The free Fed put was tested once again last week, and once again it held. It seems that the line in the sand is $300 for the (SPY), and if that doesn’t hold, $270 will do. At least, for a month.

How long this game will last is anyone’s guess. $14 trillion is a lot of money to throw at the problem. But then so are US Covid-19 deaths approaching 1,000 a day. Who knows what Jay Powell has up his sleeve? Probably quite a lot.

A large chunk of the US economy has gone missing and is never coming back, especially the portion represented by small companies. Whether stock investors will notice this will be the big bet for the remainder of 2020. My bet is they will if the spread of the epidemic can’t be stopped. I give it a 50/50 chance.

If the worst-case scenario happens, get ready to load the boat of LEAPS once again, for we have a Roaring Twenties and second American Golden Age ahead of us, if you can live to see it. We are one wonder drug discovery away from that starting tomorrow morning at 9:00 AM.

We got encouraging news last week with the commonplace steroid dexamethasone, which reduces deaths by 30%. Publishing the Mad Hedge Biotechnology & Health Care Letter, I can tell you there are hundreds more drugs like this under rapid development. Click here.

There is no doubt that biotech stocks (IBB) are breaking out to the upside. Take a look at the ten largest components of the iShares NASDAQ Biotechnology ETF and you’ll see they all have virtually the same chart (click here), stocks like Amgen (AMGN), Gilead Sciences (GILD), and Illumina (ILMN)

The trillions of dollars pouring into Covid-19 research is a big driver. In the meantime, past headaches have magically gone away, like the threat of a nationalization and drug price controls. No one feels like regulating drug companies in this environment. Almost all impediments to research have been tossed away. Relative to the rest of the superheated stock market, biotech shares are still cheap.

The Fed is to starting to buy individual bonds, in another unprecedented expansion of quantitative easing. They are clearly worried about exploding Corona cases, as I am. US Treasury bonds (TLT) dove two points on the news as this may represent a diversion of Fed buying from that market. Stocks soared 1,000 points.

The big message is more QE to come. Another election play? It is called “QE Infinity” for a reason. It’s a great level to trade against. I hope you loaded up on tech LEAPS at the bottom, as I begged you to do.

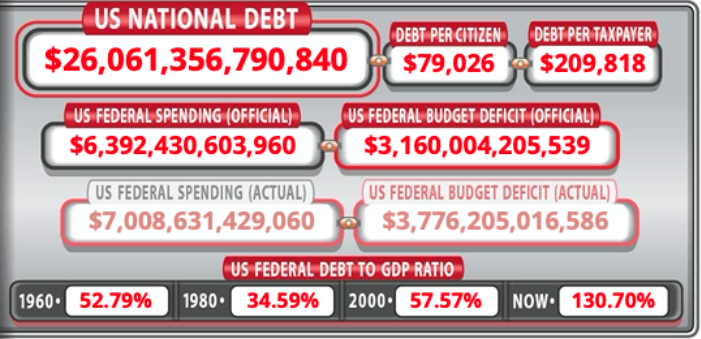

The Fed balance sheet soars, from $4 trillion to $7 trillion this year, says Fed governor Jay Powell. It is the fastest debt blow up in history. That’s $18,750 per taxpayer in four months. It could be $10 trillion by yearend. If you received less than this stimulus money, you got screwed. This always ends in stagflation….high inflation and slow growth, like we saw after the Vietnam War. Your grandkids are going to have to take side jobs driving for Uber to pay off this bill.

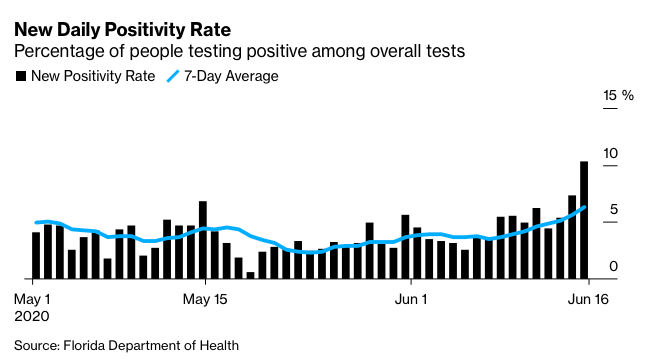

Reopening states see corona cases explode, tossing the “V” shaped economic recovery out the window. Some 25 states are seeing a rapid rise in new cases. Is this the second wave or an extension of the first? The green shoots have been squashed. Stocks won’t like it. The free pass is over.

Stocks pop on miracle steroid drug that reduces Covid-19 death rates. Dexamethasone is the drug in question, normally used for arthritis treatments. It’s just in time as Beijing is closing down schools again in the wake of a second wave.

A US dollar crash is a sure thing, says my old Morgan Stanley colleague, Steven Roach. I couldn’t agree more. Steve is expecting a 35% swan dive for Uncle Buck. A negative savings rate combined with a retreat from Globalization is a toxic combo. A 1970s type stagflation could ensue.

Weekly Jobless Claims are still sky-high, at 1.51 million, far above estimates. The Dow gave up 300 points at the opening, then quickly clawed it back. Walk down Main Street these days and they are still filled with empty storefronts. Many companies are simply running out of money, unable to wait for a recovery. In the meantime, Corona cases are hitting new records every day. Florida cases are off the charts. Things will get worse before they get better.

Retail Sales posted record pop, up 17.7% in May. You are going to see a lot of these record data points because we are coming off a near-zero base. It will actually take years to get to January business levels. I’m sorry, but the higher the free Fed put drives the stock market, the worse the long-term outlook for the economy is going to be.

Homebuilder Confidence is off the charts, with Sales Expectations jumping 22 points to 68. It’s a positive perfect storm, with record-low 2.90% 30-year fixed rate mortgage, Fed buying of mortgage securities and a massive Millennial tailwind that I have been calling for years. A sudden Corona-driven urban flight is sending customers into the arms of suburban builders. Get into Lennar Homes (LEN), KB Homes (KBH), and Pulte Homes (PHM) on dips if you can.

Tesla (TSLA) to open the second US factory this year, somewhere in the southwest as demand overwhelms supply for electric vehicles, exacerbated by the two-month Corona shutdown. The tax break bidding war has already begun, with Texas and Oklahoma slugging it out. The factory comes with 5,000 jobs. Tesla got its first factory for free, giving stock to Toyota for $10 a share. It was the best investment Toyota ever made.

The Mad Hedge June 4 Traders & Investors Summit recording is up. For those who missed it, I have posted all 9:15 hours of recordings of every speaker. This is a collection of some of the best traders and investors I have stumbled across over the past five decades. To find it, please click here.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

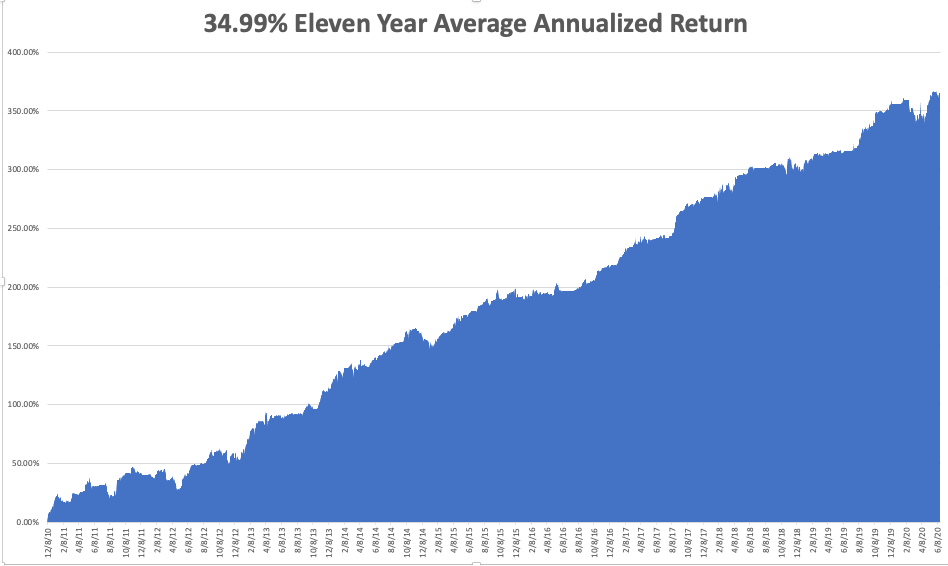

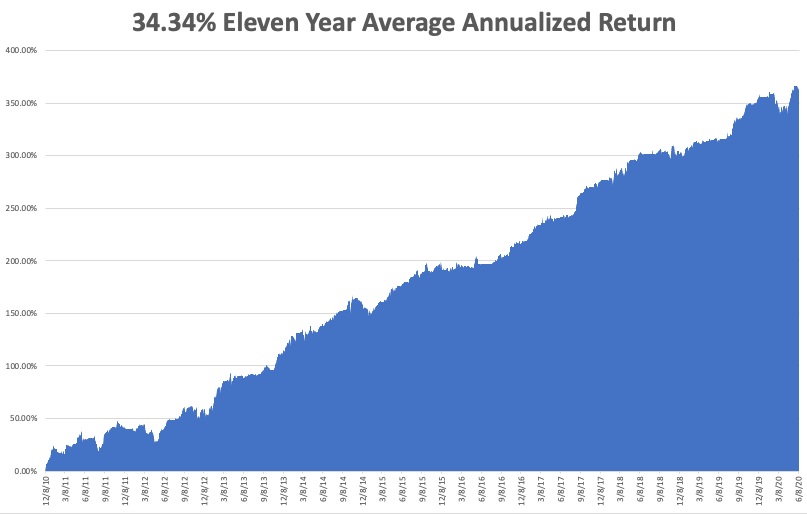

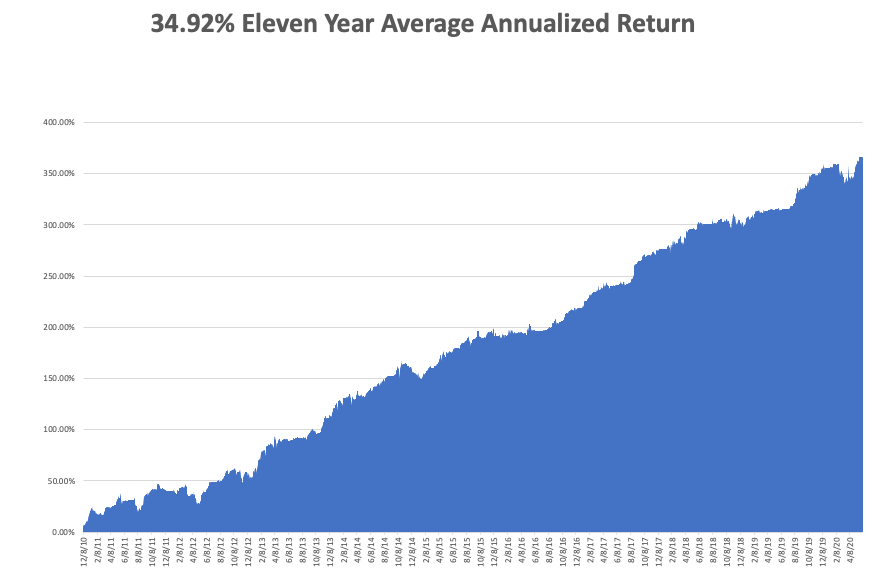

My Global Trading Dispatch performance nicely recouped the pasting we took last week, taking in a nice 7%, bringing June in at +1.21%. With the June options expiration, we managed to cash in on the accelerated time decay in seven positions for Global Trading Dispatch and another three for the Mad Hedge Technology Letter. My eleven-year performance stands at a new all-time high of 367.44%.

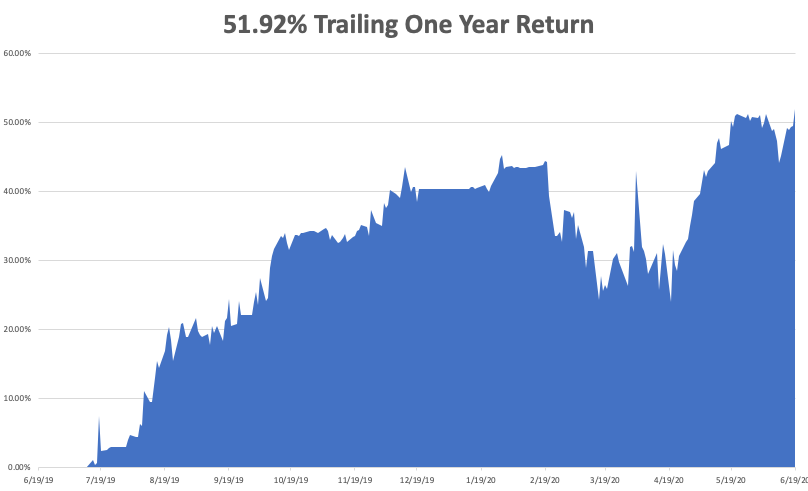

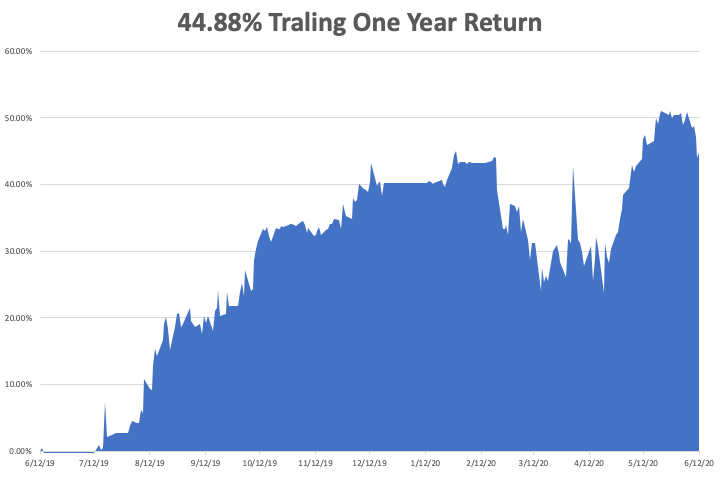

That takes my 2020 YTD return up to a more robust +11.53%. This compares to a loss for the Dow Average of -9.2%, up from -37% on March 23. My trailing one-year return popped back up to 51.92%. My eleven-year average annualized profit recovered to +34.99%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. On the economic front, some low-grade inflation numbers are published.

On Monday, June 22 at 11:00 AM EST, the May Existing Home Sales are out.

On Tuesday, June 23 at 11:00 AM EST, May New Home Sales are published.

On Wednesday, June 24, at 8:15 AM EST, the National Home Price Index is printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 25 at 8:30 AM EST, Weekly Jobless Claims are announced. Also out it the final figure for Q1 GDP.

On Friday, June 26, at 10:00 AM EST, the Baker Hughes Rig Count is out. At 11:00, we get the University of Michigan Inflation Expectations.

As for me, I’ll spend the weekend modernizing my camping equipment, some pieces of which are WWII surplus, or are at least 50 years old. Since all of the Boy Scout summer camps for the year have been cancelled, such a Philmont and Catalina Island, I’m creating my own.

We’re going on a 50-mile hike around California’s High Sierra Desolation Wilderness, a part of Northern California my family has been fishing at for a hundred years.

We’ll be trekking on the Pacific Crest Trail featured in the film Wild. I’ll try to regale you with pictures on my return and wild fish stories.

It’s easier said than done, for there is a national camping boom going on. It can be difficult to get simple things, like maps, without an August delivery date. Some of my WWII stuff may have to suffice after all.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader