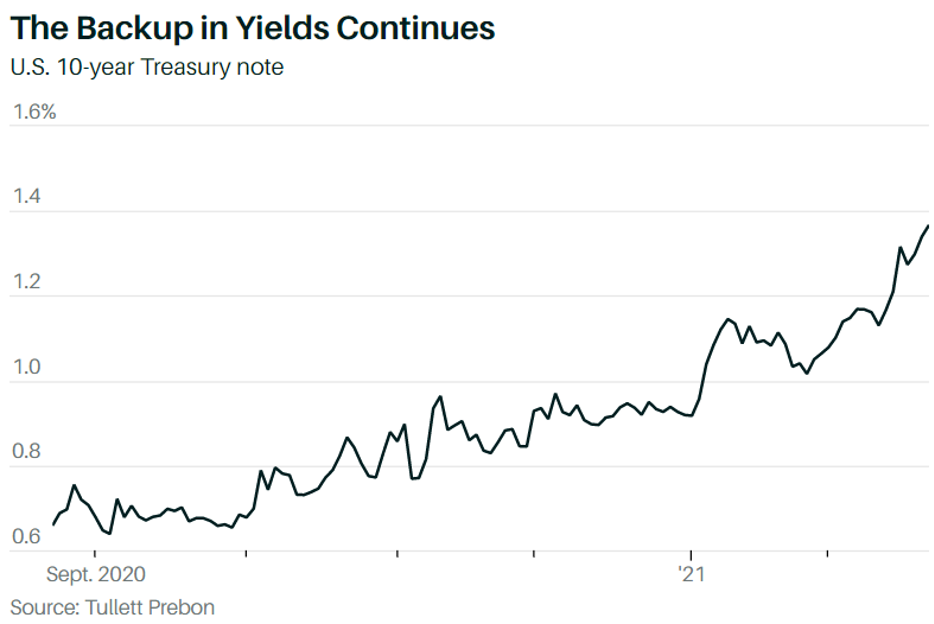

This was the week the stock traders learned there was such a thing as a bond market. They know this because it was bonds that completely demolished their stock trading books.

Suddenly, markets went from zero offered to zero bid. Many strategists labored under the erroneous assumption that ten-year US Treasury yields would never surpass 1.50% in 2021. Yet, here we are only in March and it’s already topped 1.61%. It’s become the one-way trade of the year.

The bond market seems to be discounting an imminent runaway inflation rate. But at a 1.4% annual figure, it's nowhere to be seen, not with 20 million unemployed and Main Streets everywhere looking like ghost towns.

I still believe that technology is evolving so fast, hyper-accelerated by the pandemic, that it will wipe out any return of inflation. I will not believe in inflation until I see the whites of its eyes, to paraphrase Colonel William Prescott at the Battle of Bunker Hill.

Of course, it is I who has been screaming from the rooftops about the coming crash of the bond markets, since March 20. Being short the bond market has been one of my most profitable trades of 2020 AND 2021. If I am annoyed by anything, it happened too fast, depriving me several more round trips a slower crash would have permitted.

When you have to own stocks, make them financials (JPM), (BAC), (C), which benefit from rising rates. Their loan rates are rocketing while their cost of money is fixed at the Fed overnight cost of funds at 0.25%. Trading volumes at the brokers (MS), (GS) are through the roof, especially for options traders.

It is all a perfect money-making machine. At least, the stock market thinks so.

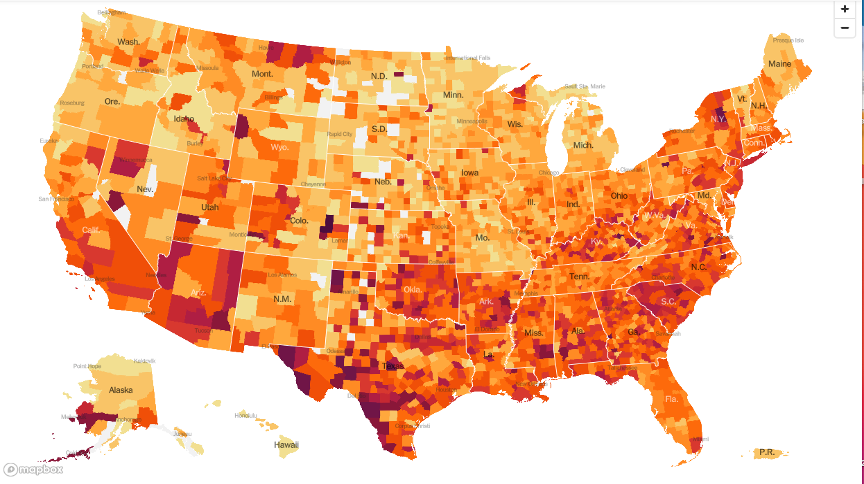

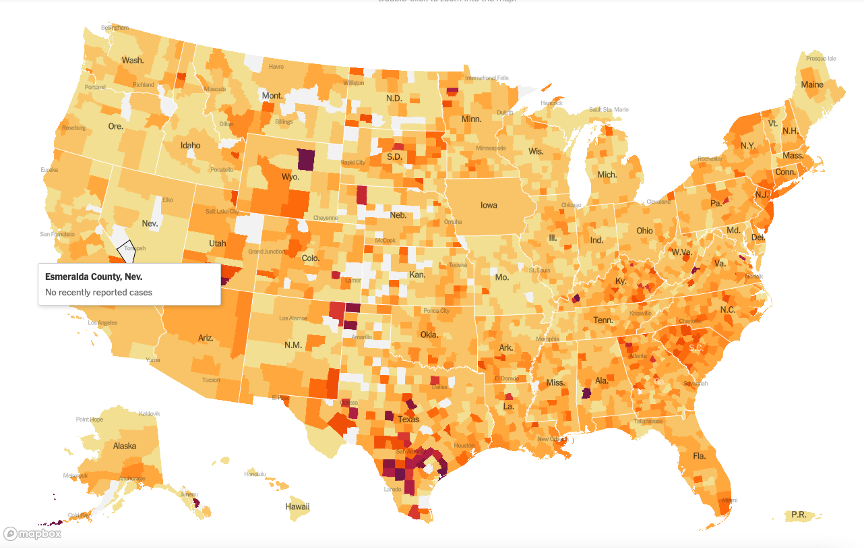

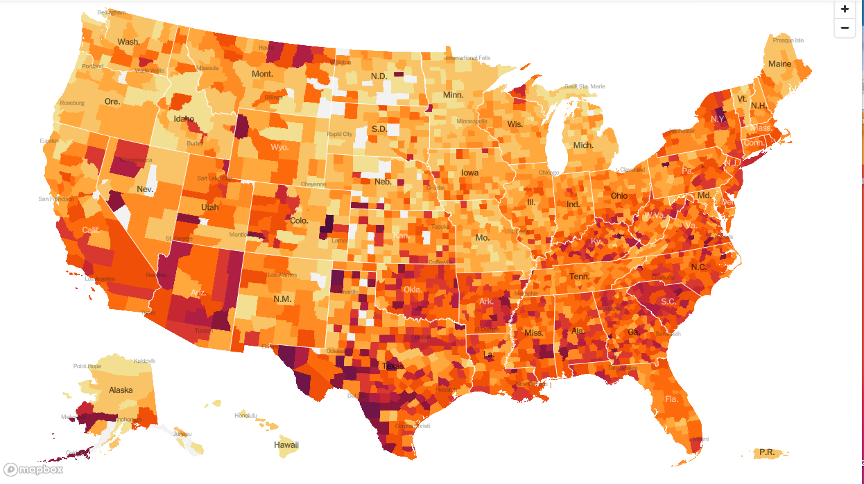

I’ll tell you something that markets are not paying attention to at all, and it is the tremendous improvement in the pandemic. Since January 20, news cases have cratered from 250,000 a day to only 70,000, down 72%. The best-case scenario which markets discounted by near doubling in 11 months is happening.

With the addition of the Johnson & Johnson (JNJ) vaccine, some 700 million doses will be available by June. We could be back to normal by summer, at least in the parts of the country that don’t believe it is still a hoax.

This breathes life into the blockbuster 7.5% GDP growth scenarios now making the rounds. I think people have no idea how hot the economy is really going to get. Labor and materials shortages may be only three months off, but with no inflation.

So, what does all this mean for the markets? It all sets up the normal 5%-10% correction that I have been predicting. If you have two-year LEAPS on your favorite names, hang on to them. We are going much higher.

I went into the Monday selloff with a rare 100% cash position. The 20% I have now in commodities I picked up on puke out, throw up on your shoe capitulation days.

The barbell is still the winning strategy.

Domestic recovery stocks have been on fire for six months, with small banks up a ballistic 80%. Big tech has gone nowhere. But their earnings are still exploding, in effect, making them 20% cheaper over the same time period.

It’s just a matter of time before markets rotate back into tech and give domestic recovery a break. Think (AAPL), (FB), (AMZN), and (GOOGL). That is where the smart money is going right now.

The bond auction was a total disaster. The US Treasury offered $62 billion worth of seven-year US Treasury bonds, double the amount a year earlier. At a 1.95% yield and no one showed. Foreign participation was the worst in seven years. The bid-to-cover ratio was pitiful. Over issuance by the government crushing the market? Who knew? Imagine how high interest rates would be if the Fed wasn’t buying $120 billion a month of bonds?

The insanity is back, with GameStop (GME) doubling in the last 15 minutes of the month. Nobody knows why. It was why stocks tanked at the close on Thursday, scaring away real investors in real stocks. (GME) has become an indicator of all that’s wrong with the market.

Copper demand is rocketing, says Freeport McMoRan (FCX) CEO Richard Adkerson. That’s why he is opening three new US mines this year, adding 250 million pounds in annual output. Biden’s ambitious EV plans are the trigger. You can’t build an EV without a lot of the red metal. The world’s largest copper producer has become a major climate change and ESG play.

NVIDIA blows it away, with sales up a blockbuster 66%. Demand from gamers locked up at home was overwhelming. Purchases by bitcoin miners were through the roof. Even demand from the auto industry was up 16%, even though card sales aren’t. Too bad they picked the wrong day to announce, with the stock off 8.2%. (NVDA) is the one tech stock I would buy on dips.

Fed says business failures will continue at record pace, mostly occurring among small, unlisted local businesses. Biden’s $1.9 trillion rescue budget will come too late for many. Unemployment could stay chronically high for years, as the Weekly Jobless Claims are suggesting.

Housing starts fell in January, down 6.0% to 1.58 million units. A much smaller drop was expected. Rising land and lumber costs are cutting into the economics of new construction. Home prices are going to have to accelerate to suck in more supply. Housing Permits for new construction soared by 10.4% last month, so the future looks bright for builders.

Tesla (TSLA) crashed, down $180 in two days. We have just suffered a perfect storm of bad news about Tesla. Interest rates have been soaring, bad for all tech in the mind of the market. Competitor Lucid Motors announced a SPAC valued at $11 billion. And Elon Musk said Bitcoin looked “high” after investing $1.5 billion. Get ready to buy the dip, but not yet.

Quantitative easing to continue, says Fed governor Jay Powell, even if the economy improves. The $120 billion in bond-buying remains, even if the economy improves. He’s doing everything possible to create inflation.

Panic hits the crypto markets, dragging down technology equities with them. The two have been trading 1:1 for four months. Bitcoin suffered an eye-popping 25% plunge from $58,000 to 43,600. The tail is now wagging the dog. All risk-taking may have spiked with the Friday options expiration. Watch Bitcoin for a tech stock revival and vice versa. Stocks have earnings multiple support. Crypto doesn’t. I’ll buy Bitcoin when they post a customer support number.

Australian dollars soars as predicted, from $58 to $79 in 11 months. We could hit parity in 2022. The Aussie is basically a call option on a synchronized global economic recovery. End of the pandemic will also bring a resumption of massive Chinese investment in the Land Down Under. Keep buying the dips in (FXA).

Case-Shiller explodes to the upside, up 10.4% in December. It’s the hottest read in seven years for the National Home Price Index. Phoenix (14.4%), San Diego (13.0%), and Seattle (13.6%) were the strongest cities. The flight from the cities continues.

(TLT) breaks $138, surpassing my end 2021 target of a 1.50% ten-year US Treasury yield. So, I lied. My new yearend target is now $120, which would take ten-year yields to 2.00%. With a $1.9 trillion rescue budget about to kick in after the $900 billion that passed in December, the economy and demand for funds are about to rocket. Better hurry up and buy that house before mortgage rates rise out of reach.

Weekly Jobless Claims sink to 730,000. I can’t believe that 730,000 is now considered a good number, compared to 50,000 a year ago.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

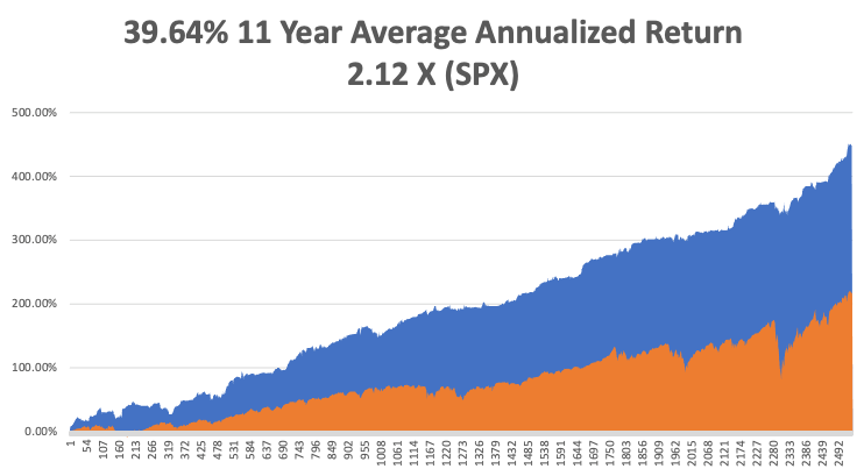

My Mad Hedge Global Trading Dispatch closed out with a 13.28% profit in February after a blockbuster 10.21% in January. The Dow Average is up a miniscule 1.1% so far in 2021.

This is my fourth double-digit month in a row. My 2021 year-to-date performance soared to 23.49%. After the February 19 option expiration, I am now 80% in cash, with longs in (XME) and (FCX).

That brings my 11-year total return to 446.04%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 39.64%.

My trailing one-year return exploded to 93.48%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 103.31% since the March 20, 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 28 million and deaths topping 510,000, which you can find here.

The coming week will be a boring one on the data front.

On Monday, March 1, at 10:00 AM EST, the ISM Manufacturing Index is out. Zoom (ZM) reports.

On Tuesday, March 2, at 9:00 AM, Total US Vehicle Sales for February are announced. Target (TGT) and Hewlett Packard (HPQ) report.

On Wednesday, March 3 at 8:15 AM, the ADP Private Employment Report is released. Snowflake (SNOW) reports.

On Thursday, March 4 at 9:30 AM, Weekly Jobless Claims are printed. Broadcom (AVG) and Costco (CSCO) report.

On Friday, March 5 at 8:30 AM, The February Nonfarm Payroll Report is announced. Big Lots (BIG) reports. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, the deed is done, I got my first Covid-19 shot, pure Pfizer.

The Marine Corps failed to deliver, as only active duty are getting shots. Washoe County ran out. Incline Village said I couldn’t get a shot until July. My own doctor had no clue.

Then I got an automated call from the doctor who did my stem cell treatment on my knees five years ago. They belonged to a large group that had my birthday in their system and my number came up on the first day the under ’70s opened up.

Going there was a celebration. Everyone was thrilled to death to get their shot. It was like winning the lottery. Our little local hospital operated with machine-like efficiency, inoculating 1,300 a day. It was a straight drive in, dive out. It was an “all hands-on deck” effort, with everyone from the board directors to the billing clerks manning the needles. It took longer to buy a Big Mac than to get my shot.

To make sure I didn’t pass out, I was sent to a holding area, where a person was assigned to each car. I got the CEO and grilled him relentlessly on his business model for 30 minutes.

I haven’t felt this good since I got my polio vaccine sugar cube in 1955.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

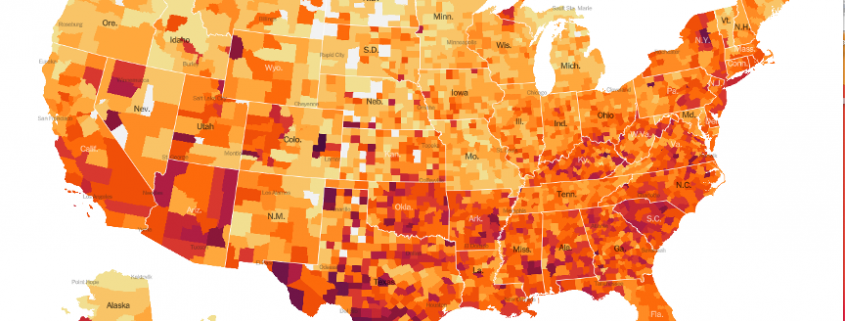

January 20 Infection Rate

March 3 Infection Rate