Softbank’s CEO Masayoshi Son is playing with fire by snapping up more than $50 billion of call option exposure.

These call options are directly targeted at tech stocks which Son has an absolute fascination with.

The heavy purchasing of stock options has been the main catalyst in tech stock’s heading into bubble territory pushing prices up to outrageous highs.

Cornering the options market could lead to Softbank taking major write-downs if this high-risk strategy blows up in their face.

Remember that markets usually fall at a faster pace than vice-versa because of the nature of liquidity drying up and an avalanche of forced selling through stop-losses orders.

To add fuel to the fire, we have the U.S. Central Bank that is creating a false sense of security by buying junk bonds and supporting asset prices with broad-based asset purchases, and the lack of real opportunities in the tech market is forcing traders to leverage up multiple times just to spin a profit.

This all sounds eerily similar to Long-Term Capital Management L.P. (LTCM), doesn’t it?

Call option bets on technology stocks are now the narrative driving the broader market as we are unequivocally detached from reality at this point.

A worst-case scenario is a full-fledged rise in the systemic risk if a sell-off, which we are in the midst of, triggers a nasty and chaotic unwinding of bullish positions with indiscriminate selling.

The revealing of Softbank’s high stakes strategy appears to be the variable rocking the market.

Once these call options are deployed, Softbank is out of bullets and there is no incremental amount of capital to support the next leg up, meaning a “taking profits” pivot is the next order on the menu.

I believe regulators will take a look at the recent price action with Tesla at one point rising 75% in the past month alone. Are U.S. regulators prepared for the new normal to allow tech stocks like Amazon to rise 40% per day or drop 80% in one day? Markets cannot function with that level of volatility.

Clearly, Softbank’s heft in trading is moving markets and almost to the point of market manipulation which is cause for another concern.

The point is that this isn’t sustainable and the coming fall after unrealized gains are all taken off the table could slam the market with volatility so bad that it will make the 2008 recession look like a 1% pullback.

It is hard to know where this finally ends as the Fed is implicitly funding cheap money strategies that allow hedge funds to bet the ranch.

Now, this is bet the ranch and multiply that by ten. That’s the feeling I am getting from the price action lately.

Are we heading into hedge funds borrowing trillions of dollars and putting on 10s of trillions in highly leveraged directional bets?

That’s a scary thought.

If the brazenness gets to that level, it could finally be the straw that broke the camel's back for the U.S. financial system.

At the bare minimum, that day is certainly creeping closer.

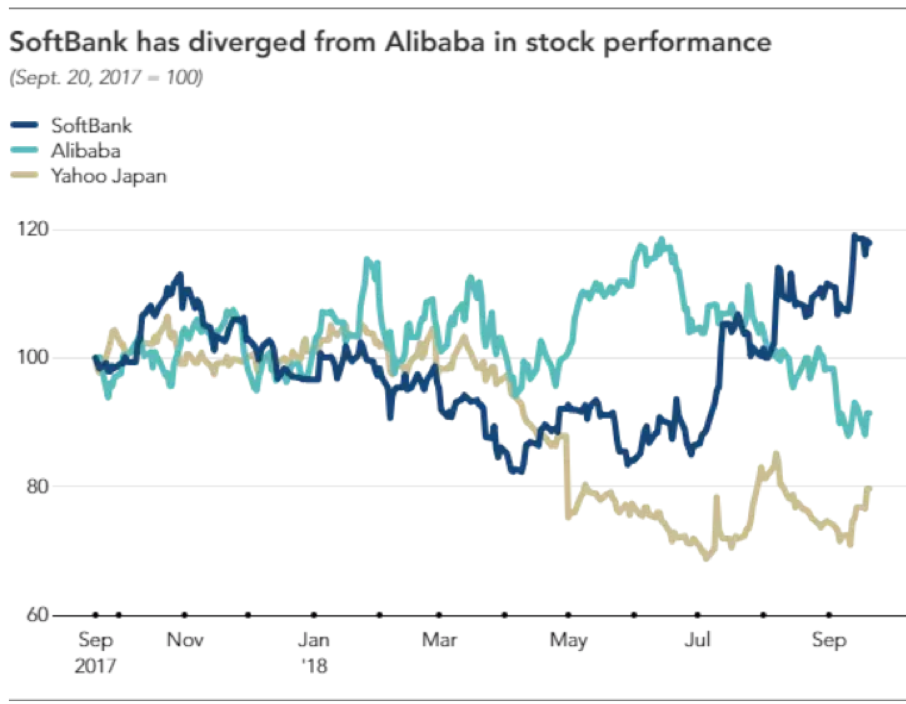

One thing I can tell you is that Japanese investors are scared to death with these revelations.

Softbank is a massive conglomerate in Japan with many retail traders owning pieces of it.

Granted, Softbank could make it out of this with $10 billion in profits, but could also lose more than that and become a system risk in the Japanese financial system.

If it is found out that there are multiple hedge funds mimicking Softbank’s tens of billions call options strategy, we are headed into the eye of the storm and volatility is about to shoot through the roof.

Traders who aren’t used to 10% swings in daily pricing should sit this one out on the sidelines for the time being.

Yesterday alone, Softbank took a $10 billion loss on their positions.

Each day, Son’s nerves must be jangling.

Only he and his confidantes know the math of the positions, but if big losses mount, it could force him to cut losses if equity markets keep crashing.

The knock-on effects could be contagion around other parts of the global markets catalyzing yet another financial crisis on top of the current economic crisis.

Is the incremental trader willing to help out Son’s bet by buying the dip?

I would say the recent volatility should scare away traders in the short term boding ill for Softbank. The plain the vanilla buy the dip strategy is looking tenuous at best these days.

Where did this out of the blue trading strategy come from?

The company has recently indicated investing in U.S. markets: SoftBank announced in August that it would start a new unit for public investments with $555 million in capital.

The purchases are also notable given how much cash SoftBank has been raising this year. Last month, the company announced that it would sell more than one million shares in its Japanese mobile carrier affiliate SoftBank Corp., worth 1.47 trillion yen (nearly $14 billion) signaling this wave of call option buying has been in the works for a while.

That asset sale came on top of plans the firm announced in March to raise some 4.5 trillion yen ($42 billion) by selling assets.

SoftBank said last month that it believed it was "necessary to expand cash reserves ... to ensure flexible options to respond to changes in the market environment."

Prior to Monday's fall, SoftBank's stock was up about a third this year. It was a stunning turnaround for the company, which was embarrassed by a massive write-down on the disastrous WeWork bet last year.

This appears to be revenge and redemption wrapped into one.

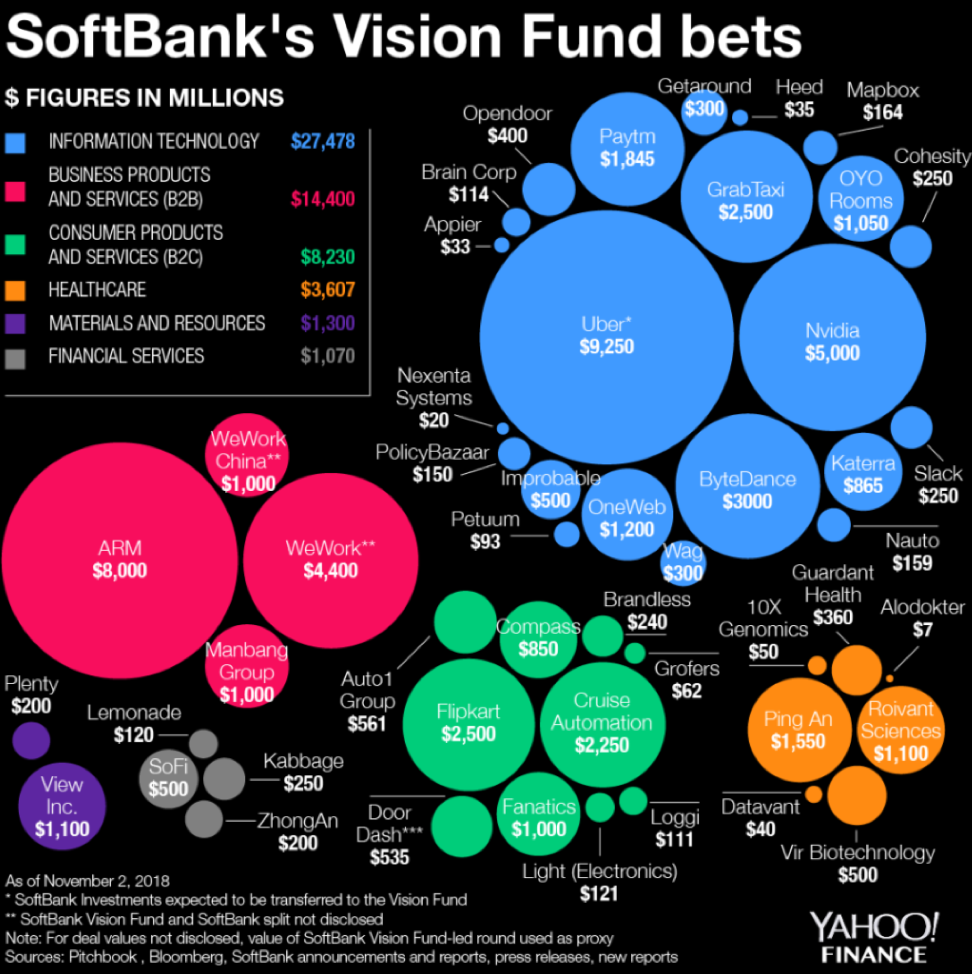

In May, SoftBank reported an annual operating loss of 1.36 trillion yen ($12.7 billion) driven by massive write-downs in the Vision Fund.

What a world we live in!