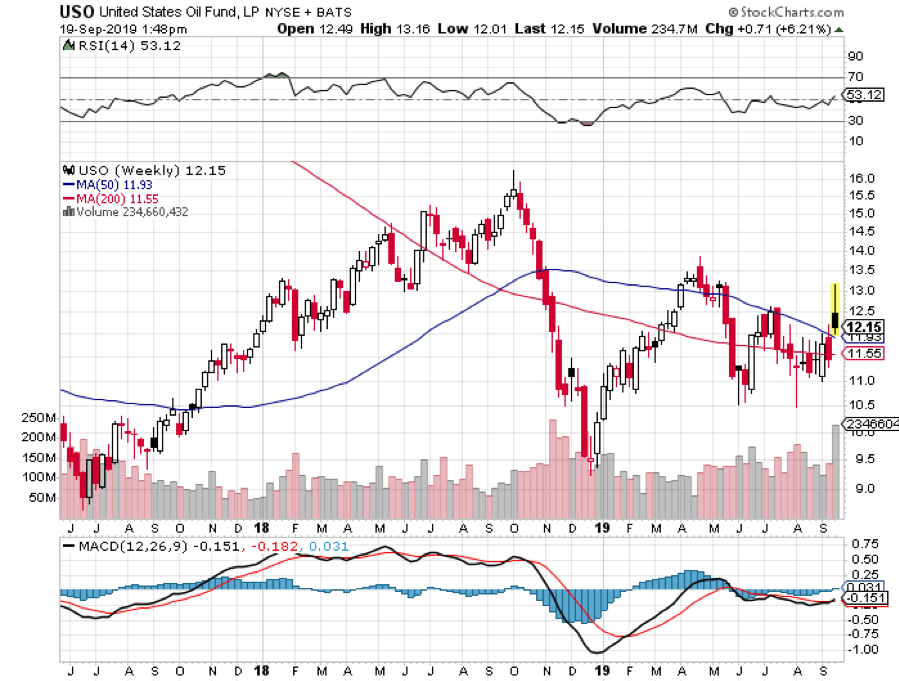

On Wednesday, October 14, at 8:30 AM EST, The Producer Price Index for September is released. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, October 15 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get the Empire State Manufacturing Index.

On Friday, October 16, at 8:30 AM EST, US Retail Sales are printed. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I eventually found the perfect desk on Craigslist Reno. It was from the 1930s and had once occupied the office of the Metropolitan Life Insurance Company of New York, complete with two inkwells.

The company logo was prominently displayed in its wrought iron legs. When the Metropolitan modernized its offices in the 1950s, it sold off its furniture, which has been in circulation in the antique market ever since.

I told the seller, who had just moved from the east coast, of my amazing connection with the company. My Uncle Ed spent three years on a Navy destroyer in the Pacific during WWII. Enlistees in the 1940s were required to take out life insurance policies before they went off to war.

When Ed passed away a few years ago, I went through his papers and what did I find but a life policy from the Metropolitan Life Insurance Company for $1,000.

Ever the history buff, I called the company to find out if the policy was worth anything 70 years later. It turned out to have a cash value of $100,000, which they paid out immediately. I divided the money among my mom’s 20 grandchildren to pay for their college educations. Several now have PhDs. Got to love that compounding of interest.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader