Below please find subscribers’ Q&A for the Mad Hedge Fund Trader October 16 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

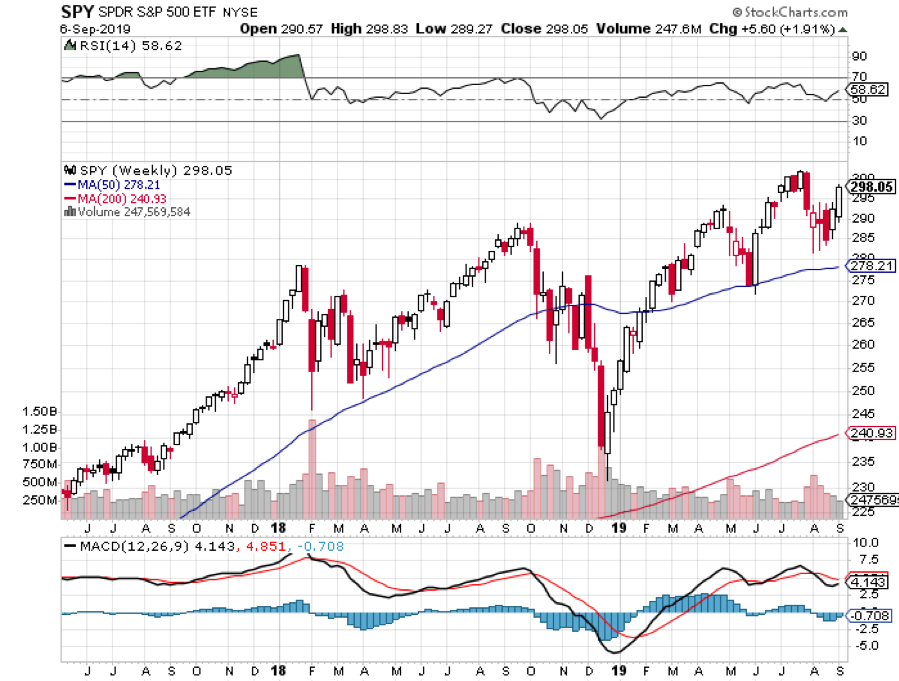

Q: How do you think the S&P 500 (SPX) will behave with the China trade negotiations going on?

A: Nobody really knows; no one has any advantage here and logic or rationality doesn’t seem to apply anymore. It suffices to say it will continue to be up and down, depending on the trade headline of the day. It’s what I call a “close your eyes and trade” market. If it’s down, buy it; if it’s, upsell it.

Q: How long can Trump keep kicking the can down the road?

A: Indefinitely, unless he wants to fold completely. It looks like he was bested in the latest round of negotiations because the Chinese agreed to buy $50 billion worth of food they were going to buy anyway in exchange for a tariff freeze. Of course, you really don’t get a trade deal unless you get a tariff roll back to where they were two years ago.

Q: Did I miss the update on the Citigroup (C) trade?

A: Yes, we came out of Citigroup a week ago for a small profit or a break-even. You should always check our website where we post our trading position sheet every day as a backstop to any trade alerts you’re getting by email. Occasionally emails just go completely missing, swallowed up by the ether. To find it go to www.madhedgefundtrader.com , log in, go to My Account, Global Trading Dispatch, then Current Positions. You can also find my newly updated long-term portfolio here.

Q: How much pain will General Motors (GM) incur from this standoff, and will they ever reach a compromise?

A: Yes, the union somewhat blew it in striking GM when they had incredibly high inventories which the company is desperate to get rid of ahead of a recession. If you wonder where all those great car deals are coming from, that's the reason. All of the car companies want to go into a recession with as little inventory as possible. It's not just GM, it’s everybody with the same problem.

Q: When does the New Daily Position Sheet get posted?

A: About every hour after the close each day. We need time to process our trades, update all the position sheets before getting it posted.

Q: What do you think about Bitcoin?

A: We hate it and don’t want to touch it. It’s unanalyzable, and only the insiders are making money.

Q: Are you predicting a repeat of Fall 2018 going into the end of this year to close at the lows?

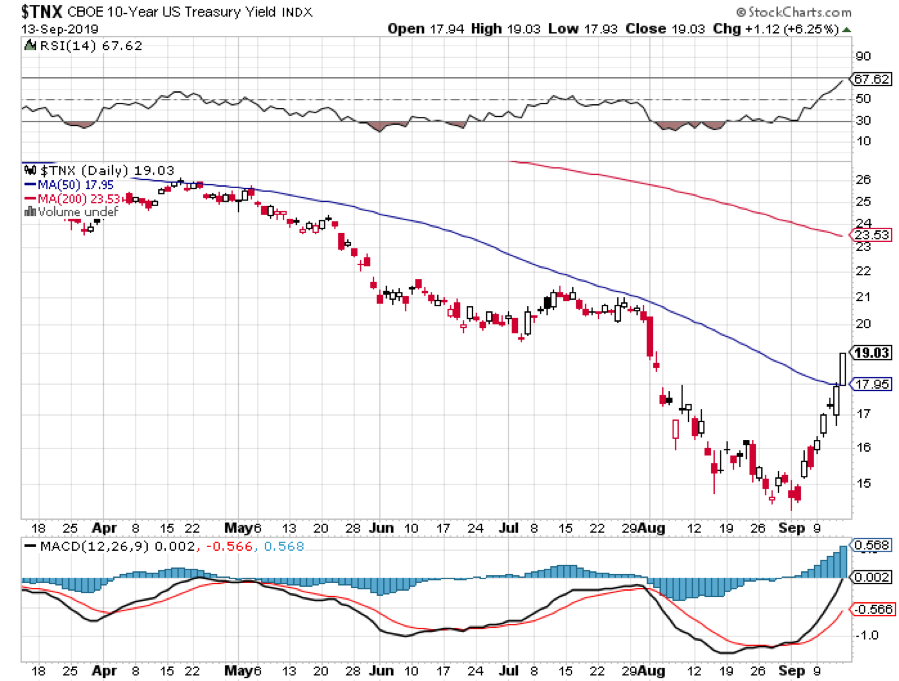

A: No, I’m not. A year ago, we were looking at four interest rate increases to come. This year we’re looking at 1 or 2 more interest rate cuts. It’s nowhere near the situation we saw a year ago. The most we’re going to get is a 7% selloff rather than a 20% selloff and if anything, stocks will rise into the yearend then fall.

Q: Why are we trading the Russell 200 (IWM) instead of the ($RUT) Small Cap Index? We pay less commissions to brokers.

A: There's more liquidity in the (IWM). You have to remember that the combined buying power of the trade alert service is about $1 billion. And that’s harder to do with smaller illiquid ETFs like the ($RUT), especially the options.

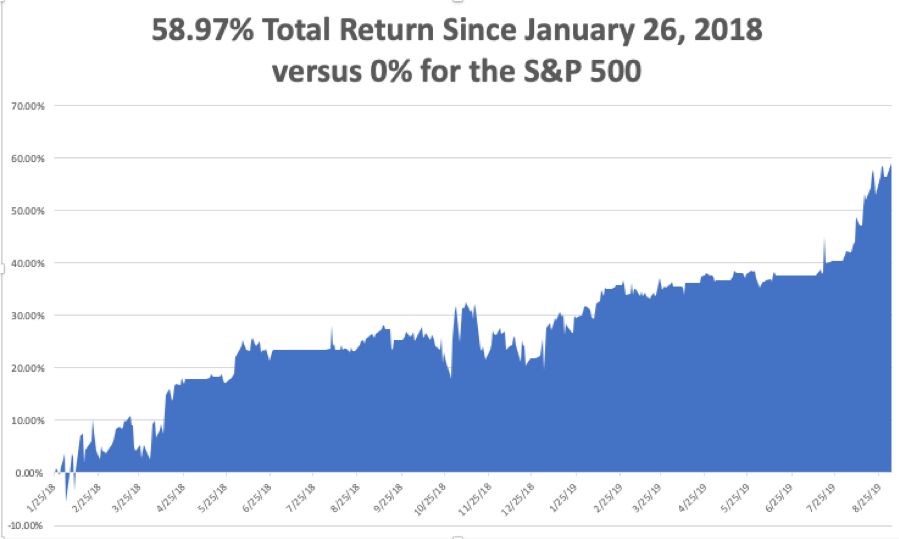

Q: If this is a “Don’t fight the Fed” rally for investors, where else is there to go but stocks?

A: Nowhere. But it’s happening in the face of an oncoming recession, so it’s not exactly a great investment opportunity, just a trading one. 2009 was a great time not to fight the Fed.

Q: Do you want to buy Facebook (FB) even though there are so many threats of government scrutiny and antitrust breakups?

A: The anti-trust breakups are never going to happen; the government can't even define what Facebook does. There may be more requirements on disclosures, which means nothing because nobody really cares about disclosures—they just click the box and agree to anything. I was actually looking at this as a buy when we had the big selloff at the end of September and instead, I bought four other Tech stocks and (FB) had moved too far when we got around to it. I think there’s upside potential for Facebook, especially if we can move out of this current range.

Q: Would you sell short European banks? It seems like they’re cutting jobs right and left.

A: I always get this question after big market meltdowns. European banks have been underpricing risks for decades and now the chickens are coming home to roost. Some of these things are down 80-90% so it’s too late to sell short. The next financial crisis is going to be in Europe, not here.

Q: Is it time to short Best Buy (BBY) due to the China deal?

A: No, like Macys (M), Best Buy is heavily dependent on imports from China, and the stock has gotten so low it’s hard to short. And the problem for the whole market in general is all the best sectors to short are already destroyed, down 80-90%. There really is nothing left to short, now that all the bad sectors have been going down for nearly two years. There has been a massive bear market in large chunks of the market which no one has really noticed. So, that might be another reason the market is going up—that we’ve run out of things to short.

Q: Do you like Intel (INTC)?

A: Yes, for the long term. Short term it still could face some headwinds from the China negotiations, where they have a huge business.

Q: Would you buy American Airlines (AA) on the return of Boeing 737 MAX to the fleet?

A: Absolutely, yes. The big American buyers of those planes are really suffering from a shortage of planes. A return of the 737 MAX to the assembly line is great news for the entire industry.

Q: Do you like Raytheon (RTN)?

A: No, Trump has been the defense industry’s best friend. If he exits in the picture, defense will get slaughtered—it will be the first on the chopping block under a future democratic administration. And, if you’re doing nothing but retreating from your allies, you don't need weapons anyway.

Q: Will Freeport McMoRan (FCX) benefit from a trade war resolution?

A: Yes, the fact that it isn't moving now is an indication that a trade war resolution has not been reached. (FCX) has huge exposure to traditional metal bashing industries like they still have in China.

Q: Would you go long or short gold (GLD) here?

A: No, I'm waiting for a bigger dip. If you can get in close to the 200-day moving average at $129.50, that would be the sweet spot. Longer term I still like gold and it is a great recession hedge.

Good Luck and Good Trading!

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader