The wild west of the data wars is spawning into an all-out, gunslinging shoot-out with a winner-takes-all mentality.

This slugfest is reminiscent of the unregulated 19th-century American oil barons whose clout and complete control of the supply of oil fueled the industrial revolution that drove America's economy to the top of the global food chain.

Yes, data has become the oil of the 21st century. It is the oxygen of the next leg of the Internet revolution.

And there is one man moving early to stake out the premium real estate of our futures: SoftBank's Masayoshi Son.

His $100 billion SoftBank Vision Fund is not only creating waves in Silicon Valley but tidal waves.

Many countries, such as Iran, Saudi Arabia, and Russia, still rely on petroleum for the lion's share of government revenues. Saudi Arabia is attempting to wean themselves from the reliance on oil, but teething pains are sprouting up everywhere.

The choreographed killing of former Saudi Arabian dissident Jamal Khashoggi at a Saudi Arabian Embassy in Turkey will have many unintended consequences to the future economy further delaying the supposed pivot to a legitimate knowledge economy.

Oil prices crashing offers less financial support to make this pivot even possible.

Even though oil is still integral to the growth of the global economy, there is a new sheriff in town: big data.

Cut it up any way you want, data is simply information, the "zeros" and "ones" that make up the digital world. The information that commands mouthwatering premiums these days can be unraveled by computers.

Computer-deciphered data can show behavioral and consumer trends in stark daylight, helping companies ferret out business strategies that are proving immensely powerful.

There is an exponential hockey stick effect going on here. As the quantity of data accumulates, the more valuable it becomes.

The types of data being collected are personal data, transactional data, web data, and sensor data used for IoT (Internet of Things) products.

Who is the major player vacuuming up this data?

Masayoshi Son, the CEO of SoftBank (SFTBY), is an ethnic Korean who grew up in a small village in Japan. He transferred to Serramonte High School on the San Francisco Peninsula as a bustling youth and graduated in three weeks.

He was and still is that brilliant.

Son ventured on to UC Berkeley majoring in economics and computer science. He is one of the most dynamic people in the world and has amassed personal wealth of around $25 billion.

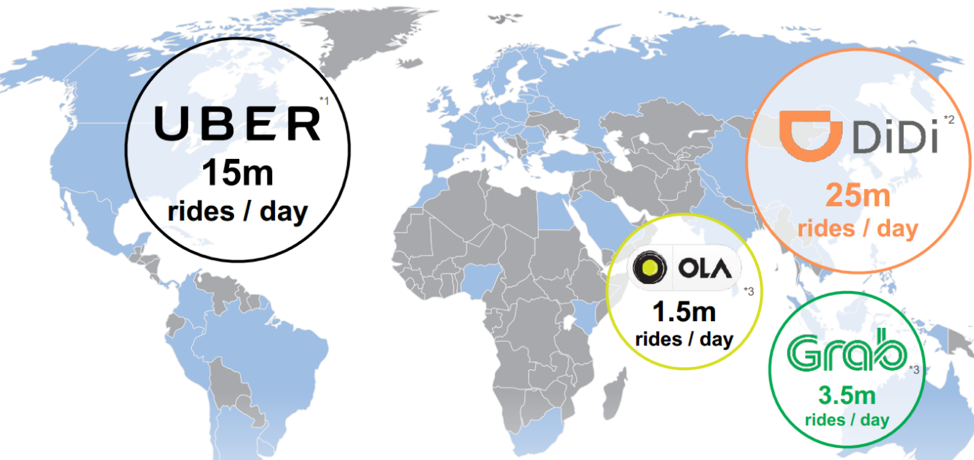

A few of his brilliant preemptive strikes were seed-investing in Yahoo, creating Yahoo Japan, and a $20 million for a stake in Alibaba (BABA) in 1999. These investments increased more than 100-fold in value.

Son is on a mission to own or control assets that are the linchpin to global growth nourished by Artificial Intelligence in selective industries such as transportation, food, work, medicine, and finance.

The solid anchor that ties all these firms together is the massive hordes of harvested data which are central to directing how future automated robots and machines perform.

His goal envisions the construction of responsive robots that will emerge as the cash cow in 2045. The construction, utilization, and high performance of these machines will be the key to his vision.

Instead of splurging for premium human data, investors will be competing for the best performing robots and the data derived from them. Accurate human data will provide the springboard to the machine data these robots will generate.

After the first generation of robots endows us with their first batch of data, all human data will be irrelevant. Human information is the test case on which robots are founded.

Once the first cohort of robot data comes to market, the second generation of robots will be derived off the first generation of robots.

Humans and the data generated from us will become irrelevant.

Once you marry the treasure trove of data with A.I., the results will enter the realm of today's science fiction. Imagine being the first CEO to bring functional robots to mass market and how valuable that first tranche of robot data would represent.

Priceless.

Son is positioning himself to organically engineer the highest-grade robots catalyzing the next gap up in global competition.

This year, Son is on a global treasure hunt to meld together the most precise "big data" he requires to build his robot squadron that will take over the world.

The fight these days is acquiring the oxygen to power these non-human contraptions. Without pure oxygen, i.e. massive amounts of data, engineers will create faulty, error-prone robots that underperform and are less valuable.

Looking at the amalgam of companies in which Son has bet on, it is difficult to decipher any rhyme or reason. That is until you find the commonality of big data.

Son invested $200 million in "Plenty" in July 2017, a company developing indoor farms. If indoor farm data is not diverse enough, then how about the $300 million he showered on the San Francisco dog-walking app called "Wag."

The biggest holding in the SoftBank Vision Fund is Uber. For those without an Internet connection, Uber is ubiquitously known as a ride-sharing company that shuttles passengers from spot A to spot B.

Sweetening the deal was a substantial discount the Vision Fund received on a private placement of Uber shares. Uber is now worth about $70 billion and may someday become a FANG in its own right.

Supplementing this transaction is the custom online map app Mapbox, founded as a competitor to Google Maps. Some of Mapbox's partners include Snapchat, Lonely Planet, and The Weather Channel.

Vision Fund's second largest position is ARM Holdings which is an English semiconductor chip company that has carved out a large segment of the Android and laptop market.

It produces simple CPUs (central processing units) and much more advanced GPUs (graphics processing units) that are placed in smartphones, TVs, tablets, and computers.

Son has shelled out $8.2 billion through the SoftBank Vision Fund already, and the remaining 75% stake is owned by parent company SoftBank Group. ARM is one of the shining beacons of European tech and SoftBank has pegged its future to its success.

There are even whispers of a second $100 billion vision fund lurking around the corner.

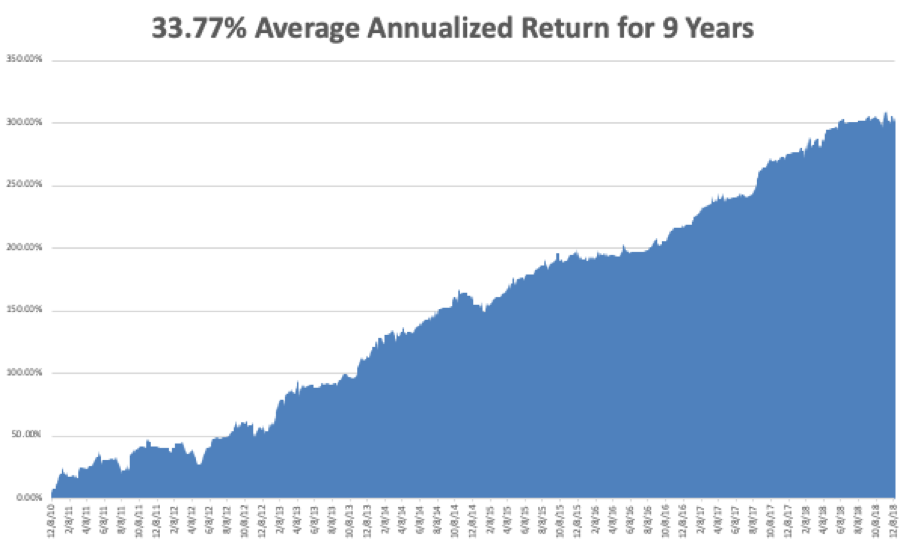

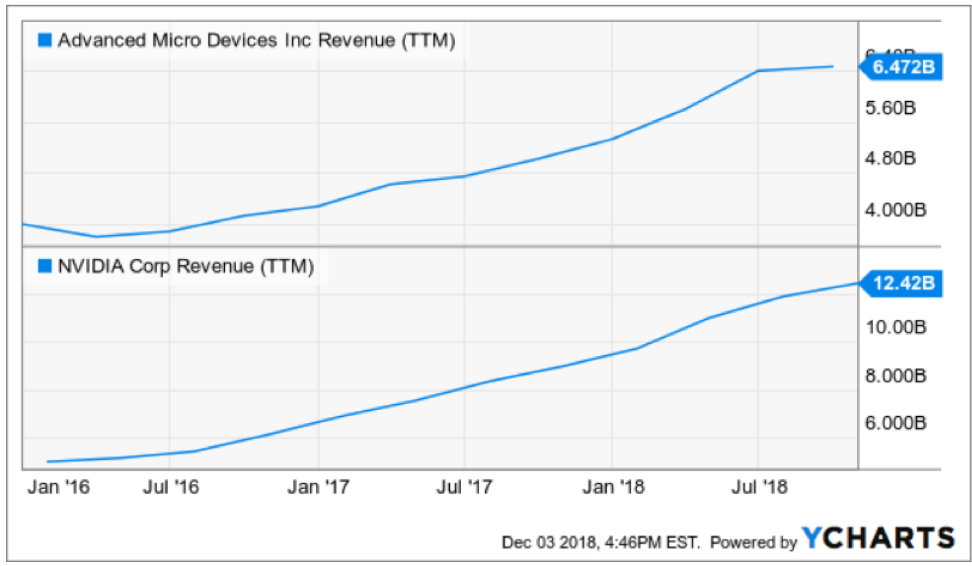

Unsurprisingly, Nvidia (NVDA) is the third-largest weighting, and the $5 billion SoftBank investment into Nvidia (NVDA) represents a 4.9% stake in the company. The Nvidia commitment is logical considering ARM licenses its chip designs to Nvidia.

As autonomous vehicles will be one of the first benefactors from the cross-pollination between big data and automation, these investments completely justify Son's long-term vision.

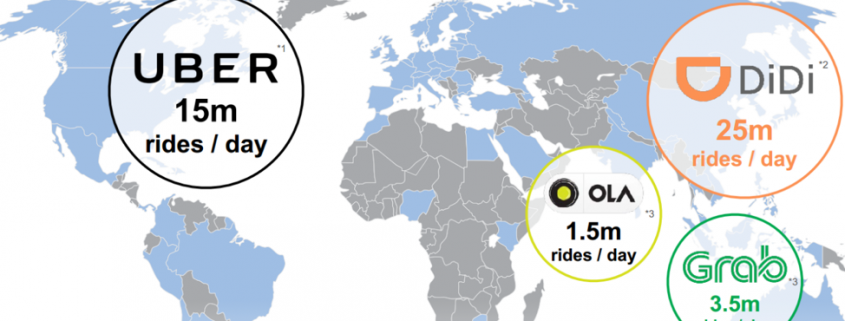

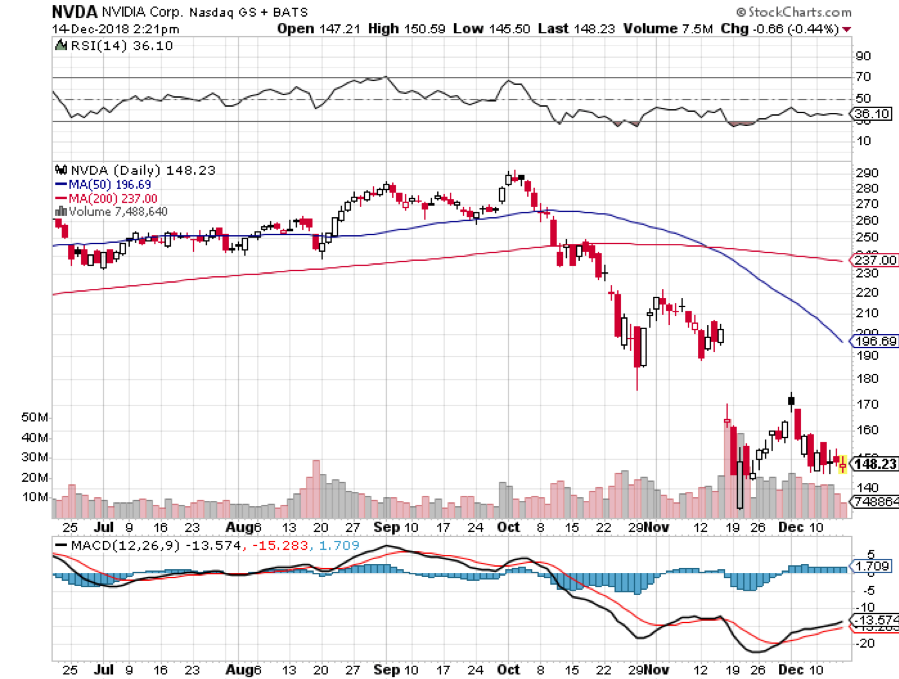

Son has also snapped up other ride-sharing entities such as Didi Chuxing in China, Ola in India, Grab in Southeast Asia, and 99 in Brazil.

Some 31% of the global population is without Internet connectivity. Thus, Son bought OneWeb which pioneers low-cost, high-quality satellites striving to grant Internet access for the people still without access. This maneuver will surely see his net data load increase.

In many of the Mad Hedge Technology Letters, we often offer readers the creme de la creme of public stock symbols, but this time it is different.

First, the major holdings in the SoftBank vision fund, aside from Nvidia, are privately held companies that do not trade on any stock market.

However, it is very important to watch what he buys as it gives insights into the best-performing, fastest-growing sub-sectors of technology and a comprehensive barometer or tech risk appetite from higher echelon VCs.

Or you could just buy SoftBank itself whose shares have doubled over the past two years.

Giving further color to the backstory, not all is doom and gloom for Saudi Arabia as they have invested heavily into the Vision Fund giving Son a key source of financing.

Son’s relationship with the Saudis is important to spearheading a 2nd Vision Fund which he hopes to deploy shortly.

Readers must not forget that 40% of the $100 billion constitutes debt and must be serviced forcing Son to supercharge the growth of the companies he purchases to maintenance his monthly debt bills.

Son won't just flip these companies for a 30% or 50% profit. Tenfold, or hundred-fold gains are the order of the day and that is exactly what he has been successful at.

In reality, Son's ultimate goal is to leach out the future aggregate data spewing from his underlying portfolio and cross-pollinate it with A.I. and automation to revolutionize the world while becoming the richest man in the world.

As 5G is literally on our doorstep, Son, large tech firms, China, and the rest of the VC universe are jockeying with each other and staunchly positioning themselves accordingly for the next 30, 40 and 50 years.

Welcome to the future and good luck.