If you said I am going to the well too many times with this enterprise software theme, I would say you are out of your mind.

Next up is Symantec Corp. (SYMC) who offers global cybersecurity products, services, and solutions, and will be a primary beneficiary of the acceleration of network security products that expanded 12.6% YOY in 2018 and a secondary beneficiary to the migration to enterprise software.

The uptick in gorging cybersecurity products helps reflect the strongest industry metrics since analytics started tracking cybersecurity figures.

As more corporations take the leap of faith and splurge on data centers to house digital secrets, cloud service providers will store corporate data on these massive server farms and perimeter protection software is needed to guard against trojan horses and other malware.

This development has led to a vibrantly healthy market for firewall products, a traditional cybersecurity tool applied to block access to portions of a corporate network from the outside internet.

Firewall products weren’t shy registering 16.3% YOY growth to $2.4 billion in Q4 2018.

Advanced threat protection products used to find more sophisticated and modern offshoots of malicious software exploded to $416 million in Q4 2018, up 19.1% YOY.

Where does it stop?

Nobody knows, but the internet is becoming more of a chaotic free-for-all, and corporations existing for the sheer purpose of maximizing shareholder value will need to dole out an extra layer or two of digital protection.

Remember executive careers can be ruined from corporate cyberespionage these days and being the guy who lets the North Korean cyber army through the front door to fleece proprietary data isn’t a great pitch for a future executive gig.

The thorny Huawei issue has also heightened awareness of this sensitivity of security issues demonstrating how American tech prowess can be looted in a zero-sum cross-border game.

Internet users have also experienced a sudden balkanization of the web by totalitarian governments ready to weaponize the internet where they see fit while clamping down on freedom of expression on expressions that aren’t favorable to the interests above.

The orange alert climate has forced corporations to rush into cybersecurity products and my two favorite companies in this sphere are Palo Alto Networks, Inc. (PANW) and Fortinet, Inc. (FTNT).

I cannot say that Symantec is a better company than these two, it wouldn’t be true because their model doesn’t have the super growth trajectory when you analyze them head to head.

But this year should be an improvement on last year and I see room to the upside.

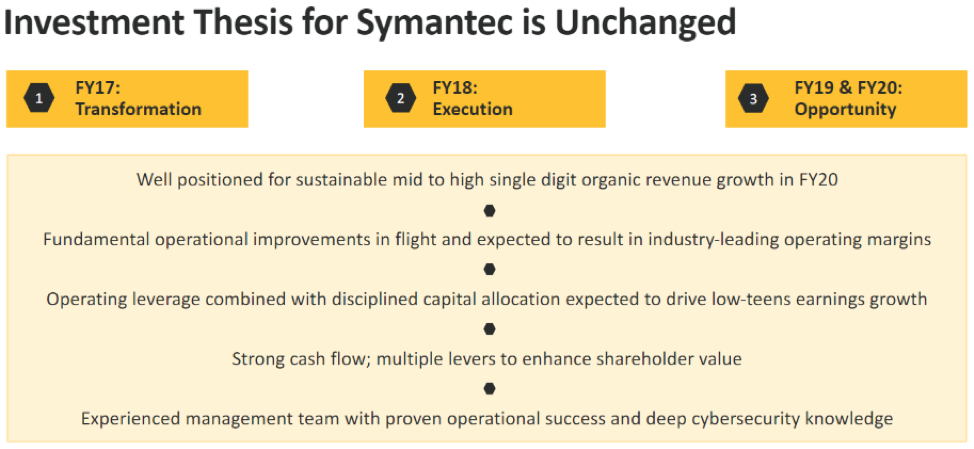

Every important metric will improve, aided by a return to better-calibrated execution, stabilization in business mix, and the benefit of revenue already on the balance sheet.

Operating margins slightly beat guidance with a 32% upswing last quarter and strong cash flow from operations of $377 million in the third quarter meant the company is more profitable.

Enterprise Security chipped in with revenue of $616 million, $31 million above the high end of the guidance range, and after a turbulent first half of 2018, Enterprise Security is back to organic growth of 3%.

And the main reason this company won’t be a massive winner is because of the lack of top-line growth indicating expansion in fiscal 2019 of only 1.5% in total revenue comprising of relatively flat revenue for Enterprise Security and 3% growth for the Consumer Digital Safety division.

Not good enough in the tech world of today.

Remember that the Consumer Digital Safety division contributes 49% to the top line while Enterprise Security only makes up 15%.

I believe this amounts to serious weakness in their business model because it should be the other way around to take advantage of the fast-growing enterprise business market and the even better margins.

The sluggish growth has hit shares with the chart flat as a pancake if you string it out the past 5 years with undulation in between.

The top line growth from 2017 to 2018, went from $4.02B to $4.83B and was a revelation, yet management has begged for more time with its prognosis of flat revenue for 2019.

Symantec will compensate for the lack of revenue growth with slightly better profitability maintaining a 30% operating margin, and predicting cash flow from operations for fiscal year 2019 to be in the range of $1.25B to $1.35B, a nice bump from the total cash flows from operations of $950 million in fiscal year 2018.

The catalyst to share appreciation is hidden in between the lines with management hyping up 2020 as the period when Symantec gets its mojo back with mid-single digit growth, with the Enterprise Security segment particularly benefiting from organic revenue expanding in the mid to high single digits from 2019.

A roll-off from existing contract liabilities will boost the Consumer Digital Safety segment but will not demonstrate any meaningful organic revenue growth projected to be unchanged at the low to mid-single digits YOY.

This sets up nicely for 2020 – the company expects a boost in operating margins to mid-30s and expected EPS growth in the low double digits with cash flow from operations benefitting from the 2019 restructuring, transition and transformation effort.

In short, they had a poor 2018 and Symantec’s management is telling investors to allocate downtime to fix the firm - growth will be missing this year, but they will be more profitable than last year, albeit with flat revenue.

The jury will be out in 2020 which is when they promised to have all their ducks in a row.

Even though they aren’t promising double-digit revenue growth in 2020, the high single-digit growth could see shares slowly grind up for the rest of this year.

This is another example of how legacy companies get stuck digging themselves out of a sinkhole before they can hyper-energize their profit model.

They are still in a holding pattern and I am neutral to slightly bullish on Symantec shares.