Global Market Comments

January 13, 2021

Fiat LuxFeatured Trade:

(MY RADICAL VIEW OF THE MARKETS),

(INDU), (SPY), (AAPL), (FB), (AMZN), (ROKU)

Tag Archive for: (SPY)

What if the consensus is wrong?

What if instead of being in the 12th year of a bull market, we are actually in the first year, which has another decade to run? It’s not only possible but also probable. Personally, I give it a greater than 90% chance.

There is a possibility that the bear market that everyone and his brother have been long predicting and that the talking heads assure you is imminent has already happened.

It took place during the first quarter of 2020 when the Dow Average plunged a heart-rending 40%. How could this be a bear market when historical ursine moves down lasted anywhere from six months to two years, not six weeks?

Blame it all on hyperactive algorithms, risk parity traders, Robin Hood traders, and hedge funds, which adjust portfolios with the speed of light. If this WAS a bear market and you blinked, then you missed it.

It certainly felt like a bear market at the time. Lead stocks like Amazon (AMZN), Apple (AAPL), Facebook (FB), and Alphabet (GOOGL) were all down close to 40% during the period. High beta stocks like Roku (ROKU), one of our favorites, were down 60% at the low. It has since risen by 600%.

It got so bad that I had to disconnect my phone at night to prevent nervous fellows from calling me all night.

In my experience, if it walks like a duck and quacks like a duck, then it is a bear. If true, then the implications for all of us are enormous.

If I’m right, then my 2030 target of a Dow Average of $120,000, an increase of 300% no longer looks like the mutterings of a mad man, nor the pie in the sky dreams of a permabull. It is in fact eminently doable, calling for a 15% annual gain until then, with dividends.

What have we done over the last 11 years? How about 13.08% annually with dividends reinvested for a total 313% gain.

For a start, from here on, we should be looking to buy every dip, not sell every rally. Institutional cash levels are way too high. Markets have gone up so fast, up 12,000 Dow points in eight months, that many slower investors were left on the sideline. Most waited for dips that never came.

It all brings into play my Golden Age scenario of the 2020s, a repeat of the Roaring Twenties, which I have been predicting for the last ten years. This calls for a generation of 85 million big spending Millennials to supercharge the economy. Anything you touch will turn to gold, as they did during the 1980s, the 1950s, and well, the 1920s. Making money will be like falling off a log.

If this is the case, you should be loading the boat with technology stocks, domestic recovery stocks, and biotech stocks at every opportunity. Although stocks look expensive now, they are still only at one fifth peak valuations of the 2000 market summit.

Let me put out another radical, out of consensus idea. It has become fashionable to take the current red-hot stock market as proof of a Trump handling of the economy.

I believe the opposite is true. I think stocks have traded at a 10%-20% discount to their true earnings potential for the past four years. Anti-business policies were announced and then reversed the next day. Companies were urged to reopen money-losing factories in the US. Capital investment plans were shelved.

Yes, the cut in corporate earnings was nice, but that only had value to the 50% of S&P 500 companies that actually pay taxes.

Now that Trump is gone, that burden and that discount are lifted from the shoulders of corporate America.

It makes economic sense. We will see an immediate end to our trade war with the world, which is currently costing us 1% a year in GDP growth. Take Trump out of the picture and our economy gets that 1% back immediately, leaping from 2% to 3% growth a year and more.

The last Roaring Twenties started with doubts and hand wringing similar to what we are seeing now. Everyone then was expecting a depression in the aftermath of WWI because big-time military spending was ending.

After a year of hesitation, massive reconstruction spending in Europe and a shift from military to consumer spending won out, leading to the beginning of the Jazz Age, flappers, and bathtub gin.

I know all this because my grandmother regaled me with these tales, an inveterate flapper herself, which she often demonstrated. This is the same grandmother who bought the land under the Bellagio Hotel in Las Vegas for $500 in 1945 and then sold it for $10 million in 1978.

And you wonder where I got my seed capital.

It all sets up another “Roaring Twenties” very nicely. You will all look like geniuses.

I just thought you’d like to know.

Global Market Comments

January 12, 2021

Fiat Lux

Featured Trade:

(MAD HEDGE 2020 PERFORMANCE ANALYSIS),

(SPY), (TLT), (TBT), (TSLA), (GLD),

(SLV), (V), (AAPL), (VIX), (VXX)

(TESTIMONIAL)

When a Marine combat pilot returns from a mission, he gets debriefed by an intelligence officer to glean whatever information can be obtained and lessons learned.

I know. I used to be one.

Big hedge funds do the same.

I know, I used to run one.

Even the best managers will follow home runs with some real clangors. Every loss is a learning experience. If it isn’t, investors will flee and you won’t last long in this business. McDonald’s beckons.

By subscribing to the Mad Hedge Fund Trader, you get to learn from my own half-century of mistakes, misplaced hubris, arrogance, overconfidence, and sheer stupidity.

So, let’s take a look at 2020.

It really was a perfect year for me during the most adverse conditions imaginable, a pandemic, Great Depression, and presidential election. I made good money in January, went net short when the pandemic hit in February, and played the big bounce in technology stocks that followed.

Right at the March crash bottom, I sent out lists of 25 two-year option LEAPS (Long Term Equity Participation Securities). Many of these were up ten times in months. I then used a Biden election win as a springboard for a big run with domestic recovery stocks and financials.

One client turned $3 million into $40 million last year. He owes me a dinner and my choice on the wine list. (Hmmmmm. Lafitte Rothschild 1952 Cabernet Sauvignon with a shot of Old Rip Van Winkle bourbon as a chaser?). I usually get a few of these every year.

See, that’s all you have to do to bring in a big year. Piece of cake. It’s like falling off a log. But then I’ve been practicing for 50 years.

In the end, I managed to bring in a net return of 66.5% for all of 2020. That compares to a net return for the Dow Average of 5.7%.

My equity trading in general brought in 71.94% in profits, with 216 trade alerts, and were far and away my top performing asset class. This was the best year for trading equities since the 1999 Dotcom bubble top.

Of course, the best single trade of the year was with Tesla (TSLA), with 18 trades bringing in a 10.55%. I dipped in and out during the 10-fold increase from the March low to yearend.

Readers were virtually buried with an onslaught of inside research about the disruptive electric car company. It’s still true if you buy the stock, you get the car for free, as I have done three times.

Some 26 trades in Apple (AAPL) brought in a net 5.94%. It did get stopped out a few times, hence the lower return.

The second most profitable asset class of the year was in the bond market, with 58 trades producing a 31.16% profit. Virtually all of these trades were on the short side.

I sold short the United States Treasury Bond Fund from $180 all the way down to $154. I called it my “rich uncle” trade of the year, writing me a check every month and sometimes several a month. This is the trade that keeps on giving in 2021. Eventually, I see the (TLT) falling all the way to $80.

I did OK with gold (GLD), making 4.88% with eight trades in the SPDR Gold Shares ETF. Gold rose steadily until August and then fell for the rest of the year. I picked up another 1.77% on two silver trades (SLV).

It was not all a bed of roses.

Easily my worst asset class of the year was with volatility, selling short the iPath Series B S&P 500 VIX Short Term Volatility ETN (VXX). I was dead right with the direction of the move, with the (VIX) falling from $80 to $20. But my timing was off, with time decay eating me up. I lost 7.29% on six trades.

Two trades in credit card processor Visa (V) cost me 4.37%. I had a nice profit in hand. Then right before expiration, rumors of antitrust action from the administration emerged, a spate of bad economic data was printed, and an expensive acquisition took place.

I call this getting snakebit when unpredictable events come out of the blue to force you out of positions. Visa shares later rose by an impressive 22% in two months.

I lost another 0.99% on my one oil trade of the year with the United States Oil Fund (USO), buying when Texas tea was at negative -$5.00 and stopping out at negative $15.00. Oil eventually fell to negative -$37.00.

Go figure.

I didn’t offer any foreign exchange trades in 2020. I got the collapse of the US dollar absolutely right, but the moves were so small and so slow they could compete with what was going on in equities and bonds.

However, I played the weak dollar in other ways, with bullish calls in commodities and bearish ones in bonds. It always works.

Anyway, it’s a New Year and we work in the “You’re only as good as your last trade” business. 2021 looks better than ever, with a 5% profit straight out of the gate during the first five trading days.

It really is the perfect storm for equities, with $10 trillion about to hit the US economy, most of which will initially go into the stock market.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

December 7, 2020

Fiat Lux

FEATURED TRADE:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A DICEY LANDING)

(SPY), (TLT), (AMZN), (TSLA), (CRM), (JPM), (CAT), (BABA),

(FCX), (GLD), (SLV), (UUP), (FXE), (FXA), (FXB), (FXY), (FXI), (EWZ), (THD), (EPU)

Landing my 1932 de Havilland Tiger Moth biplane can be dicey.

For a start, it has no brakes. That means I can only land on grass fields and hope my tail skid catches before I run out of landing strip. If it doesn’t, the plane will hit the end, nose over, and dump a fractured gas tank on top of me. Bathing in 30 gallons of 100 octane gasoline with sparks flying is definitely NOT a good long term health plan.

The stock market is starting to remind me of landing that Tiger Moth. On Friday, all four main stock indexes closed at all-time highs for the first time since pre-pandemic January. A record $115 billion poured into equity mutual funds in November. This has all been the result of multiple expansion, not newfound earnings.

Yet, stocks seem hell-bent on closing out 2020 at the highs.

And there is a major factor that the market is completely ignoring. What if the Democrats win the Senate in Georgia?

If so, Biden will have the weaponry to go bold. The economy goes from zero stimulus to maybe $6 trillion raining down upon it over the next six months. That will go crazy, possibly picking up another 10%, or 3,000 Dow points on top of the post-election 4,000 points we have seen so far.

That is definitely NOT in the market.

The other big decade-long trend that is only just starting is the weak US dollar. Lower interest rates for longer were reaffirmed by the appointment of my former economics professor Janet Yellen as Treasury Secretary.

A feeble dollar brings us a fading bond market, as half the buyers are foreigners. A sickened greenback also provides the launching pad for all non-dollar assets to take off like a rocket, including commodities (FCX), precious metals (GLD), (SLV), Bitcoin, and the currencies (UUP), (FXE), (FXA), (FXB), (FXY), and emerging stock markets like China (FXI), Brazil (EWZ), Thailand (THD), and Peru (EPU).

All of this is happening in the face of a US economy that is clearly falling apart. Weekly jobless claims for November came in at 245,000, compared to a robust 638,000 in October, taking the headline unemployment rate down to 6.9%. The real U6 unemployment rate stands at an eye-popping 12.0%, or 20 million.

Some 10.7 million remain jobless, 900,000 higher than in February. Transportation and Warehousing were up 140,000, Professional & Business Services by 60,000, and Health Care 46,000. Retail was down 35,000 as stores shut down at a record pace.

OPEC cuts a deal, adding 500,000 barrels a day to the global supply. The hopes are that a synchronized global recovery can take additional supply. Texas tea finally busts through a month's long $44 cap, the highest since March. Avoid energy. I’d rather buy more Tesla, the anti-energy.

Black Friday was a disaster, with in-store shopping down 52%. Long lines and 25% capacity restrictions kept the crowds at bay. If you don’t have an online presence, you’re dead. In the meantime, online spending surged by 26%.

Amazon (AMZN) hires 437,000 in 2020, probably the greatest hiring binge since WWII, and is continuing at the incredible rate of 3,000 a week. That takes its global workforce to 1.2 million. Most are $12 an hour warehouse and delivery positions. The company has been far and away the biggest beneficiary of the pandemic as the world rushed to online commerce.

Tesla’s (TSLA) full self-driving software may be out in two weeks, instead of the earlier indicated two years. The current version only works on freeways. The full street to street version could be worth $8,000 a car in upgrades. Another reason to go gaga over Tesla stock.

Goldman Sachs raised Tesla target to $780, the Musk increased market share to a growing market. No threat from General Motors yet, just talk. Volkswagen is on the distant horizon. In the meantime, Tesla super bear Jim Chanos announced he is finally cutting back his position. He finally came to the stunning conclusion that Tesla is not being valued as a car company. Go figure. Short interest in Tesla has plunged from a peak of 35% in March to 6% today. It’s learning the hard way.

The U.S. manufacturing sector pauses, activity in the U.S. manufacturing sector barely ticked up in November as production and new orders cratered, data from a survey compiled by the Institute for Supply Management showed on Tuesday. The ISM Manufacturing Report on Business PMI for November stood at 57.5, slipping from 59.3 in October.

Salesforce (CRM) overpays for workplace app Slack, knocking its stock down 9%. This is worth a buy the dip trade in the short-term and this is still a great tech company which is why the Mad Hedge Tech Letter sent out a tech alert on Salesforce on the dip.

Weekly Jobless Claims dive, with Americans applying for unemployment benefits falling last week to 712,000 down from 787,000 the week before. The weakness is unsurprising as we head into seasonal Christmas hiring.

The end of the tunnel for Boeing (BA) as they bring to an end an awful 2020. Irish-based airline Ryanair Holdings placed a large order for a set of brand new Boeing 737 MAX aircraft, giving the plane maker a shot in the arm as the single-aisle jet comes off an unprecedented 20-month grounding.

Ryanair, Europe’s low-cost carrier, has 135 Boeing 737 MAX jets on order and options to bring the total to 200 or more. Hopefully, they won’t crash this time around. My fingers are crossed.

Dollar Hits 2-1/2 Year Low. With global economies recovering, the next big-money move will be out of the greenback and into the Euro (FXE), the Aussie (FXA), the Looney (FXC), the Japanese yen (FXY), the British pound (FXB), and Bitcoin. Keeping interest rates lower for longer will accelerate the downtrend.

When we come out the other side of this pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Global Trading Dispatch catapulted to another new all-time high. December is up 5.34%, taking my 2020 year-to-date up to a new high of 61.78%.

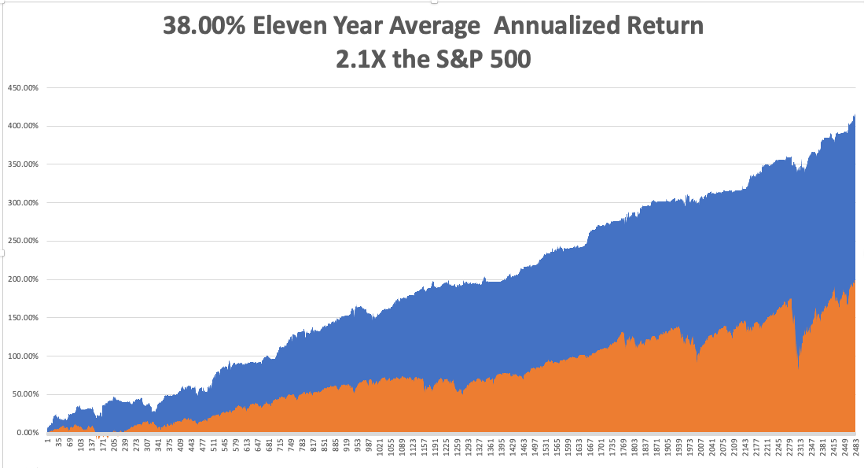

That brings my eleven-year total return to 417.69% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.00%. My trailing one-year return exploded to 64.56%. I’m running out of superlatives, so there!

I managed to catch the 50%, two-week Tesla melt-up with a 5X long position, which is always nice for performance.

The coming week will be a slow one on the data front. We also need to keep an eye on the number of US Coronavirus cases at 14.5 million and deaths at 285,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, December 7 at 4:00 PM EST, US Consumer Credit is out.

On Tuesday, December 8 at 11:00 AM, the NFIB Business Optimism Index is published.

On Wednesday, December 9 at 8:00 AM, MBA Mortgage Applications for the previous week are released.

On Thursday, December 10 at 8:30 AM, the Weekly Jobless Claims are published. At 9:30 AM, US Core Inflation is printed.

On Friday, November 11, at 9:30 AM EST, the US Producer Price Index is announced. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, at least there is one positive outcome from the pandemic. Boy Scout Christmas tree sales are absolutely through the roof! We took delivery of 1,300 trees from Oregon for our annual fundraiser expected to sell them in two weeks. We cleared out our entire inventory in a mere six days!

We sold trees as fast as we could load them. With the scouts tying the knots, only one fell onto the freeway on the way home. An “all hands on deck” call has gone out to shift the inventory.

It turns out that tree sales are booming nationally. The $2 billion a year market places 21 million trees annually at an average price of $8 and are important fundraisers for many non-profit organizations. It seems that people just want something to feel good about this year.

Governor Gavin Newsome’s order to go into a one-month lockdown Sunday night inspired the greatest sales effort I have ever seen, and I worked on a Morgan Stanley sales desk! We shifted the last tree hours before the deadline, which was full of mud with broken branches and had clearly been run over by a truck at a well-deserved 50% discount.

I can’t wait until next year!

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

November 30, 2020

Fiat Lux

FEATURED TRADE:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SANTA COMES EARLY),

(SPY), (TLT), (TSLA), (JPM), (CAT), (BABA)

Everyone has been expecting a Santa Claus rally this year, but it looks like the jolly old man arrived early.

The holiday-shortened month was the best for stocks in 37 years. If you owned Tesla, like we did, it was even better. Elon Musk’s miracle creation shot up an incredible 60% this month.

At $600 a share, the company’s market capitalization expanded by an eye-popping $363 billion to $580 billion, the fastest wealth creation in history. The gain alone would rank it as the 55th largest company in the S&P 500. Similarly, Elon himself earned $100 billion this year, or $17 million an hour, the speediest wealth accumulation since capitalism begin.

These are numbers for the ages.

It’s all proof that if you live long enough, you see everything. OK, all of you who thought the Dow would soar by 12,000 points, or 67% in eight months, please raise your hands. Yes, I didn’t think I’d see many.

Which all raises some concerns for me. But then I’m always concerned. That’s why I’m still alive. That’s why I still have two nickels to rub together. My Mad Hedge Market Timing Index shouting “EXTREME SELL” urges further caution.

Rising at this meteoric pace, the market is pulling forward a big chunk of gains from 2021. Make hay while the sun shines because we may suffer long periods of boredom next year, when the Volatility Index (VIX) drops down to $10 and stays there.

It all reminds me of the Plaza Accord in 1987, when Japan agreed to a doubling of the yen against the US dollar in exchange for continued access to the US car market.

We all knew this would eventually demolish the Japanese stock market, but not for a while. I remember at the time, an old Japanese folk expression became popular. “The fool may be dancing, but the greater fool is watching.” The Nikkei Average doubled in three years before it crashed. Portfolio managers who only watched were left to pull rickshaws for a living. (This was before Uber).

This is why I have been urging followers to realize their biggest profits, as in Tesla, so they have dry powder with which to buy the next inevitable dip. And you don’t want to be left pulling a rickshaw.

The US Treasury delivered a hit for stocks, as outgoing Secretary Mnuchin cancels all remaining stimulus programs, sucking $459 billion out of the economy. It has so far prompted a $740-point dive in the Dow Average and a $7 rally in the TLT. It’s the ultimate scorched earth strategy that will prolong the recession. Use this move to buy more stocks (SPY) and sell short more bonds (TLT).

Janet Yellen was appointed the new Treasury Secretary in the incoming Biden administration. My old Berkeley economic professor wins again. She is probably the most qualified secretary ever appointed and as academic and former Fed governor. It looks like I may serve as an informal consultant on financial and monetary affairs like I did last time. I drove by her house last week and the vans were already loading up. The markets love her, with the Dow up 500 points and hitting 30,000. Janet is the Queen of Ease and the Master of QE, running a hyper-accommodative policy for five years.

Money is pouring into Asia. First into the pandemic, China was first out. With the most draconian lockdown yet seen, the Middle Kingdom was able to cap total deaths at 4,000. The US is now losing that number of people every two days….with one fourth the population. As a result, China now has the world’s strongest economy, growing at a 6.6% annual rate. The incoming Biden administration will lead to a major improvement in trade relations, bringing us back to a return of globalization. All of this is hugely positive for China.

Tesla tops $580 billion in market cap with a ballistic 37% move since its S&P 500 listing was announced two weeks ago. Look like Elon is due for another $20 billion bonus. Mad Hedge went into this with an aggressive 40% long weighting, making it the best trade of 2020, if not the decade. Tesla is my next trillion-dollar company.

Bitcoin crashed, down nearly $4,000 in 24 hours, or almost 20%. As is always the case with an asset with no fundamentals, nobody knows why as the cryptocurrency tests $16,000, down from $20,000. Fears of increased US regulation may be a factor.

New Home Sales exploded, up 41% YOY to 999,000, and gaining 1.5% in October. It’s the hottest since 2006. Homes sold but still under construction are up 60% YOY. Inventories plunged to 3.5 months and prices are rising due to shortages of labor and materials. This is where inflation begins.

Weekly Jobless Claims leaped to 778,000. The Coronavirus is felling people in the labor force in large numbers. Workers are losing jobs, benefits, and health care just as the pandemic goes exponential.

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

This has been the best week, month, and year in the 13-year history of the Mad Hedge Fund Trader, and the week was only three and a half days long!

My Global Trading Dispatch catapulted to another new all-time high. November is up 22.06%, taking my 2020 year-to-date up to a new high of 58.09%.

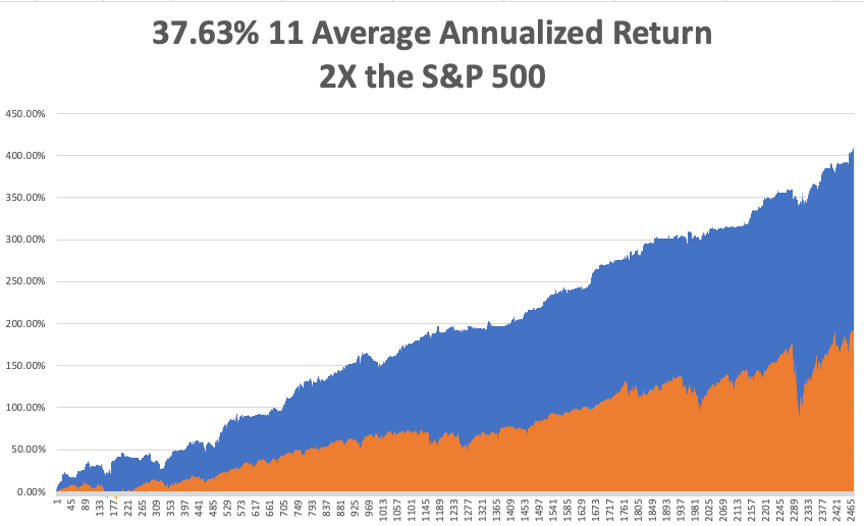

That brings my eleven-year total return to 414.00% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 37.63%. My trailing one-year return exploded to 64.91%. I’m running out of superlatives, so there!

I managed to catch the 50%, two-week Tesla melt-up with a rare quadruple long position, which is always nice for performance.

The coming week will be all about jobs. We also need to keep an eye on the number of US Coronavirus cases at 13 million and deaths 270,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, November 30 at 11:00 AM EST, Pending Home Sales for October are released.

On Tuesday, December 1 at 11:00 AM, The ISM Manufacturing Index for November is out.

On Wednesday, December 2 at 9:15 AM, the ADP Private Employment Report is printed.

On Thursday, December 3 at 9:30 AM, the Weekly Jobless Claims are published.

On Friday, December 4 at 8:30 AM, the Nonfarm Payroll Report for November is called. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, it’s Christmas tree season for the Boy Scouts again, so I just spent the morning unloading 700 conifers from a semi-truck that just arrived from Corvallis, Oregon. The scouts sell them to raise money for camping trips for the upcoming year. Some of the trees were 12 feet high and two men had to struggle to get them in place.

Last week, I took the scouts to Hendy State Park in northern Mendocino county. We were the only ones camping among the 2,000 year old giant redwoods, but all the RV sites were full. I realized then that tens of thousands are riding out the pandemic and the Great Depression in the California State Park system, rotating locations every two weeks to keep from being kicked out. These are our modern-day “Hooverville’s.”

It’s a sign of the times.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

November 27, 2020

Fiat Lux

FEATURED TRADE:

(NOVEMBER 25 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (CRM), (CRSP), (CVS), (SQ), (CRSP), (LUV), (GLD). (SLV), (SPY), (TMO), (UUP), (TAN), (FXA), (FXE), (FXY), (FXB), (CYB)

Below please find subscribers’ Q&A for the November 25 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis.

Q: Is gold (GLD) still a hold?

A: Long term yes; short term no. Short term, cash is being drained out of gold in order to buy Bitcoin, just like silver. And once Bitcoin peaks, which could be today or tomorrow when it hits 20,000, then you could get a round of profit-taking and a nice little pop in gold. So, it's basically moving totally counter-cyclically to Bitcoin and the other cryptocurrencies right now.

(Note: since this webinar, Bitcoin has crashed by $3,000)

Q: A competitor of yours claims that asymptomatic transmission of COVID does not occur.

A: I would bet money that person does not have a medical degree. Asymptomatic transmission occurs in almost all diseases, so why COVID would be an exception is beyond me. I suggest that somebody is trying to sell newsletters at your expense with zero knowledge about the topic. Ask him to kiss a Covid victim. This is common in my industry where 99% of the people are crooks. This is also an example of the vast amounts of information that have been spread during an election year.

Q: Will you take a vaccine when it’s out or will you let others try it first?

A: Actually, by the time the public gets the vaccine, more than a million people will have already tried it, so I think it will be fairly safe. I am probably already the most vaccinated person on the planet; I've had flu shots every year for 40 years, so I will happily try it out. At my age, I have little to lose. And I would like to travel again, and that’s going to be a requirement for international travel. I am worried there could be long term side effects that we’ve seen with other drugs in the past, like all future children being born without arms and legs, which is what happened in the 1950s with Thalidomide.

Q: If the Senate flips to the Democrats, how do you see it affecting the market?

A: It doesn’t really affect the market overall; what it will do is affect sector reallocation. Solar, alternative energy and ESG companies do a lot better in A Democratic Senate, and energy oil companies do a lot worse. All you do is short the losers and buy the winners; it really makes no difference who wins. Most of the big conflicts over issues these days are social ones that don’t affect the market.

Q: Where do you see Tesla (TSLA) by the end of the year?

A: Well, this morning, it’s at an all-time high of $565. It looks like it wants to take a run at $600, and then we will be up 50% from where the news was announced that it was joining the S&P 500. That seems to me like a heck of a move on no real fundamental news. During this news, the market completely ignores a Model X recall and a Model Y pan from Consumer Reports. I would be inclined to take profits there or at least roll the strikes up on my options positions.

Q: What’s a good stock to play a commodity recovery?

A: You can’t do any better than Freeport-McMoRan (FCX), which I’ve been following for almost 50 years since I covered it for the Australian Financial Review newspapers.

Q: Will Salesforce (CRM) hold?

A: Yes, it’s just a matter of time before we break out to substantial new highs, and this is a stock that could double next year.

Q: What brokers do you suggest?

A: I would pick tastytrade. Click here for their site.

Q: Is CVS (CVS) a good buy?

A: I would say yes; a billion Covid-19 vaccine doses will need to be distributed next year. You can't do that without all the drug companies participating big time.

Q: Does Trump have a chance to win in his lawsuits?

A: It’s more likely that I will be elected the next Miss America; so, I wouldn’t place any bets on that. Some 30 consecutive Republican judges ruling against him does not augur well for his future.

Q: Would you buy any LEAPS here (Long Term Equity Participation Securities)?

A: Only in special one-off situations in the domestic stocks that haven’t moved in ten years. There are a lot of those out there now that I have been recommending. Those are all fertile territory for LEAPs, especially going out 2 years where you get the maximum bang for the buck and a 1,000% return. Don’t touch LEAPs in technology stocks here, and don’t touch Tesla in LEAPs.

Q: What’s your outlook on Southwest Air (LUV)?

A: I like it; it’s one of the healthiest domestic airlines most likely to come back.

Q: Are you going to update your long-term portfolio?

A: Yes, but I only update it twice a year and my next turn is on January 22. If you bought the last update on July 22, you made a fortune getting into Freeport McMoRan at $12 (it’s now $23), CRISPER Therapeutics at $80 (CRSP) (it’s now $110), and Square (SQ) at $110 (the current is $212). You can find it by logging into www.madhedgefundtrader.com, going to My Account, clicking on Global Trading Dispatch, on the drop-down menu, click on the Long-Term Portfolio tab and then clicking on the red tab for the Long-Term Portfolio. That lets you download an excel spreadsheet.

Q: Do you have any LEAPS to suggest now?

A: I only put out portfolios of LEAPS at giant market bottoms like we had in March. Then I put out lists and lists of LEAPS. At all-time highs, it’s not good LEAPS territory, except for specific names. So, if you want to get involved in that on a regular basis, I suggest you sign up for our Mad Hedge Concierge Service. There they are making millions of dollars a week right now.

Q: Where does the US dollar (UUP) go from here?

A: Straight down; the outlook for the buck couldn't be worse. I would be selling short the US dollar like crazy right now except that there are much better trades in US equities.

Q: Just to be clear, there’s no voter fraud?

A: There’s probably never been an election in US history without voter fraud on all sides; it’s just a question of who’s better at it. In the 1948 Texas Democratic Party runoff, back when the party owned Texas, Lyndon Johnson won by 87 votes out of 988,295 cast. It was later found that in five Hispanic-dominated counties that bordered Mexico, everyone had voted 100% for Johnson ….in alphabetical order. Johnson then took the seat with a 66% margin and went on to dominate the US Senate. I remember in the 1960 election, all the military absentee votes were sent flying around in circles over the Atlantic so Kennedy would win; that’s a story that’s been out there for a long time.

Q: You said stay away from other EVs except for Tesla?

A: A few have gone crazy this week, but that doesn’t mean they can actually make a car. So, you might get lucky on a quick trade on some of these, but long term, I don’t think any of the other non-Tesla EV companies are going to make it except for General Motors, which is plowing $27 billion into the sector. Even if (GM) may be able to put out a lot of cars, but they won’t be able to make very much money at it because they’re nowhere near the neighborhood of Tesla with the software where all the money is made.

Q: As the dollar gets weaker, will you expand your international stock picks?

A: Yes, we put out the first one in a long time, Ali Baba (BABA), on Monday, and we’ll be adding to that a bunch. I think the dollar could be weak for 5 or 10 years, a lot like it was in the 1970s.

Q: What’s your outlook for silver (SLV)?

A: Same as for gold (GLD). Quiet for the short term, double for the long term.

Q: Favorite names in biotech?

A: For that, you really need to subscribe to the biotech letter; we’re giving you two names a week there and all of them have done great. But another one might be Thermo Fisher (TMO), which seems to double every time I recommend it. It’s a great takeover target too.

Q: Is there any possibility of a 30% dip in the market (SPY) in 2021?

A: No, I don’t see more than a 10% dip in 2021. The tailwinds now are gale-force, generational, and will run for a decade.

Q: How do you sell the US dollar rally?

A: You buy all the ETFs that we cover in our foreign exchange sections. Those are the Australian dollar (FXA), the Euro (FXE), the Japanese Yen (FXY), the British pound (FXB), and the Chinese Yuan (CYB). Those are five ETFs that will do well on a weak dollar for the next several years.

Q: What about the Invesco Solar ETF TAN?

A: We have been recommending (TAN) for many years and it has done spectacularly well. I still love it long term, but it’s had one heck of a run; it’s up 300% from the March low. I think the entire country is about to have a solar explosion because the costs are now quite simply less than for oil. It’s an economic question. We are going to an all-Electric America.

Q: What do you think about LEAPS on gold?

A: It’s not really LEAPs territory yet, but on a two-year view, you’d have to do well on gold LEAPs.

Q: Is the Invesco DB US Dollar Index Bullish Fund (UUP) good to buy?

A: You should be looking to short the UUP. It’s a long dollar basket which we think will do terribly.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.