This AI infrastructure build-out is starting to smell more and more like the Chinese ghost city phenomenon.

Yeh, I said it.

It is starting to feel more like that type of “growth”, and that is not good for the future of tech stocks.

If the AI build-out becomes something trending closer to a Chinese ghost city, then we can expect a sharp pullback in tech stocks.

When that abrupt pullback will be is the hard question to answer, but each day we inch closer to that scenario.

There are 65 million empty homes in China that were built by developers and registered as “growth.” This type of parallel growth or paper growth can’t be ignored, and the concrete producers and wiring folks made large fortunes off that whole racket.

Sam Altman, head of OpenAI, is starting to seem more like one of these construction contractors selling 65 million appliances and calling it a success while the apartments are unused and investors get fleeced.

Wasteful spending by corporations swept into the dustbin of history. Looks more like it by the day.

When tech managers are asked about the specific numbers about what kind of revenue we can expect from the AI investment, they tell us to “spend now and ask questions later.”

That is a massive red flag, and I am calling out the whole movement now.

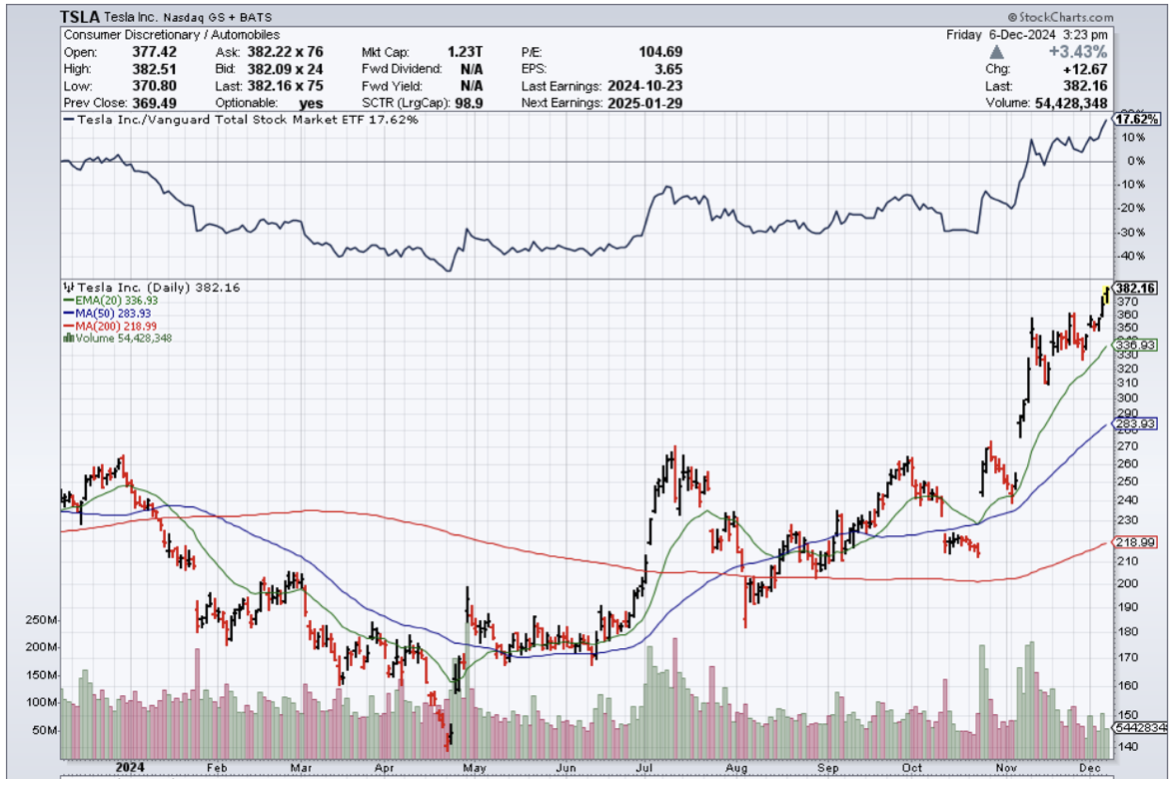

That being said, I bought the dip in mid-January on the Deepseek news, and I am riding that technical reversion to profits as it stands.

If there are no short-term pullbacks, we will end the month up over 15% YTD.

Meta (META), Microsoft (MSFT), Amazon (AMZN), and Google parent Alphabet (GOOGL) are expecting to spend a cumulative $325 billion in capital expenditures and investments in 2025, driven by a continued commitment to building out artificial intelligence infrastructure.

Taken together, this marks a 46% increase from the roughly $223 billion those companies reported spending in 2024.

The Chinese startup Deepseek rattled markets last week after it debuted open-source AI models competitive with OpenAI’s for a fraction of the price. Tech stocks sold off across the board as the model cast doubt on the rationale behind tech giants’ mammoth spending on artificial intelligence infrastructure.

But the DeepSeek surprise didn't seem to impact tech companies' big spending plans.

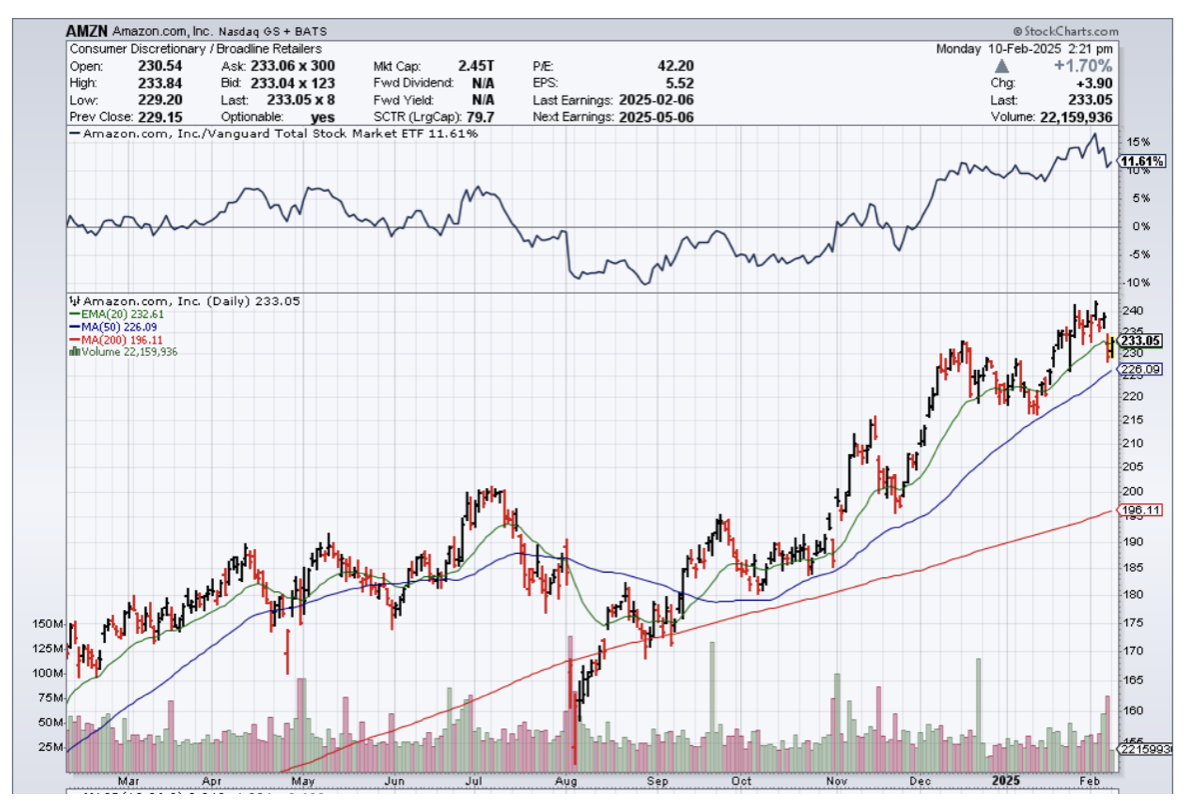

Amazon is by far the biggest spender on capital investments of the group, with its $78 billion for 2024 far eclipsing Microsoft's $56 billion and Alphabet's $53 billion.

Looking ahead, Amazon said in a post-earnings call Thursday evening that its spending of $26.3 billion in its most recent quarter is "reasonably representative" of its 2025 investment plans, suggesting investments will total roughly $105 billion this year.

Late last month, Meta confirmed that it would spend $60 billion-$65 billion in 2025, a massive bump from its prior guidance to investors of $38 billion-$40 billion in investment for the year.

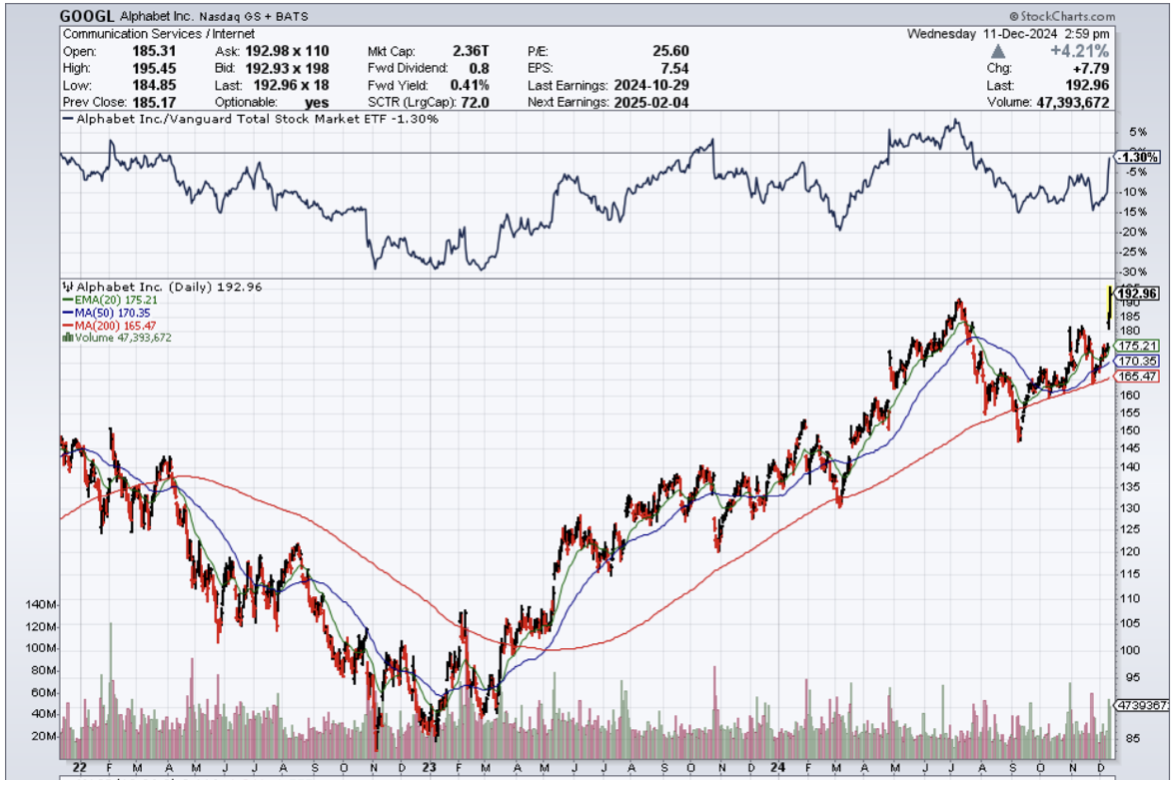

Google said on Tuesday that it expects to spend $75 billion this year.

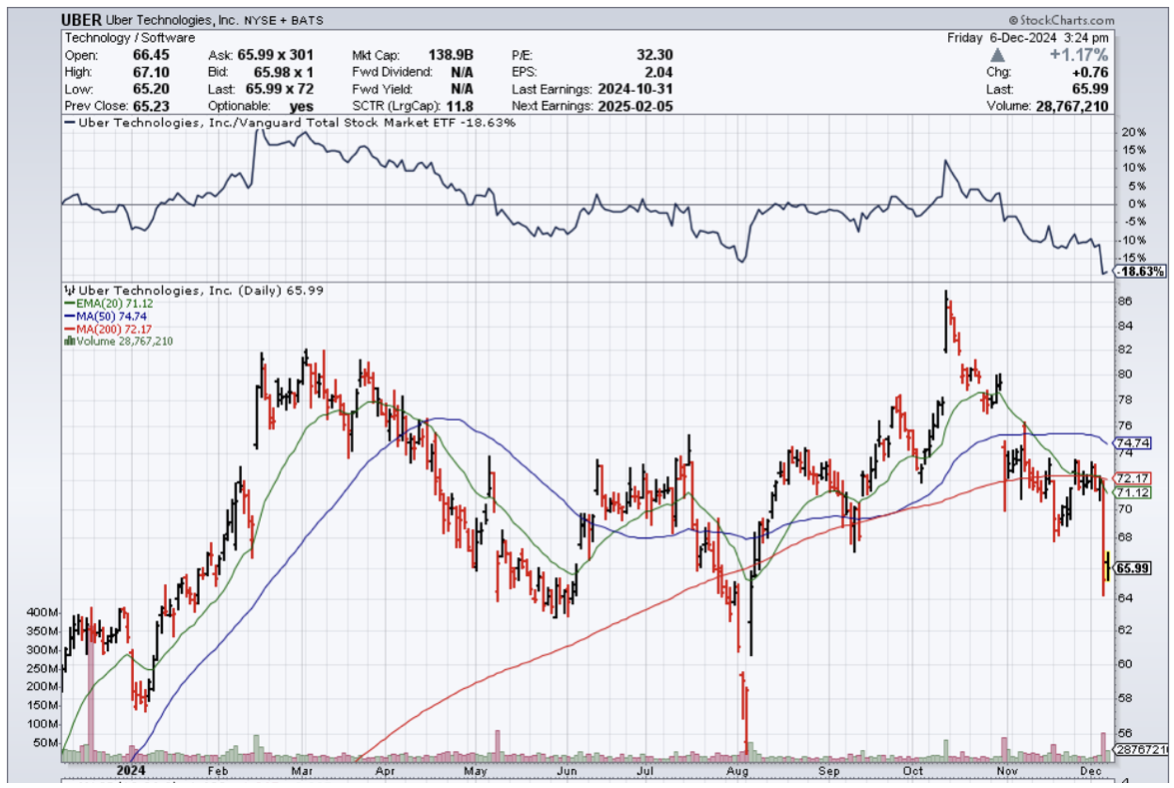

In the short-term, I expect earnings reports to be met with a selloff producing optimal buying opportunities.

These dips are bought by traders then take profits – rinse and repeat.

It’s not guaranteed that tech will go up in a straight line, so it’s better to use the volatility in your favor for some profits.