Global Market Comments

January 17, 2019

Fiat Lux

Featured Trade:

(WHAT HAPPENED TO THE DOW?)

($INDU), (EK), (S), (BS), (CVX), (DD), (MMM),

(FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Global Market Comments

January 17, 2019

Fiat Lux

Featured Trade:

(WHAT HAPPENED TO THE DOW?)

($INDU), (EK), (S), (BS), (CVX), (DD), (MMM),

(FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Last week saw the sharpest move up in stock prices in seven years. Why doesn’t it feel like it? Maybe it’s because we are all recovering losses instead of posting new profits. The mind has a funny way of working like that.

In fact, 2018 may go down as the year that EVERYTHING went down. Stocks (SPY), bonds (TLT), commodities (COPX), precious metals (GLD), foreign currencies (FXE), emerging markets (EEM), oil (USO), real estate (IYR), vintage cars, fine art, and even my neighbor’s beanie baby collection were all posting negative numbers as of a week ago.

In fact, Deutsche Bank tracks 100 global indexes and 88 of them were posting losses on the year. The normal average in any one year is 27. This is why hedge fund are having their worst year in history (except for this one). When your longs AND your shorts plunge in unison, there is nary a dime to be had. Even gold, the ultimate flight to safety asset has failed to perform.

Theoretically, this is supposed to be impossible. When stocks go down, bonds are supposed to go up and visa versa. So are emerging markets and all other hard assets.

This only happens in one set of circumstances and that is when global liquidity is shrinking. There is just not enough free cash around to support everything. So, the price of everything goes down.

The reason most of you don’t recognize this is that last time this happened was in 1980 when most of you were still a gleam in your father’s eye.

If you don’t believe me check, out the chart below from the Federal Reserve Bank of St. Louis. It shows that after peaking in July 2014, the Adjusted Monetary Base has been going nowhere and recently started to decline precipitously.

This was exactly three months before the Federal Reserve ended the aggressive, expansionary monetary policy known as quantitative easing.

The rot started in commodities and spread to precious metals, agricultural prices, bonds, and real estate. In October, it spread to global equities as well. Beanie babies were the last to go.

Want some bad news? Shrinking global liquidity, which is now accelerating, is a major reason why I have been calling for a recession and bear market in 2019 all year.

They say imitation is the sincerest form of flattery. Perhaps that is why 2019 recession calls are lately multiplying like rabbits. Nothing like closing the barn door after the horses have bolted. I wish you told me this in September.

Disturbing economic data is everywhere if only people looked. The S&P Case-Shiller Home Price Index rate of price rise hit an 18-month low at 5.5%. With housing in free fall nationally further serious price declines are to come. With mortgage rates up a full point in a year and affordability at a decade low, who’s surprised?

General Motors (GM) closed 3 plants and laid off 15,000 workers, as trade wars wreak havoc on old-line industries. It looks like Millennials would rather ride their scooters than buy new cars.

Weekly Jobless Claims soared 10,000, to 234,000, a new five-month high. Not what stock owners want to hear. THE JOBS MIRACLE IS FADING!

October New Home Sales were a complete disaster, down a stunning 8.9% and off 12% YOY. These are the worst numbers since the 2009 housing crash. I told you not to buy homebuilders! They can’t give them away now!

Oil plunged again, off 20% in November alone. Is this punishment for Saudi Arabia chopping up a journalist or is the world headed into recession?

It seems we don’t have quiet weeks anymore. Normally, sedentary Jay Powell ripped it up with a few choice words at the New York Economic Club.

By saying that we are close to a neutral rate, the Fed Governor implied that there will be one more rate rise in December and then NO MORE. Happy president. But the historical neutral range is 3.5%-4.5%, meaning there is room for 2-6 X 25 basis point rate hikes to keep the bond vigilantes at pay. Such a card! Thread that needle!

Cyber Monday sales hit a new all-time high, up to $7.3 billion, with Amazon (AMZN) taking far and away the largest share. The stock is now up $300 from its November $1,400 low.

Salesforce, a Mad Hedge favorite, announced blockbuster earnings and was rewarded with a ballistic move upwards in the shorts. Fortunately, the Mad Hedge Technology Letter was long.

The Mad Hedge Alert Service managed to pull victory from the jaws of defeat in November with a last-minute comeback. Add October and November together and we limited out losses to 0.59% for the entire crash.

This was a period when NASDAQ fell a heart-stopping 17% and lead stocks fell as much as 60%. Most investors will take that all day long. I bet you will too. Down markets is when you define the quality of a trader, not up ones, when anyone can make a buck.

My year to date return recovered to +27.80%, boosting my trailing one-year return back up to 31.56%. November finished at a near-miraculous -1.83%. That second leg down in the NASDAQ really hurt and was a once in 18-year event. And this is against a Dow Average that is up a pitiful +2.9% so far in 2018.

My nine-year return recovered to +304.27. The average annualized return revived to +33.80.

The upcoming week is all about jobs reports, and on Friday with the big one.

Monday, December 3 at 10:00 EST, the November ISM Manufacturing Index is published. All hell will break loose at the opening as the market discounts the outcome of the Buenos Aires G-20 Summit.

On Tuesday, December 4, November Auto Vehicle Sales are released.

On Wednesday, December 5 at 8:15 AM EST, the November ADP Private Employment Report is out.

At 10:30 AM EST the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, December 6 at 8:30 AM EST, we get the usual Weekly Jobless Claims. At 10:00 AM we learned the November ISM Nonmanufacturing Index.

On Friday, December 7, at 8:30 AM EST, the November Nonfarm Payroll Report is printed.

The Baker-Hughes Rig Count follows at 1:00 PM. At some point, we will get an announcement from the G-20 Summit of advanced industrial nations.

As for me, I’ll be driving my brand new Tesla Model X P100D which I picked up from the factory yesterday. I’ll be zooming up and down the hills and dales of the mountains around San Francisco this weekend.

I’ll also be putting to test the “ludicrous mode” to see if it really can go from zero to 60 in 2.9 seconds and give passengers motion sickness. I will go well equipped with air sickness bags which I lifted off of my latest Virgin Atlantic flight.

Talley Ho!

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 17, 2018

Fiat Lux

Featured Trade:

(WHO WAS THE GREATEST WEALTH CREATOR IN HISTORY?)

(FB), (AAPL), (GOOG), (AMZN),

(XOM), (BRKY), (T), (GM), (VZ), (CCA),

(WHY DOCTORS MAKE TERRIBLE TRADERS?)

Global Market Comments

October 10, 2018

Fiat Lux

SPECIAL TESLA ISSUE

Featured Trade:

(OCTOBER 14 SAVANNAH GEORGIA STRATEGY BREAKFAST),

(THE BULL CASE FOR TESLA),

(TSLA), (GM), (F)

Talk about a bad news factory.

A short interest of 26% in Tesla (TSLA) stock has the tendency to manufacture bad news on a daily basis, whether it is true or not. It really has been a black swan a day.

This really is the most despised stock in the market. But you have to expect that when you are simultaneously disputing the auto, oil, dealer, and advertising industries, and doing it all union-free.

It also doesn’t help that Tesla is on the Department of Justice speed dial, undergoing no less than three investigations since the advent of the new administration. I can’t imagine why this is happening, given that the White House is now packed with oil industry executives.

That’s why I have been advising investors to buy the car and not the stock.

That is until now.

The truth is that all of this negativity is generating the best entry point for Tesla shares in two years.

In the meantime, the San Francisco Bay Area has become flooded with new Tesla 3’s. These are suddenly everywhere and soon will outnumber the ubiquitous Toyota Prius, until now the favorite of technology employees.

Q3 production of Tesla 3’s reached an eye-popping 55,840, up from 18,440 the previous quarter, taking Tesla’s total output to 80,000 including the model X.

That puts the company on target to reach 250,000 units in 2019. Tesla may be about to see something it has not witnessed in the company’s 15-year history: a real profit.

When I picked up my first Tesla 1 in 2010, chassis no. 125, I was all alone and treated like I was visiting royalty. The sales staff fawned all over me, offering me free hats, coffee mugs, and other tchotchke. Today, a staggering 200 people a day are gleefully driving their new wheels away from the Fremont factory, and another 200 getting them home-delivered by semis. Take a number and wait in line.

I have pinned down several of these drivers in parking lots, shopping malls, and trailheads to quiz them about their new ride and the answer is always the same. It’s a car from 20 years in the future, the best they have ever driven, and they will never buy another marque again.

Sounds pretty good, doesn’t it?

So I perked up the other day when I heard my old pal, legendary value investor Ron Baron, make the bull case for Tesla.

Ron has never done things by halves. He expects Tesla’s market capitalization to soar from $43 billion today to $1 trillion by 2030, a mere 12 years away. By then, Tesla should be generating $150 billion a year in profits. That implies that a 23-fold increase in the share price to $5,570 is ahead of us.

Half of this will be generated by the auto sales, while the other half will be produced by a burgeoning battery business. Tesla will easily become the largest auto manufacturer in the world within a few years.

Tesla will sell 10-15 million cars a year by 2030, compared to the current 300,000 annual rate.

It already is the one American auto maker with the highest US parts content, nearly 100%. It has also been one of the largest creators of new jobs over the past decade, right behind Amazon (AMZN), at some 46,000.

It’s really all about the math. Today, Tesla is building its Tesla 3’s at a cost of $28,000 apiece and selling them for $62,000. That’s the high price they have been realizing with extra options like four-wheel drive, 300-mile extended range batteries, painted wheels, and all the other bells and whistles. That gives you a $34,000 profit per vehicle.

Tesla’s “cheap” cars, the stripped-down rear wheel drive Tesla 3’s that will sell for a modest but world-beating $35,000 won’t be available until early 2019.

At this rate, the entire company will become profitable when it hits a production rate of 10,000 units a week compared to the current 6,000 units. They should achieve that sometime in early 2019.

Much has been made of drone video footage showing vast parking lots in Fremont, CA chock-a-block with shiny new Tesla 3’s. This creates a false sense of poor sales.

The actual fact is that Tesla has no dealer network. All of those parked cars have been sold and are awaiting owners to pick them up. The months it takes from payment to actual delivery gives Tesla a free float on billions of dollars. That’s worth a lot in a world of steadily rising interest rates.

Oh, and those notorious tents? They could withstand a category 5 hurricane. However, like everything else the company does, they’re revolutionary. They enable bypassed permitting procedures and can be built very quickly and cheaply.

How are things going with the competition? Not so good. The traditional internal combustion car industry has hundreds of billions of dollars tied up in engine factories that will eventually become worthless. They really are the 21st century equivalent of buggy whip makers.

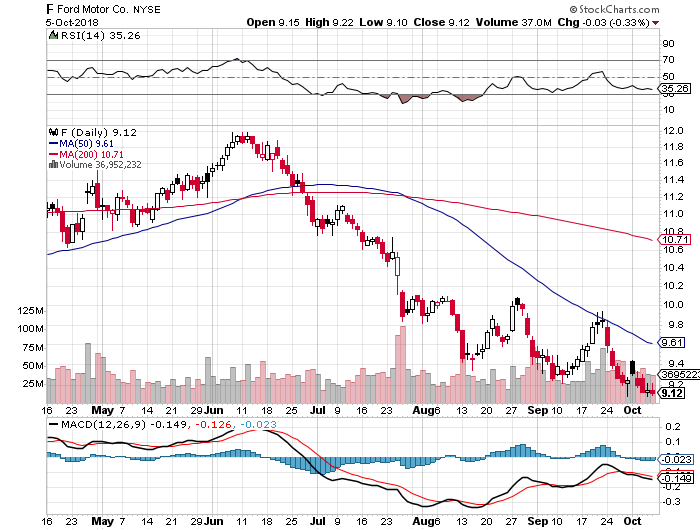

General Motors (GM), Ford (F), and Chrysler are executing slow motion roll out of electric cars in order to squeeze a few more years of use out of these legacy plants. Electric cars don’t use engines. That is putting them ever further behind.

This is what the poor share performance of auto shares has been screaming at you all year despite one of the strongest economies and stock markets in history. Yes, “peak Auto” is at hand.

The high-end brands like Mercedes, BMW, Audi, and Porsche that just entered the all-electric market are a decade behind Tesla in autonomous software and manufacturing processes. They all have huge, expensive dealer networks.

Let’s see how sales go after they suffer their first fatal crash. In the meantime, Tesla has run up 200 million miles worth of driving data.

Factory insiders say a speed-up of new Tesla orders is in the works. Orders placed before December 31, 2018 are entitled to a $7,500 federal tax credit. That drops to $3,750 in the first half of 2019, only $1,750 in the second half, and zero in 2020.

In the meantime, the oil industry is still collecting $55 billion a year of federal oil depletion allowances. Go figure.

At the same time, many states like California, far and away Tesla’s largest market (Texas is no. 2), are either maintaining or expanding their own electric car subsidies or gas guzzler penalties. It is $2,500 per car in California.

Ron Baron is not alone in his admiration of Tesla. Macquarie Research has just initiated coverage with a strong “BUY” and a target of $430 a share, up 70% from today’s close.

Next in the works will be a Tesla Model Y, a small four-wheel drive based on the Tesla 3 chassis. A Roadster relaunch comes next in 2022, a $250,000 super car that will be doubtless aimed at Arab sheiks and billionaire car collectors.

By then the entire product line will spell SEXY. See! Elon Musk does have a sense of humor after all!

Global Market Comments

October 8, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or GET ME OFF THIS ROLLER COASTER),

(THE INCREDIBLE FUTURE OF THE AUTOMOBILE),

(TSLA), (GM), (F), (TM)

It was the kind of dinner invitation I couldn’t turn down. What I learned was amazing.

I usually prefer to spend my evenings at home catching up on my research, calling customers, and plotting my next great Trade Alert.

So, it takes a lot to get me out of my cozy digs, especially given the recent incredible sunsets we have been getting.

Attending would be senior executives from Tesla (TSLA), General Motors (GM), and engineering professor from the University of California at Berkeley, and the California Air Resources Board.

With US car stocks going ballistic lately, I thought the event would be timely.

The dinner was hosted by a retired billionaire from Microsoft at the top of the Mark Hopkins Hotel in San Francisco.

The topic for discussion would be the very long-term future of the car industry.

I get invited to these things because the guests want to know how their views would fit in within a long-term global geopolitical/economic context, my own particular specialty.

I didn’t want to cramp anyone’s style so I kept my notebook under the table and scribbled away blindly, and illegibly. There’s no particular story line here.

I’ll just give you my random thoughts.

(GM) launched its second-generation Chevy Volt in 2015, and the customer response has been fantastic. The company is building a new $400 million battery plant on the east coast to help meet demand.

Some 60% of the buyers are coming from other automakers. It is fast becoming the new face of Chevy, like the Corvette Stingray and Camaro of years past.

The future is in a 200-mile range $30,000 car, and the Volt is that car, followed by the recently launched all electric Bolt.

Customers want to get away from oil and will only buy the products that accomplish that, be they hybrids or all electric.

He also mentioned that GM is launching an electric bike, which is already widespread in Europe. Not a big needle mover there.

The Tesla guy then proceeded to jump all over him, saying the Volt was “green washing” as usual, since it represents only a tiny fraction of the company’s sales.

GM had a vested interest in promoting the internal combustion engine, in which it had made a century long investment.

Its real focus can be seen in the giant new Suburban factory it was now building in Texas.

Mr. Tesla had driven from the south Bay with his S-1 entirely on autopilot.

The hardware has already been pre-installed in every S-1 produced since 2014, and all that is needed to make them self-driving is to execute a wireless overnight software upgrade.

What is truly amazing is that each car will have a learning program unique to the vehicle. If it misses a hard turn the first time, it will remember that turn and then make it perfectly every time from then on.

The Tesla person said that with the new Gigafactory the company will be on schedule for a tenfold ramp up in car production by 2020.

The $35,000 Tesla 3 that will make this possible will be offered in two wheel and four wheel drive variations. That will take them from 92,000 units a year to 500,000. Q3 2018 Production has already reached 53,000.

I asked him if this means that if your wife suspects you of cheating, will your Tesla rat you out. He answered, “Only if she is a coder.”

Then I wondered what would stop Tesla from selling your driving habits to marketers who would then make special offers from stores you prefer.

A previous Tesla experiment landed me a pair of Seven for All Mankind designer jeans for half off.

Tesla outsells every other luxury car of its class, including the Mercedes S class, the BMW Series 7, and the Audi 8.

Among the US car industry, only Ford and Tesla have never filed for bankruptcy. Tesla is the first new car manufacturer to succeed since Chrysler made its debut in 1928.

I asked about the S-1 maximum single charge range achieved by a driver.

An enthusiast in Norway managed to take one 800 miles on a flat track with no wind and perfect conditions. Wow! My drive from Lake Tahoe record of 400 miles doesn’t come close, and that involved a 7,000 foot decline from the High Sierra crest.

I also enquired about the Cambridge University battery breakthrough (click here for “Battery Breakthrough Promises Big Dividends.”

He said he was aware of it, but that it takes a long time to get a technology from the bench to the marketplace.

Just with their own in-house tinkering, Tesla is boosting battery ranges by 3-5% a year. The current S-1 gets a 305-mile range, compared to my four-year-old 255-mile range.

The Berkeley professor made some interesting observations about Millennials.

He said that while 75% of baby boomers got drivers licenses at 16, and 70% of Generation Xer’s did so by then, only 55% of Millennials took to the road at that age.

The rule of thumb for anything regarding Millennials is that they do everything late.

The gentleman from the Air Resources Board brought out some interesting facts.

More than 80% of all cancer-causing chemicals entering the atmosphere come from diesel engines, so a major effort will be made to cut back emissions from commercial trucks.

Look for the electric fleet coming to a neighborhood near you. Goodbye Volkswagen!

Workplace charging of employee cars will be the next big growth area for charging stations.

Half of all greenhouse gases derive from the burning of oil. The biggest savings in greenhouse gas emissions will come from a clampdown on the refining industry.

Think Koch Brothers.

I was amazed at his commitment to meet California’s goal of obtaining 50% of its energy from alternative sources by 2030.

The oil industry managed to exempt gasoline from the legislation, SB 350. But Governor Jerry Brown put it back in through an executive order.

The state is paying for the initial build-out of hydrogen refueling stations for the new $57,500 Toyota Mirai. A single tank will take the fuel cell vehicle 312 miles.

The state is making major investments in biofuel, planning to obtain 10% of the 50% target from this source.

During a slow moment, I asked a bleach blond trophy girlfriend sitting next to me of her interest in electric cars, expecting the worst.

To my surprise, she said that last summer, she drove an electric bike from New York to Los Angeles, towing a trailer with a solar panel cut in half to provide power.

The southern route avoided the high mountain ranges. I noticed she seemed unusually tanned, and it wasn’t from a can.

I was humbled. For once, I knew less about electric cars than anyone else in the room.

After the dinner, I went up to the Tesla executive and told him “Job well done.” I used to own one of the oldest S-1’s, number 125 off the assembly line, until it was totaled by a drunk driver on Christmas Eve.

I even tested to their safety claims.

Thank you, Tesla! You saved my life!

Mad Hedge Technology Letter

October 4, 2018

Fiat Lux

Featured Trade:

(HOW SOFTBANK IS TAKING OVER THE US VENTURE CAPITAL BUSINESS),

(SFTBY), (BABA), (GRUB), (WMT), (GM), (GS)

One of the few people who can magnify pressure on the venture capitalists of Silicon Valley is none other than Masayoshi Son.

What a ride it has been so far. At least for him.

His $100 billion SoftBank Vision Fund has put the Sand Hill Road faithful in a tizzy – utterly revolutionizing an industry and showing who the true power broker is in Silicon Valley.

He has even gone so far as doubling down his prospects by claiming that he will raise a $100 billion fund every few years and spend $50 billion per year.

This capital logically would flow into what he knows best – technology and the best technology money can buy.

As Yahoo Japan and Alibaba (BABA) shares have floundered, SoftBank’s stock has decoupled from the duo displaying explosive brawn.

SoftBank’s stock is up 30% in the past few months and I can tell you it’s not because of his Japanese telecommunications business which has served him well until now as his cash cow.

Yahoo Japan, in which SoftBank owns a 48.17% stake, has existing synergies with SoftBank’s Japanese business, but has experienced a tumble in share price as Son turns his laser-like focus to his epic Vision Fund.

His tech investments are bearing fruit and not only that, Son revealed his Alibaba investment is about to clean up shop to the tune of $11.7 billion next year shooting SoftBank shares into orbit.

A good portion of the lucrative windfall will arrive from derivatives connected to the sale of Alibaba, and the other 60% comes from the paper profits finally realized in this shrewd piece of business.

Equally paramount, SoftBank’s Vision Fund hauled in $2.13 billion in operating profits from the April-June quarter underscoring the effectiveness of Masayoshi Son’s tech ardor.

Son said it best of the performance of the Vision Fund saying, “Results have actually been too good.”

So good that after this June, Son changed his schedule to spend 3% of his time on his telecom business down from 97% before June.

His telecommunications business in Japan has turned into a footnote.

It was the first quarter that Son’s tech investments eclipsed his legacy communications company.

Son vies to rinse and repeat this strategy to the horror of other venture capitalists.

The bottomless pit of capital he brings to the table predictably raises the prices for everyone in the tech investment world.

Son’s capital warfare strategy revolves around one main trope – Artificial Intelligence.

He also strictly selects industry leaders which have a high chance of dominating their field of expertise.

Geographically speaking, the fund has pinpointed America and China as the best sources of companies. India takes in the bronze medal.

Unsurprisingly, these two heavyweights are the unequivocal leaders in artificial intelligence spearheading this movement with the utmost zeal.

His eyes have been squarely set on Silicon Valley for quite some time and his record speaks for himself scooping up stakes in power players such as Uber, WeWork, Slack, and GM (GM) Cruise.

Other stakes in Chinese firms he’s picked up are China’s Uber Didi Chuxing, China’s GrubHub (GRUB) Ele.me and the first digital insurer in China named Zhongan International costing him $500 million.

Other notable deals done are its sale of Flipkart to Walmart (WMT) for $4 billion giving SoftBank a $1.5 billion or 60% profit on the $2.5 billion position.

In 2016, the entire venture capitalist industry registered $75.3 billion in capital allocation according to the National Venture Capital Association.

This one company is rivalling that same spending power by itself.

Its smallest deal isn’t even small at $100 million, baffling the local players forcing them to scurry back to the drawing board.

The reverberation has been intense and far-reaching in Silicon Valley with former stalwarts such as Kleiner Perkins Caufield & Byers breaking up, outmaneuvered by this fresh newcomer with unlimited capital.

Let me remind you that it was considered standard to cautiously wade into investment with several millions.

Venture capitalists would take stock of the progress and reassess if they wanted to delve in some more.

There was no bazooka strategy then.

SoftBank has thrown this tactic out the window by offering aspiring firms showing promise boatloads of capital up front even overpaying in some cases.

Conveniently, Son stations himself nearby at a nine-acre estate in Woodside, California complete with an Italianate mansion he bought for $117.5 million in 2012.

It was one of the most expensive properties ever purchased in the state of California even topping Hostess Brands owner Daren Metropoulos, who bought the Playboy Mansion from Hugh Hefner in 2016 for $100 million.

If you think Son is posh – he is not. He only fits himself out in the Japanese budget clothing brand Uniqlo. He just needed a comfortable place to stay and he hates hotels.

In August, SoftBank decided to top off the $4.4 billion investment in WeWork, an American office space-share company, with another $1 billion leading Son to proclaim that WeWork would be his “next Alibaba.”

Son continued to say that WeWork is “something completely new that uses technology to build and network communities.”

The rise of remote workers is taking the world by storm and this bet clearly follows this trend.

The unlimited coffee and beer found in the new Japanese Roppongi WeWork office that opened earlier this year was a nice touch.

WeWork plans to open 10-12 offices in Japan by the end of 2018.

Thus far, WeWork is operating in over 300 locations in over 20 countries.

Revenue is growing rapidly with the $900 million in 2017 a 12-fold improvement from 2014.

The newest addition to SoftBank’s dazzling array of unicorns is Bytedance, a start-up whose algorithms have fueled news-stream app Jinri Toutiao’s meteoric rise in China.

The deal values the company at $75 billion.

It also runs video sharing app Douyin, and overseas version TikTok.

Bytedance’s proprietary algorithm, serving to personalize streams for users, is the best in China.

They have been able to insulate themselves from local industry giants Tencent and Alibaba.

TikTok has piled up over 500 million users and brilliant investment like these is why Son revealed that the Vision Fund’s annual rate of return has been 44%.

SoftBank’s ceaseless ambition has them in the news again with whispers of investing in a Chinese online education space with a company called Zuoyebang.

China’s online education market is massive. In 2017, this industry pulled down over $33 billion in revenue, and 2018 is poised to break $55 billion.

Zuoyebang has lured in Goldman Sach’s (GS) as an investor.

This platform allows users to upload homework questions for third party assistance – the name of the app literally translates into “homework help.”

Cherry-picking off the top of the heap from the best artificial intelligence companies in the world is the secret recipe to outperforming your competitors.

At the same time, aggressively throwing money at these companies has effectively frozen out any resemblance of competition. Once the competition is frozen out, the value of these investments explodes, swiftly super-charged by rapidly expanding growth drivers.

How can you compete with a man who is willing to pay $300 million for a dog walking app?

Venture capitalist funds have been scrambling to reload and mimic a Vision Fund-like business of their own, but its not easy raising $100 billion quickly.

This genius strategy has made the founder of SoftBank the most powerful businessman in the world.

Son owns the future and will have the largest say on how the world and economies evolve going forward.

Global Market Comments

September 27, 2018

Fiat Lux

Featured Trade:

(HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING),

(GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY),

(PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY),

(KODK), (SLV), (AAPL),

(TUESDAY, OCTOBER 16, 2018, MIAMI, FL,

GLOBAL STRATEGY LUNCHEON)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.