The Davos World Economic Forum is the optimal place to get a snapshot of the state of the American technology sector and apply its underpinnings to an overall trading strategy for 2020.

Stepping back, one clear theme is the lasting effects of the trade war and how that will manifest itself in the broader tech sector.

We got some serious sound bites from CEO of Microsoft Satya Nadella at Davos who is convinced that mutual economic saber-rattling between the US and China will show up in higher costs because of the misallocation of resources.

The most critical point of contention is the development in the semiconductor space as we move into the 5G world and this $470 billion industry which realizes cost savings from scaling by global supply is splintering off as we speak into two separate industries.

This just translates into higher costs to source components for your Microsoft Surface laptop or your Apple Ear Buds.

The follow-through effect is ultimately bludgeoning global growth rates and tech intermediaries will be forced to pick up the extra tab or face the looming decision to pass costs on to the consumer.

As we move forward, the administration is considering more limits to US semiconductor companies’ access to the Chinese consumer market.

The scaremongering fueled by the rise and threat of Huawei has reached fever pitch.

Remember that even with the aggression of the American administration hoping to cap Huawei’s revenue explosion, Huawei still managed to grow sales 18% last year to $122 billion.

I can tell you that if the U.S. administration came after the Mad Hedge Technology Letter guns blazing, we wouldn’t be sitting here growing 18% annually!

The U.S. administration hasn’t stopped at Huawei and is putting in shifts attempting to convince other nations to avoid using Chinese infrastructure equipment for the 5G revolution.

The “Phase One” of the trade agreement is largely seen as a moot point in the technology community and in some cases can be argued as a net negative to component makers whose access to the local Chinese market has narrowed.

The agreement signed also delivered no meaningful protection to intellectual property for US technology companies working with China which was largely viewed as the main catalyst provoking a geopolitical fight.

The trade war has sped up the bifurcation of internets, better known as “splinternet,” and I believe that sometime in the near future, you will need to download Chinese software and platforms to function inside of China.

Much of these misunderstandings stem from the lack of trust that has accumulated between the two parties.

The American tech sector and Wall Street have indirectly subsidized China’s technological rise to this point and now they must go head-to-head in every future technology such as artificial intelligence, 5G, fintech, augmented reality, and virtual reality.

This appears to be the new normal - a frosty and adversarial tech relationship.

There is now zero good will between each other.

The trust of tech on American shores could almost be ironically argued that it is worse than the trust level with China.

Edelman’s 20th annual trust barometer surveyed more than 34,000 adult respondents in 38 markets around the world.

It found that 61% of participants said the pace of change in technology is too fast and government does not fully understand emerging technologies enough to regulate them efficiently.

Trust in tech from 2019 to 2020 declined the most significantly in France, Canada, Italy, Russia, Singapore, the U.S. and Australia.

Much of the narrative has been about the domination of American tech by a handful of actors that has seen American companies go up against foreign governments.

France and America recently announced a temporary truce after the French President Emmanuel Macron reached out by phone to President Trump hoping to end the threat of tariffs while they work out a broader accord on digital taxation.

The French leader agreed to postpone until the end of 2020 a tax that France levied on big tech companies last year and in turn, the U.S. will delay the counter-tariffs that were in the works set to be levied on the French.

And it’s not just the French.

India has taken heed from the brooding trouble between the encroachment on sovereignty and American tech giants by adopting an aggressive stance towards Amazon.

Amazon CEO Jeff Bezos' lowlight of a recent India work trip came in the form of being snubbed by the Indian government.

India’s commerce minister Piyush Goyal said, “It’s not as if they (Amazon) are doing a great favor to India when they invest a billion dollars.”

He called Amazon a capital guzzler equating its mounting losses up to “predatory pricing or some unfair trade practices.”

India is on the verge of turning protectionist on foreign tech and this flies in the face of the tech atmosphere even just a few years ago.

Governments have come to realize that America’s FANGs are too dominant and entrenched often resulting in a net negative to the local populace.

More often than not, American tech found ways of rerouting local revenue to coffers of a few billionaires while paying zero local tax.

The easy money has been made and now the Tim Cooks and Sundar Pichais of the world will have to fight tooth and nail with not only the U.S. antitrust regulators, but foreign governments.

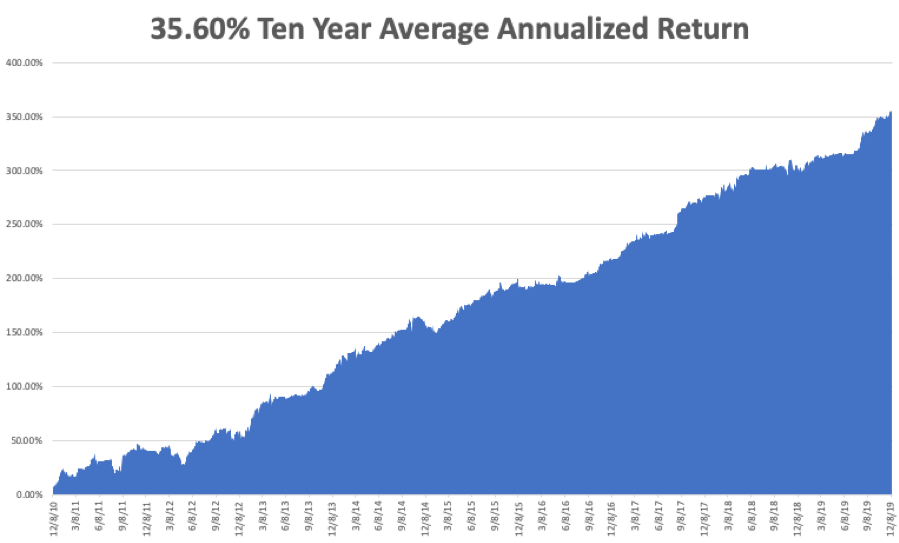

This is why a handful of tech companies this dominant has been the outsized winners over the past generation as their share prices have gone from the lower left to the upper right but now command minimal consumer trust.

The ultimate Davos message is that big tech continues to grind higher, but alarm bells have started to ring.

There’s only so much friction they can handle before investors pull the rug.