In recent days, two antitrust suits have arisen from both the Federal government and 49 states seeking to fine, or break up the big four tech companies, Facebook (FB), Apple (AAPL), Amazon (AMZN), and Google (GOOG). Let’s call them the “FAAGs.”

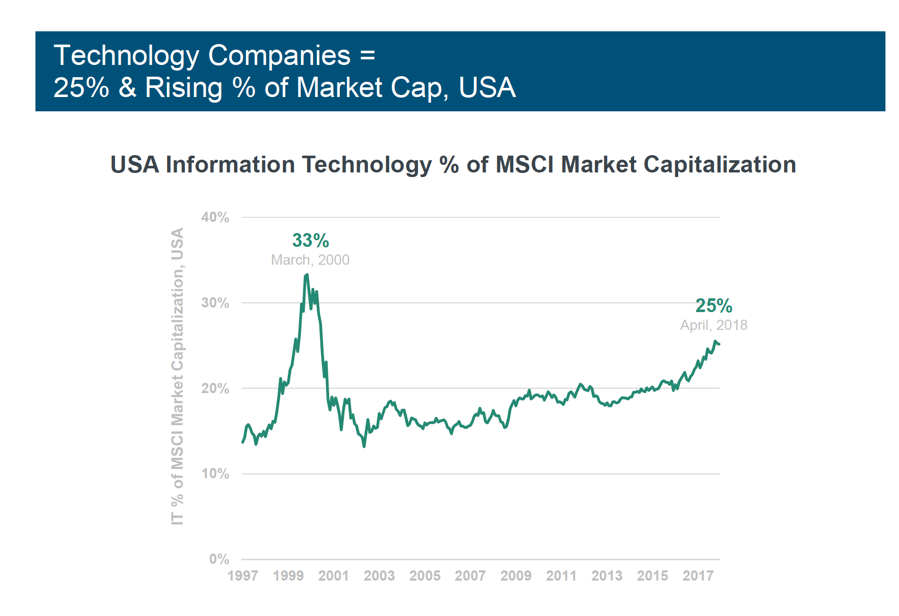

And here is the problem. These four companies make up the largest share of your retirement funds, whether you are invested with active managers, mutual funds, or simple index funds. The FAAGs dominate the landscape in every sense, accounting 13% of the S&P 500 and 33% of NASDAQ.

They are also the world’s most profitable large publicly listed companies with the best big company earnings growth.

I’ll list the antitrust concern individually for each company.

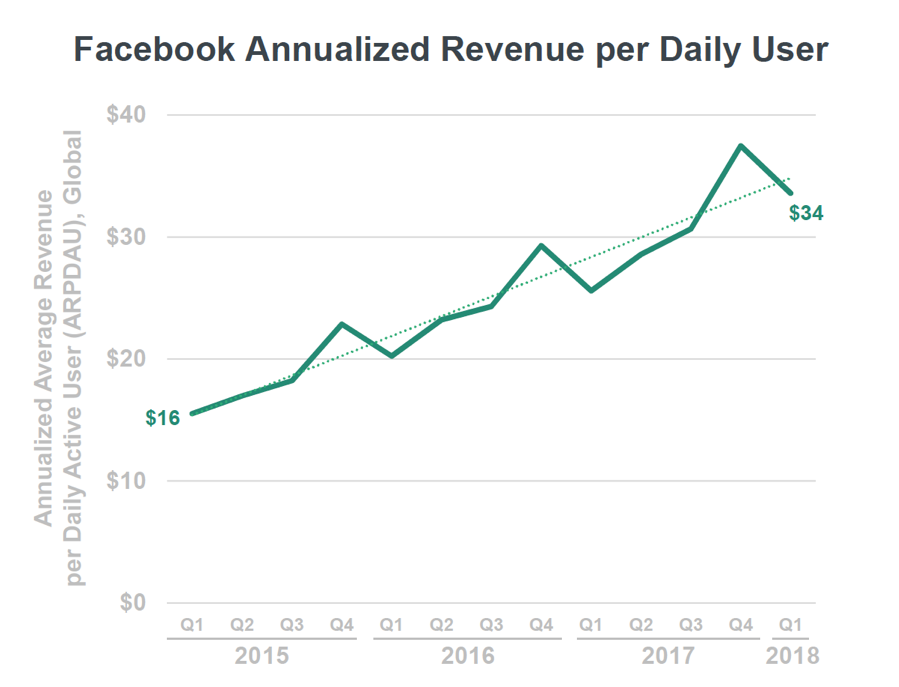

Facebook has been able to maintain its dominance in social media through buying up any potential competitors it thought might rise up to challenge it through a strategy of serial defense acquisitions

In 2012, it bought the photo-sharing application Instagram for a bargain $1 billion and built it into a wildly successful business. It then overpaid a staggering $19 billion for WhatsApp, the free internet phone and texting service that Mad Hedge Fund Trader uses while I travel. It bought Onovo, a mobile data analytics company, for pennies ($120 million) in 2013.

Facebook has bought over 70 companies in 15 years, and the smaller ones we never heard about. These were done largely to absorb large numbers of talented engineers, their nascent business shut down months after acquisition.

Facebook was fined $5 billion by the Fair Trade Commission (FTC) for data misuse and privacy abuses that were used to help elect Donald Trump in 2016.

Apple

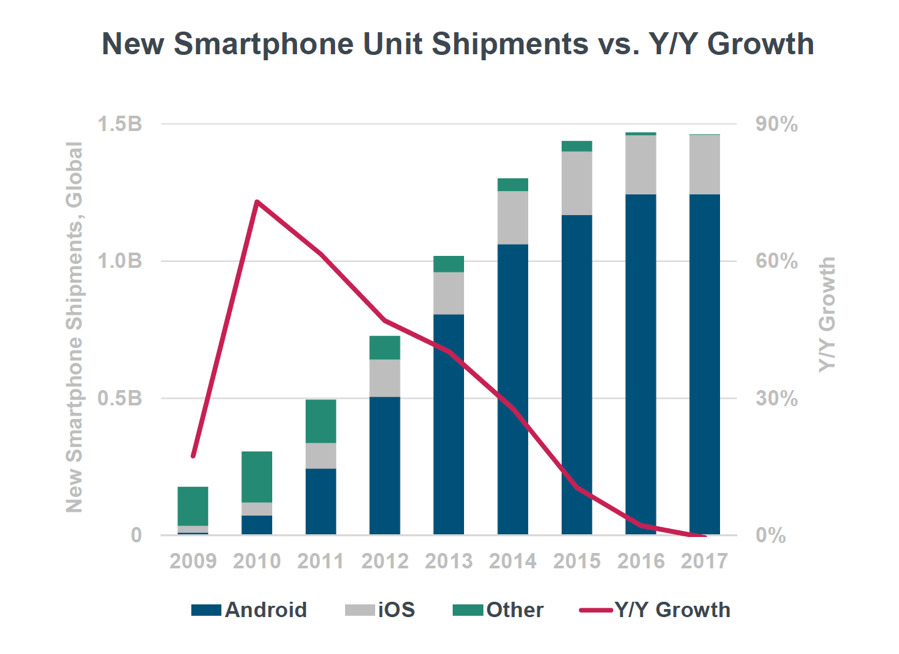

Apple only has a 6% market share in the global smart phone business. Samsung sells nearly 50% more at 9%. So, no antitrust problem here.

The bone of contention with Apple is the App Store, which Steve Jobs created in 2008. The company insists that it has to maintain quality standards. No surprise then that Apple finds the products of many of its fiercest competitors inferior or fraudulent. Apple says nothing could be further from the truth and that it has to compete aggressively with third party apps in its own store. Spotify (SPOT) has already filed complaints in the US and Europe over this issue.

However, Apple is on solid ground here because it has nowhere near a dominant market share in the app business and gives away many of its own apps for free. But good luck trying to use these services with anything but Apple’s own browser, Safari.

It’s still a nonissue because services represent less than 15% of total Apple revenues and the App Store is a far smaller share than that.

Amazon

The big issue is whether Amazon unfairly directs its product searches towards its own products first and competitors second. Do a search for bulk baby diapers and you will reliably get “Mama Bears”, the output of a company that Amazon bought at a fire sale price in 2004. In fact, Amazon now has 170 in-house brands and is currently making a big push into designer apparel.

Here is the weakness in that argument. Keeping customers in-house is currently the business strategy of every large business in America. Go into any Costco and you’ll see an ever-larger portion of products from its own “Kirkland” branch (Kirkland, WA is where the company is headquartered).

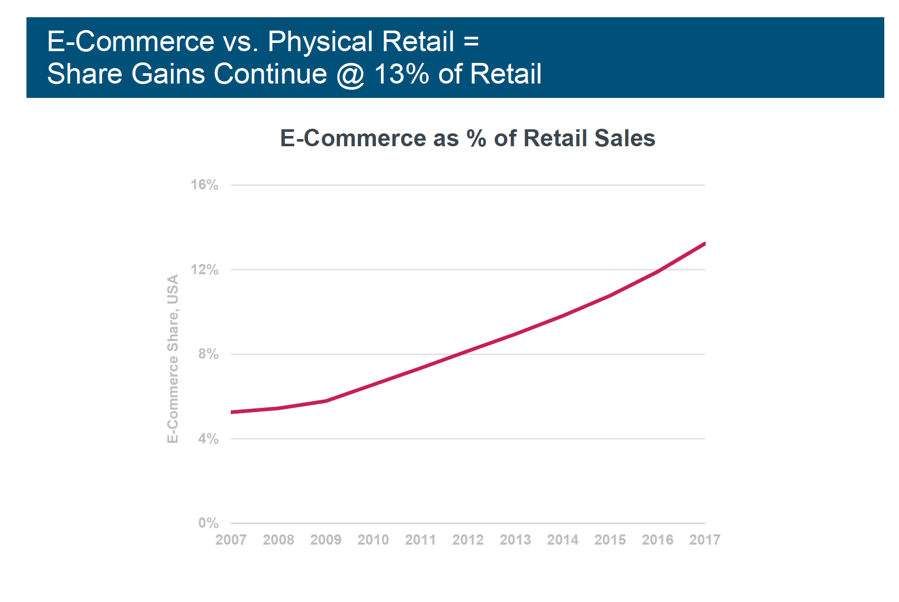

Amazon has a market share of no more than 4% in any single product. It has the lowest price, and often the lowest quality offering. But it does deliver for free to its 100 million Prime members. In 2018, some 58% of sales were made from third-party sellers.

In the end, I believe that Amazon will be broken up, not through any government action, but because it has become too large to manage. I think that will happen when the company value doubles again to $2 trillion, or in about 3-5 years, especially if the company can obtain a rich premium by doing so.

Directed search is also the big deal here. And it really is a monopoly too, with some 92% of the global search. Its big breadwinner is advertising, where it has a still hefty 37% market share. Google also controls 75% of the world’s smart phones with its own Android operating software, another monopoly.

However, any antitrust argument falls apart because its search service is given away to the public for free, as is Android. Unless you are an advertiser, it is highly unlikely that you have ever paid Google a penny for a service that is worth thousands of dollars a year. I myself use Google ten hours a day for nothing but would pay at least that much.

The company has already survived one FTC investigation without penalty, while the European Union tagged it for $2.7 billion in 2017 and another $1.7 billion in 2019, a pittance of total revenues.

The Bottom Line

The stock market tells the whole story here, with FAAG share prices dropping a desultory 1%-2% for a single day on any antitrust development, and then bouncing back the next day.

Clearly, Google is at greatest risk here as it actually does have a monopoly. Perhaps this is why the stock has lagged the others this year. But you can count on whatever the outcome, the company will just design around it as have others in the past.

For start, there is no current law that makes what the FAAGs do illegal. The Sherman Antitrust Act, first written in 1898 and originally envisioned as a union-busting tool, never anticipated anticompetitive monopolies of free services. To apply this to free online services would be a wild stretch.

The current gridlocked congress is unlikely to pass any law of any kind. The earliest they can do so will be in 18 months. But the problems persist in that most congressmen fundamentally don’t understand what these companies do for a living. And even the companies themselves are uncertain about the future.

Even if they passed a law, it would be to regulate yesterday’s business model, not the next one. The FAAGs are evolving so fast that they are really beyond regulation. Artificial intelligence is hyper-accelerating that trend.

It all reminds me of the IBM antitrust case, which started in 1975, which my own mother worked on. It didn’t end until the early 1990s. The government’s beef then was Big Blue’s near-monopoly in mainframe computers. By the time the case ended, IBM had taken over the personal computer market. Legal experts refer to this case as the Justice Department’s Vietnam.

The same thing happened to Microsoft (MSFT) in the 1990s. After ten years, there was a settlement with no net benefit to the consumer. So, the track record of the government attempting to direct the course of technological development through litigation is not great, especially when the lawyers haven’t a clue about what the technology does.

There is also a big “not invented here” effect going on in these cases. It’s easy to sue companies based in other states. Of the 49 states taking action against big tech, California was absent. But California was in the forefront of litigation again for big tobacco (North Carolina), and the Big Three (Detroit).

And the European Community has been far ahead of the US in pursuing tech with assorted actions. Their sum total contribution to the development of technology was the mouse (Sweden) and the World Wide Web (Tim Berners Lee working for CERN in Geneva).

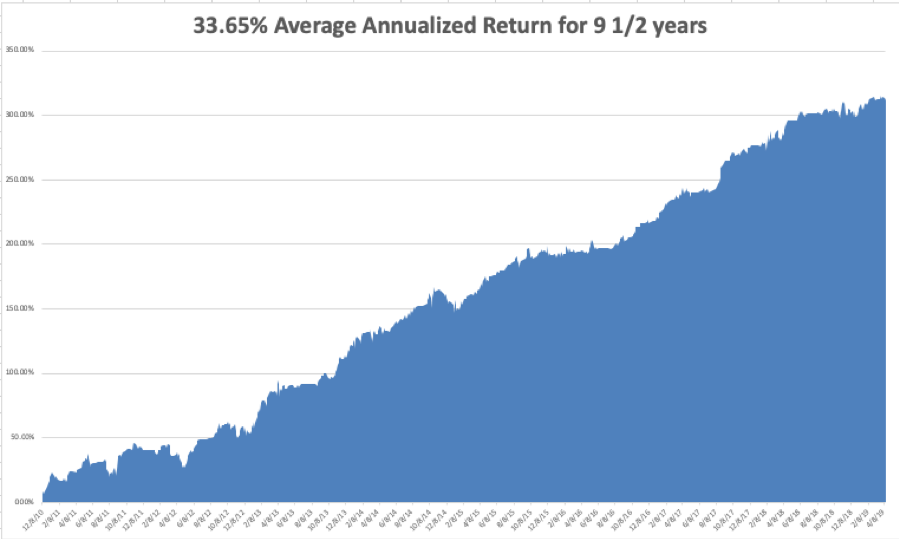

So, I think your investments in FAAGs are safe. No need to start eyeing the nearest McDonald’s for your retirement job yet. Personally, I think the value of the FAAGs will double in five years, as they have over the last five years, recession or not.