How far will society and government allow tech companies to adventure before there is some blowback?

Honestly, it’s hard to say when to put the shackles on these companies that are getting too powerful for their own good.

Tech companies have been pedal to the medal pushing the limitations of what the human world can offer.

The hoard of profits showered on the tech giants is one thing, but should they be held accountable for the unintended consequences that there robot-like profit-making operations dump on society?

Each company has chosen different ways to deploy the capital. Apple decided to reward shareholders by executing a $100 billion share buyback program.

The stock has performed great this year.

Apple (AAPL) and CEO Tim Cook have been keen to show a trustful face among a growing phalanx of data misusers.

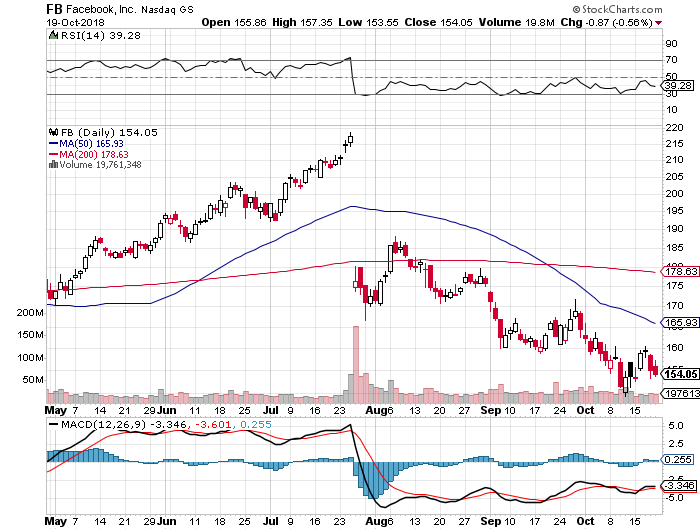

Facebook (FB) has used the surplus capital to build a secretive research center modeled after the Defense Advanced Research Projects Agency (DARPA) called Building 8.

DARPA is an agency of the United States Department of Defense responsible for the development of emerging technologies for military use.

The division of the government was launched in 1958 by United States President Dwight D. Eisenhower to counteract the Soviet launching of Sputnik 1 in 1957.

DARPA smartly partnered together with America’s business leaders, academia, and other talents dotted around the government and military branches to develop projects that would broaden the frontiers of technology and science far beyond immediate U.S. military current needs.

Building 8 met the real world for the first time when its first product Portal, a vertically-shaped display screen attached to a smart camera, debuted with befuddlement.

How does a company that just announced a breach of 50 million accounts, after a torrid string of mishaps which made a mockery of Facebook’s use of big data, launch a device that gives Facebook unfettered access into the confines of one’s personal home?

A Facebook spokesman said that Facebook will “use this information to inform the ads we show you across our platforms. Other general usage data, such as aggregate usage of apps, etc., may also feed into the information that we use to serve ads.”

Executives at Facebook know that this product would be a commercial write-off, but the sunk cost associated with this project forced them to throw it on the market with reckless abandon.

And at the end of the day, some data is better than no data at all and that is what the earth’s existence is boiling down to.

So, if you thought that Facebook might finally decide to stop being your effective cyber-stalker, you are wrong.

And this is all just the beginning, it gets a lot worse than this, let me explain.

In fact, Facebook’s Building 8 was led by the former Director of the Defense Advanced Research Projects Agency Regina Dugan.

The more I sniff around, the more I see her pawprints everywhere she went.

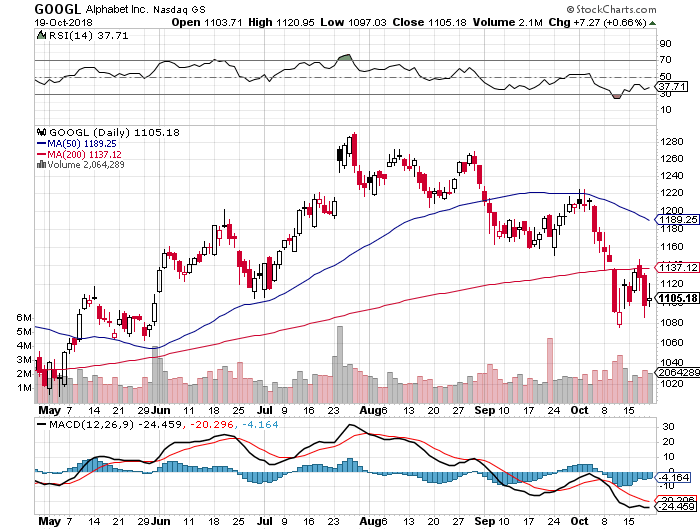

Dugan used her elite role at DARPA to score a job at Google’s (GOOGL) Advanced Technology and Projects (ATAP) group before she jumped ship to Facebook’s secretive research center Building 8.

Dugan’s tenure at DARPA from 1996 to 2012 meant she was privy to the LifeLog project which was developed for just one year and subsequently shut down.

This program was cancelled after heavy criticism from activists advocating privacy and rightly so.

But, was this program really shut down?

Lifelog was a program with the mission to effectively record all of an individual’s physical movements, conversations and everything they listened to, ate, read and bought.

Everything!

The premise of this program was to cultivate a permanent searchable record of one’s life.

The daredevil program was light years ahead of its time predating the iPhone, tablet, and the current wave of populism engulfing the free world.

Back then, the weaponizing of consumer technology was largely absent from the world, and the top brass of DARPA surely wasn’t naïve enough to believe that this technology could only be applied to create an epic cyber-diary of one’s life.

In any case, Dugan conveniently was employed by Google and Facebook and her knowledge of Lifelog was fluid, deep and comprehensive.

Unintended consequences are rife and, if I connect the dots, it appears that DARPA’s Lifelog found new spawning grounds in Silicon Valley’s richest companies, or at least two of them.

There is no way to know for sure, but monetizing Lifelog’s cyber-record technology to harness it as a tool to collect personal information for the use of digital ad targeting has rained profits down on these two companies.

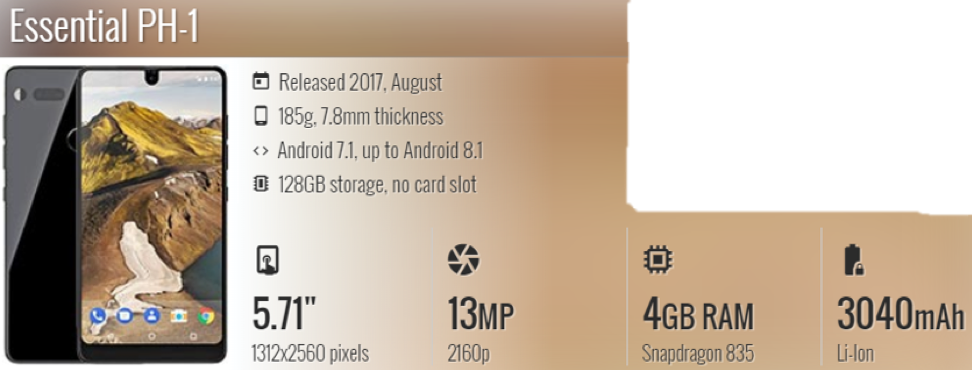

Building 8 is serving up round two of its DARPA-esque mission by announcing that they have built a prototype producing an armband that will facilitate the understanding of oral language “through a person’s skin.”

It was in January 2017 when Dugan took the stage in San Jose at a conference to announce this project.

It was mostly dismissed as fantasy and something out of science fiction.

Well, it’s one more step closer to being rolled out in mass market form.

The way the language process works is that vibrations allow for the roots of words to be transformed into silent speech.

If scientists manage to do this, it would give deaf people a new lifeline giving them the capability to understand what people are saying without the need for lip reading.

However, on the other side of the coin, the technology could be modified to aid spies in eavesdropping if the range of the vibrations allows them to.

The second project announced by Dugan that same night in San Jose was Facebook’s bold attempt of a noninvasive brain sensor designed to turn thoughts into text.

This would require brain surgery to install a sensor, and the plan for this technology is for people to access devices from their brain without the need to physically or orally communicate with it.

I suspect that Facebook would collect the data from this brain sensor and the sensor would be in contact with the Facebook infrastructure sharing the performance and state of operations.

If the sushi hits the fan and a person dies from the sensor, Facebook would need to analyze the specific details in the malfunction.

What a scary thought.

Facebook adopting the DARPA blueprint from its halted project of Lifelog to respawn similar technology that painstakingly retrieves as much data about our lives as possible is the first step to something substantially bigger.

However, the digital ad business has made Facebook and Google insanely rich and they want an encore.

I am surprised that other Silicon Valley cash-rich companies avoid tapping up the offspring of other military-grade technology to join the profit parade.

Apparently, there has been zero backlash from it.

If Facebook somehow manages to roll-out a commercialized brain sensor giving Mark Zuckerberg access to our minds, I wonder what on earth could round three entail for Zuckerberg…

Nothing is impossible.