Below please find subscribers' Q&A for the Mad Hedge Fund Trader August 8 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: What should I do about my (SPY) $290-295 put spread?

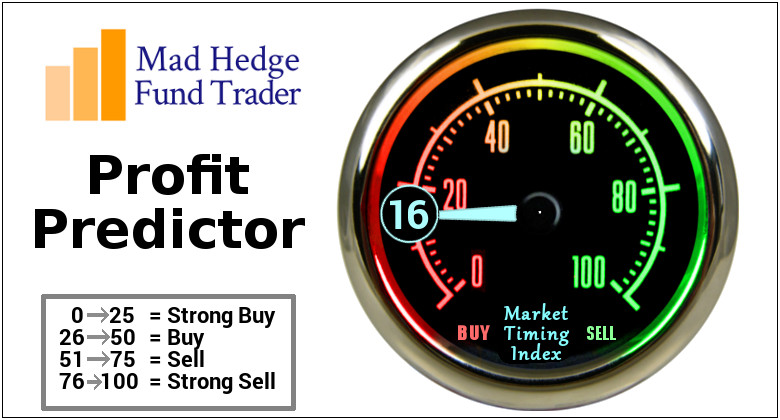

A: That is fairly close to the money, so it is a high-risk trade. If you feel like carrying a lot of risk, keep it. If you want to sleep better at night, I would get out on the next dip. The market has 100 reasons to go down and two to go up, the possible end of trade wars and continuing excess global liquidity, and the market is focusing on the two for now.

Q: What are your thoughts on the ProShares Ultra Short Treasury Bond Fund (TBT)?

A: Short term, it's a sell. Long term it's a buy. It's possible we could get a breakout in the bond market here, at the 3% yield level. If that happens, you could get another five points quickly in the TBT. J.P. Morgan's Jamie Diamond thinks we could hit a 5% yield in a year. I think that's high but we are definitely headed in that direction.

Q: What are your thoughts on the India ETF (PIN)?

A: It goes higher. It's been the best-performing emerging market, and a major hedge fund long for the last five years. The basic story is that India is the next China. Indicia is the next big infrastructure build-out. Once India gets regulatory issues out of the way, look for more continued performance.

Q: What are your thoughts on Intuitive Surgical (ISRG)?

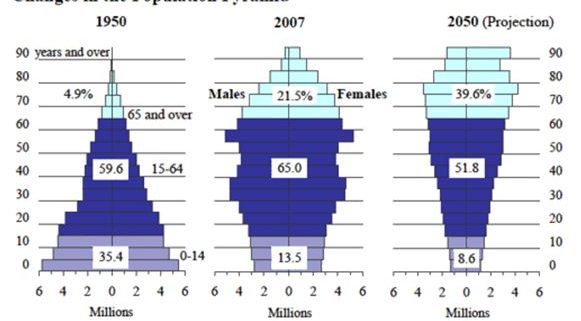

A: Intuitive is a kind of microcosm in the market right now. It's trading well above a significant support level, which happens to be $508. I don't typically like Intuitive Surgical stock because the options are very inefficient, and therefore very pricey. I think, at this point, there is a bigger possibility of it breaking down than continuing to head higher. In other words, it's overbought. Buy long term, the sector has a giant tailwind behind it with 80 million retiring baby boomers.

Q: What are your thoughts on the entire chip sector, including Micron (MU), Lam Research (LRCX) and NVIDIA (NVDA)?

A: NVIDIA is the top of the value chain in the entire sector, and it looks like it wants to break to a new high. My target is $300 by the end of the year, from the current $240s. I think the same will happen with Lam Research (LRCX), which just had a massive rally. All three of these have major China businesses; China buys 80% of its chips from the U.S. You can do these in order in the value chain; the lowest value-added company is Micron, followed by Lam Research, followed by NVIDIA, and the performance reflects all of that. So, I think until we get out of the trade wars, Micron will be mired down here. Once it ends, look for it to get a very sharp upside move. Lam is already starting to make its move and so is NVIDIA. Long term, Lam and NVIDIA have doubles in them, so it's not a bad place to buy right here.

Q: You once recommended the Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ) which is now down 10%, one of your few misses. Keep or sell?

A: Keep. It's had the same correction as the rest of Technology. All corrections in Technology are short term in nature--the long-term bull story is still there. (BOTZ) is a huge play on artificial intelligence and automation, so that is going to be with us for a long time, it's just enduring a temporary short-term correction right now, and I would keep it.

Q: What do you have to say about the CRISPR stocks like Editas Medicine Inc. (EDIT)?

A: The whole sector got slammed by a single report that said CRISPR causes cancer, which is complete nonsense. So, I would use this sell-off to increase your current positions. I certainly wouldn't be selling down here.

Q: What could soften the strong dollar?

A: Only one thing: a recession in the U.S. and an end to the interest-raising cycle, which is at least a year off, maybe two. Keep buying the U.S. dollar and selling the currencies (FXE), (FXY), (FXA) until then.

Q: What are your thoughts on Baidu and Alibaba?

A: I thought China tech would get dragged down by the trade wars, but they behaved just as well as our tech companies, so I'd be buying them on dips here. Again, if we do win the trade wars, these Chinese tech companies could rocket. The fundamental stories for all of them is fantastic anyway, so it's a good long-term hold.

Q: Have you looked at Companhia Vale do Rio Doce (VALE)? (A major iron ore producer)

A: No, I've kind of ignored commodities all this year, because it's such a terrible place to be. If we had a red-hot economy, globally you would want to own commodities, but as long as the recovery now is limited to only the U.S., it's not enough to keep the commodity space going. So, I would take your profits up here.

Q: With Tesla (TSLA) up $100 in two weeks should I sell?

A: Absolute. If the $420 buyout goes through you have $40 of upside. If it doesn't, you have $140 of downside. It's a risk/reward that drives like a Ford Pinto.

Q: How long will it take global QE (quantitative easing) to unwind?

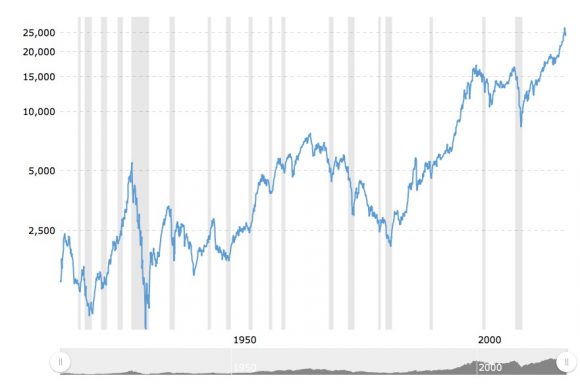

A: At least 10 years. While we ended our QE four years ago, Europe and Japan are still continuing theirs. That's why stocks keep going up and bonds won't go down. There is too much cash in the world to sell anything.

Q: Apple (AAPL)won the race to be the first $1 trillion company. Who will win the race to be the first $2 trillion company?

A: No doubt it is will be Amazon (AMZN). It has a half dozen major sectors that are growing gangbusters, like Amazon Web Services. Food and health care are big targets going forward. They could also buy one of the big ticket selling companies to get into that business, like Ticketmaster.

Good Luck and Good trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader