Alphabet (GOOGL) is entangled in the same imbroglio as Apple (AAPL), that is why I have held back on issuing any trade alerts on this name.

The stalwart is still grinding out a respectable 20% of revenue growth in their core business but the underlying conundrum is that their hyper-growth segments are 5 times or more diminutive than their bread and butter of digital ads.

Apple is addressing the same type of strain in attempting to flip high octane revenue drivers into a bigger piece of the pie – the services business trails the hardware business by a large margin.

This phenomenon highlights how investors demand tech companies to grow at elevated rates and a maturing business model isn’t given any free passes.

Investors simply migrate towards higher growth names period.

That being said, Alphabet’s digital ad business is one of the premier tech divisions in all of technology and the American economy.

How powerful is it?

They did $32.6 billion in sales last quarter.

If you look at that number without context, it is quite impressive, but there are several lurking impediments.

This 20% QOQ growth is flatter than a pancake offering evidence that the best days are behind them.

No investors like to hear the dreaded “P word” thrown into a company’s business trajectory – peak.

In respect to revenue growth rates, I expect Google’s digital ad business to gradually decline relative to competition.

This segment also battles with the law of large numbers.

It’s simply difficult to accelerate revenue rates at a 25% YOY clip when revenues are already over $30 billion per quarter. Again, this is another Apple problem and a side effect of being overly successful in one part of the business model.

If investors' tepid reaction about these aspects of the core business telegraph dissatisfaction, then discovering further ancillary problems might be the final dagger in the heart.

Google search’s price per click cratered 29% YOY indicating that variables in the current marketing environment have significantly blunted Google’s pricing power.

Traffic Acquisition Cost (TAC) represents the cost for a company to acquire internet traffic onto their assets.

Alphabet faced a 15% YOY rise in TAC costs last quarter to $7.44 billion illustrating the difficulty in keeping these high costs down.

The bulk of the $7.44 billion stems from a widely known agreement with Apple contracting Google search as its default search engine on Apple devices.

This TAC expense has been surging the past few years and Alphabet has little negotiating power.

Expect an annual 15-20% rise in TAC expenses as long as Alphabet’s digital ads are expanding the standard vanilla 20% most investors expect them to grow.

As a whole, TAC costs soaked up 23% of the digital ad revenue which was in line with analysts’ expectations.

However, I expect this number to surpass 25% before winter because I believe Google search’s ad business will confront ceaseless growth problems.

Amazon’s (AMZN) new-found digital ad business is an influential factor in this story.

New marketing dollars aren’t being showered on Google as they once were, over 50% of product searches populate from Amazon.com today boding poorly for the future of Google search.

This optionality could be a large reason in driving the cost per click downwards.

CEO of Amazon Jeff Bezos refused to enter the digital ad game for years but his recent change of heart will correlate to subduing Google digital ad model.

Consumers are finding less incentive to search on Google for products when they just can smartly and efficiently search on Amazon directly.

Clearly, this only affects product searches and not searches on other informative content such as widely popular searches including “top 10 places to travel in Europe” or “best Thanksgiving recipes.”

Google’s “other revenues” is chugging along nicely with 31% YOY growth headed by Google’s cloud business and hardware division.

This is what Alphabet needs to focus on going forward similar to Microsoft and Amazon web services.

Yes, Google is the 3rd biggest cloud player but miles behind the top two.

Being in catch-up mode is no fun and is part of the reason capital expenditures exploded and came in $1.38 billion higher than expected.

Alphabet simply isn’t doing a good job at executing relative to Amazon and Microsoft frittering away more capital in the name of growth but not curating the type of growth that current expenses justify.

Higher costs damaged operating margins coming down 2% YOY to 21%.

Even more worrisome is that there has been no material progress on the Waymo business.

This is the year that Alphabet expected the technology to roll out to the masses.

However, this broad-based integration will not happen as fast as they would like.

I blame regulation and consumers' hesitation to quickly adopt this new technology.

Alphabet is reliant on this business to carry them to the next level of growth and I believe it can become a $100 billion per year business in a $2 trillion addressable market.

But when you peruse through the “Other Bets” category which houses Alphabet’s other companies such as health venture Verily, the $154 million in revenue was a huge miss against the $187.4 million expected.

Estimates aside, the pitiful fact that Waymo only brings in revenue of less than 1% of total revenue is disappointing.

Summing things up, Alphabet is a great company and is a long-term buy and hold stock even with short term transitory headaches.

In the near term, there is uneasiness about the decreasing profitability, exploding expense factors, a heavy reliance on weakening core business revenue, and a lack of top-line contribution of “other revenues” relative to their core business.

Long term, Alphabet’s game-changing investments have yet to show signs of life in terms of real revenue expansion even though Alphabet is the global leader of artificial intelligence and self-driving technology.

Investors would like to see actionable steps to incorporate this best of breed technology that funnels down to the top and bottom line.

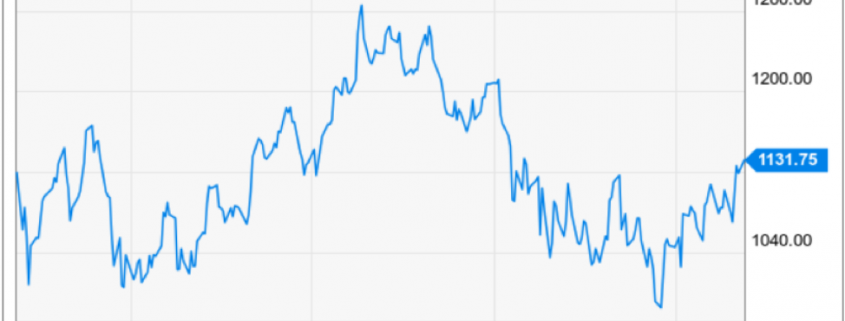

Investors are stuck with a stale digital ads business that has locked the stock into a holding pattern essentially trading sideways for the past year until they prove they are ready to take the next step up.

Looking at Alphabet’s chart, the stock has iron-clad support at $1,000 which it tested in April 2018 and December 2018.

Using this entry point as the lower range would be sensible as I don’t foresee any demonstrably negative news blindsiding the stock, and I surmise that investors will start receiving positive news on Waymo’s roll out towards the middle of the year.